Canada Online Travel Market Size, Share, Trends and Forecast by Service Type, Platform, Mode of Booking, Age Group, and Region, 2025-2033

Canada Online Travel Market Overview:

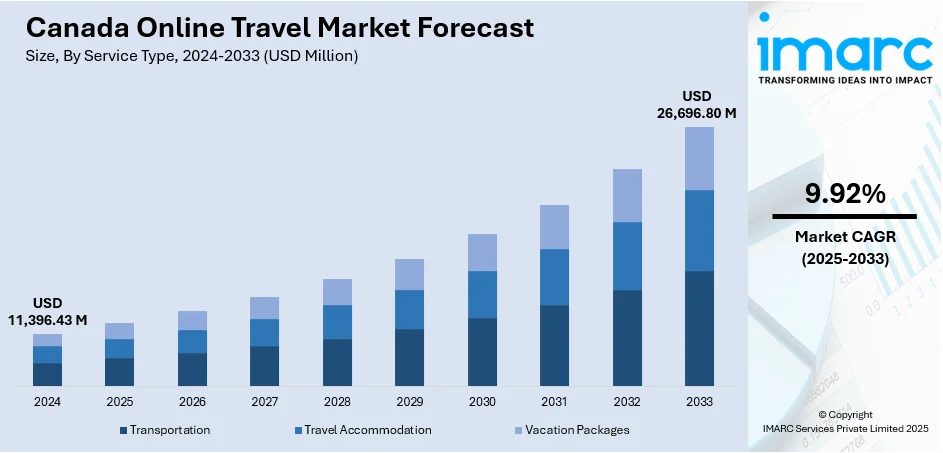

The Canada online travel market size reached USD 11,396.43 Million in 2024. The market is projected to reach USD 26,696.80 Million by 2033, exhibiting a growth rate (CAGR) of 9.92% during 2025-2033. The market is experiencing steady growth, driven by increasing internet and mobile penetration, rising preference for personalized travel, and widespread adoption of digital booking platforms. Package holidays and solo travel are gaining traction, reflecting demand for curated and independent experiences. Domestic-focused booking services are also flourishing alongside cross-border tourism, supported by major OTAs like Expedia and Booking. These developments are enhancing the Canada online travel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11,396.43 Million |

| Market Forecast in 2033 | USD 26,696.80 Million |

| Market Growth Rate 2025-2033 | 9.92% |

Canada Online Travel Market Trends:

AI-Driven Personalized Travel Itinerary

By 2025, artificial intelligence (AI) is having a big impact on the way Canadians are planning and booking travel. Many internet travel sites provide AI-driven tools such as chatbots and itinerary builders to assist consumers in mixing flights, accommodations, and activities into customized vacations. These AI systems are learning consumers' personal preferences, enabling travelers to get suggested recommendations tailored specifically to them, making it easier to make decisions and save time. More and more, voice and predictive technology are being combined to further increase convenience. This emphasis on AI-based personalization is also in line with Canadian travelers' desire for seamless, intuitive booking experiences. Consequently, the travel sector is heavily investing in these technologies to match consumer demand. Introducing AI tools is a driving force behind Canada online travel market growth since it enhances engagement and satisfaction. It also represents a wider movement towards data-led, consumer-focused travel businesses which respond in real-time to customers' requirements, driving increased online booking and customer loyalty.

To get more information on this market, Request Sample

Continued Growth in Domestic Travel

In 2025, domestic travel continues to be a major focus for Canadian travelers, driven largely by ongoing uncertainties around international travel and shifting preferences for nearby destinations. Popular spots like Tofino on the west coast and St. John’s in the east have seen notable increases in visitor interest as people opt for accessible, nature-rich vacations closer to home. Airlines including WestJet and Air Canada have expanded regional flight routes to accommodate the growing demand for domestic travel options. Online travel platforms actively promote local vacation packages, offering travelers curated experiences that highlight Canada’s natural beauty and cultural heritage. Many travelers also seek flexible booking and cancellation policies to manage unpredictable schedules. This strong domestic travel trend reflects broader shifts in traveler behavior, where convenience, safety, and meaningful experiences are prioritized. It plays a significant role in shaping Canada online travel market trends, encouraging growth in local tourism sectors and supporting regional economies. The emphasis on short-haul travel is expected to continue influencing how Canadians plan their vacations through digital channels.

