Canada Smart Home Devices Market Size, Share, Trends and Forecast by Component, Type, and Region, 2025-2033

Canada Smart Home Devices Market Size and Share:

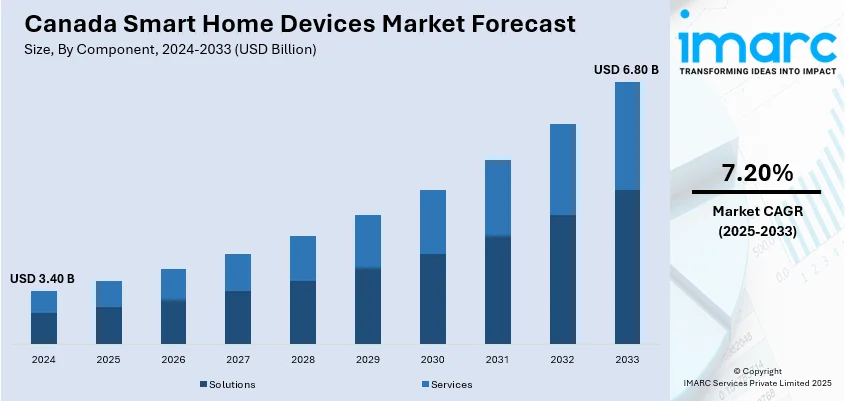

The Canada smart home devices market size was valued at USD 3.40 Billion in 2024. Looking forward, the market is projected to reach USD 6.80 Billion by 2033, exhibiting a CAGR of 7.20% during 2025-2033. The market is driven by the increasing adoption of smart technologies and home automation among Canadian consumers. Furthermore, the growing focus on energy efficiency and enhanced home security is fueling the demand for these devices. The trend towards convenience, coupled with greater product availability, is expected to further augment the Canada smart home devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.40 Billion |

| Market Forecast in 2033 | USD 6.80 Billion |

| Market Growth Rate 2025-2033 | 7.20% |

The market is primarily driven by the increasing consumer interest in home automation and convenience. In line with this, the growing availability of affordable and innovative products is also providing an impetus to the market. In September 2025, Levven Electronics Ltd. announced a partnership with Schneider Electric Canada to accelerate the adoption of wire-free smart switch technology across Canada. The collaboration combines Levven’s Switched Right® platform with Schneider Electric’s national sales network, aiming to provide sustainable, affordable, and efficient homebuilding solutions. This strategic alliance is expected to enhance the Canada smart home devices market growth by offering innovative, flexible solutions that reduce material waste, speed installation, and improve the homeowner experience. Moreover, the considerable rise in energy efficiency awareness is acting as a significant growth-inducing factor for the market. In addition to this, the expanding number of tech-savvy individuals and the rise in disposable incomes are resulting in a higher investment in advanced smart home devices.

Besides this, the demand for seamless integration with existing home systems is creating lucrative opportunities in the market. Also, the increasing influence of social media and tech influencers is one of the major Canada smart home devices market trends that are impacting the market positively. The market is further driven by favorable government initiatives promoting smart home technologies for energy conservation. In August 2025, the Canadian government announced a nearly USD 12 million investment in six innovative housing projects across southern Ontario, aimed at improving construction efficiency and affordability. This includes advancements in 3D printing and automated manufacturing. These investments are expected to enhance homebuilding technologies and contribute to a smarter, more sustainable housing market in Canada. Apart from this, the ease of online and offline availability of smart home products is propelling the market. Some of the other factors contributing to the market include rapid urbanization, growing awareness around home security, and the rise in consumer demand for personalized and customizable home environments.

Canada Smart Home Devices Market Trends:

Increasing Geriatric Population

According to an article published in 2024 on the website of Statistique Canada, people aged 65 and above reached 7,568,308 in July 2023 across Canada. Many seniors prefer to live independently in their own homes rather than transferring to assisted living facilities, which is resulting in higher product adoption, as per the Canada smart home device market forecast. Smart home technology, such as smart sensors and automation systems, contributes to this by providing safety measures that allow seniors to remain independent. Moreover, smart cameras and home monitoring systems enable family members and caregivers to keep a check on seniors from a distance, assuring their well-being while respecting their liberty. Besides this, smartwatches and health trackers that monitor vital indications like heart rate and activity levels are becoming popular among seniors. These technologies enable proactive health management and the early detection of prospective health risks. Also, smart home technologies are frequently integrated with telehealth services, allowing elders to consult healthcare providers from home, which is particularly advantageous for those with mobility issues. With safety and security concerns, seniors are turning to smart locks, security cameras, and alarm systems with remote access and monitoring. These technologies help elders feel comfortable at home. Furthermore, emergency alarm systems can be built into smart home gadgets to warn caregivers or emergency personnel if a senior falls or has a medical emergency. Apart from this, smart home assistants enable elderly people to control their home environment via voice commands, decreasing the need for physical interaction with gadgets, thus enhancing the Canada smart home devices market outlook.

