Canada Vegetable Oil Market Size, Share, Trends and Forecast by Oil Type, Application, and Region, 2025-2033

Canada Vegetable Oil Market Overview:

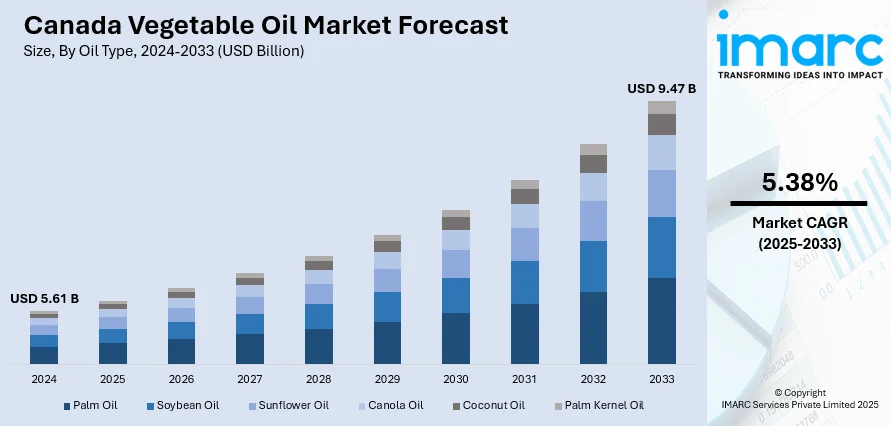

The Canada vegetable oil market size reached USD 5.61 Billion in 2024. Looking forward, the market is projected to reach USD 9.47 Billion by 2033, exhibiting a growth rate (CAGR) of 5.38% during 2025-2033. The market is driven by wide-scale use across food processing, influenced by consumer demand for clean-label and functional oils. Canada’s robust canola cultivation and efficient export infrastructure support both domestic and global supply stability. Rising applications in biofuels, circular processing, and green industries are further augmenting the Canada vegetable oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.61 Billion |

| Market Forecast in 2033 | USD 9.47 Billion |

| Market Growth Rate 2025-2033 | 5.38% |

Canada Vegetable Oil Market Trends:

Expanding Food Processing Sector and Culinary Versatility

Canada’s large-scale food manufacturing sector, which includes bakeries, snack producers, frozen foods, and prepared meals, heavily relies on vegetable oils for texture, preservation, and cooking stability. Oils such as canola, soybean, and sunflower are used across a range of food categories including baked goods, frying applications, and condiments. The growing popularity of plant-based foods, gluten-free snacks, and ethnic cuisines has further broadened the use of refined and specialty oils. Health trends are also shaping this demand; food producers are shifting away from trans fats and hydrogenated oils toward non-GMO, cold-pressed, and heart-healthy options. Consumer brands are highlighting oil sources on packaging to align with clean-label preferences, while restaurants are standardizing vegetable oil use to ensure flavor consistency and cost-effectiveness. Meanwhile, ethnic foodservice operators—especially in multicultural cities like Toronto and Vancouver—create steady demand for diverse oil types such as palm and mustard oil. This combination of industrial versatility and culinary application across home and commercial kitchens reinforces the role of vegetable oil in Canada’s evolving food economy. These broad, embedded uses are foundational to Canada vegetable oil market growth, enabling resilient consumption across consumer and institutional segments.

To get more information on this market, Request Sample

Strong Oilseed Production and Export-Oriented Supply Chain

Canada is one of the world’s top producers and exporters of canola oil, and this agricultural backbone significantly supports the country’s vegetable oil ecosystem. The Prairies—particularly Saskatchewan and Alberta—are key hubs for oilseed cultivation, processing, and refining. Canola oil is prized for its light flavor, high smoke point, and low saturated fat profile, making it ideal for both culinary and industrial applications. Advanced agronomy practices and government-supported R&D have enhanced yield, resistance, and oil content in canola crops, increasing efficiency for domestic processors. Additionally, Canada’s refining and crushing capacity is well integrated into its rail and port infrastructure, enabling smooth export flow to the US, China, and Japan. These exports include both crude and refined oils, as well as canola meal used in livestock feed, supporting diversified value streams. The Canadian Grain Commission enforces strict quality standards and traceability, which enhances international buyer confidence. As the global market increasingly values clean, traceable, and sustainable oils, Canada’s farm-to-port structure offers a competitive edge. This strong agricultural and export foundation stabilizes domestic supply and amplifies the country's global standing in the vegetable oil trade.

