Caustic Soda Market Size, Share, Trends and Forecast by Product Type, Manufacturing Process, Grade, Application, and Region, 2026-2034

Caustic Soda Market Size, Share & Growth Trends:

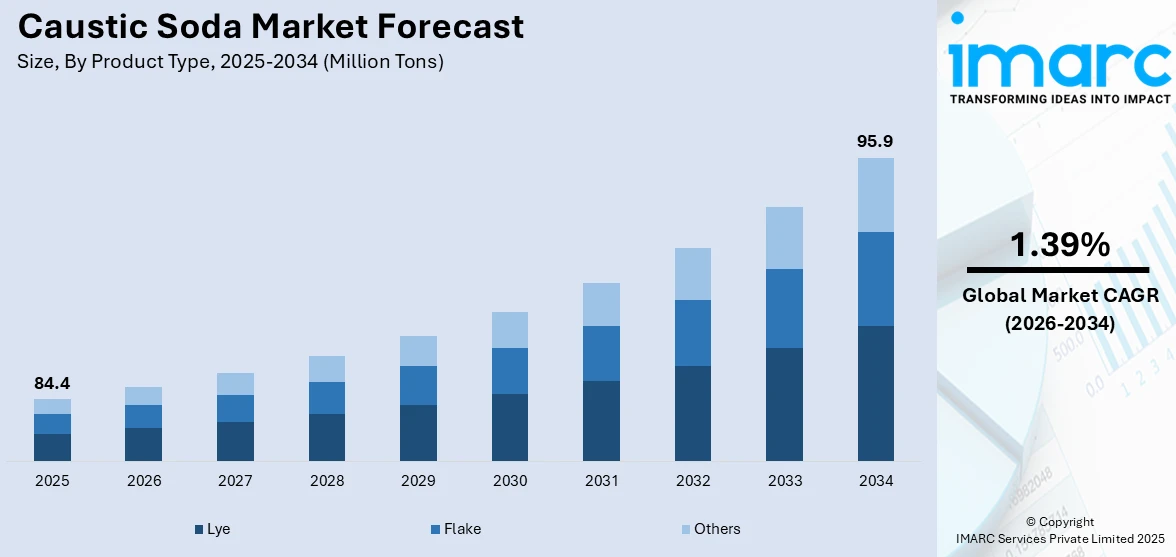

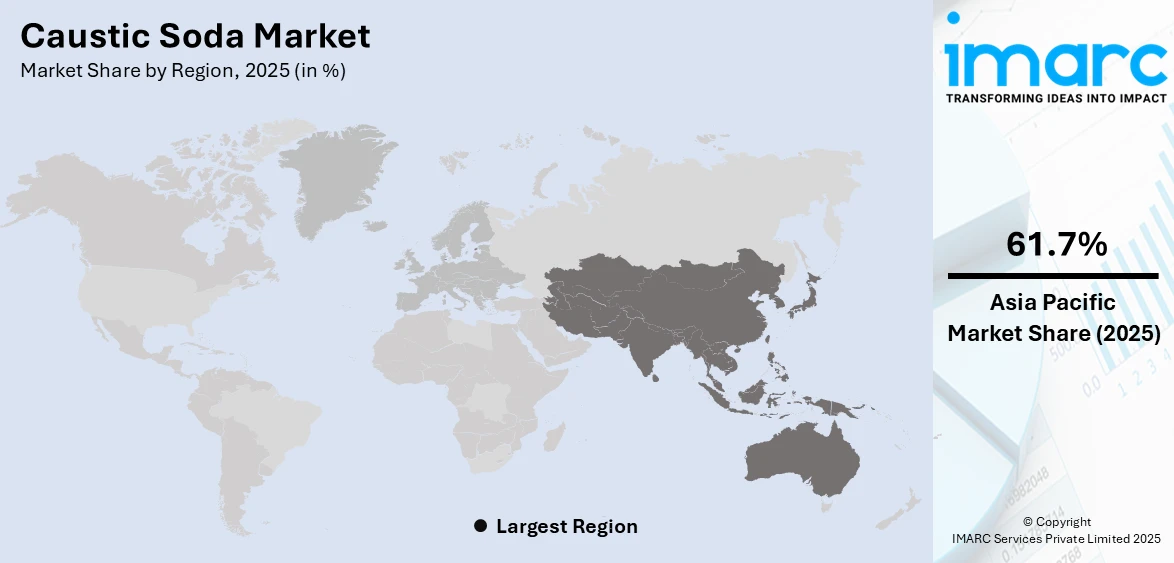

The global caustic soda market size reached 84.4 Million Tons in 2025. Looking forward, IMARC Group estimates the market to reach 95.9 Million Tons by 2034, exhibiting a CAGR of 1.39% during 2026-2034. Asia-Pacific currently dominates the market. The increasing demand for lightweight materials such as aluminium, rapid expansion in the pulp and paper industry, and the significant growth of water treatment services globally represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 84.4 Million Tons |

| Market Forecast in 2034 | 95.9 Million Tons |

| Market Growth Rate 2026-2034 | 1.39% |

The global caustic soda market is driven by its widespread application across industries such as pulp and paper, textiles, chemicals, and aluminum. The increasing demand for alumina in the construction and automotive sectors significantly enhances caustic soda consumption, as it is a critical input in alumina production. Additionally, the growth in the textile industry, fueled by rising urbanization and consumer demand for clothing, which is augmenting the caustic soda market revenue. The chemical industry’s expansion, driven by innovations in pharmaceuticals and petrochemicals, further amplifies caustic soda usage. Moreover, advancements in manufacturing processes and the development of eco-friendly production techniques enhance market prospects. Furthermore, an enhanced focus on sustainable development is providing an impetus to the market. For instance, on December 11, 2024, Brenntag announced the introduction of 100% green caustic soda in the Netherlands and Belgium, offering it at a comparable price to conventional alternatives. This initiative aligns with Brenntag's commitment to sustainability and supports customers in achieving their environmental objectives. The company plans to expand the availability of green caustic soda to additional regions in the future.

To get more information on this market Request Sample

