Canada Glamping Market Size, Share, Trends and Forecast by Age Group, Accommodation Type, Booking Mode, and Region, 2025-2033

Canada Glamping Market Overview:

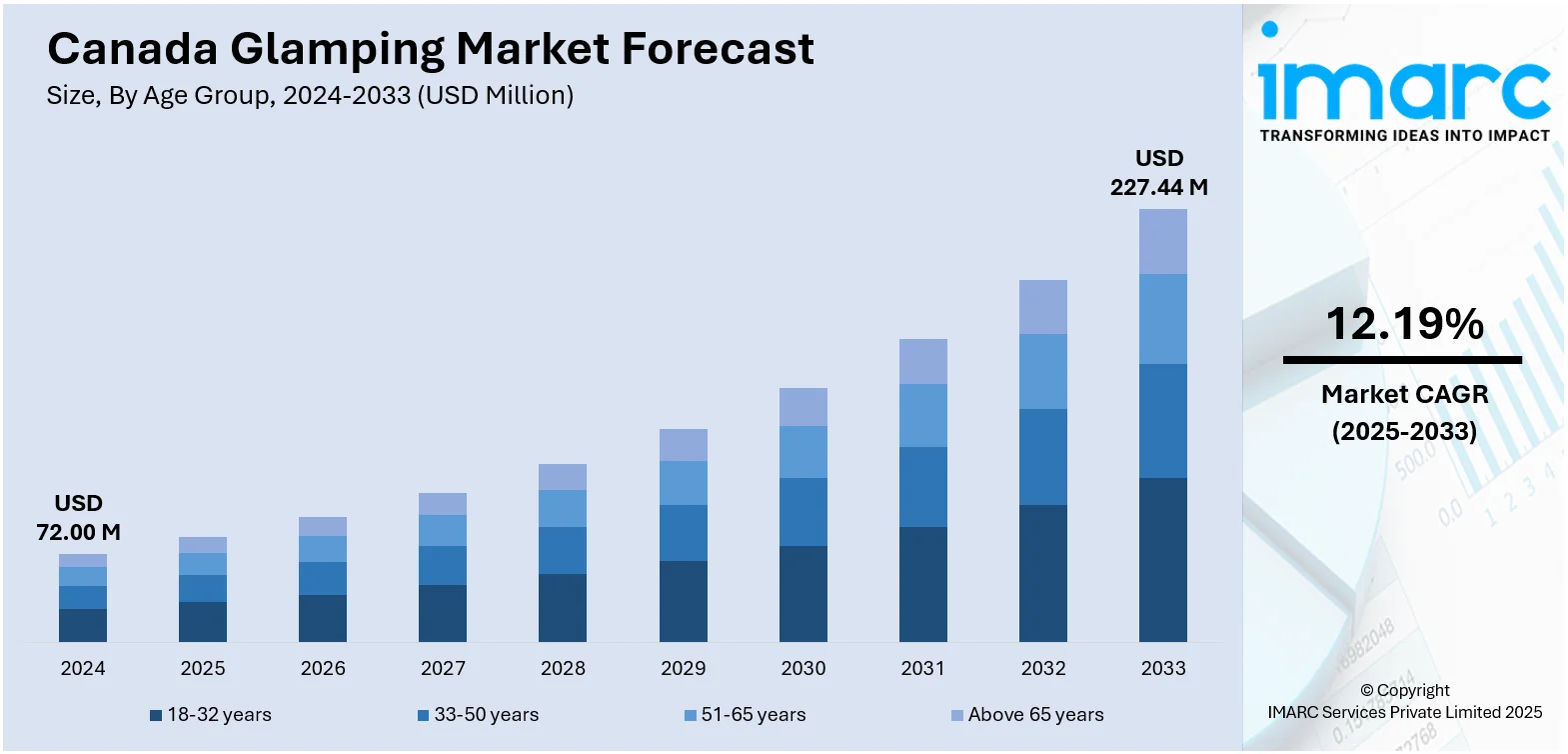

The Canada glamping market size reached USD 72.00 Million in 2024. The market is projected to reach USD 227.44 Million by 2033, exhibiting a growth rate (CAGR) of 12.19% during 2025-2033. The market is driven by the increasing consumer shift towards sustainable and experience travel, with more Canadians opting for environmentally friendly accommodations. Apart from this, increased domestic tourism, facilitated by government campaigns to encourage rural and outdoor locations, is further driving demand for glamping options. Also, growing unique glamping choices, such as geodesic domes, treehouses, and luxury tents, are also attracting a broader audience, which is augmenting the Canada glamping market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 72.00 Million |

| Market Forecast in 2033 | USD 227.44 Million |

| Market Growth Rate 2025-2033 | 12.19% |

Canada Glamping Market Trends:

