Canada Mushroom Market Size, Share, Trends and Forecast by Type, Form, Distribution Channel, End-Use, and Region, 2025-2033

Canada Mushroom Market Overview:

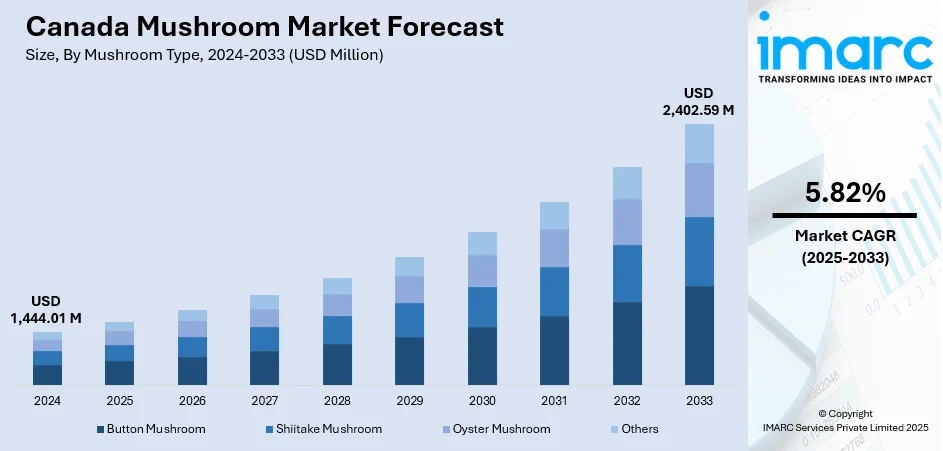

The Canada mushroom market size reached USD 1,444.01 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,402.59 Million by 2033, exhibiting a growth rate (CAGR) of 5.82% during 2025-2033. Shifting culinary habits and broader retail access are strengthening the market growth in Canada. Consumers seek diverse mushroom varieties for new recipes, encouraging local sourcing. Additionally, smaller stores, online services, and meal kits expand availability, keeping mushrooms visible, convenient, and appealing for everyday cooking, thereby increasing the Canada mushroom market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,444.01 Million |

| Market Forecast in 2033 | USD 2,402.59 Million |

| Market Growth Rate 2025-2033 | 5.82% |

Canada Mushroom Market Trends:

Growth in Culinary Trends

Changing culinary preferences strongly influence consumer purchases, and mushrooms continue to benefit from this shift. Chefs, culinary writers, and digital food platforms are elevating mushrooms from a simple side ingredient to a feature element in modern recipes. An increasing number of people are now looking for new textures and tastes, which is catalyzing the demand for specialty types beyond the standard white button mushroom. Shiitake, oyster, and various other distinctive varieties often feature in dishes that provide lighter or plant-based substitutes for meat. This preference for diverse options encourages restaurant chains and meal kit companies to source produce from local or regional suppliers, creating opportunities for Canadian growers to increase production capacity. A distinct illustration of this trend took place in November 2024 when Wendy’s Canada launched the Garlic Mushroom Bacon Cheeseburger. This item featured a Canadian beef patty, Applewood smoked bacon, sautéed mushrooms, garlic spread, and Muenster cheese, and was offered nationwide for a limited period, along with a Mushroom Poutine. This launch showcased the potential of mushrooms to enhance gourmet allure in quick-service menus and draw wider consumer attention. The eagerness to try new recipes and culinary experiences is establishing mushrooms as a flexible, useful ingredient that improves daily meals. This sustained interest supports expansion in domestic production and strengthens the connection between emerging food trends and the support the Canada mushroom market growth.

