Car Subscription Market Size, Share, Trends and Forecast by Service Providers, Vehicle Type, Subscription Period, End Use, and Region, 2026-2034

Car Subscription Market Size and Share:

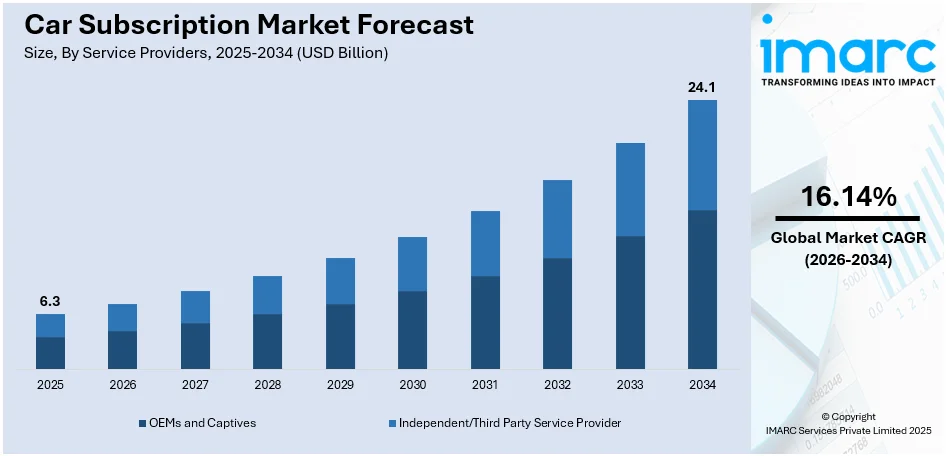

The global car subscription market size was valued at USD 6.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 24.1 Billion by 2034, exhibiting a CAGR of 16.14% from 2026-2034. Europe currently dominates the market, holding a market share of over 41.9% in 2025. The growth of the Europe region is driven by strong regulatory support, diverse vehicle options, advanced digital platforms, and sustainability initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 6.3 Billion |

|

Market Forecast in 2034

|

USD 24.1 Billion |

| Market Growth Rate 2026-2034 | 16.14% |

Individuals are seeking alternatives to traditional car ownership that allow them to adapt to changing lifestyles, short-term needs, or financial conditions. The ability to access vehicles without long-term commitments makes car subscription services attractive, particularly to younger, urban population and digital-first individuals. Besides this, the integration of advanced technologies, including mobile apps and artificial intelligence (AI)-powered platforms, is enhancing user experience. These tools enable seamless booking, real-time vehicle tracking, and data-driven customization of subscription plans. The proliferation of digital platforms makes it easier for companies to offer scalable, user-friendly services, broadening the market's appeal. Moreover, the rise of shared mobility, coupled with declining car ownership rates in urban areas, is reshaping the transportation landscape. Congestion, parking constraints, and high ownership costs are leading city dwellers to opt for car subscriptions over buying vehicles.

To get more information on this market Request Sample

The United States is a key segment in the market, driven by growing electric vehicle (EV) adoption and technological advancements. EV subscriptions allow clients to experience the benefits of these vehicles without the upfront costs or infrastructure investments, encouraging broader EV adoption while supporting environmental goals. Businesses are also turning to car subscriptions for fleet management and employee transportation needs. Subscription services simplify operations by bundling insurance, maintenance, and other costs, offering companies a convenient and cost-effective mobility solution. In addition, the availability of subscription services that bundle maintenance, insurance, and roadside assistance into a single package is bolstering the market growth. These all-inclusive plans simplify vehicle access, reducing the complexity and financial burden associated with traditional car ownership. In 2024, Volkswagen launched "VW Flex," a subscription service in Atlanta, Georgia, in partnership with Volkswagen Financial Services. This month-to-month service includes maintenance, insurance, and roadside assistance, allowing customers to select from popular models like the Atlas and Tiguan. Vehicles can be reserved online and picked up at participating dealerships or delivered for a fee.

