Canada Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2025-2033

Canada Meat Market Overview:

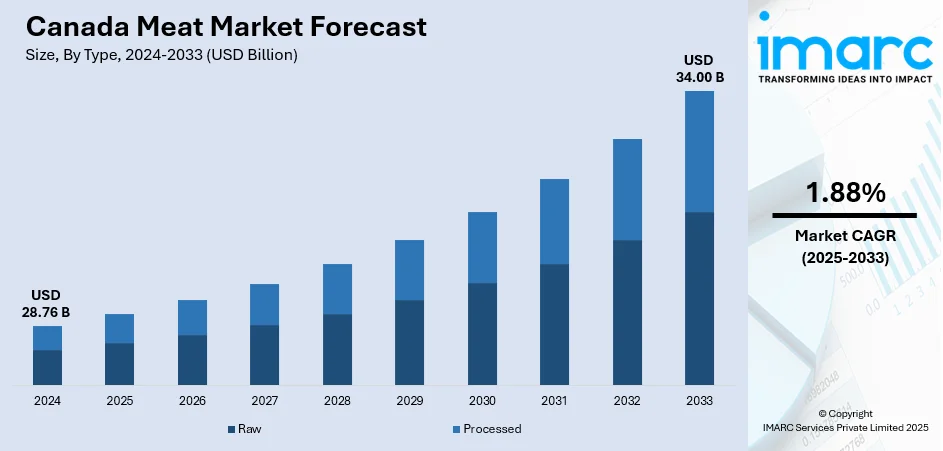

The Canada meat market size reached USD 28.76 Billion in 2024. The market is projected to reach USD 34.00 Billion by 2033, exhibiting a growth rate (CAGR) of 1.88% during 2025-2033. The market is driven by the shifting consumer preferences toward convenience, health, and sustainability. Busy lifestyles are fueling demand for ready-to-eat (RTE) and easy-to-cook options, while growing health awareness boosts interest in lean, organic, and hormone-free meats. Ethical concerns around animal welfare and environmental impact are also shaping purchasing habits. Additionally, strong international demand and Canada’s role as a major meat exporter drive production decision, with trade dynamics influencing pricing, supply chains, and market access across regions further bolstering the Canada meat market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 28.76 Billion |

| Market Forecast in 2033 | USD 34.00 Billion |

| Market Growth Rate 2025-2033 | 1.88% |

Canada Meat Market Trends:

Convenience & Ready-to-Eat (RTE) Products

Hectic lifestyles are reshaping how consumers purchase and consume meat, further influencing the Canada meat market trends. Consumers are seeking convenient, ready-to-cook or RTE products that suit their busy lifestyles without any compromise on flavor. This has created increased demand for pre-marinated meats, completely cooked goods, and portions vacuum-sealed. People desire speedy meal solutions that take little preparation time but pack all the flavor and nutrition of home food. Manufacturers and retailers are catering to this demand by increasing their product portfolios to incorporate more convenient formats. They are most in demand in urban settings, where time pressure and cramped domestic facilities make cooking from raw ingredients less convenient. This transformation is also driving innovation in packaging and shelf life extension to maintain freshness while providing on-the-go convenience. Ultimately, convenience is becoming a driving factor for the Canada meat market growth.

To get more information on this market, Request Sample

Trade Dynamics & Export-Driven Production

Canada’s meat industry, particularly beef and pork, is heavily influenced by global trade dynamics. In 2023, Canadian beef exports hit nearly 499,000 tonnes, reaching a record C$5 billion in value—despite a 2.4% drop in volume, export value rose 7.4% from 2022. This underscores how critical international markets are to the sector’s success. Canadian producers rely on global demand to sustain profitability, meaning any shifts in trade policy, foreign regulations, or geopolitical tensions can directly affect domestic operations. Import restrictions from major buyers can create immediate market uncertainty, forcing producers to pivot quickly. Conversely, strong export demand boosts carcass values and influences production strategies, pricing, and supply chains. The balance between domestic consumption and international opportunity shapes everything from animal selection to product development. As a result, Canada's meat market remains tightly interwoven with global economic and political developments, making it both opportunistic and exposed to volatility.

