Canada Office Furniture Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, Price Range, and Region, 2025-2033

Canada Office Furniture Market Overview:

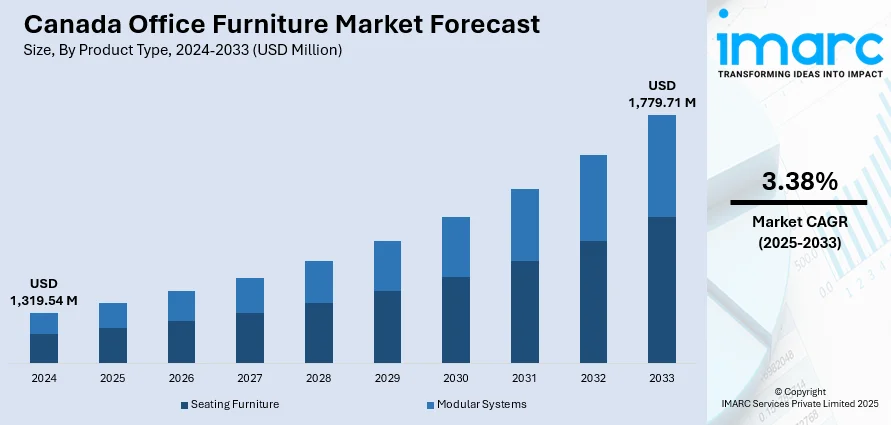

The Canada office furniture market size reached USD 1,319.54 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,779.71 Million by 2033, exhibiting a growth rate (CAGR) of 3.38% during 2025-2033. Canadian firms want furniture that blends comfort, flexibility, and smart design. Higher rents encourage businesses to optimize smaller spaces with adaptable layouts, while premium upgrades show commitment to employee wellbeing. Suppliers benefit by offering durable, ergonomic, and stylish pieces that suit evolving workplace needs, contributing to the expansion of the Canada office furniture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,319.54 Million |

| Market Forecast in 2033 | USD 1,779.71 Million |

| Market Growth Rate 2025-2033 | 3.38% |

Canada Office Furniture Market Trends:

Premium Product Upgrades

Companies now see furniture not just as functional equipment but as an investment that reflects their commitment to employee wellbeing and workplace appeal. This is catalyzing the demand for upgraded product lines that combine durability with high-end aesthetics and ergonomic performance. Buyers are more willing to allocate budget to premium seating, sit-stand desks, and thoughtfully designed collaborative pieces that boost comfort, productivity, and the overall work atmosphere. Manufacturers respond by expanding their portfolios with advanced materials, innovative designs, and added features that address back support, posture, and adjustability. For example, in 2024, Canadian-based company Primo International announced a new line of Sealy Posturepedic office chairs. The upgraded collection featured enhanced comfort and design. Besides this, branding around these upgrades focuses on health benefits, modern design trends, and longer product life cycles, which appeals to corporate buyers seeking to future-proof their spaces. This trend encourages suppliers to invest in research operations and to market their collections as part of a company’s strategy for creating inspiring, productive environments. Upgraded furniture also ties into broader facility renovations and rebranding efforts, giving companies a way to modernize interiors without large structural changes. This demand for quality and comfort is supporting the Canada office furniture market growth, raising standards across price tiers.