Car Subscription Market Trends:

Access to a Variety of Vehicles

Car subscription services provide subscribers with access to a diverse range of vehicles, including sedans, SUVs, luxury cars, and electric vehicles (EVs). For instance, in June 2024, Astara launched Move, a new car subscription service that offers models from all sectors for private and professional usage. This portfolio includes models from four of the companies it represents, namely Kia, Mitsubishi, Maxus, and Isuzu, as well as the Suzuki range and the two-seater electric "Microlino,". This allows individuals to experience different car models and switch between them as desired, depending on their needs or preferences. These factors are expected to propel the car subscription market in the coming years. In India, approximately 5,000 passenger cars in a variety of pricing points, from Rs 3 to Rs 18 lakh, was subscribed for in 2022, according to industrial report.

Changing User Preferences

Individual attitudes toward car ownership are undergoing a notable shift, driven by changing priorities among younger generations, particularly millennials and Gen Z. These groups are increasingly drawn to the flexibility and convenience offered by car subscription models, which align with their preference for access over ownership. Factors like urbanization, rising living costs, and a growing awareness about environmental impacts further contribute to this trend. For instance, according to an article published by Deloitte in March 2024, one in every five people of all ages (18%) supported the car subscription model, with 18-34-year-olds showing the highest interest at 28%. This demographic prioritizes experiences and hassle-free solutions, avoiding the financial burden and maintenance responsibilities of car ownership. As subscription services bundle insurance, maintenance, and flexibility into a single plan, they cater directly to these user needs, significantly enhancing their appeal.

Technological Advancements

Technology is transforming car subscription services by enabling seamless digital experiences, allowing users to complete the entire process online with ease. Mobile applications and online platforms provide a user-friendly interface for browsing vehicles, comparing subscription plans, and managing accounts, offering unparalleled convenience. These tools streamline the subscription process, requiring only a simple KYC verification, making it accessible to a broader audience. Additionally, real-time updates and customization options through apps enhance user satisfaction by providing tailored plans to suit individual needs. For instance, in October 2022, Myles, a vehicle subscription provider, introduced a one-month subscription plan, allowing users to switch cars monthly. This service, available through the Myles Zero Mobile app or website, highlights the growing trend of flexibility and personalization. By integrating digital technology and offering adaptable options, companies are not only meeting client demands but also boosting the car subscription market revenue.

Car Subscription Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global car subscription market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on service providers, vehicle type, subscription period, and end use.

Analysis by Service Providers:

- OEMs and Captives

- Independent/Third Party Service Provider

Independent/third party service provider leads the car subscription market, holding 37.8% in 2025. This dominance is attributed to its extensive flexibility, competitive pricing, and diverse offerings tailored to varying user needs. These providers often collaborate with multiple automakers, enabling them to offer a wide range of vehicle options, including luxury, electric, and budget-friendly models. Their focus on customer-centric solutions, such as customizable subscription plans and short-term commitments, appeals to people who prefer adaptable alternatives to traditional car ownership. Additionally, independent providers invest heavily in technology-driven platforms that enhance user experiences, simplifying processes like vehicle selection, subscription management, and seamless transitions between models. Their ability to operate across regions without brand-specific limitations also broadens their market reach. By integrating maintenance, insurance, and client support into subscription packages, these providers offer a holistic approach to mobility, further solidifying their leadership in the market. This strategic adaptability and user-first approach position independent/third party service providers as the largest segment in the car subscription industry.

Analysis by Vehicle Type:

- IC Powered Vehicle

- Electric Vehicle

IC powered vehicle leads the market with 73.0% of market share in 2025. IC powered vehicle holds the largest share in the market, primarily driven by its widespread availability, established infrastructure, and diverse range of options across price points and vehicle categories. Internal combustion engine (ICE) vehicles have a long-standing presence in the automotive sector, making them more accessible to user through a well-developed supply chain and robust servicing networks. Their dominance in the subscription market is also attributed to their versatility, as they cater to various individual preferences, including sedans, SUVs, and compact cars. Subscription providers prioritize IC-powered models due to their familiarity with clients and lower upfront costs compared to EVs, ensuring affordability and reliability. Moreover, advancements in fuel efficiency and emission control technologies continue to make IC vehicles an attractive option. The ability to deliver consistent performance and convenience through a proven technology platform positions IC Powered Vehicles as the leading segment in the car subscription market.