Focus on Sustainable and Realistic Travel

Sustainability remains a top concern for Canadian tourists in 2025. More travelers opt for environmentally friendly hotels, sustainable wildlife excursions, and immersive culture that benefits local people and the environment. Travel websites meet this demand by introducing sustainability filters and presenting selected packages centered on eco-tourism. Virtual reality excursions and online guides also enable travelers to discover places responsibly prior to reservation. Technology is being employed more and more to market Indigenous-owned tourism and regenerative travel practices so that visitors can interact in ways that honor local culture and nature. Such shifts mirror larger societal momentum toward environmental consciousness and responsible travel decisions. Consequently, the Canada online travel market growth is significantly driven by the need for open, sustainable choices that resonate with travelers' values. The travel market is adapting to deliver experiences that strike a balance between immersive and eco-responsible behavior, helping tourism be a net positive for communities and the environment. The emphasis on sustainability is structuring the future of Canadian travel considerably.

Canada Online Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type, platform, mode of booking, age group.

Service Type Insights:

- Transportation

- Travel Accommodation

- Vacation Packages

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, travel accommodation, and vacation packages.

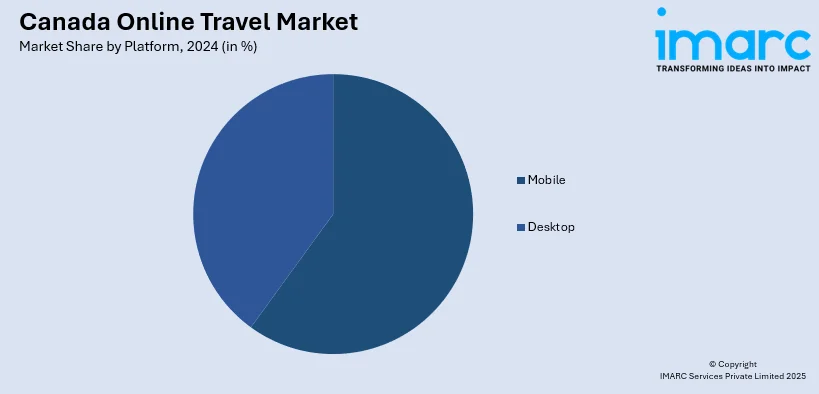

Platform Insights:

- Mobile

- Desktop

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes mobile and desktop.

Mode of Booking Insights:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

The report has provided a detailed breakup and analysis of the market based on the mode of booking. This includes online travel agencies (OTAs) and direct travel suppliers.

Age Group Insights:

- 22-31 Years

- 32-43 Years

- 44-56 Years

- Above 56 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 22-31 years, 32-43 years, 44-56 years, and above 56 years.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Online Travel Market News:

- In October 2024: Montreal-based travel platform FlightHub collaborated with UK firm InterLnkd to create Canada’s first AI-powered pre-travel e-commerce mall. The innovation allows travelers to shop curated fashion, beauty, and essentials based on their travel bookings, enhancing both convenience and monetization opportunities for travel operators.

- In May 2024: Destination Canada launched the Tourism Data Collective in partnership with Statistics Canada and the Innovation department. The AI-powered platform centralizes tourism-related data to help businesses, investors, and local governments make better-informed decisions. The initiative won the 2024 DataIQ AI Award for best nonprofit AI use and supports the country's goal of growing tourism revenues to CAD 160 billion annually.

Canada Online Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Travel Accommodation, Vacation Packages |

| Platforms Covered | Mobile, Desktop |

| Mode of Bookings Covered | Online Travel Agencies (OTAs), Direct Travel Suppliers |

| Age Groups Covered | 22-31 Years, 32-43 Years, 44-56 Years, Above 56 Years |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada online travel market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada online travel market on the basis of service type?

- What is the breakup of the Canada online travel market on the basis of platform?

- What is the breakup of the Canada online travel market on the basis of the mode of booking?

- What is the breakup of the Canada online travel market on the basis of age group?

- What is the breakup of the Canada online travel market on the basis of the region?

- What are the various stages in the value chain of the Canada online travel market?

- What are the key driving factors and challenges in the Canada online travel market?

- What is the structure of the Canada online travel market and who are the key players?

- What is the degree of competition in the Canada online travel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada online travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada online travel market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)