Carbide Tool Market Size, Share, and Trends by Product Type, Configuration, Coating, End Use Industry, Region, and Forecast 2025-2033

Carbide Tool Market Size and Share:

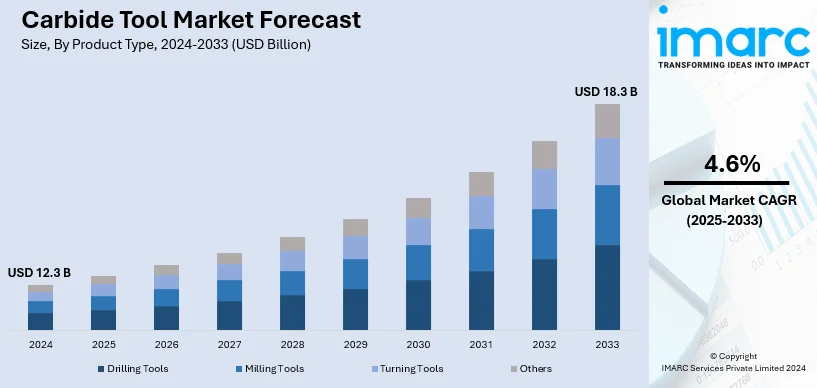

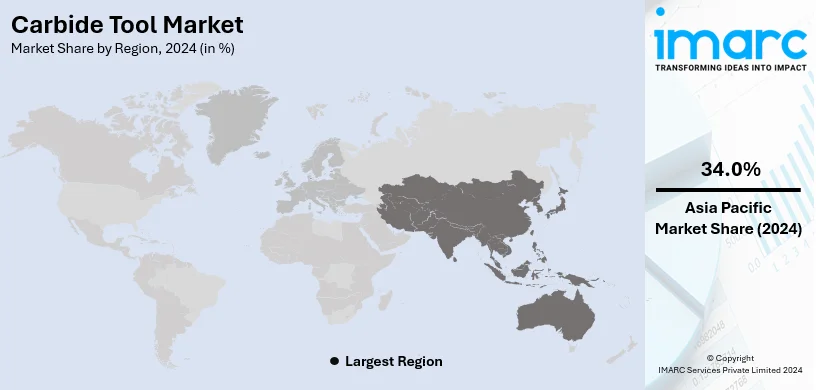

The global carbide tool market size was valued at USD 12.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 18.3 Billion by 2033, exhibiting a CAGR of 4.6% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 34.0% in 2024. Factors like advancements in machining technology, increasing demand for precision tools in automotive and aerospace industries, the durability of carbide tools, and rising adoption in metal fabrication and computer numerical control (CNC) machining operations are propelling the carbide tool market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.3 Billion |

|

Market Forecast in 2033

|

USD 18.3 Billion |

| Market Growth Rate 2025-2033 | 4.6% |

The demand for carbide tools is accelerating primarily due to the need for precision and performance tools in extreme environments, such as automotive, aerospace, and manufacturing, among others. As industries seek to enhance their output and minimize operating expenses, high performance and high-speed machining tools, such as carbide tools which are tough and efficient hardworking machines become a necessity. For instance, the construction industry in China is expected to grow at 4% due to several projects aimed at developing smart cities, better transport systems, and making housing affordable. This spike is raising the demand for construction cutting tools made from tungsten carbide that are fitted on construction machines and heavy machinery for civil works. Also, the rising penetration of advanced manufacturing technology and the growth of industrialization tend to propel the growth of the overall market.

The United States has emerged as a key market for carbide tools. The regional market is primarily driven by the rising demand for precision machining solutions in key sectors such as automotive, aerospace, and manufacturing. In line with this, the growing adoption of advanced machining techniques to enhance production efficiency is also providing an impetus to the market. Moreover, the increasing focus on reducing operational costs while improving tool durability is acting as a significant growth-inducing factor. In addition to this, the shift toward lightweight materials in automotive and aerospace applications is driving the need for high-performance cutting tools. Apart from this, the U.S. government has introduced several incentives to promote advanced manufacturing, which is acting as a major market driver. For instance, the CHIPS and Science Act of 2022 allocates $52.7 billion to bolster U.S. semiconductor manufacturing, research, and workforce development over a five-year period and aims to strengthen domestic semiconductor manufacturing, indirectly benefiting the carbide tools market by bolstering related industries. Some of the other factors contributing to the market include the increasing penetration of 3D printing technologies, the expansion of renewable energy projects requiring specialized tools, and extensive research and development (R&D) activities in tool design.

