Canada Watch Market Size, Share, Trends and Forecast by Type, Price Range, Distribution Channel, End User, and Region, 2025-2033

Canada Watch Market Overview:

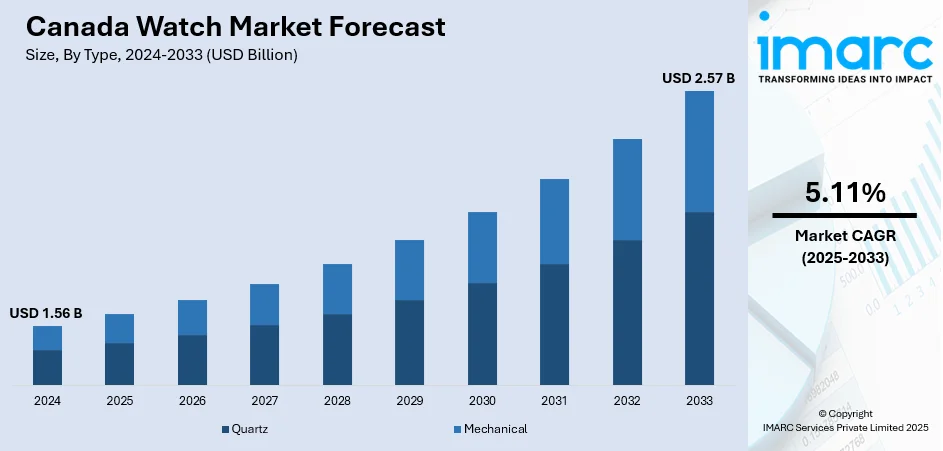

The Canada watch market size reached USD 1.56 Billion in 2024. The market is projected to reach USD 2.57 Billion by 2033, exhibiting a growth rate (CAGR) of 5.11% during 2025-2033. The industry is expanding steadily driven by a growing demand for luxury watches as well as affordable timepieces. Buyers are broadening their range of tastes, and smartwatches are gaining acceptance alongside traditional mechanical and quartz watches. Sales of watches through retail points are on the rise, with an expanding share coming from online channels. Demand varies regionally depending on cultural and economic factors. The future of the industry appears good, contributing to the Canada's watch market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.56 Billion |

| Market Forecast in 2033 | USD 2.57 Billion |

| Market Growth Rate 2025-2033 | 5.11% |

Canada Watch Market Trends:

Independent and Custom Craftsmanship Growth

In September 2024, sources spotlighted increased federal support for regional artisans, including bespoke watchmakers operating within small-scale manufacturing. This formal recognition aligns with a growing consumer shift toward locally made, story-driven timepieces that reflect regional identity and personal values. Microbrands and independent watchmakers now offer limited-edition models with custom engravings, heritage-inspired dials, and hand-assembled movements. Buyers increasingly seek exclusivity and emotional connection qualities that mass production fails to deliver. Platforms like collector forums and design showcases highlight how handmade craftsmanship is regaining prestige within luxury circles. Customers are drawn to the transparency and direct engagement that independent makers offer, often participating in the creative process from concept to final assembly. This sense of narrative ownership enhances emotional value and brand loyalty. As these makers expand visibility both online and through boutique events, they’re significantly shaping Canada watch market growth, demonstrating that authenticity, locality, and personalized experience are becoming just as important as mechanical precision in the collector’s mindset.

To get more information on this market, Request Sample

Rise in Certified Pre-Owned Watch Demand

By January 2025, Canadian resale platforms recorded a notable increase in certified pre-owned luxury watch sales, reflecting shifting consumer preferences towards sustainability and authenticity. Buyers are increasingly drawn to watches accompanied by detailed condition reports, provenance verification, and documented servicing histories, which build trust and confidence in the second-hand market. The pre-owned segment is no longer just an affordable alternative but is viewed as a curated marketplace offering timepieces valued for their craftsmanship, heritage, and unique stories. Vintage models and historically significant watches appeal to collectors seeking emotional connection and long-term value, while also supporting ethically conscious consumption. Resale platforms emphasize transparency, offering clear pricing and authentication processes that mirror the standards of new luxury retail. This growing market now acts as a trusted avenue for acquiring quality timepieces, broadening access to luxury watches. These changes are shaping Canada watch market trends, where sustainability and storytelling are becoming central to consumer decision-making, reinforcing the importance of heritage and responsible collecting within the luxury watch space.

