Canada Gaming Market Size, Share, Trends and Forecast by Device Type, Platform, Revenue Type, Type, Age Group, and Region, 2025-2033

Canada Gaming Market Overview:

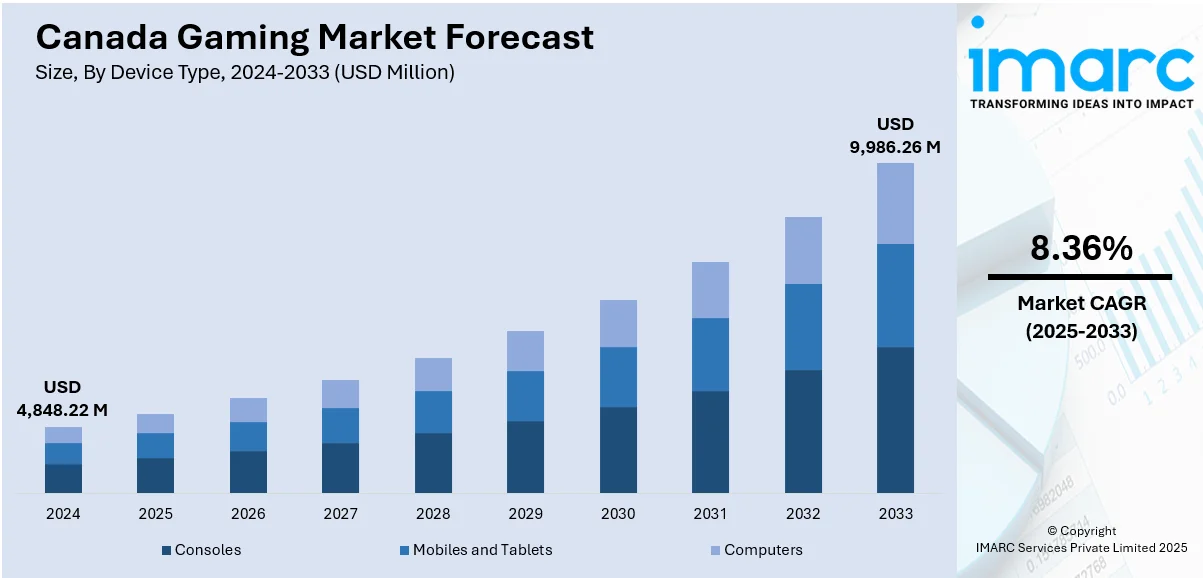

The Canada gaming market size reached USD 4,848.22 Million in 2024. The market is projected to reach USD 9,986.26 Million by 2033, exhibiting a growth rate (CAGR) of 8.36% during 2025-2033. The market is driven by rising smartphone penetration and widening access to high-speed internet, which have widened the user base for online and mobile games. Growth in consumer expenditures on digital entertainment and the demand for multiplayer and cloud-based gaming platforms also contribute to the market growth. Also, government initiatives to support game development and eSports are fostering domestic production and international partnerships, further augmenting the Canada gaming market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,848.22 Million |

| Market Forecast in 2033 | USD 9,986.26 Million |

| Market Growth Rate 2025-2033 | 8.36% |

Canada Gaming Market Trends:

Expansion of Mobile Gaming and Freemium Monetization Models

Mobile gaming has become a dominant force in the market due to widespread smartphone adoption and improved network infrastructure. As of early 2024, the country's internet penetration reached 94.3% of the population, reflecting a highly connected consumer base that supports strong digital engagement. This widespread access to high-speed connectivity has created an ideal environment for mobile gaming adoption across various demographics. The mobile gaming segment continues to expand rapidly, with projections indicating that the number of users in Canada will climb to approximately 13.67 million by 2027. Many Canadian gamers now engage with games primarily through mobile devices, driven by convenience and the broad availability of free-to-play titles. These games often employ a freemium model, offering core gameplay at no cost while monetizing through in-app purchases, subscriptions, and advertising. Apart from this, the freemium approach has proven particularly effective in converting a small percentage of highly engaged users into paying customers. This model reduces barriers to entry while maximizing lifetime value through recurring microtransactions and exclusive content. Additionally, developers are increasingly optimizing for retention and session length, using analytics to refine monetization strategies. The combination of broad accessibility, flexible pricing, and continuous content updates is positively impacting the Canada gaming market growth.

To get more information on this market, Request Sample

Investment in Domestic Game Development and Creative Talent

Canada has positioned itself as a world center for game development, with large studios in cities such as Montreal, Vancouver, and Toronto. The presence of leading publishers has encouraged an environment that facilitates both AAA games and independent developers. In addition to this, the market is undergoing rapid expansion, fueled by rising digital engagement and growing regulatory support. According to industry reports, Ontario Lottery and Gaming Corporation (OLG), a major player in the industry, estimates its online gambling revenue to grow 41% and surpass USD 1 Billion over the next four years. This growth is supported by tax incentives from the government, funding initiatives, and academic collaborations for the development of local talent and technological innovation in interactive media. In addition, learning institutions provide specialized courses in game design, animation, and coding, generating a highly skilled workforce responsive to industry requirements. Further, Canadian studios are known to create both unique IP and worldwide franchises. There is also an emerging trend of international firms offshoring creative and technical work to Canadian teams as they have a reputation for quality and efficiency. Aside from this, independent game developers get to enjoy affordable digital distribution platforms and incubators, enabling them to compete in international markets. In addition, ongoing investment in motion capture, AI-based game design, and immersive technologies makes Canada a long-term player in the advancement of game content, production, and storytelling.