The United States stands out as a key regional market, primarily driven by growing demand in the food and beverage industry, where it is used for cleaning and sanitation purposes. The expansion of the healthcare sector, particularly in the production of pharmaceuticals, has further propelled the need for caustic soda as a key chemical input. Additionally, its application in producing soaps and detergents aligns with rising consumer demand for hygiene products. The energy sector also contributes to market growth, as caustic soda is used in gas treatment and biodiesel production. Moreover, its role in the production of specialty chemicals and the increasing adoption of advanced manufacturing technologies are fueling the caustic soda market share, reflecting the material's essential role across various industries.

Caustic Soda Market Trends:

Increasing demand in the aluminum industry

The aluminum industry is one of the major drivers for the demand in the caustic soda market today. The industry is heavily relying on caustic soda in the Bayer process, which is an active refining of bauxite to alumina, or aluminum oxide, a precursor for producing aluminum. Additionally, the increasing use of aluminum in the aerospace and automotive industries to manufacture lightweight components and increase fuel efficiency is catalyzing its demand globally. According to the Press Information Bureau, India handled 15 percent YoY growth of total air passengers which reached 376 Million in FY24. Besides this, increasing construction and renovation activities around the world are increasing demand for aluminum-based building materials to improve environmental health as well as minimize hazardous GHG emissions. According to the caustic soda market research report, the rising use in alumina refining is further influencing dynamics. This is fueling growth while driving demand for aluminum in buildings' construction.

Rapid expansion in the paper and pulp industry

The pulp and paper industry are rapidly expanding, thereby highly influencing the demand for caustic soda in pulping and bleaching processes involved in converting wood into paper. In pulping, caustic soda is used to break the lignin found in wood to separate cellulose fibers and produce paper pulp. For bleaching, it is used to remove any residual lignin and brighten the pulp. Furthermore, the proliferation of the e-commerce sector, which relies heavily on paper and cardboard for packaging, is catalyzing the demand for paper. Moreover, according to the UNICEF, the youth literacy rate has increased from 87% in 2000 to 92% in 2020. This also increased the requirement for educational materials, such as books and notebooks, which are primarily paper based, aligning with caustic soda market forecast that highlight its crucial role in paper and pulp production.