Integration with Renewable Fuels and Bio-Based Industries

Vegetable oil in Canada is gaining importance in the transition to low-carbon energy systems and bio-based manufacturing. Canola and soybean oil serve as feedstocks for biodiesel and renewable diesel production, a trend supported by federal programs such as Canada’s Clean Fuel Regulations (CFR). These mandates require fuel suppliers to gradually reduce the carbon intensity of transportation fuels, prompting greater uptake of vegetable oil-derived biofuels. Provincial programs—especially in British Columbia and Quebec—offer additional incentives for biofuel blending and investment in renewable energy infrastructure. Used cooking oil (UCO) collection networks are also expanding in major cities, contributing to circular economy objectives. Beyond fuels, vegetable oils are finding industrial uses in lubricants, adhesives, and biodegradable plastics, helping to replace petroleum-based inputs. Canadian innovation clusters are increasingly supporting bio-based R&D, including the valorization of oilseed waste in animal nutrition and biochemicals. These emerging sectors are diversifying demand for vegetable oil beyond food and elevating its relevance in sustainability-driven innovation. As Canada intensifies its climate and industrial decarbonization efforts, vegetable oils are becoming critical components of both the clean energy transition and the green manufacturing shift.

Canada Vegetable Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on oil type and application.

Oil Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

The report has provided a detailed breakup and analysis of the market based on the oil type. This includes palm oil, soybean oil, sunflower oil, canola oil, coconut oil, and palm kernel oil.

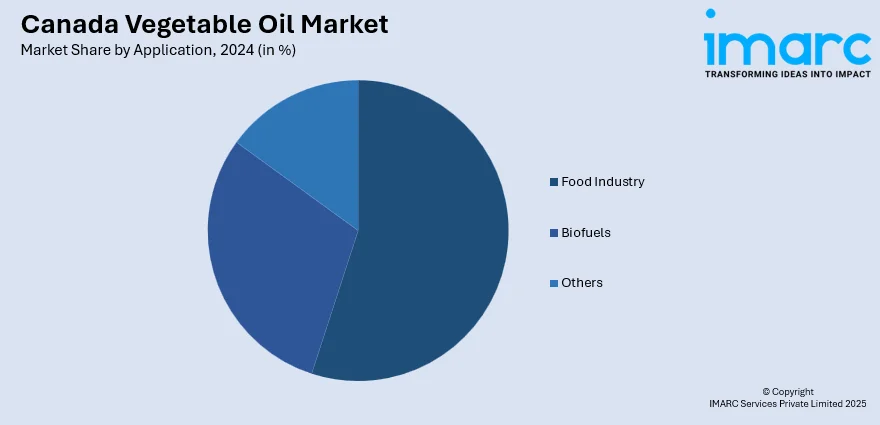

Application Insights:

- Food Industry

- Biofuels

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food industry, biofuels, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Vegetable Oil Market News:

- On July 16, 2024, Cargill announced it had surpassed the 50% construction milestone of its new canola processing facility in West Regina, Saskatchewan, which is scheduled to open in 2025. The facility will process 1 million metric tons of canola annually, producing crude canola oil for food and biofuel applications, as well as canola meal for animal feed. This expansion enhances supply capacity for vegetable oil exports, potentially influencing import volumes in key markets like Australia’s vegetable oil sector.

Canada Vegetable Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oil Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil |

| Applications Covered | Food Industry, Biofuels, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada vegetable oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada vegetable oil market on the basis of oil type?

- What is the breakup of the Canada vegetable oil market on the basis of application?

- What is the breakup of the Canada vegetable oil market on the basis of region?

- What are the various stages in the value chain of the Canada vegetable oil market?

- What are the key driving factors and challenges in the Canada vegetable oil market?

- What is the structure of the Canada vegetable oil market and who are the key players?

- What is the degree of competition in the Canada vegetable oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada vegetable oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada vegetable oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada vegetable oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)