Carbide Tool Market Trends:

Growing Importance of Sustainability in Production Processes

In 2022, the recycling rate saw a steady increase, with the addition of approximately 1.0 percentage points from metal recovered and recycled from waste incineration, maintaining the same contribution level as in 2020. This reflects a growing emphasis on sustainability within the manufacturing industry. Carbide tools play a crucial role in these sustainability efforts, offering extended service life and enhanced material removal rates, thereby reducing energy consumption per unit of manufactured product. Additionally, their recyclability further supports sustainable manufacturing practices, making carbide tools an increasingly preferred choice across sectors seeking to minimize environmental impact.

Rise of Advanced Materials and Composites

The carbide tool market overview also emphasized the increasing use of advanced materials and composites in industries such as aerospace, automotive, and medical devices as a significant growth driver. These materials often possess properties such as high strength-to-weight ratios, corrosion resistance, and the ability to withstand high temperatures, making them difficult to machine with traditional tools. Carbide tools, known for their exceptional hardness and wear resistance, are ideally suited for these tasks and they can improve machining efficiency by 30-40%. They can handle the abrasive and stringent machining conditions imposed by composites and superalloys like titanium and Inconel, which are prevalent in aerospace engine and airframe components. The burgeoning need for carbide tools that can efficiently cut and shape these difficult materials is fostering market expansion as industries continue to innovate in materials science.

Increasing Integration of Digital Manufacturing Techniques

In contemporary industrial environments, digital manufacturing technologies such as automated production lines and computer numerical control (CNC) machining are becoming more prevalent. These technologies are dependent on accuracy and reliability. For instance, if a machine in a single-shift CNC facility operates for only 30 hours out of a potential 40-hour week, its utilization rate stands at 75%. The integration of digital manufacturing necessitates carbide tools capable of sustaining high accuracy and minimal wear over extended periods to ensure the quality and efficiency of automated processes. Moreover, with the advent of Industry 4.0 and smart factory initiatives, there's a growing emphasis on tools that can seamlessly integrate into systems, providing real-time data on tool wear and machine performance, which is bolstering carbide tool market revenue.

Carbide Tool Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global carbide tool market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, configuration, coating, end-use industry, and region.

Analysis by Product Type:

- Drilling Tools

- Milling Tools

- Turning Tools

- Others

Milling tools dominates the market with around 40.7% of market share in 2024. According to the carbide tool market report, the burgeoning demand for carbide tools in milling applications due to the growing complexity of machining tasks that require high precision and efficiency is strengthening the market growth. Carbide milling tools play an irreplaceable role in machining complex parts from challenging materials such as titanium and stainless steel, particularly in industries like aerospace and automotive. Their exceptional hardness and wear resistance enable them to maintain surface finish quality and dimensional stability even at high cutting speeds, thereby significantly enhancing productivity. Furthermore, the shift towards more advanced manufacturing processes, including high-speed machining and dry machining is favoring market growth as carbide tools can withstand the high temperatures generated during these processes without losing their cutting edge, thereby ensuring operational efficiency and reducing downtime for tool changes.

Analysis by Configuration:

- Hand-based

- Machine-based

Carbide hand tools are popular for manual use – this gives way to precision in actions such as turning, cutting, and drilling. They are used in fields such as construction, car fixing services, and even in artisanship. These tools come in handy for work that must be done with the utmost detail and care such that there is no way the work can be completed without the use of their hands hence small works and custom designs.

On the other hand, machine-based tools are designed for integration with automated equipment, allowing the achievement of high-speed operations and uniformity in production. These tools are widely employed in manufacturing industries when performing processes such as heavy cutting, milling, and turning. Such tools are indispensable for mass and industrial production where precision and efficiency are paramount. Machine-based tools contribute significantly to the scalability of modern industrial processes.

Analysis by Coating:

- Coated

- Non-Coated

Coated leads the market with around 65.5% of market share in 2024. The coated carbide tool demand is growing due to its enhanced performance in demanding machining environments. Coatings such as titanium nitride (TiN), titanium carbide (TiC), and aluminum titanium nitride (AlTiN) significantly improve the hardness and heat resistance of carbide tools, allowing for higher cutting speeds and longer tool life. These coatings effectively reduce friction and wear on the tool's surface, minimizing the thermal degradation that can occur during intense machining operations. Additionally, coated carbide tools can handle a broader range of materials, including harder alloys and composites, which are increasingly used in advanced engineering applications.