E-Commerce Growth

According to the International Trade Administration (ITA), in December 2024, e-commerce made up 6.1% of all retail sales in Canada, reaching about USD 3.14 Billion in online sales. People can access numerous smart home devices from various brands easily through e-commerce platforms which enable Canadians to shop independently of their location. In confluence with this, e-commerce lets customers buy smart home products at any moment which traditional retail cannot duplicate. Moreover, their wide selection of smart home devices and online marketplaces offer customers access to special products that traditional stores cannot provide. The wide selection of products on the market prompts customers to perform research until they find products that align with their specifications. Besides this, through e-commerce technology, customers gain the ability to review multiple brands simultaneously which enables them to choose their purchases with better information. Additionally, e-commerce platforms frequently provide customer reviews, ratings, and product comparisons, which assist educate buyers on the benefits and features of smart home products. This information can enhance consumer confidence in acquiring these devices. Many e-commerce websites also offer video tutorials and demonstrations that show how to utilize smart home devices properly. This can increase uptake among people who are unfamiliar with the technology. Furthermore, e-commerce sites typically provide promotional deals, discounts, and bundling options for smart home gadgets, making them more inexpensive to customers. As per the data published on the website of the International Trade Administration (ITA) in 2023, eCommerce users in Canada are expected to reach 77.6% in 2025. This is significantly boosting the Canada smart home devices market share.

Canada Smart Home Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Canada smart home devices market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on component and type.

Analysis by Component:

- Solutions

- Services

The solutions segment encompasses the hardware and software integrated into smart home devices, such as smart thermostats, lighting systems, security cameras, and home assistants. These solutions are designed to enhance home automation, improve energy efficiency, and increase convenience for homeowners. As the demand for connected homes grows, solutions continue to evolve with new technologies like artificial intelligence (AI) and the Internet of Things (IoT), enabling devices to work seamlessly together.

On the other hand, the services segment includes installation, maintenance, and support services for smart home devices. With the increasing complexity of smart home systems, many consumers rely on professional services for setup and troubleshooting. The growth of this segment is being driven by the need for personalized home automation solutions, customer support, and upgrades as new devices and technologies are introduced to the market. Companies are also offering subscription-based services, which further drive the growth of this segment.

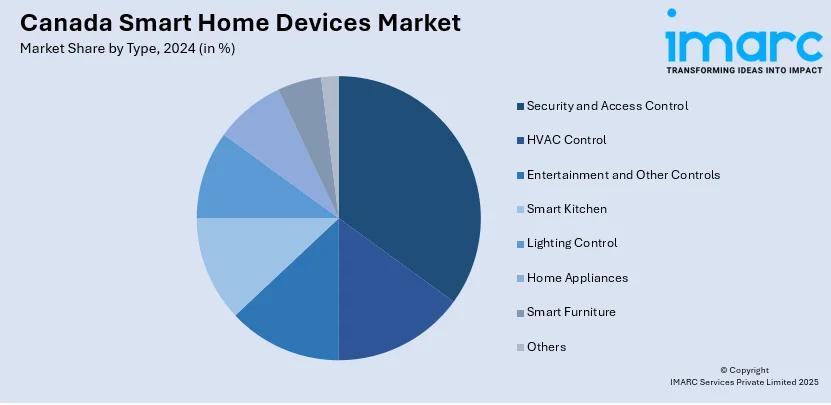

Analysis by Type:

- Security and Access Control

- HVAC Control

- Entertainment and Other Controls

- Smart Kitchen

- Lighting Control

- Home Appliances

- Smart Furniture

- Others

The security and access control segment includes devices like smart locks, video doorbells, and surveillance cameras. These devices provide enhanced home security by allowing homeowners to monitor and control access remotely, offering convenience and peace of mind. The growing concerns around home safety, coupled with the increasing popularity of smart technology, are driving the adoption of security solutions in smart homes.