Analysis by Subscription Period:

- 1 to 6 Months

- 6 to 12 Months

- More Than 12 Months

6 to 12 months dominates the market with 45.3% of market share in 2025. The 6 to 12 months subscription period is the largest segment owing to its ideal balance between flexibility and affordability for users. This duration appeals to individuals and businesses seeking medium-term mobility solutions without the long-term commitment of leasing or the higher costs of shorter-term rentals. People in this segment benefit from lower monthly rates compared to shorter subscriptions, while still retaining the ability to adapt their vehicle choices within a reasonable timeframe. This period is especially suitable for those undergoing temporary job relocations, extended travel plans, or testing specific car models before making a purchasing decision. Subscription providers often offer exclusive incentives, like reduced fees and additional services, to users opting for this duration. Furthermore, the 6 to 12 months period enables subscription companies to manage fleet utilization more effectively, optimizing operations while meeting consumer demands. These factors collectively establish this category as the dominant segment in the market.

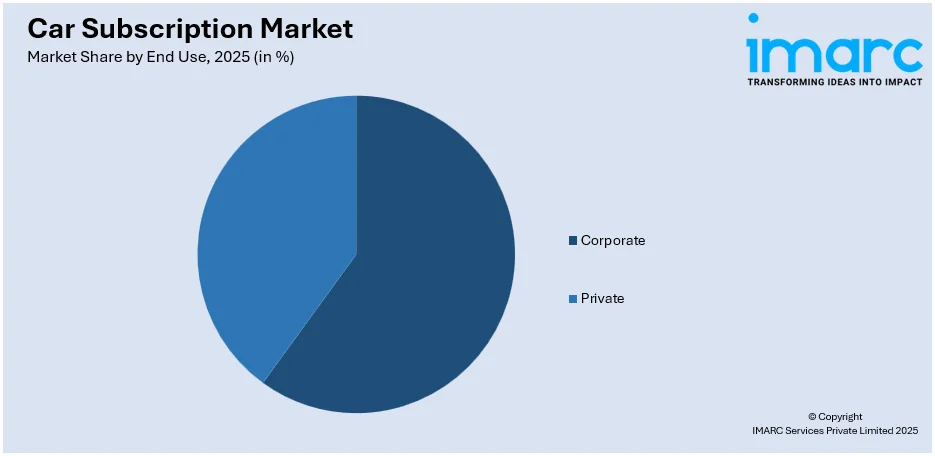

Analysis by End Use:

Access the comprehensive market breakdown Request Sample

- Private

- Corporate

Corporate holds the biggest market share, accounting for 62.0% in 2025. Corporate leads the market due to its ability to meet the dynamic mobility needs of businesses with cost-effective and flexible solutions. Companies increasingly rely on subscription services for their employee transportation and fleet management, as these plans eliminate the complexities of ownership, such as maintenance, insurance, and depreciation. Subscription providers cater to corporate clients by offering tailored packages, including multi-vehicle options and customizable durations, ensuring businesses can adapt their mobility strategies as needed. Additionally, car subscription services align with corporate sustainability goals by offering access to fuel-efficient or electric vehicles without requiring significant capital investments. The streamlined processes and centralized management provided by subscription platforms further enhance operational efficiency, enabling businesses to focus on core activities. By addressing these requirements with a comprehensive and flexible approach, the corporate segment has become the largest contributor to the car subscription market, driven by its strategic value to organizations across industries.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Europe accounted for the largest market share of 41.9%. Europe dominates the market, driven by a well-established automotive ecosystem and a strong focus on sustainability and innovative mobility solutions. The region's regulatory environment encourages alternative ownership models, promoting subscriptions as a viable solution for reducing vehicle emissions and congestion. Individuals in the region show a growing preference for flexible transportation options that eliminate the long-term financial commitment of car ownership. Additionally, the extensive presence of international and local automakers supports the availability of diverse vehicle options, including electric and hybrid models, through subscription services. Advanced digital platforms in Europe streamline the subscription process, enhancing user experience and convenience. In 2024, Avis launched "Switch by Avis" in Germany, a flexible car subscription service available online with no start fee and monthly cancellation options. Clients can choose from packages offering varying mileage, additional drivers, and reduced damage excess. The service is initially offered at 23 train stations in cities like Berlin, Hamburg, and Munich.

