Canada Steel Market Size, Share, Trends and Forecast by Type, Product, Application, and Region, 2025-2033

Canada Steel Market Overview:

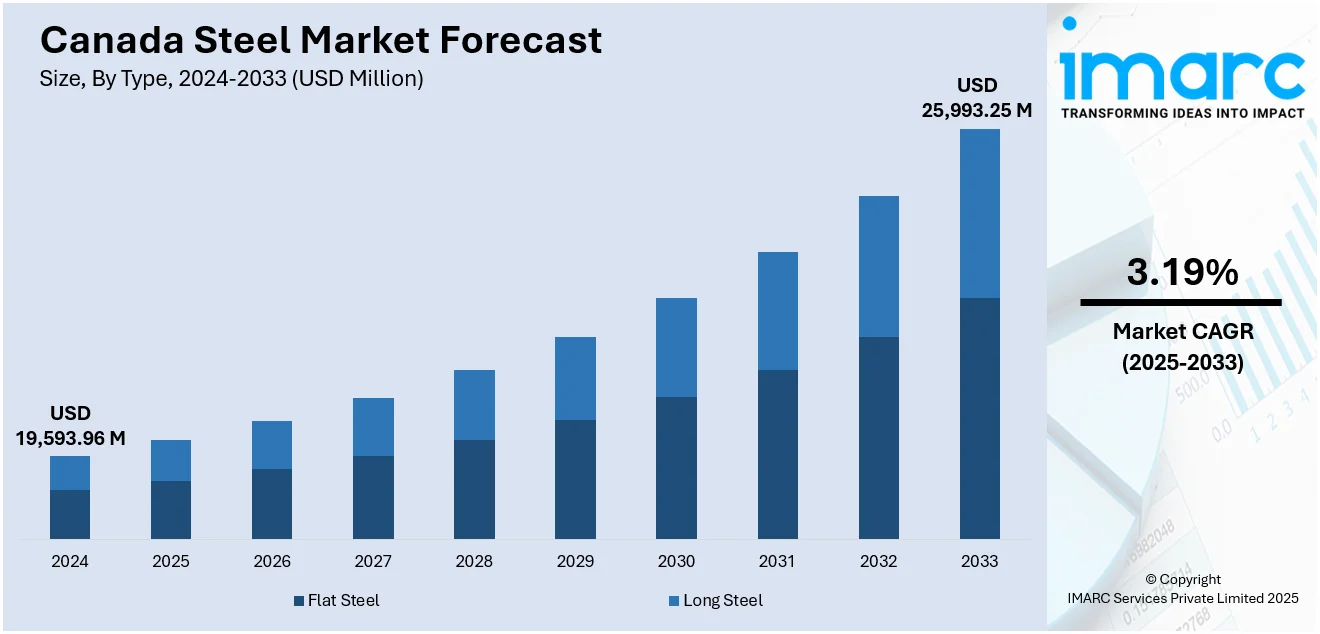

The Canada steel market size reached USD 19,593.96 Million in 2024. The market is projected to reach USD 25,993.25 Million by 2033, exhibiting a growth rate (CAGR) of 3.19% during 2025-2033. The market is driven by the robust infrastructure development fueled by government investments in transportation, energy, and urban projects; strong demand from the automotive sector, especially with the shift towards electric vehicles requiring advanced steel grades; and the impact of trade policies and global market dynamics, including tariffs, anti-dumping measures, and raw material price fluctuations. These factors drive domestic production, affect pricing dynamics, and promote technological advancements, helping maintain competitiveness in global steel markets, thereby strengthening Canada steel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 19,593.96 Million |

| Market Forecast in 2033 | USD 25,993.25 Million |

| Market Growth Rate 2025-2033 | 3.19% |

Canada Steel Market Trends:

Automotive Industry Fuels Growth and Innovation

The automotive sector is a substantial consumer of Canadian steel, driving demand for high-strength, lightweight steels essential for vehicle manufacturing. With plants operated by global automakers such as Ford, General Motors, and Stellantis in Ontario, the auto industry heavily influences steel production trends. The shift towards electric vehicles (EVs) adds momentum, as EV manufacturing requires advanced steel grades for battery enclosures, chassis, and body structures. Canada’s proximity to the US auto belt and its role in the USMCA trade agreement strengthens cross-border steel flows, ensuring market stability. Moreover, government incentives supporting EV production, including tax credits and plant subsidies, attract new investments in automotive manufacturing, indirectly benefiting steel producers. The circular economy push for vehicle recycling also supports steel scrap usage, crucial for electric arc furnace operations in Canadian steel mills.

To get more information on this market, Request Sample

Infrastructure Development

Canada’s ambitious infrastructure initiatives are a major driver of steel demand, with the federal investing in Canada Infrastructure Program committing over CA$33 billion towards transit, highways, water systems, and energy projects through 2023. Such government-backed developments require substantial volumes of steel, particularly long products like rebar and structural steel. Urban expansion in cities such as Toronto, Vancouver, and Calgary further supports construction-driven steel consumption. Additionally, Canada’s transition to green energy including wind farms, hydroelectric facilities, and transmission infrastructure demands high-grade steel for turbines, towers, and grids. This continuous stream of projects stabilizes domestic steel requirements, encourages production capacity growth, and sustains technological advancements across the sector. The result is a resilient steel market that serves national development and also maintains employment and competitiveness thus bolstering the Canada steel market growth.