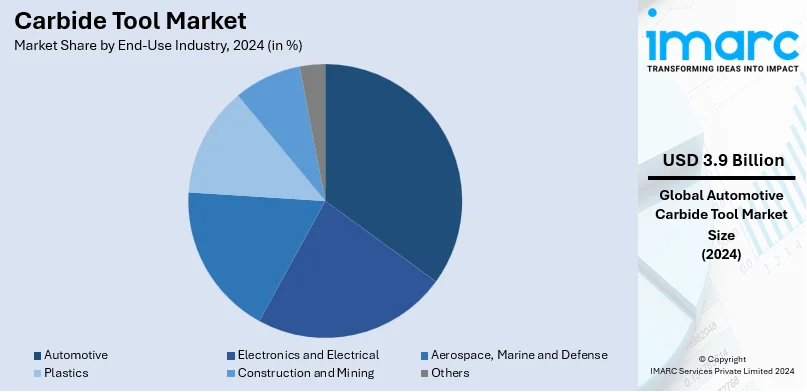

Analysis by End-Use Industry:

- Automotive

- Electronics and Electrical

- Aerospace, Marine and Defense

- Plastics

- Construction and Mining

- Others

Automotive lead the market with around 32.0% of market share in 2024. The carbide tool market analysis shows that the demand for these tools in the automotive sector is propelled by the industry's stringent requirements for precision and efficiency in manufacturing processes. Carbide tools are essential in automotive production due to their ability to handle tough materials like hardened steel and advanced alloys used in vehicle components. Their superior wear resistance and ability to maintain sharpness under continuous use enable high-speed machining, which is crucial for meeting the high production volumes required in the automotive industry. Additionally, the shift towards lightweight materials such as aluminum and titanium to enhance fuel efficiency and reduce emissions in vehicles necessitates tools that can precisely cut and shape these materials without wear, contributing to the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of 34.0%. Asia Pacific region accounts for the largest carbide tool market share, driven by the rapid industrial growth and expansion of manufacturing sectors in countries such as China, India, and Southeast Asia. This region is witnessing significant investments in infrastructure development and industrialization efforts, which require robust tools for machining and production. The flourishing automotive and electronics industries are also boosting the demand for high-precision and efficient carbide tools. Additionally, the region's commitment to enhancing domestic manufacturing capabilities, as seen in initiatives like China's "Made in China 2025" and India's "Make in India" campaign, further fueling the demand for durable and efficient machining tools. These initiatives encourage the adoption of advanced manufacturing technologies, including CNC machining and automation, thereby propelling the demand for carbide tools.

Key Regional Takeaways:

United States Carbide Tool Market Analysis

In 2024, the US dominated the North America market with a market share of 79.8%. The advanced manufacturing sector in the US and the rising need for precision machining in sectors like automotive, aerospace, defense, and energy are driving the market for carbide tools in the US. Owing to their exceptional durability, heat resistance, and hardness, carbide tools are crucial for machining operations that demand accuracy, speed, and economy. Carbide tools are used by the automobile industry, a significant customer, to machine lightweight materials used in electric vehicles (EVs), transmission parts, and engine components. The demand for high-precision tools for intricate designs is being further fueled by the expansion of the EV market.

The market is mostly driven by the aerospace and defense industries, which need carbide tools to work with cutting-edge materials like composites and titanium. The growth of aerospace and defense industry is a major catalyst for the growth of the market. The economic value of the aerospace and defense sector was $425 billion, or 1.6% of the nominal GDP of the United States in 2023. In 2023, the aerospace and defense sector produced $955 billion in total company production. $533 billion was produced directly by the sector, and the domestic A&D supply chain produced around $422 billion in indirect activity. Additionally, carbide tools are used in the U.S. energy sector for drilling, pipeline building, and wind turbine manufacture, especially in the oil and gas and renewable energy sectors. Opportunities for carbide tools in solar and wind energy projects are growing because of the move toward sustainable energy solutions. The market for carbide tools is also being driven by government incentives that support domestic manufacture and the use of Industry 4.0 technologies like automation and CNC machining. Key players like Kennametal and Seco Tools contribute to the innovation landscape by keeping cutting-edge carbide tools accessible to satisfy changing industry demands.

