Canada Higher Education Market Size, Share, Trends and Forecast by Component, Deployment Mode, Course Type, Learning Type, End User, and Region, 2025-2033

Canada Higher Education Market Overview:

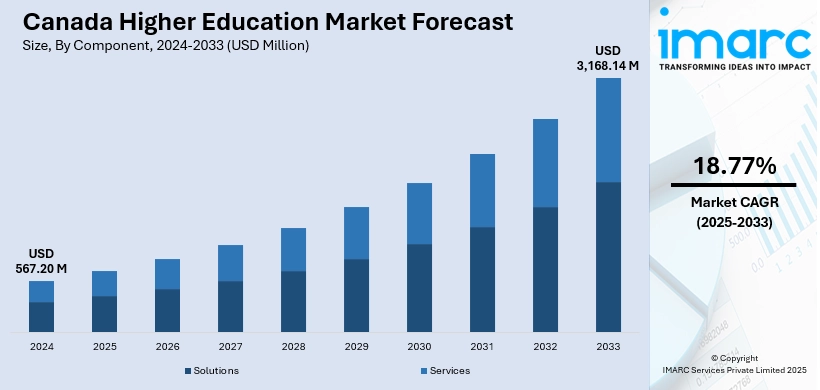

The Canada higher education market size reached USD 567.20 Million in 2024. The market is projected to reach USD 3,168.14 Million by 2033, exhibiting a growth rate (CAGR) of 18.77% during 2025-2033. The market is driven by rising demand for flexible online and hybrid programs, fueled by student preferences for accessibility and advancements in edtech, such as AI-powered learning tools. Additionally, the shift toward workforce-aligned micro-credentials responds to employer needs for specialized skills, with institutions partnering with industries to enhance job readiness. Government initiatives and digital infrastructure investments further support these trends, further augmenting the Canada higher education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 567.20 Million |

| Market Forecast in 2033 | USD 3,168.14 Million |

| Market Growth Rate 2025-2033 | 18.77% |

Canada Higher Education Market Trends:

Increasing Demand for Online and Hybrid Learning Programs

The market is experiencing a significant shift toward online and hybrid learning models. The COVID-19 pandemic increased the demand for digital education, and many institutions continue to expand their virtual offerings to meet student demand. Canada's post-secondary education system is rapidly embracing digital learning, with 62% of educational institutions expecting to see a growth in completely online courses over the next two years, marking a significant shift towards more adaptable learning options. The use of generative AI (GenAI) has experienced tremendous growth, with 49% of instructors utilizing it in their teaching in 2024, compared to just 19% in 2023, signaling a strong trend towards the adoption of technology in Canadian post-secondary education. Despite ongoing issues, such as burnout among faculty (70%) and concerns about academic integrity (78%), 84% of respondents predict continued growth in the use of technology for learning and teaching in all formats within post-secondary institutions in Canada. According to recent studies, Canadian universities now provide fully online degree programs, with enrollment in these courses rising steadily. Students increasingly prioritize flexibility, especially working professionals and international learners who seek high-quality education without relocating. Additionally, advancements in edtech, such as AI-driven learning platforms and virtual labs, are enhancing the online learning experience. Institutions are investing in digital infrastructure to remain competitive, while government initiatives support broadband access in remote areas, further fueling this trend. As a result, universities that successfully integrate hybrid models are likely to attract a broader student base and improve retention rates in the coming years.

To get more information on this market, Request Sample

Growing Focus on Workforce-Aligned Programs and Micro-Credentials

The rising emphasis on workforce-aligned programs and micro-credentials is also supporting the Canadia higher education market growth. Employers increasingly seek candidates with specialized, up-to-date skills, prompting universities and colleges to develop shorter, industry-relevant courses. Micro-credentials, which include digital badges, certificates, and nano-degrees, enable students to acquire specialized skills without the need to enroll in extensive degree programs. Sectors such as cybersecurity, data analytics, and renewable energy are experiencing a significant demand for these credentials. In 2023, 84% of Canadian businesses reported an increase in their cybersecurity measures, with 72% incorporating employee training as part of their strategies to mitigate the threats associated with cybercrime. Cybersecurity breaches continue to impact Canadian businesses, with approximately 47% of companies reporting security concerns, resulting in an average of USD 5,000 for every incident related to response and recovery. The survey highlights the growing need for enhanced cybersecurity infrastructure in Canadian post-secondary education, as 41% of post-secondary institutions cite cybersecurity as a significant operational issue. This underscores the need for Canadian colleges and universities to enhance their cybersecurity infrastructure as the digital industry continues to grow. Government partnerships, such as those with the Future Skills Centre, are also supporting this shift by funding skills-based training initiatives. Additionally, educational institutions are partnering with businesses to develop curricula that meet the demands of the labor market, thereby ensuring that graduates are prepared for employment. This trend reflects a broader move toward lifelong learning, where professionals continuously upskill to adapt to changing industries, making higher education more accessible and career-oriented.