Trade Policies and Global Market Dynamics

Another significant factor is the heavy influence of trade policies, tariffs, and international market dynamics. As a member of USMCA and the World Trade Organization (WTO), Canada balances its steel imports and exports with global obligations. Protective measures, such as safeguard tariffs and anti-dumping duties, shield domestic producers from unfairly priced imports, especially from countries like China and Russia. Conversely, any relaxation in these policies can flood the market with cheap foreign steel, impacting local pricing and production. Global trends such as shifts in demand from Asia, currency fluctuations, and raw material (iron ore, scrap) prices also affect Canadian steel competitiveness. Furthermore, geopolitical tensions, energy costs, and environmental regulations (like carbon tariffs) alter production economics, prompting strategic adjustments by Canadian mills to remain profitable and sustainable. These ongoing developments continue to shape Canada steel market trends in a rapidly evolving global landscape

Canada Steel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and application.

Type Insights:

- Flat Steel

- Long Steel

The report has provided a detailed breakup and analysis of the market based on the type. This includes flat steel and long steel.

Product Insights:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes structural steel, prestressing steel, bright steel, welding wire and rod, iron steel wire, ropes, and braids.

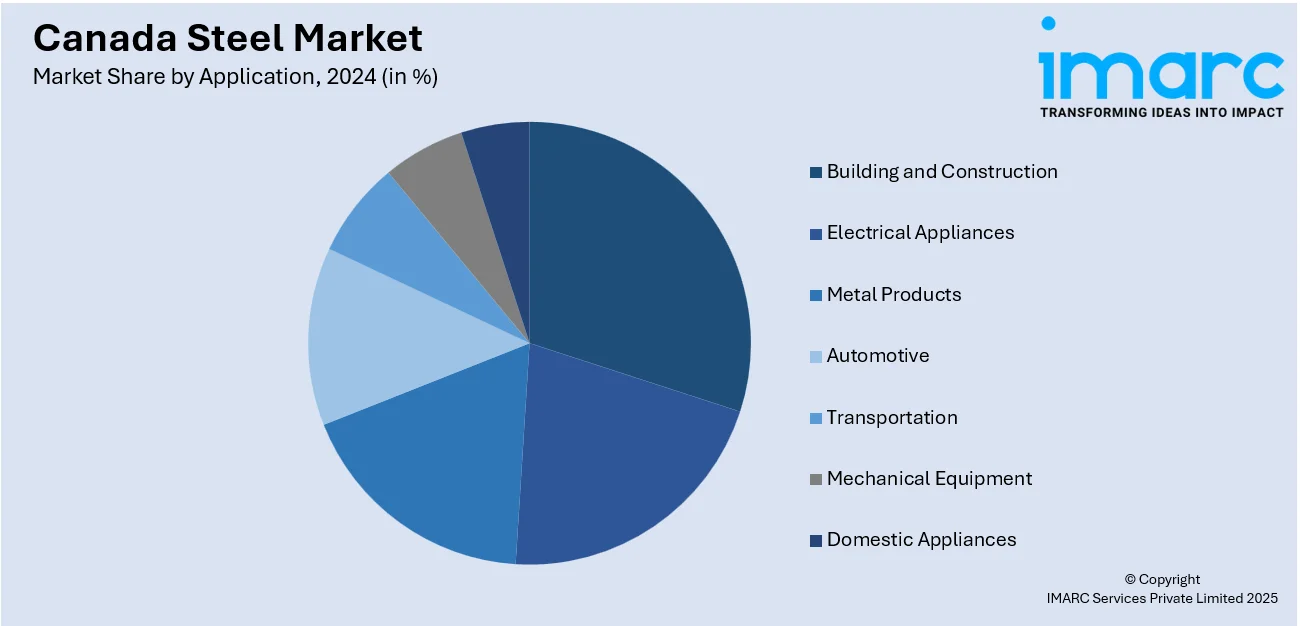

Application Insights:

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

The report has provided a detailed breakup and analysis of the market based on the application. This includes building and construction, electrical appliances, metal products, automotive, transportation, mechanical equipment, and domestic appliances.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Steel Market News:

- In November 2024, Cleveland-Cliffs Inc. finalized its acquisition of Stelco Holdings Inc., a major Canadian steelmaker operating blast furnace/BOF facilities in Ontario. This move strengthens Cliffs' position as North America’s largest flat-rolled steel producer, expands its market reach into Canada, and maintains Stelco as a wholly owned subsidiary with its iconic Canadian brand intact. Cliffs’ CEO highlighted the deal as a commitment to integrated steelmaking and supporting union jobs across North America.

Canada Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flat Steel, Long Steel |

| Products Covered | Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids |

| Applications Covered | Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada steel market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada steel market on the basis of type?

- What is the breakup of the Canada steel market on the basis of product?

- What is the breakup of the Canada steel market on the basis of application?

- What is the breakup of the Canada steel market on the basis of region?

- What are the various stages in the value chain of the Canada steel market?

- What are the key driving factors and challenges in the Canada steel market?

- What is the structure of the Canada steel market and who are the key players?

- What is the degree of competition in the Canada steel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada steel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada steel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)