Key Regional Takeaways:

United States Car Subscription Market Analysis

The market for car subscription is growing fast in the United States, holding 80.80% of the North American market share. Individual desires for flexible ownership models are driving the US car subscription business. Car subscriptions are becoming more and more popular among individuals as urbanization and the move to on-demand services pick up steam. These approaches, which combine maintenance, insurance, and depreciation expenses into a single monthly payment, provide flexibility from long-term obligations. Younger generations and millennials who value mobility without the financial burden of car ownership will find this convenience appealing.

Another important factor is the rise in electric cars (EVs). According to International Energy Agency, in the United States, new electric car registrations totaled 1.4 million in 2023, increasing by more than 40% compared to 2022. EVs are frequently included in car subscription schemes, enabling users to experience cutting-edge innovations without committing to ownership. Subscription models are being used by automakers like Tesla, Hyundai, and Volvo to advertise their EV products. Digitalization and technology also contribute to market expansion, as app-based platforms streamline subscription procedures. Subscriptions that encourage car sharing and fleet efficiency are appealing to people who are concerned about sustainability as environmental awareness rises.

Europe Car Subscription Market Analysis

The market for car subscriptions in Europe is driven by the region's aim for sustainable mobility and strict environmental restrictions. Interest in electric and hybrid car subscriptions has increased because of the European Union's aggressive carbon emission reduction goals. To access EVs without having to deal with the infrastructure and financial burden of ownership, individuals are increasingly choosing subscription arrangements. The market is also impacted by changing perceptions of car ownership, particularly in major cities like Berlin, London, and Paris, where subscription services and car-sharing provide affordable alternatives to ownership in areas with expensive parking and traffic. To meet this increasing demand, businesses like Lynk & Co., Volkswagen, and Sixt are diversifying their subscription offerings.

Germany is one European market with a comparatively high number of auto subscription contracts; between 100,000 and 200,000 car subscriptions have been taken out. Based on industry reports, subscriptions might account for as much as 40% of the market by 2030.

Asia Pacific Car Subscription Market Analysis

Urbanization, rising disposable incomes, and shifting user preferences are all contributing to the Asia-Pacific auto subscription market growth. The growing need for adaptable and affordable mobility solutions is propelling the adoption of subscription models in nations like China, Japan, and India. Subscriptions are preferred by the growing middle class in the area because they provide access to luxury cars without the high initial cost of ownership. Furthermore, automakers such as Hyundai and Toyota are extending their subscription services in the area, providing individuals with choices for both conventional and electric cars. In Southeast Asia, Carzuno has become a leading car subscription services provider in countries like Singapore and Thailand. Additionally, Indian automakers Mahindra & Mahindra, Tata Motors Limited, and Maruti Suzuki India have all added subscription vehicles to their lineups. More than 10,000 people have signed up for Maruti Suzuki's automobile subscription plan since the company launched it in 2020.

The adoption of app-based subscription services is made possible by technological improvements and the increasing use of smartphones. EV-focused auto subscriptions are growing because of government subsidies for electric vehicles, especially in places like China and South Korea.

Latin America Car Subscription Market Analysis

Growing urbanization and the need for affordable mobility options are driving the car subscription business in Latin America. Because subscription models offer financial flexibility and package services like maintenance and insurance, people in nations like Brazil and Mexico are becoming interested in them. Growing interest in electric vehicles and rising gasoline prices are pushing individuals to investigate subscription services that give them access to sustainable and fuel-efficient transportation. The wide variations in petrol prices across Latin America in 2024 are a reflection of the various economic environments and policies of each nation, including Chile with the highest price in the region (USD 1.441 per liter), while the lowest price in the region is USD 0.035 per liter in Venezuela. The growth of app-based subscription services is also being fueled by the region's youthful, tech-savvy populace. To increase their visibility and meet the rising demand, automakers are also collaborating with regional platforms.

