Canada Ice Cream Market Size, Share, Trends and Forecast by Flavor, Category, Product, Distribution Channel, and Region, 2025-2033

Canada Ice Cream Market Overview:

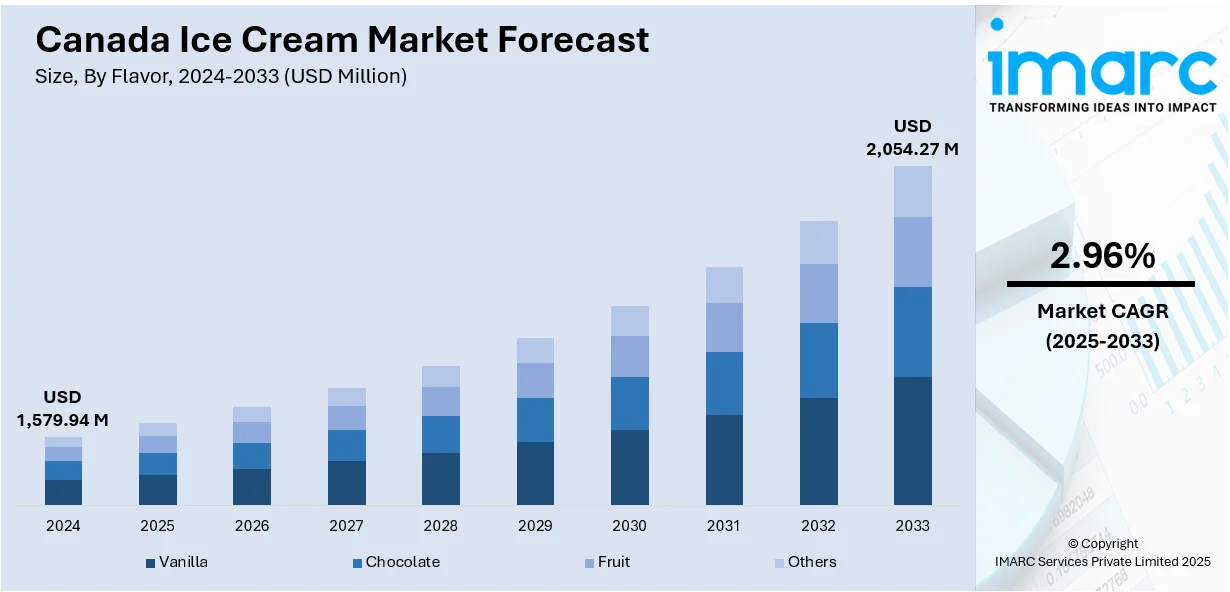

The Canada ice cream market size reached USD 1,579.94 Million in 2024. The market is projected to reach USD 2,054.27 Million by 2033, exhibiting a growth rate (CAGR) of 2.96% during 2025-2033. The market is driven by consumer interest in premium, artisan, and plant-based products. Rising health awareness and greenness have propelled demand for dairy-free alternatives. In addition, new flavor pairings that combine traditional Canadian ingredients with international influences are drawing consumers from diverse backgrounds. This emphasis on quality, sustainability, and distinctive taste experiences is creating product differentiation and market growth. All of these trends work together to add to the growth of the Canada ice cream market share, a testament to their growing importance in frozen dessert industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,579.94 Million |

| Market Forecast in 2033 | USD 2,054.27 Million |

| Market Growth Rate 2025-2033 | 2.96% |

Canada Ice Cream Market Trends:

Premiumization and Artisanal Craftsmanship in Canadian Ice Cream

The growth of the Canada ice cream market is driven, in large part, by the premium and artisanal nature of what people are now seeking. Ice creams that benefit from better quality through natural, organic, and local ingredients are appealing to consumers. Small-batch methods and handcrafted processes increase the perceived value and uniqueness of these items. Those high-end products tend to incorporate rich textures and advanced flavor profiles, such as the use of specialty ingredients such as single-origin chocolates, unique spices, and specialty nuts. That is a trend toward indulgence with an emphasis on authenticity and craftsmanship. In addition, customers are also willing to pay an extra amount for these handcrafted ice creams since they perceive them as an indulgence of luxury. This trend of premiumization has played a key role in the growth of the Canada ice cream market, providing opportunities for differentiation and innovation for brands through quality and distinctive flavor experiences. For example, in March 2023, Chapman's Ice Cream introduced Super Premium Plus, the global first in allergy-friendly high-end ice cream, empowering Indigenous communities and sustainable living through co-branded innovation and environmentally friendly packaging in Canada.

To get more information on this market, Request Sample

Plant-Based and Dairy-Free Ice Cream Alternatives are Increasing

Among the most rapid-growing Canadian ice cream trends is the growing appeal of plant-based and dairy-free ice creams. Lifestyle behaviors like veganism, lactose intolerance, and health-oriented consumption are propelling demand for almond, oat, coconut, and cashew milk-based ice creams. Scientific innovations have improved the creaminess and taste of these offerings, overcoming earlier texture issues. Besides, sustainability and environmental factors drive consumers to opt for plant-based products instead of conventional dairy ice cream. Such offerings have a broader appeal and cater to consumers who are interested in lower-calorie and allergen-free alternatives. Enhancement of this segment is one of the key drivers of the overall Canada ice cream market growth, as manufacturers are able to diversify their portfolios and accommodate changing consumer requirements for healthier and more environmentally friendly dessert products.