Rising Demand for Sustainable and Eco-friendly Tourism

One of the prominent market trends is the increasing focus among consumers on sustainability and eco-friendly travel. With greater awareness of global warming and environmental degradation, most Canadian travelers increasingly opt for accommodations that reduce ecological impacts while providing close contact with nature. Glamping sites across the country are responding by adopting green practices such as solar-powered facilities, composting toilets, rainwater harvesting systems, and locally sourced construction materials. Operators are also integrating wildlife conservation and forest management programs to meet the values of travelers. This trend is not confined to private consumers; government organizations and tourism commissions are also actively promoting ecologically friendly tourist activities as part of Canada's wider agenda on sustainability. With sustainability increasingly becoming a determining factor in travel decisions, glamping, in its incorporation within nature and minimal infrastructure over traditional hotels, has stepped forward as one of the top choices for environmentally conscious travelers. This trend keeps affecting design, business practices, and marketing strategies in the glamping industry.

To get more information on this market, Request Sample

Diversification of Accommodation Offerings

The growing diversification of accommodation options to suit a wider range of travelers is contributing majorly to the Canada glamping market growth. Classic safari tents and yurts have been supplemented by out-of-the-box structures like geodesic domes, A-frame cabins, treehouses, floating pods, and glass-encased lodges. These unique units not only enhance the appeal of glamping as a novelty-driven experience but also allow operators to target different consumer segments, including couples seeking romantic retreats, families requiring multi-room spaces, and adventure tourists desiring immersive wilderness stays. In addition, technological inclusion, including underfloor heating, intelligent lighting, and fast internet, is also integrated into most of these high-end buildings to improve the guest experience while preserving the rural ambiance. The trend towards personalization and themed design also increases demand as it provides visitors with personalized experiences. This variety in lodging options is a key competitive differentiator and helps attract both domestic and international visitors year-round, including during off-peak seasons.

Growth in Experiential and Wellness-Oriented Travel

Experiential and wellness tourism is a growing market trend as travelers seek deeper, more personal connections with nature and themselves. Glamping operators are integrating value-added offerings such as guided nature walks, forest bathing, yoga retreats, sound therapy sessions, stargazing experiences, and culinary workshops using locally foraged ingredients. These experiences are designed not only for leisure but also for mental rejuvenation and physical well-being, tapping into the broader health and wellness tourism trend. Besides, locations near natural landmarks, such as national parks, mountain ranges, and lakes, are being specifically developed or marketed as wellness retreats, enabling visitors to escape urban stress in serene environments. Moreover, wellness-focused glamping has become particularly popular among millennial and Gen Z demographics, who prioritize mindfulness, authenticity, and digital detox. As a result, glamping providers are rebranding their offerings from merely "luxury camping" to holistic lifestyle experiences, integrating spa services, meditation decks, and wellness coaching to meet growing consumer expectations.

Canada Glamping Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on age group, accommodation type, and booking mode.

Age Group Insights:

- 18-32 years

- 33-50 years

- 51-65 years

- Above 65 years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 18-32 years, 33-50 years, 51-65 years, and above 65 years.