Middle East and Africa Car Subscription Market Analysis

The growing need for flexible mobility options, especially among young professionals and expats in cities like Dubai and Johannesburg, is propelling the automobile subscription business throughout the Middle East and Africa. By removing ownership expenses like maintenance and insurance, subscriptions provide flexibility and convenience. Rich individuals who want access to high-end cars without long-term commitments are catered to by the growth of luxury car subscription services. Demand for EV-specific subscriptions is also rising because of increased interest in EVs, which is being aided by government incentives. In the region, EVs are rapidly becoming more popular. According to an industrial estimates, with almost 35,000 new EVs registered in 2023, the UAE's EV sales penetration rate increased to 3%, which is still much lower than the worldwide average but much greater than that of other Gulf states like Saudi Arabia (0.1%) and Qatar (0.6%). Another factor driving market expansion in the area is digitalization and the expansion of app-based services.

Competitive Landscape:

Key players in the market are focusing on enhancing client experiences by integrating digital platforms and streamlining services. They are expanding their fleet offerings to include diverse vehicle types, including electric and hybrid models, catering to evolving user preferences. Many are forging strategic partnerships with automakers, insurers, and technology providers to deliver comprehensive, value-added packages. Efforts are also being directed toward geographic expansion to tap into emerging markets with rising demand for flexible mobility solutions. Additionally, companies are leveraging data analytics to personalize subscription plans and optimize fleet utilization. Sustainability initiatives, such as promoting eco-friendly vehicles and reducing carbon footprints, are also gaining prominence as part of their long-term strategies to meet regulatory and user expectations. In April 2024, Helixx Technologies launched an electric car and van subscription service. This service provides a brand-new automobile or van with insurance and maintenance for as low as $0.25 per hour or $6.00 per day, with no up-front fees.

The report provides a comprehensive analysis of the competitive landscape in the car subscription market with detailed profiles of all major companies, including:

- Carly Holdings Limited

- Cluno GmbH (Cazoo Limited)

- Cox Enterprises Inc.

- Facedrive Inc.

- Lyft Inc.

- Onto Ltd.

- OpenRoad Auto Group

- The Hertz Corporation

- Wagonex Limited

- ZoomCar

Latest News and Developments:

- June 2024: Astara, launched Move, a new car subscription service that offers models from all sectors for private and professional usage. This portfolio includes models from four of the companies it represents, namely Kia, Mitsubishi, Maxus, and Isuzu, as well as the Suzuki range and the two-seater electric "Microlino,".

- May 2024: Wagonex, a vehicle subscription service, established a transatlantic alliance. The Cardiff-based company, which specialises in developing, marketing, and expanding subscription platforms for automakers and retailers, is a pioneer in the rapidly expanding UK car subscription sector. With OneSummit, one of the biggest car dealership groups in Chile, it has now established a platform.

- February 2024: AMT Auto launched a vehicle subscription service that allows clients to drive the automobile they want, when they want, and without the burden of ownership.

Car Subscription Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Providers Covered | OEMs and Captives, Independent/Third Party Service Provider |

| Vehicle Types Covered | IC Powered Vehicle, Electric Vehicle |

| Subscription Periods Covered | 1 to 6 Months, 6 to 12 Months, More Than 12 Months |

| End Uses Covered | Private, Corporate |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Carly Holdings Limited, Cluno GmbH (Cazoo Limited), Cox Enterprises Inc., Facedrive Inc., Lyft Inc., Onto Ltd., OpenRoad Auto Group, The Hertz Corporation, Wagonex Limited, ZoomCar, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the car subscription market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global car subscription market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the car subscription industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The car subscription market was valued at USD 6.3 Billion in 2025.

The car subscription market is projected to exhibit a CAGR of 16.14% during 2026-2034, reaching a value of USD 24.1 Billion by 2034.

The market is majorly driven by growing demand for flexible mobility solutions, urbanization, rising EV adoption, technological advancements in digital platforms, changing user preferences favoring access over ownership, and bundled subscription services including maintenance and insurance, catering to a wide range of individual and corporate needs.

Europe currently dominates the car subscription market, accounting for a share exceeding 41.9%. This dominance is fueled by stringent regulatory support, sustainability initiatives, advanced digital platforms, and diverse vehicle options.

Some of the major players in the car subscription market include Carly Holdings Limited, Cluno GmbH (Cazoo Limited), Cox Enterprises Inc., Facedrive Inc., Lyft Inc., Onto Ltd., OpenRoad Auto Group, The Hertz Corporation, Wagonex Limited, and ZoomCar, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)