Innovative, Culturally Inspired Flavors Fuelling Consumer Demand

Flavor development is a major trend determining the dynamics of the Canada ice cream marketplace. Consumers have boosting interest in innovative, culturally inspired flavors that merge traditional Canadian flavors with global influences. Trendy local flavors like maple, wild berries, and butter tart are being redeveloped with ingredients such as exotic spices, herbs, and international fruits. Limited and seasonal flavor introductions further connect consumers with the provision of novelty and scarcity, building product trial and loyalty. For instance, in August 2023, McDonald's Canada debuted the Squishmallows McFlurry, an exclusive dessert, which combines soft-serve, blueberry syrup, and pink popping candy, evoking the popular plush toy collection. Moreover, this trend reflects a wider consumer need for experiential and adventurous food consumption, especially in younger consumers and multicultural populations. The emphasis on diversity of flavor increases the sensory attractiveness and makes products stand out in a competitive marketplace. Therefore, new flavor innovation is a significant catalyst for Canada ice cream market trends, generating much consumer buzz and driving sales.

Canada Ice Cream Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on flavor, category, product, and distribution channel.

Flavor Insights:

- Vanilla

- Chocolate

- Fruit

- Others

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes vanilla, chocolate, fruit, and others.

Category Insights:

- Impulse Ice Cream

- Take-Home Ice Cream

- Artisanal Ice Cream

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes impulse ice cream, take-home ice cream, and artisanal ice cream.

Product Insights:

- Cup

- Stick

- Cone

- Brick

- Tub

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes cup, stick, cone, brick, tub, and others.

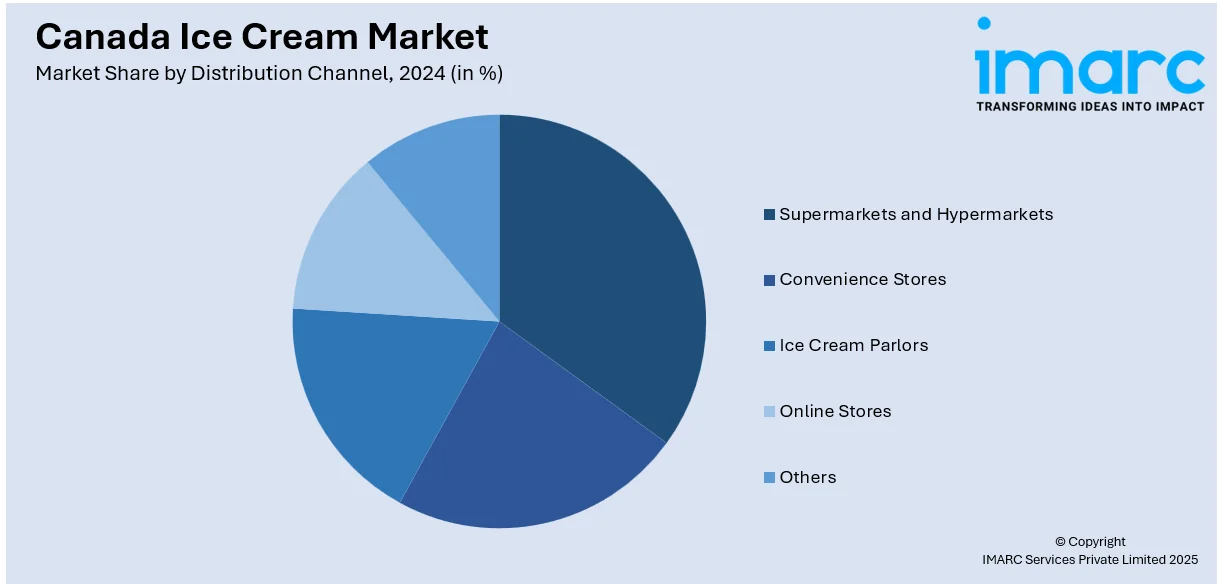

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Ice Cream Parlors

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, ice cream parlors, online stores, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Ice Cream Market News:

- In January 2025, Nuii launched its new Peanut Butter & Canadian Maple Syrup ice cream, combining creamy peanut butter with Canadian maple syrup and a crunchy chocolate coating. Supported by a £14 million marketing campaign across TV, cinema, and outdoor media, this marks Nuii’s boldest indulgent flavour innovation to date.

- In July 2024, Subway Canada introduced its Ice Cream Cookie Sandwich to mark National Ice Cream Day. Made with creamy vanilla ice cream between two signature Chocolate Chunk cookies, the limited-time dessert provided Canadians a cool and indulgent summer treat as part of the brand's shifting seasonal menu.

Canada Ice Cream Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Flavours Covered | Vanilla, Chocolate, Fruit, Others |

| Categories Covered | Impulse Ice Cream, Take-Home Ice Cream, Artisanal Ice Cream |

| Products Covered | Cup, Stick, Cone, Brick, Tub, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Ice Cream Parlors, Online Stores, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada ice cream market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada ice cream market on the basis of flavor?

- What is the breakup of the Canada ice cream market on the basis of category?

- What is the breakup of the Canada ice cream market on the basis of product?

- What is the breakup of the Canada ice cream market on the basis of distribution channel?

- What is the breakup of the Canada ice cream market on the basis of region?

- What are the various stages in the value chain of the Canada ice cream market?

- What are the key driving factors and challenges in the Canada ice cream?

- What is the structure of the Canada ice cream market and who are the key players?

- What is the degree of competition in the Canada ice cream market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada ice cream market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada ice cream market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada ice cream industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)