Digital-First Watch Purchasing Experience

The Canda watch market is rapidly embracing digital transformation to meet growing consumer demand for seamless luxury shopping. Virtual try-on tools, AI-driven personalized suggestions, and blockchain-backed authentication have become standard features on e-commerce platforms, enhancing buyer confidence and replicating in-store experiences online. Interactive virtual boutiques, live product unveilings, and real-time customer support now allow consumers to engage with brands more deeply from any location. Retailers are making significant investments in secure payment systems, cloud-based inventory management, and responsive websites optimized for mobile devices. These innovations create a smooth, trustworthy journey from discovery to purchase, attracting tech-savvy collectors and first-time buyers alike. As expectations for digital convenience rise, physical showrooms are increasingly positioned as experiential extensions rather than primary retail channels. This digital emphasis reflects broader shifts in consumer behavior and sales channels, driving modernization across the sector. Ultimately, these developments contribute significantly to Canada watch market growth, merging traditional craftsmanship with innovative digital retail strategies to provide elevated, accessible luxury experiences across the country.

Canada Watch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, price range, distribution channel, and end user.

Type Insights:

- Quartz

- Mechanical

The report has provided a detailed breakup and analysis of the market based on the type. This includes quartz and mechanical.

Price Range Insights:

- Low-Range

- Mid-Range

- Luxury

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes low-range, mid-range, and luxury.

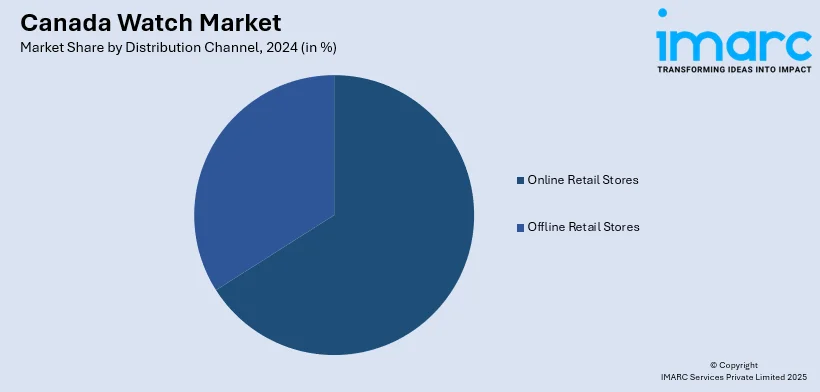

Distribution Channel Insights:

- Online Retail Stores

- Offline Retail Stores

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online retail stores and offline retail stores.

End User Insights:

- Men

- Women

- Unisex

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and unisex.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Watch Market News:

- July 2025: Marathon Watch has released a limited-series ADANAC Navigator Pilot's Automatic watch to celebrate the 60th anniversary of the Canadian flag. Limited to 500 units, this red-and-white patriotic watch sports a white face with a red bezel and a red-and-white NATO strap, recreating Canada's national colours. Designed to withstand harsh environments, the watch leverages Marathon's military-grade engineering proficiency. It features a sapphire crystal, luminous dial, and bi-directional bezel, which makes it perfectly suitable for pilots and explorers. It is an apt homage to Canada's history and the brand's heritage.

Canada Watch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Quartz, Mechanical |

| Price Ranges Covered | Low-Range, Mid-Range, Luxury |

| Distribution Channels Covered | Online Retail Stores, Offline Retail Stores |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada watch market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada watch market on the basis of type?

- What is the breakup of the Canada watch market on the basis of price range?

- What is the breakup of the Canada watch market on the basis of distribution channel?

- What is the breakup of the Canada watch market on the basis of end user?

- What is the breakup of the Canada watch market on the basis of the region?

- What are the various stages in the value chain of the Canada watch market?

- What are the key driving factors and challenges in the Canada watch market?

- What is the structure of the Canada watch market and who are the key players?

- What is the degree of competition in the Canada watch market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada watch market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada watch market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada watch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)