Premiumization, Sustainability & Healthy Meats

Canadian consumers are increasingly discerning when it comes to the meat they buy, typically valuing quality over quantity. Consumers are increasingly interested in meat that not only tastes good but is also produced ethically and healthier for them. This includes grass-fed, organic, and hormone-free meat, which is perceived as cleaner and more sustainable options. Consumers are also looking more closely at how animals are raised, preferring farms that employ humane and sustainable methods. Attention to values and well-being is driving purchasing, as consumers opt for smaller quantities of better-quality meat over large quantities of less expensive cuts. Manufacturers are responding by providing premium offerings that live up to these standards, from specialty sausages to specialty cuts. The outcome is a market in which health, ethics, and sustainability increasingly influence consumer choice, driving how meat is produced and sold throughout the nation.

Canada Meat Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and distribution channel.

Type Insights:

- Raw

- Processed

The report has provided a detailed breakup and analysis of the market based on the type. This includes raw and processed.

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes chicken, beef, pork, mutton, and others.

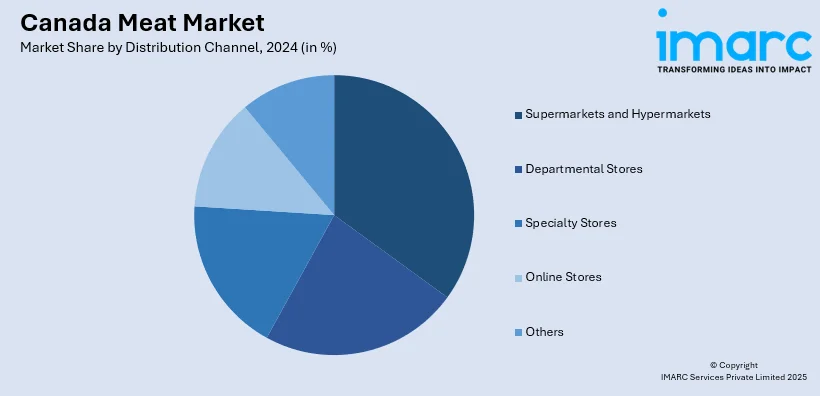

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, departmental stores, specialty stores, online stores, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Meat Market News:

- In April 2025, Olymel, Canada’s top pork and poultry processor, launched a new line of premium pork cuts in Quebec grocery stores. These innovative products reimagine classic beef cuts using Canadian pork, offering both great taste and convenience. Aimed at home cooks seeking quality and simplicity, the new line reflects Olymel’s ongoing commitment to innovation and promoting Canadian-sourced meat, helping consumers enjoy easy-to-prepare, elevated meals with locally produced ingredients.

- In November 2024, Maple Leaf Foods completed its $215 million acquisition of VIAU Foods, a Canadian leader in premium charcuterie and dry-cured meats. The deal strengthens Maple Leaf’s presence in the growing market for value-added meat products and enhances production capacity in Quebec. VIAU’s portfolio includes Italian meats, sausages, and pizza toppings, with expansion plans into antibiotic-free products. The move supports Maple Leaf’s strategy to boost both Canadian and U.S. sales.

Canada Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada meat market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada meat market on the basis of type?

- What is the breakup of the Canada meat market on the basis of product?

- What is the breakup of the Canada meat market on the basis of distribution channel?

- What is the breakup of the Canada meat market on the basis of region?

- What are the various stages in the value chain of the Canada meat market?

- What are the key driving factors and challenges in the Canada meat market?

- What is the structure of the Canada meat market and who are the key players?

- What is the degree of competition in the Canada meat market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada meat market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada meat market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)