Canada Mental Health Market Size, Share, Trends and Forecast by Disorder, Service, Age Group, and Region, 2025-2033

Canada Mental Health Market Overview:

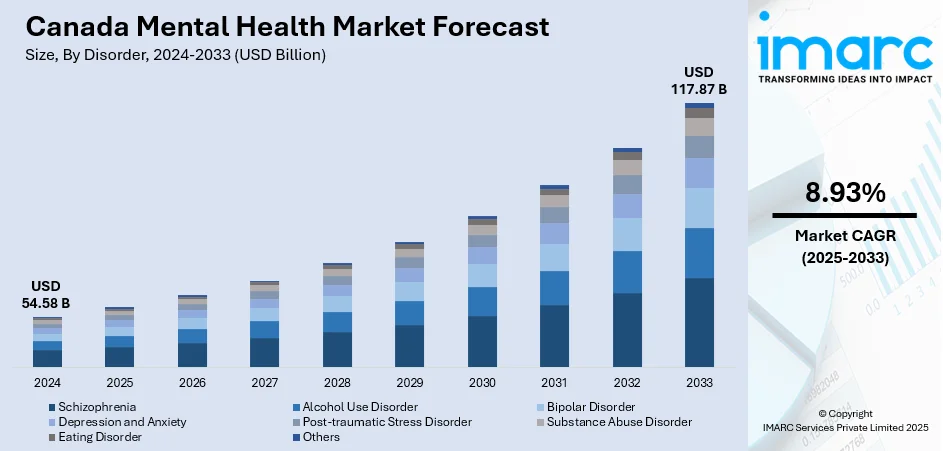

The Canada mental health market size reached USD 54.58 Billion in 2024. The market is projected to reach USD 117.87 Billion by 2033, exhibiting a growth rate (CAGR) of 8.93% during 2025-2033. The market is driven by robust government investments, national policy reforms, and growing demand for integrated community-based care. Rapid adoption of digital platforms, teletherapy, and AI-driven tools is expanding mental health access across urban and remote regions. Furthermore, increasing corporate engagement in employee mental wellness programs and evolving societal attitudes toward mental health are further augmenting the Canada mental health market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 54.58 Billion |

| Market Forecast in 2033 | USD 117.87 Billion |

| Market Growth Rate 2025-2033 | 8.93% |

Canada Mental Health Market Trends:

Government Initiatives and Mental Health Policy Reforms

Canada has prioritized mental health through targeted government initiatives and sustained public funding aimed at improving access to mental health services. The national “Wellness Together Canada” platform, launched during the COVID-19 pandemic, marked a significant step in providing free digital mental health resources and virtual counseling to Canadians. Federal investments through the “Bilateral Agreements on Mental Health and Addictions” with provinces ensure that funding directly addresses regional service gaps. On June 12, 2025, OBIO® announced its support for A4i to expand digital mental health care in Canada through a new partnership with Waypoint Centre for Mental Health Care. Currently, 23% of individuals with complex behavioral and mental health conditions in Canada face re-hospitalization within 30 days of discharge, and 75% discontinue medications within 18 months. This collaboration strengthens A4i’s commercialization efforts by providing mobile technology that empowers patient self-management and enables clinicians to intervene early, directly addressing gaps in Canada’s mental health system. Additionally, the Mental Health Commission of Canada continues to play a vital role in policy development, focusing on stigma reduction and promoting community-based care models. Emphasis is also being placed on expanding culturally appropriate mental health services, particularly for Indigenous communities, supported by partnerships with local organizations and advocacy groups. Moreover, mental health services are increasingly integrated into primary healthcare delivery, simplifying access for individuals seeking help. The rise of mental health awareness campaigns and government commitment to long-term funding are fostering an environment of sustained improvement in service delivery. These national strategies and reforms are fundamental in supporting Canada mental health market growth, ensuring equitable care access and improved population mental wellness.

To get more information on this market, Request Sample

Increasing Demand for Digital Mental Health Solutions

The adoption of digital mental health platforms in Canada is rising rapidly as individuals and healthcare providers seek convenient, accessible, and timely mental health interventions. Virtual therapy services, mental health apps, and AI-driven diagnostic tools have become essential components of Canada’s mental healthcare infrastructure. Both public and private healthcare providers are integrating tele-mental health into routine care, reducing geographical barriers for individuals in remote and underserved regions. Startups and technology firms in Canada are collaborating with healthcare providers to develop evidence-based digital therapies, offering services such as cognitive behavioral therapy (CBT), mood tracking, and crisis intervention through mobile platforms. These innovations not only increase access but also provide anonymity, helping individuals who may otherwise hesitate to seek in-person support. Furthermore, employers across sectors are adopting employee assistance programs (EAPs) with embedded digital mental health services to promote workforce well-being. For instance, on May 27, 2025, the Canadian Mental Health Association (CMHA) launched Not Myself Today® for Managers, a first-of-its-kind LMS-compatible eLearning program to integrate mental health training into workplace systems. With 3 in 5 employees experiencing work-related stress, organizations providing manager mental health training have reported a 28% reduction in sick leave and a 27% decrease in disability durations. This initiative strengthens workplace mental health support across Canada, aligning with broader efforts to reduce mental health-related costs and improve employee well-being. This convergence of technology and mental health care has positioned Canada as a leader in digital healthcare innovation, driving sustained growth in virtual behavioral health offerings tailored to diverse population needs.