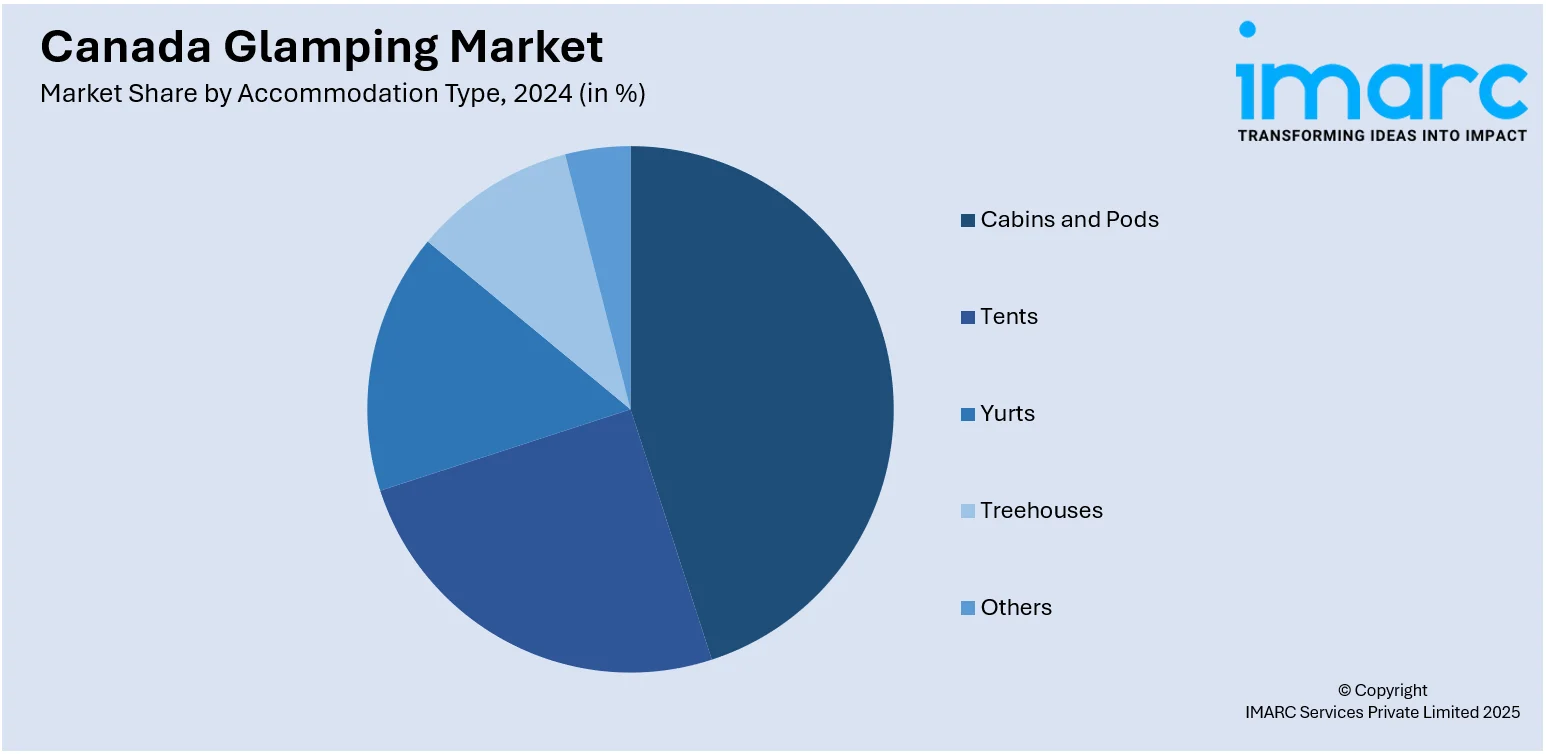

Accommodation Type Insights:

- Cabins and Pods

- Tents

- Yurts

- Treehouses

- Others

A detailed breakup and analysis of the market based on the accommodation type have also been provided in the report. This includes cabins and pods, tents, yurts, treehouses, and others.

Booking Mode Insights:

- Direct Booking

- Travel Agents

- Online Travel Agencies

The report has provided a detailed breakup and analysis of the market based on the booking mode. This includes direct booking, travel agents, and online travel agencies.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Glamping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Age Groups Covered | 18-32 years, 33-50 years, 51-65 years, Above 65 years |

| Accommodation Types Covered | Cabins and Pods, Tents, Yurts, Treehouses, Others |

| Booking Modes Covered | Direct Booking, Travel Agents, Online Travel Agencies |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada glamping market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada glamping market on the basis of age group?

- What is the breakup of the Canada glamping market on the basis of accommodation type?

- What is the breakup of the Canada glamping market on the basis of booking mode?

- What is the breakup of the Canada glamping market on the basis of region?

- What are the various stages in the value chain of the Canada glamping market?

- What are the key driving factors and challenges in the Canada glamping market?

- What is the structure of the Canada glamping market and who are the key players?

- What is the degree of competition in the Canada glamping market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada glamping market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada glamping market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada glamping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)