Canada Plywood Market Size, Share, Trends and Forecast by Application, Sector, and Region, 2025-2033

Canada Plywood Market Overview:

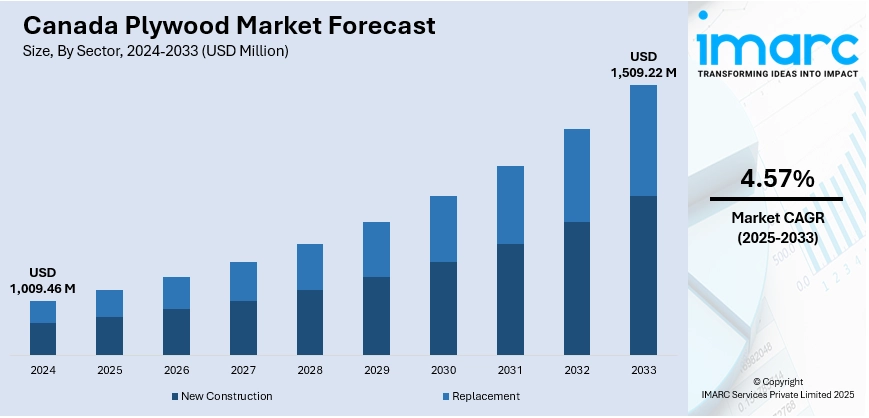

The Canada plywood market size reached USD 1,009.46 Million in 2024. The market is projected to reach USD 1,509.22 Million by 2033, exhibiting a growth rate (CAGR) of 4.57% during 2025-2033. With the rise of new residential, commercial, and infrastructure developments nationwide, builders continue to depend on plywood for various structural and interior applications, including flooring, roofing, walls, subfloors, and cabinetry. The presence of raw materials ensures steady production, motivating both small and large plywood manufacturers to function effectively. This is fueling the Canada plywood market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,009.46 Million |

| Market Forecast in 2033 | USD 1,509.22 Million |

| Market Growth Rate 2025-2033 | 4.57% |

Canada Plywood Market Trends:

Increasing construction activities

Rising construction activities are positively influencing the market in Canada. As new residential, commercial, and infrastructure projects are emerging across the country, builders continue to rely on plywood for a wide assortment of structural and interior uses, such as flooring, roofing, walls, subfloors, and cabinetry. Plywood’s strength, stability, and ease of installation make it a preferred choice in both traditional and modern construction. With population growth and urban development, especially in cities like Toronto, Vancouver, and Calgary, the need for housing and public facilities continues to rise, driving the demand for plywood. Renovation and retrofitting of older buildings are also contributing to the market growth, as plywood is commonly employed in refurbishing work. In colder regions, plywood’s resistance to warping and its insulation properties are valued in construction. Moreover, the shift towards sustainable and energy-efficient building practices is supporting the utilization of certified plywood products. Government investments in infrastructure projects like schools, hospitals, and transit systems are adding further momentum. This steady increase in construction activities is leading to higher production, innovation, and supply chain efficiency within the plywood industry. As per industry reports, the construction industry in Canada is anticipated to grow by 3.9% to attain CAD 222.11 Billion in 2024.

To get more information on this market, Request Sample

Abundant forest reserves

Abundant forest reserves are propelling the Canada plywood market growth. As per the World Population Review, in the beginning of January 2025, Canada had nearly 95,000 square kilometers of its land area covered in forests. This significantly exceeded the second largest country regarding forest area, which was Russia. Canada is rich in timber resources, with vast areas of managed forests that supply the wood needed for plywood production. This natural advantage allows plywood manufacturers to access high-quality softwood and hardwood logs locally, reducing dependency on imports and keeping production costs stable. The availability of raw materials is supporting consistent manufacturing, encouraging both small and large-scale plywood producers to operate efficiently. It also allows the employment of a wide variety of plywood types, meeting diverse needs in construction, furniture, and industrial applications. The presence of well-developed forestry management practices ensures long-term supply through replanting and conservation efforts, aligning with high demand for sustainable wood items. The local timber supply also supports innovations, such as engineered plywood with improved strength and moisture resistance. In addition, having forests close to production facilities lowers transportation costs and refines supply chain speed.

Canada Plywood Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application and sector.

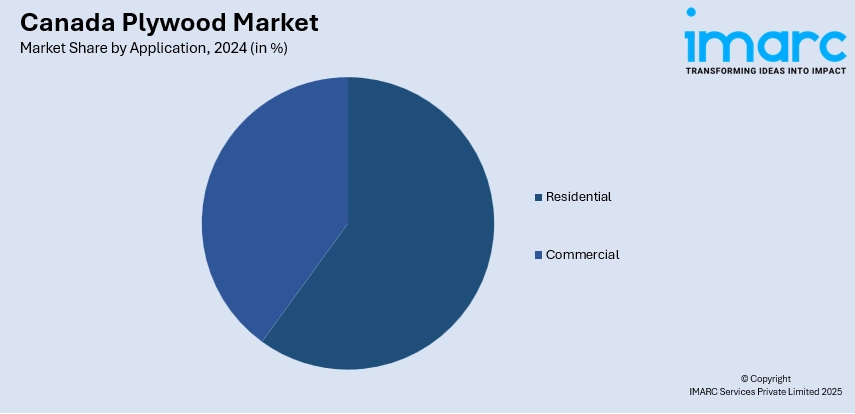

Application Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial.

Sector Insights:

- New Construction

- Replacement

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes new construction and replacement.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Plywood Market News:

- In May 2024, Tolko Industries was set to obtain USD 8 Million in government funding to grow its plywood mill in Heffley Creek, established in Kamloops, Canada, which included building a facility for a new engineered wood division. This encompassed items to assist in new residential construction, in addition to millwork, door and window, and non-residential building systems. The growth was anticipated to generate 20 new positions.

- In April 2024, Fraser broadened the William Lake plywood facility in Canada by substituting one of its three current dryers. The upgraded wood veneer drying machine would enhance productivity, efficiency, safety, and reliability, while also supporting the mill in maintaining its superior product quality, which extended the resilience of the company’s established Williams Lake operations. Drying wood veneer was an essential process in the production of plywood to maintain the appropriate stability.

Canada Plywood Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Residential, Commercial |

| Sectors Covered | New Construction, Replacement |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada plywood market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada plywood market on the basis of application?

- What is the breakup of the Canada plywood market on the basis of sector?

- What is the breakup of the Canada plywood market on the basis of region?

- What are the various stages in the value chain of the Canada plywood market?

- What are the key driving factors and challenges in the Canada plywood market?

- What is the structure of the Canada plywood market and who are the key players?

- What is the degree of competition in the Canada plywood market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada plywood market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada plywood market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada plywood industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)