Canada IT Training Market Size, Share, Trends and Forecast by Application, End-User, and Region, 2025-2033

Canada IT Training Market Overview:

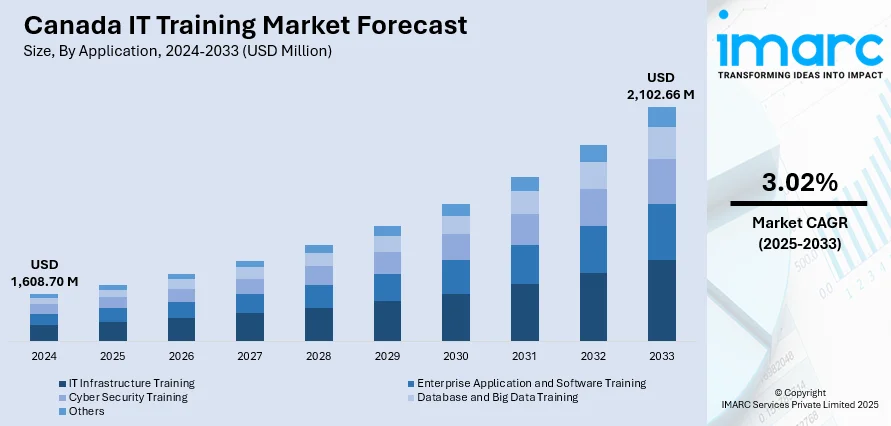

The Canada IT training market size reached USD 1,608.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,102.66 Million by 2033, exhibiting a growth rate (CAGR) of 3.02% during 2025-2033. The market is driven by rising demand for advanced digital skills and reskilling initiatives aligned with Canada’s expanding digital economy. Growth in remote work has accelerated the adoption of flexible, cloud-based training platforms across sectors. Additionally, tailored corporate partnerships and enterprise-driven IT academies are ensuring sustained talent development, further augmenting the Canada IT training market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,608.70 Million |

| Market Forecast in 2033 | USD 2,102.66 Million |

| Market Growth Rate 2025-2033 | 3.02% |

Canada IT Training Market Trends:

Growing Demand for Digital Skills and Workforce Reskilling

Canada’s digital economy is expanding rapidly, creating an urgent demand for advanced IT skills across sectors such as finance, healthcare, logistics, and government services. Employers increasingly seek professionals proficient in cybersecurity, cloud computing, software development, and data science. To address skill shortages, Canadian companies are investing heavily in workforce upskilling and reskilling programs, often in partnership with specialized IT training providers. This demand is further amplified by government initiatives like the Digital Skills for Youth (DS4Y) program, designed to equip young professionals with practical technology skills aligned with market needs. Additionally, Canada’s emphasis on technology-driven economic growth, supported by national policies such as the Innovation and Skills Plan, encourages continuous investment in professional training. An IBM-commissioned study surveying over 2,400 IT decision-makers across Canada revealed that 83% of Canadian IT decision-makers reported progress in executing their AI strategies in 2024, with 42% already seeing positive ROI from their AI investments. Despite limited short-term returns, 56% of Canadian respondents plan to increase AI investment in 2025, focusing on areas such as open-source ecosystems (41%), hiring specialized talent (41%), evaluating models (43%), and utilizing cloud-managed services (49%). Universities, technical colleges, and private IT academies are collaborating to deliver customized, short-duration programs that provide industry certifications recognized globally. These coordinated efforts help ensure that Canadian workers can transition into high-demand technology roles across multiple industries. Together, these factors are propelling sustained Canada IT training market growth, positioning the country as a leader in digital skills development across North America.

To get more information on this market, Request Sample

Expansion of Remote Work and Cloud-Based Training Platforms

The widespread adoption of remote work in Canada has significantly accelerated the demand for flexible, cloud-based IT training solutions. Organizations transitioning to distributed work environments require their employees to develop technical competencies that support remote operations, cybersecurity, virtual collaboration tools, and data-driven decision-making. IT training providers have responded by expanding cloud-based learning management systems (LMS) and virtual bootcamps, offering learners personalized modules and interactive experiences. Additionally, partnerships between Canadian IT training institutes and global certification bodies, such as CompTIA, AWS, Google, and Microsoft, ensure that participants acquire globally recognized skills while remaining engaged in local industries. On June 4, 2025, Google Canada announced a USD 13 million AI Opportunity Fund to strengthen Canada's AI workforce through IT training initiatives. The fund will support four organizations, including the Alberta Machine Intelligence Institute and the First Nations Technology Council, to provide AI skills training to over two million Canadians. This move supports Canada's goal to become a leader in AI, with generative AI expected to contribute USD 230 billion to the economy and save workers over 175 hours annually. These developments are not limited to the corporate sector; educational institutions are integrating online IT training modules into their curricula, preparing students for hybrid work environments from an early stage. As companies shift towards digital-first business models, investments in virtual IT training infrastructure continue to rise. This convergence of remote work culture with scalable online education platforms is driving long-term structural change in Canada’s training landscape, creating sustained growth opportunities for technology learning providers.

Canada IT Training Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application and end-user.

Application Insights:

- IT Infrastructure Training

- Enterprise Application and Software Training

- Cyber Security Training

- Database and Big Data Training

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes IT infrastructure training, enterprise application and software training, cyber security training, data and big data training, and others.

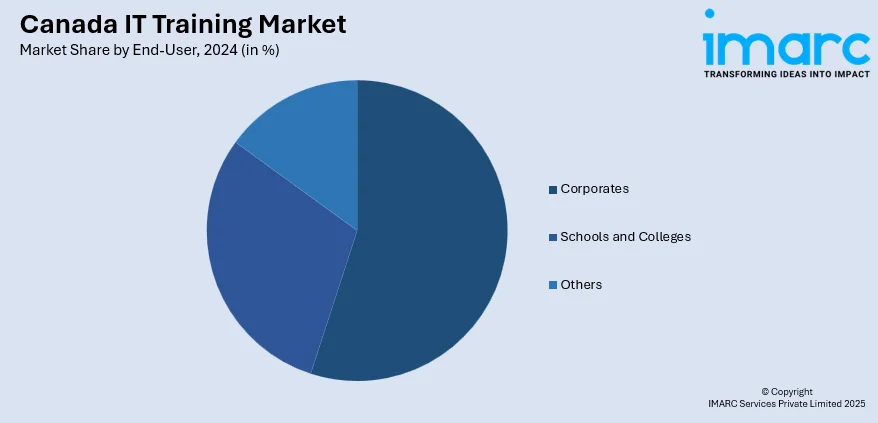

End-User Insights:

- Corporates

- Schools and Colleges

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes corporates, schools and colleges, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report also covers all major regional markets. These include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada IT Training Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | IT Infrastructure Training, Enterprise Application and Software Training, Cyber Security Training, Database and Big Data Training, Others |

| End-Users Covered | Corporate, Schools and Colleges, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Questions Answered in This Report:

- How has the Canada IT training market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada IT training market on the basis of application?

- What is the breakup of the Canada IT training market on the basis of end-user?

- What is the breakup of the Canada IT training market on the basis of region?

- What are the various stages in the value chain of the Canada IT training market?

- What are the key driving factors and challenges in the Canada IT training market?

- What is the structure of the Canada IT training market and who are the key players?

- What is the degree of competition in the Canada IT training market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada IT training market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada IT training market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada IT training industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)