Europe Carbide Tool Market Analysis

The robust automotive, aerospace, and construction sectors in the region are the main drivers of the market. Leading precision engineering nations like Germany, France, and Italy mainly rely on carbide tools because of their effectiveness in cutting high-strength materials. Carbide tools are needed by the automotive industry, which includes the expanding EV market, to produce strong, lightweight parts that are essential to EV performance. As carbide tools are required to deal with difficult-to-machine materials like nickel-based alloys and composites used in aircraft manufacture, the European aerospace sector further fuels demand. Carbide tools are also used in the construction sector for tasks like drilling, cutting, and grinding in major infrastructure projects. Over the past decade, the region's building industry has grown steadily. Between 2010 and 2021, this percentage of the EU's Gross Value Added (GVA) ranged from 5% to 6%. It peaked in 2010 at 5.8%, dropped to 5.1% from 2014 to 2017, and then rose once more to 5.5% in 2020 and 2021.

Since environmental sustainability programs like the European Green Deal place a strong emphasis on resource efficiency, carbide tools' robustness and recyclability are crucial to their uptake. In order to satisfy the region's need for high-precision and environmentally friendly machining solutions, European manufacturers additionally concentrate on creating cutting-edge coatings and tool shapes to improve carbide tool performance.

Asia Pacific Carbide Tool Market Analysis

The Asia-Pacific carbide tool market is the fastest-growing globally, largely driven by rapid industrialization, urbanization, and the expansion of key manufacturing sectors. China, India, Japan, and South Korea are the prominent markets for carbide tool in the region with China being the biggest manufacturer and consumer of carbide tools because of its substantial building and manufacturing activity. Chinese manufacturers are catching up to their international rivals quite rapidly. Official data indicates that throughout the 2019–2022 period, the export volume of cemented carbide inserts increased by 50% and the export value by 74%. The region's rapidly expanding electronics and automotive sectors rely significantly on carbide tools for high-precision component manufacturing.

The use of carbide tools for sophisticated manufacturing processes is further supported in South Korea and Japan by developments in automation and robotics technology. In the meantime, demand for carbide tools in energy and construction applications is being driven by India's renewable energy endeavors and infrastructure. The use of carbide tools is also increasing due to the growing acceptance of smart manufacturing technologies, such as CNC machines and additive manufacturing, which guarantees higher quality and productivity.

Latin America Carbide Tool Market Analysis

In Latin America, especially in nations like Brazil, Mexico, and Chile, the mining, construction, and automotive sectors are the main drivers of the carbide tool market. The abundance of natural resources in the area generates a high demand for carbide tools for use in material processing, excavation, and drilling. Adoption of carbide tools in construction projects is being further stimulated by government funding in infrastructure development efforts. Moreover, the region's industrial sectors' adoption of sophisticated production processes is driving up demand for high-performance carbide tools, which is fueling market expansion.

Middle East and Africa Carbide Tool Market Analysis

The mining, construction, and oil and gas industries have the most effects on the carbide tool industry in the Middle East and Africa. Carbide tools are necessary for drilling and pipeline maintenance due to the Middle East's vast oil and gas development activity. Meanwhile, the need for carbide tools in mining operations is driven by Africa's abundant mineral resources. The expansion of infrastructure encourages the use of carbide tools in manufacturing and construction, especially in nations like South Africa, the United Arab Emirates, and Saudi Arabia. It is anticipated that the need for sophisticated carbide tools would increase as the region's industrial sectors modernize and implement precision machining technologies.

Competitive Landscape:

Key players in the market are driving growth through innovation, strategic partnerships, and global expansion. They are investing heavily in research and development to design advanced tools with improved durability, efficiency, and precision, catering to changing industrial demands. Companies are adopting advanced manufacturing technologies, such as CNC machining and additive manufacturing, to enhance productivity and reduce costs. Additionally, partnerships and acquisitions enable market leaders to expand their portfolios, reach new customer segments, and penetrate emerging markets. Sustainability initiatives, like using eco-friendly materials and energy-efficient production processes, are gaining traction among top manufacturers. By offering customized solutions, comprehensive after-sales services, and embracing digital technologies like IoT-enabled tools, these players are enhancing customer satisfaction and solidifying their market positions.