Canada Mental Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on disorder, service, and age group.

Disorder Insights:

- Schizophrenia

- Alcohol Use Disorder

- Bipolar Disorder

- Depression and Anxiety

- Post-traumatic Stress Disorder

- Substance Abuse Disorder

- Eating Disorder

- Others

The report has provided a detailed breakup and analysis of the market based on the disorder. This includes schizophrenia, alcohol use disorder, bipolar disorder, depression and anxiety, post-traumatic stress disorder, substance abuse disorder, eating disorder, and others.

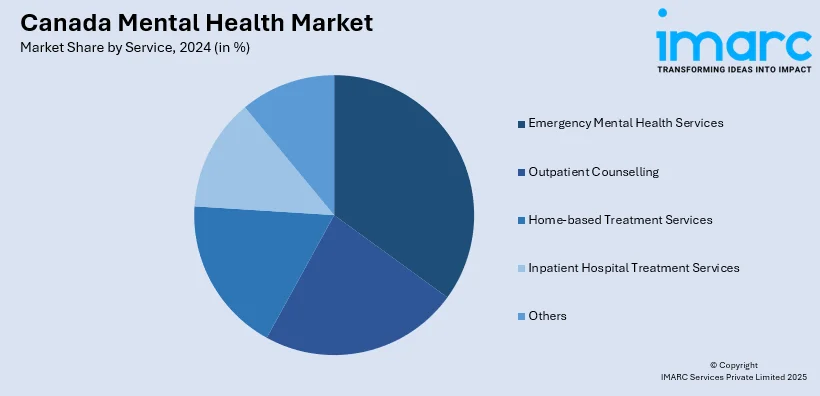

Service Insights:

- Emergency Mental Health Services

- Outpatient Counselling

- Home-based Treatment Services

- Inpatient Hospital Treatment Services

- Others

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes emergency mental health services, outpatient counselling, home-based treatment services, inpatient hospital treatment services, and others.

Age Group Insights:

- Pediatric

- Adult

- Geriatric

The report has provided a detailed breakup and analysis of the market based on the age group. This includes pediatric, adult, and geriatric.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Mental Health Market News:

- On May 26, 2025, the Canadian Association of Journalists (CAJ) launched the Canadian News Industry Peer Support (CNIPS) program to address growing mental health challenges faced by journalists nationwide. The initiative began with 20 trained volunteers and plans to expand to 100 trained peer supporters by the end of 2026 to meet increasing demand. Positioned as North America’s first cross-industry peer support network for journalists, CNIPS aims to combat stress, burnout, and trauma exposure prevalent in Canada’s media sector.

- On June 10, 2025, the Canadian Society for Exercise Physiology (CSEP) launched the world’s first Exercise & Depression Specialization™, providing 40 hours of multimedia training for certified professionals to support mental health through structured physical activity. With half of Canadians projected to experience mental illness by age 40, the program aligns with CANMAT’s clinical guidelines that now recognize exercise as a first-line treatment for mild to moderate depression. This credential strengthens Canada’s mental health framework by bridging exercise science with accessible mental health care solutions.

Canada Mental Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Disorders Covered | Schizophrenia, Alcohol Use Disorder, Bipolar Disorder, Depression and Anxiety, Post-Traumatic Stress Disorder, Substance Abuse Disorder, Eating Disorder, Others |

| Services Covered | Emergency Mental Health Services, Outpatient Counselling, Home-Based Treatment Services, Inpatient Hospital Treatment Services, Others |

| Age Groups Covered | Pediatric, Adult, Geriatric |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada mental health market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada mental health market on the basis of disorder?

- What is the breakup of the Canada mental health market on the basis of service?

- What is the breakup of the Canada mental health market on the basis of age group?

- What is the breakup of the Canada mental health market on the basis of region?

- What are the various stages in the value chain of the Canada mental health market?

- What are the key driving factors and challenges in the Canada mental health market?

- What is the structure of the Canada mental health market and who are the key players?

- What is the degree of competition in the Canada mental health market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada mental health market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada mental health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada mental health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)