Canada Higher Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment mode, course type, learning type, and end user.

Component Insights:

- Solutions

- Student Information Management System

- Content Collaboration

- Data Security and Compliance

- Campus Management

- Others

- Services

- Managed Services

- Professional Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (student information management system, content collaboration, data security and compliance, campus management, and others), and services (managed services and professional services).

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Course Type Insights:

- Arts

- Economics

- Engineering

- Law

- Science

- Others

The report has provided a detailed breakup and analysis of the market based on the course type. This includes arts, economics, engineering, law, science, and others.

Learning Type Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the learning type have also been provided in the report. This includes online and offline.

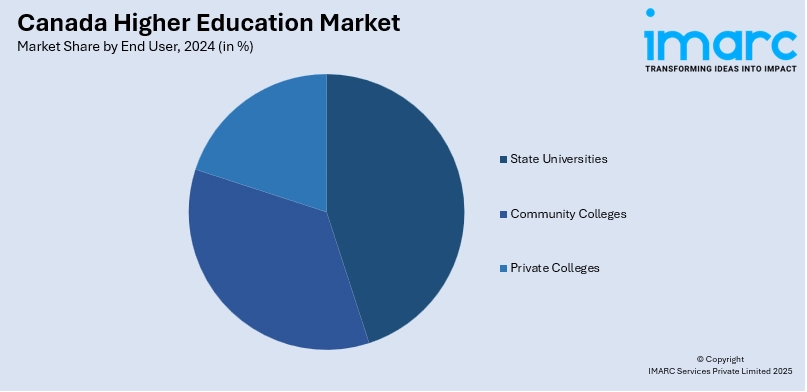

End User Insights:

- State Universities

- Community Colleges

- Private Colleges

The report has provided a detailed breakup and analysis of the market based on the end user. This includes state universities, community colleges, and private colleges.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Higher Education Market News:

- June 09, 2025: Westcliff University opened its first global campus in Toronto, offering a Master's in Information Systems Technology (MIST) program to address Canada's pressing need for skilled cybersecurity and artificial intelligence professionals. This initiative aligns with Ontario's tech industry's goal to generate 300,000 jobs by 2030. The MIST program, developed in partnership with regional industry leaders, features an industry-designed curriculum that allows for flexible learning, equipping graduates with the skills necessary to address the 51% vacancy rate in critical IT roles, including cybersecurity and smart manufacturing. Located at the heart of Markham's 50,000-square-foot innovation center, the new campus will surround students with Toronto's tech environment, supporting the city's growing digital economy and establishing its position as a global technology leader.

- January 23, 2025: Thompson Rivers University (TRU) announced that it will host Canada's first Honours College in the fall of 2025, offering interdisciplinary learning, research, and practical experiences with a starting class size of 60 to 100 students. The University Honours Certificate program combines academic excellence with international perspectives, leadership training seminars, and career-focused development to cultivate future leaders who can address societal challenges.

Canada Higher Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Course Types Covered | Arts, Economics, Engineering, Law, Science, Others |

| Learning Types Covered | Online, Offline |

| End Users Covered | State Universities, Community Colleges, Private Colleges |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada higher education market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada higher education market on the basis of component?

- What is the breakup of the Canada higher education market on the basis of deployment mode?

- What is the breakup of the Canada higher education market on the basis of course type?

- What is the breakup of the Canada higher education market on the basis of learning type?

- What is the breakup of the Canada higher education market on the basis of end user?

- What is the breakup of the Canada higher education market on the basis of region?

- What are the various stages in the value chain of the Canada higher education market?

- What are the key driving factors and challenges in the Canada higher education market?

- What is the structure of the Canada higher education market and who are the key players?

- What is the degree of competition in the Canada higher education market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada higher education market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada higher education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada higher education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)