Canada Ghee Market Size, Share, Trends and Forecast by Source, Distribution Channel, End User, and Region, 2025-2033

Canada Ghee Market Overview:

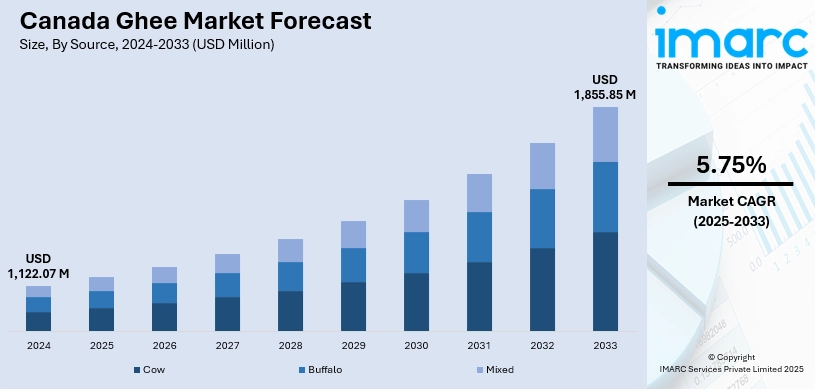

The Canada ghee market size reached USD 1,122.07 Million in 2024. The market is projected to reach USD 1,855.85 Million by 2033, exhibiting a growth rate (CAGR) of 5.75% during 2025-2033. The market is driven by rising consumer inclination toward natural and traditional dietary fats, with ghee gaining popularity as a functional ingredient in wellness-focused diets. Along with this, the growing awareness regarding Ayurveda and its association with ghee is further supporting demand. Additionally, premiumization trends and a shift toward clean-label products have encouraged domestic producers and specialty retailers to expand their ghee offerings, which is augmenting the Canada ghee market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,122.07 Million |

| Market Forecast in 2033 | USD 1,855.85 Million |

| Market Growth Rate 2025-2033 | 5.75% |

Canada Ghee Market Trends:

Mainstreaming of Ethnic Ingredients and Fusion Cooking

Ghee, once a niche ethnic product, is steadily gaining traction among a wider demographic in Canada due to increased culinary experimentation and multicultural influences. With the country’s diverse population and evolving food preferences, ghee has found new relevance in fusion recipes and contemporary cooking styles. It is embraced not only within South Asian communities but also by mainstream consumers exploring global cuisines and traditional ingredients. As per industry reports, ghee has high smoke points, which are around 485°F (250°C). This appeals to consumers who are conscious of preserving the nutritional quality of fats during cooking. As more Canadians experiment with global flavors, ghee is becoming a staple in health-conscious and gourmet kitchens alike. Cooking shows, social media platforms, and wellness influencers have also played a role in demystifying ghee and encouraging its use in non-traditional ways. This culinary integration is expanding ghee’s consumer base, moving it from international food aisles to premium and everyday grocery shelves across urban centers.

To get more information on this market, Request Sample

Health and Nutritional Awareness Driving Premium Ghee Consumption

The growing demand for premium, health-oriented products in the country is positively impacting the Canada ghee market growth. Increasing awareness about the health benefits of ghee, such as its high smoke point, richness in fat-soluble vitamins (A, D, E, and K), and butyrate content, has positioned it as a preferred cooking fat among health-conscious consumers. The rise of low-carb, ketogenic, and paleo diets has further reinforced ghee’s image as a functional food. Moreover, consumers are increasingly opting for ghee made from grass-fed cow’s milk, as it is perceived to have a better nutritional profile and ethical sourcing standards. Apart from this, organic certification, non-GMO labeling, and minimal processing are now considered essential value-adds, driving differentiation among brands. The demand for clean-label products is influencing purchasing behavior, particularly among urban millennials and aging consumers seeking alternatives to processed oils and butter. This trend is pushing both domestic and imported brands to invest in high-quality, traceable, and sustainably produced ghee offerings.

Expansion Through Direct-to-Consumer and Niche Retail Channels

The distribution landscape for ghee in Canada is undergoing transformation with the growing prominence of direct-to-consumer (DTC) models and niche retail formats. Traditional retail channels such as ethnic grocery stores and mainstream supermarkets continue to play a foundational role. However, many ghee brands are now leveraging digital platforms to build consumer relationships and offer subscription-based or customized product bundles. Online retail allows brands to reach geographically dispersed consumers, especially those seeking organic or specialty ghee that may not be available locally. At the same time, health food stores, wellness boutiques, and zero-waste refill shops are emerging as important touchpoints for premium ghee purchases. These channels enable brand storytelling around sourcing practices, production methods, and health benefits, elements that are increasingly influential in purchasing decisions. With greater control over margins and brand messaging, producers are optimizing their go-to-market strategies to serve a niche yet growing audience of informed, wellness-driven Canadian consumers.

Canada Ghee Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, distribution channel, and end user.

Source Insights:

- Cow

- Buffalo

- Mixed

The report has provided a detailed breakup and analysis of the market based on the source. This includes cow, buffalo, and mixed.

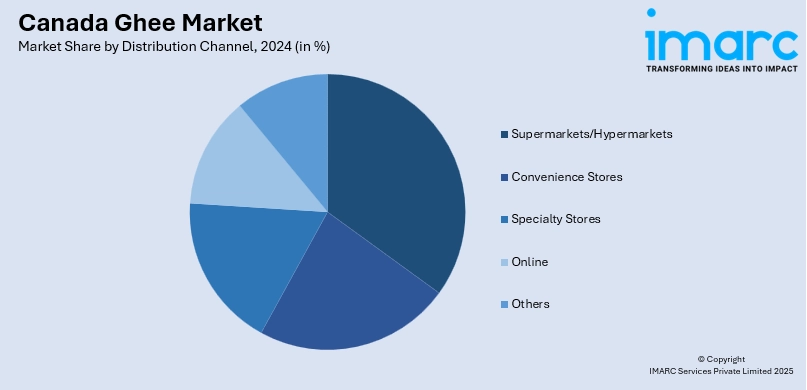

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, specialty stores, online, and others.

End User Insights:

- Retail

- Institutional

The report has provided a detailed breakup and analysis of the market based on the end user. This includes retail and institutional.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Ghee Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Cow, Buffalo, Mixed |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online, Others |

| End Users Covered | Retail, Institutional |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada ghee market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada ghee market on the basis of source?

- What is the breakup of the Canada ghee market on the basis of distribution channel?

- What is the breakup of the Canada ghee market on the basis of end user?

- What is the breakup of the Canada ghee market on the basis of region?

- What are the various stages in the value chain of the Canada ghee market?

- What are the key driving factors and challenges in the Canada ghee market?

- What is the structure of the Canada ghee market and who are the key players?

- What is the degree of competition in the Canada ghee market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada ghee market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada ghee market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada ghee industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)