To get more information on this market, Request Sample

Changing Retail Formats

Smaller grocery stores, corner shops, and online grocery delivery services are now consistently stocking fresh and packaged mushrooms. Meal kit providers and same-day delivery services commonly feature mushrooms as a staple as they have a long shelf life, enhance flavor, and need little preparation. This increased retail availability allows mushrooms to appear in places where consumers look for quick dinners and essential items, targeting shoppers who may not visit the produce section in a big grocery store but will take mushrooms if they are included in a meal kit or a nearby shop. This distribution across various sales channels reduces demand fluctuations linked to large grocery store trends and makes mushrooms readily available for busy families. Pre-packaged slices and smaller servings also cater to city dwellers with busy lifestyles. Producers and suppliers gain advantages by not depending excessively on just a handful of large grocery contracts. An instance of this reach is Red Light Holland’s announcement in 2024 that its subsidiary Happy Caps obtained a reorder from Costco Canada for more than 40,000 Mushroom Home Grow Kits, nearly doubling the initial order. The presence of varieties such as Shiitake, Lion's Mane, and Oyster mushrooms on shelves in numerous Costco stores across the country demonstrated how significant retail collaborations bring mushrooms to more homes and enhance brand awareness. Wider retail channels and such deals ensure mushrooms remain visible, accessible, and consistently in demand each month.

Canada Mushroom Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, form, distribution channel, and end-use.

Mushroom Type Insights:

- Button Mushroom

- Shiitake Mushroom

- Oyster Mushroom

- Others

The report has provided a detailed breakup and analysis of the market based on the mushroom type. This includes button mushroom, shiitake mushroom, oyster mushroom, and others.

Form Insights:

- Fresh Mushroom

- Canned Mushroom

- Dried Mushroom

- Others

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes fresh mushroom, canned mushroom, dried mushroom, and others.

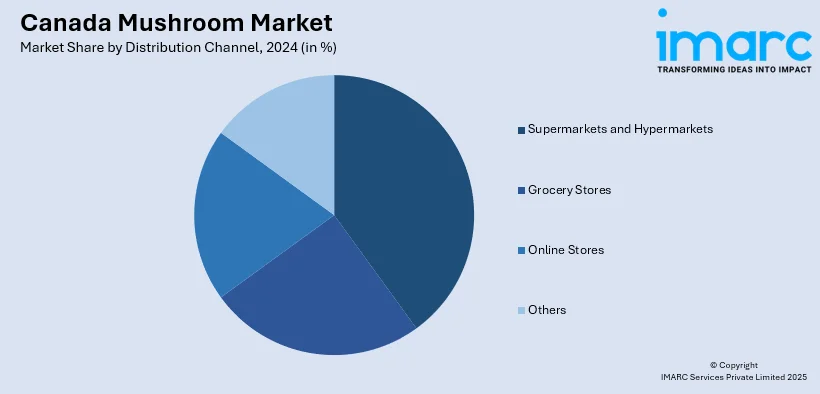

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Grocery Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, grocery stores, online stores, and others.

End-Use Insights:

- Food Processing Industry

- Food Service Sector

- Direct Consumption

- Others

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes food processing industry, food service sector, direct consumption, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Mushroom Market News:

- In May 2025, Red Light Holland’s subsidiary Happy Caps launched presales of Health Canada-approved Functional Mushroom Gummies, featuring Shiitake and Lion’s Mane for cognitive and immune support. The sugar-free gummies are available at a 25% discount on HappyCaps.ca. This marks a major step in the company’s wellness product expansion.

- In October 2024, Highline Mushrooms announced it is building a fully organic, high-tech mushroom farm in Leamington, Ontario, in partnership with the Christiaens Group. The farm, using Christiaens’ advanced Drawer System, aimed to serve both Canadian and US markets by late 2025.

Canada Mushroom Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mushroom Types Covered | Button Mushroom, Shiitake Mushroom, Oyster Mushroom, Others |

| Forms Covered | Fresh Mushroom, Canned Mushroom, Dried Mushroom, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Grocery Stores, Online Stores, Others |

| End-Uses Covered | Food Processing Industry, Food Service Sector, Direct Consumption, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada mushroom market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada mushroom market on the basis of mushroom type?

- What is the breakup of the Canada mushroom market on the basis of form?

- What is the breakup of the Canada mushroom market on the basis of distribution channel?

- What is the breakup of the Canada mushroom market on the basis of end-use?

- What is the breakup of the Canada mushroom market on the basis of region?

- What are the various stages in the value chain of the Canada mushroom market?

- What are the key driving factors and challenges in the Canada mushroom market?

- What is the structure of the Canada mushroom market and who are the key players?

- What is the degree of competition in the Canada mushroom market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada mushroom market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada mushroom market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada mushroom industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)