The report provides a comprehensive analysis of the competitive landscape in the carbide tool market with detailed profiles of all major companies, including:

- Advent Tool & Manufacturing Inc

- Ceratizit Group (Plansee SE)

- Garr Tool Company

- Ingersoll Cutting Tool Company

- KYOCERA SGS Precision Tools Inc (Kyocera Corporation)

- Makita Corporation

- Mitsubishi Materials Corporation

- OSG Corporation

- Rock River Tool Inc

- Sandvik AB

- Sumitomo Electric Industries Ltd

- vHF Camfacture AG

- YG-1 Co Ltd

Latest News and Developments:

- October 2024: Walter has expanded its Perform line with the addition of new five and six-flute solid carbide milling cutters for the ME232 Perform series, along with two and four-flute ball-nose end mills for the ME432 Perform series. These tools offer advantages for users in small to medium batch production, where tool life is often not maximized. The new cutting tools for turning centers provide significant potential for price-conscious manufacturers, as they are standard in this field.

- October 2024: Mitsubishi Materials has introduced the MC6135 grade to its MC6100 range, specifically designed for continuous, rough, and interrupted cutting applications. By incorporating crystal orientation control, the MC6135 offers thinner, impact-resistant coatings that enhance chipping and wear resistance, with a 50% reduction in thickness compared to prior versions.

- September 2023: Seco introduced a range of advanced solutions to overcome machining challenges and improve productivity, including new toolholders, PCBN inserts, round carbide inserts, and extra-long solid carbide drills. These innovative products are engineered to provide enhanced versatility and extended tool life, making them suitable for applications ranging from general ISO turning to high-volume hard turning and deep-hole drilling.

- February 2022: Peak Toolworks acquired Tooling Concepts Inc., in Elkhart, IN. This strategic move enhanced Peak’s presence in the Midwest by incorporating a new sharpening facility, complementing the company’s existing network of 12 locations across the U.S. and Canada. The addition of the Elkhart plant provides Peak with an opportunity to better serve its customers in cutting and machining metal, wood, plastics, and composites, further supporting the growing and diverse industrial base in the Midwest.

- August 2021: Sandvik AB signed and acquired a 67% share of Chuzhou Yongpu Carbide Tipped Tools Co Ltd, based in China to improve its product portfolio of carbide tools across diversified geographies. The company will be included under Sandvik Coromant, a division of Sandvik Manufacturing and Machining Solutions.

Carbide Tool Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Drilling Tools, Milling tools, Turning Tools, Others |

| Configurations Covered | Hand-based, Machine-based |

| Coatings Covered | Coated, Non-Coated |

| End Use Industries Covered | Automotive. Electronics and Electrical, Aerospace, Marine and Defense, Plastics, Construction and Mining, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advent Tool & Manufacturing Inc., Ceratizit Group (Plansee SE), Garr Tool Company, Ingersoll Cutting Tool Company, KYOCERA SGS Precision Tools Inc (Kyocera Corporation), Makita Corporation, Mitsubishi Materials Corporation, OSG Corporation, Rock River Tool Inc., Sandvik AB, Sumitomo Electric Industries Ltd., vHF Camfacture AG, YG-1 Co Ltd., etc |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Carbide Tool market from 2019-2033.

- The Carbide Tool market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Carbide Tool industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A carbide tool is a cutting tool made from a composite of tungsten carbide and cobalt, known for its exceptional hardness and durability. These tools are widely used in machining, drilling, and milling due to their ability to withstand high temperatures and maintain sharpness. Carbide tools offer superior precision, efficiency, and longevity compared to traditional steel tools.

The global carbide tool market was valued at USD 12.3 Billion in 2024.

IMARC estimates the global carbide tool market to exhibit a CAGR of 4.6% during 2025-2033.

Key factors driving the global carbide tool market include increasing demand for precision machining in industries like automotive, aerospace, and manufacturing. The need for higher productivity, longer tool life, and cost efficiency is pushing the adoption of carbide tools. Additionally, advancements in manufacturing technologies, expansion of industrial automation, and growing infrastructure projects further fuel market growth.

According to the report, milling tools represented the largest segment by product type, driven by their widespread use in precision machining across industries such as automotive, aerospace, and metalworking.

Coated leads the market by coating owing to their enhanced performance and longevity. The coating provides improved resistance to wear, heat, and corrosion, which extends tool life and enhances machining efficiency.

Automotive is the leading segment by end use industry, driven by the growing demand for precision parts and components in vehicle manufacturing.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global carbide tool market include Advent Tool & Manufacturing Inc., Ceratizit Group (Plansee SE), Garr Tool Company, Ingersoll Cutting Tool Company, KYOCERA SGS Precision Tools Inc (Kyocera Corporation), Makita Corporation, Mitsubishi Materials Corporation, OSG Corporation, Rock River Tool Inc., Sandvik AB, Sumitomo Electric Industries Ltd., vHF Camfacture AG, and YG-1 Co Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)