To get more information on this market, Request Sample

Influence of Real Estate Trends and Space Optimization

Commercial lease expenses in prominent Canadian cities have risen significantly, encouraging businesses to maximize the utility of every square foot they use. The Toronto Regional Real Estate Board (TRREB) reports that the average lease rate for commercial and retail spaces increased to $47.21 in 2024, rising from $28.01 in Q3 2023. Smaller offices and multi-use areas now dominate new fit-outs, driving the demand for furniture that adapts quickly and stores away when not needed. Items, such as collapsible tables, stackable seats, and movable dividers that also serve as sound-absorbing panels or writing surfaces are becoming standard requests. Designers and suppliers capable of providing products for compact spaces with adaptable arrangements have a competitive advantage in this landscape. Real estate advisors frequently collaborate with furniture suppliers to propose designs that enable tenants to sublease sections of their offices while still operating efficiently for individual work or team meetings. Hybrid work is making businesses more careful about committing to expansive office spaces, yet very few desire vacant desks depleting their budget. Rather than completely leaving physical offices, they reduce square footage and invest in adaptable furniture that facilitates ongoing transformation. This continuous flow of minor enhancements and adjustments maintains market activity, benefiting sellers capable of providing practical solutions that address limited spaces and increasing costs while ensuring comfort and collaboration are not sacrificed.

Canada Office Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, distribution channel, and price range.

Product Type Insights:

- Seating Furniture

- Modular Systems

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seating furniture and modular systems.

Material Type Insights:

- Wood

- Metal

- Plastic and Fiber

- Glass

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes wood, metal, plastic and fiber, glass, and others.

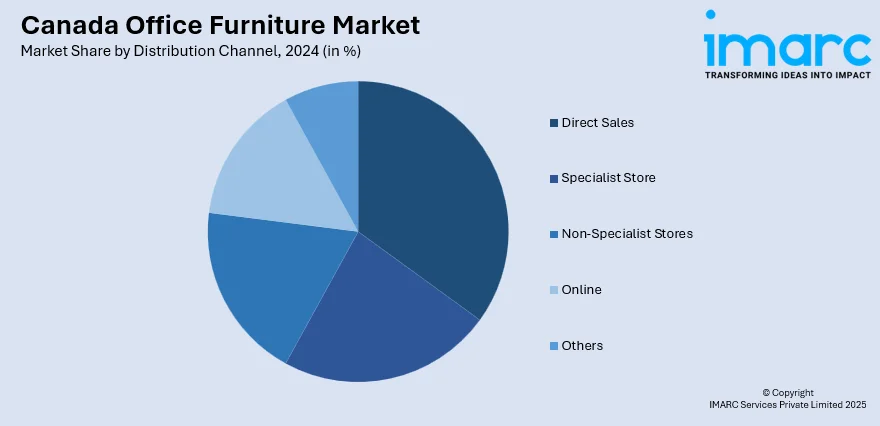

Distribution Channel Insights:

- Direct Sales

- Specialist Store

- Non-Specialist Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales, specialist store, non-specialist stores, online, and others.

Price Range Insights:

- Low

- Medium

- High

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes low, medium, and high.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Office Furniture Market News:

- In July 2024, Sihoo ergonomic chairs were officially available for purchase in Canada, coinciding with Canada Day. Canadian clints benefited from complimentary shipping within 3 to 7 days, along with a 3-year warranty and a 30-day return policy.

- In June 2024, Source Office Furniture, a Canadian retailer with 40 years in the industry, launched a brand refresh to emphasize personalized, approachable service and highlight its knowledgeable staff. The rebrand focused on creating welcoming office furniture experiences across Canada. The company remained committed to quality, ergonomics, and customer-centric solutions.

Canada Office Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seating Furniture, Modular Systems |

| Material Types Covered | Wood, Metal, Plastic and Fiber, Glass, Others |

| Distribution Channels Covered | Direct Sales, Specialist Store, Non-Specialist Stores, Online, Others |

| Price Ranges Covered | Low, Medium, High |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada office furniture market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada office furniture market on the basis of product type?

- What is the breakup of the Canada office furniture market on the basis of material type?

- What is the breakup of the Canada office furniture market on the basis of distribution channel?

- What is the breakup of the Canada office furniture market on the basis of price range?

- What is the breakup of the Canada office furniture market on the basis of region?

- What are the various stages in the value chain of the Canada office furniture market?

- What are the key driving factors and challenges in the Canada office furniture market?

- What is the structure of the Canada office furniture market and who are the key players?

- What is the degree of competition in the Canada office furniture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada office furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada office furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada office furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)