Canada Gaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on device type, platform, revenue type, type, and age group.

Device Type Insights:

- Consoles

- Mobiles and Tablets

- Computers

The report has provided a detailed breakup and analysis of the market based on the device type. This includes consoles, mobile and tablets, and computers.

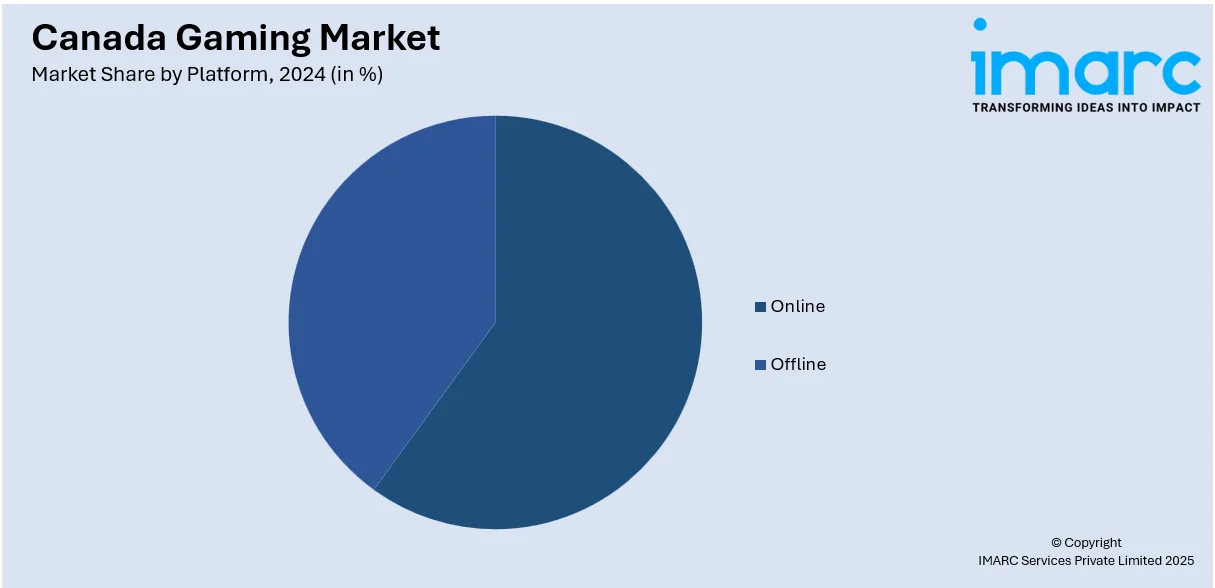

Platform Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes online and offline.

Revenue Type Insights:

- In-Game Purchase

- Game Purchase

- Advertising

The report has provided a detailed breakup and analysis of the market based on the revenue type. This includes in-game purchases, game purchase, and advertising.

Type Insights:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Stimulation

- Others

A detailed breakup and analysis of the market based on the type also been provided in the report. This includes adventure/role playing games, puzzles, social games, strategy, stimulation, and others.

Age Group Insights:

- Adults

- Children

The report has provided a detailed breakup and analysis of the market based on the age group. This includes adults and children.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Gaming Market News:

- On June 17, 2025, Inspired Entertainment, Inc. announced the launch of Canada’s first branded Hybrid Dealer Roulette game in collaboration with Loto-Québec. Now live on Loto-Québec’s online gaming platform, the game combines advanced CGI graphics, pre-recorded hosts, real-time betting timers, leaderboards, live chat, and social gaming features to offer a dynamic and immersive player experience. This launch highlights Inspired’s commitment to innovation in the digital gaming sector and establishes a new industry benchmark for licensed operators in Canada.

- On April 11, 2025, TELUS launched GameRx™, a first-of-its-kind digital platform leveraging evidence-based video game recommendations to support wellbeing in areas such as stress reduction, focus, memory, mobility, and loneliness. The initiative is grounded in data—TELUS’s 2025 gaming survey found that over one-third of Canadians use gaming to cope with life’s challenges. Available now in English, GameRx aims to destigmatize gaming and empower users to cultivate healthy digital habits through curated game recommendations.

Canada Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenue Types Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Stimulation, Others |

| Age Groups Covered | Adults, Children |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada gaming market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada gaming market on the basis of device type?

- What is the breakup of the Canada gaming market on the basis of platform?

- What is the breakup of the Canada gaming market on the basis of revenue type?

- What is the breakup of the Canada gaming market on the basis of type?

- What is the breakup of the Canada gaming market on the basis of age group?

- What is the breakup of the Canada gaming market on the basis of region?

- What are the various stages in the value chain of the Canada gaming market?

- What are the key driving factors and challenges in the Canada gaming market?

- What is the structure of the Canada gaming market and who are the key players?

- What is the degree of competition in the Canada gaming market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada gaming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada gaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)