HVAC (Heating, Ventilation, and Air Conditioning) control systems are designed to optimize temperature regulation and improve energy efficiency in homes. Smart thermostats, such as those from Nest or Ecobee, enable homeowners to remotely control their home's temperature and even adjust it based on their schedule. As energy conservation becomes a priority, HVAC control systems have seen significant growth, contributing to the overall expansion of the smart home devices market.

The entertainment and other controls segment covers smart speakers, streaming devices, and smart TVs, along with other connected entertainment devices. With increasing integration between entertainment systems and home automation, these devices allow users to control their media consumption through voice commands or mobile apps. The growing adoption of streaming services, smart TVs, and voice assistants is expanding the market for entertainment and control devices.

Regional Analysis:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

Ontario is expected to be one of the largest markets for smart home devices in Canada, driven by its large population, urbanization, and high disposable income. As the province continues to adopt innovative technologies, the demand for smart homes and devices is increasing, particularly in cities like Toronto and Ottawa, where tech-savvy consumers are looking for greater convenience, security, and energy efficiency.

Quebec's market is also growing, with a strong focus on sustainable living and energy efficiency. The province’s government initiatives to promote smart technology adoption are driving growth in smart home devices. Moreover, Quebec’s bilingual population and diverse culture present unique opportunities for customized smart home solutions that cater to both French and English-speaking consumers.

Alberta's market for smart home devices is expanding, largely due to its growing tech industry and increasing demand for home automation systems. With major urban centers like Calgary and Edmonton, the demand for energy-efficient and secure smart home solutions is on the rise. Additionally, Alberta’s interest in sustainability and cost-effective energy solutions is further propelling the adoption of smart HVAC systems and home appliances.

British Columbia is another key region driving the growth of the smart home devices market in Canada. With major metropolitan areas like Vancouver, BC is characterized by a high rate of technological adoption, a growing urban population, and an increasing demand for sustainable and energy-efficient homes. The province is known for its commitment to environmental sustainability, and many residents are looking for ways to reduce energy consumption through smart technologies.

Competitive Landscape:

The report provides a comprehensive analysis of the competitive landscape in the Canada smart home devices market with detailed profiles of all major companies.

Latest News and Developments:

- August 2025: Toronto-based Rogers announced the launch of a new range of smart home devices and functions for its Rogers Xfinity Self Protection, along with new plans with more customizable options. Users can effortlessly manage their connected lives while monitoring their homes with the help of the Rogers Xfinity app, which incorporates Self Protection smart devices and features.

- April 2025: Control4 announced plans for the launch of the Control4 X4 platform and the upgraded Control4 Connect service in Canada in Q4 2025. The Control4 ecosystem's latest version, Control4 X4, offers enhanced compatibility with smart devices, simplified management, and more robust hardware integrations. When combined with the enhanced Connect service, this platform will give homeowners access to a more comprehensive and user-friendly experience.

- March 2025: Vancouver-based TELUS further expanded its partnership with AWS by announcing that it is utilizing the new Managed Integrations functionality of AWS IoT Device Management as a crucial part of its SmartHome+ offering. SmartHome+, the first device agnostic smart home system globally, allows individuals to construct comprehensive smart homes with the help of the newest advancements in AI and ML in conjunction with both new and old internet of things (IoT) devices.

- February 2025: ABB announced the launch of the ReliaHome™ Smart Panel featuring PanelGuard technology in Canada, the United States, Central America, and the Caribbean. With intelligent, streamlined energy management for every configuration, the ReliaHome™ Smart Panel aims to completely transform house electrification.

Canada Smart Home Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solutions, Services |

| Types Covered | Security and Access Control, HVAC Control, Entertainment and Other Controls, Smart Kitchen, Lighting Control, Home Appliances, Smart Furniture, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada smart home devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada smart home devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada smart home devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The market in Canada was valued at USD 3.40 Billion in 2024.

The Canada smart home devices market is projected to exhibit a CAGR of 7.20% during 2025-2033, reaching a value of USD 6.80 Billion by 2033.

The market is driven by the increasing adoption of smart technologies and home automation among Canadian consumers. Furthermore, the growing focus on energy efficiency and enhanced home security is fueling the demand for these devices. The trend towards convenience, coupled with greater product availability, is expected to further augment the Canada smart home devices market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)