Rising use of caustic soda in water treatment services

2.2 billion people still do not utilize drinking water that is safely managed, according to the UN. With an increase in environmental awareness and stringent regulations worldwide, there is a significant rise in the demand for water treatment services, thereby propelling the caustic soda industry's growth. Caustic soda is extensively utilized to raise the pH levels of acidic water, which makes it neutral or slightly alkaline, thereby ensuring optimal conditions for water treatment processes. Along with this, caustic soda helps in detaching heavy metals and other suspended impurities from the water. This precipitates the contaminants for easier removal and therefore purifies water. Governments and organizations are constantly developing solutions to conserve water and reduce the environmental degradation due to water pollution. This has been increasing the need for efficient water treatment services along with required chemicals for the treatment, thereby acting as one of the major caustic soda market growth drivers.

Caustic Soda Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global caustic soda market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, manufacturing process, grade, and application.

Analysis by Product Type:

- Lye

- Flake

- Others

Lye stands as the largest component in 2025, due to the increasing use of lye in various industrial processes, such as the manufacturing of paper, textiles, soaps, and detergents. The growth in these industries is catalyzing the demand for lye. Additionally, the growing adoption of lye in the Bayer process to refine bauxite into alumina, which is then used to produce aluminum. Along with this, rising preferences for lightweight materials are driving the demand for lye in the aluminum industry. The International Organization of Motor Vehicle Manufacturers reports that 91.8 million automobiles were produced as of 2019. The automobile lightweight material market is expected to grow up to USD 99.3 Billion by 2025, thus further driving the demand for aluminum in the automotive sectors, thereby strengthening the growth market for caustic soda. Caustic soda industry insights also encompasses a comprehensive examination of market dynamics, including supply chain evaluations and technological advancements.

Analysis by Manufacturing Process:

- Membrane Cell

- Diaphragm Cell

- Others

According to the report, membrane cell accounted for the largest caustic soda market share. Presently, there is a rise in the adoption of membrane cell technology in the chemical industry as it provides a more efficient process, and a higher quality of end products as compared to older methods such as mercury and diaphragm cell technologies. The membrane cell process results in chlorine and caustic soda with very high purity levels. Additionally, it is more environmentally sustainable. It eliminates the need for mercury, a toxic heavy metal used in the mercury cell process, thus preventing mercury pollution. These advancements are shaping the caustic soda market outlook by promoting eco-friendly production methods. Furthermore, it consumes less energy than traditional methods, and results in reduced carbon emissions, which promotes its utilization globally. Moreover, according to the United Nations Paris Agreement, to meet the 1.5 °C Paris target, global CO2 emissions need to be reduced by 45% from 2010 levels by 2030 and come down to net zero by 2050. This will further drive the adoption of sustainable systems including membrane cell technology in various industries..

Analysis by Grade:

- Reagent Grade

- Industrial Grade

- Pharmaceutical Grade

- Others

According to the report, the industrial grade accounts for the largest market share. The industrial grade caustic soda is dominating the market due to its widespread use in various industrial processes. It is extensively used in paper manufacturing, textile processing, soap and detergent production, aluminum refining, and water treatment. The International Energy Agency has further projected global biofuel demand to grow by 35,000 MLPY or 20% over the period of 2022-2027. Further, industrial-grade caustic soda is cheaper compared to higher grades such as pharmaceutical grades or food grades. Thus, it is a cheaper alternative for many industries. Besides this, it is used in the cleaning process, pH regulation, and facilitation of chemical reactions, making it an extremely versatile product for many purposes. Statistics on the market related to caustic soda contain important information about the industry, including production volumes, consumption patterns, and import and export data, which are essential for caustic soda market price analysis.

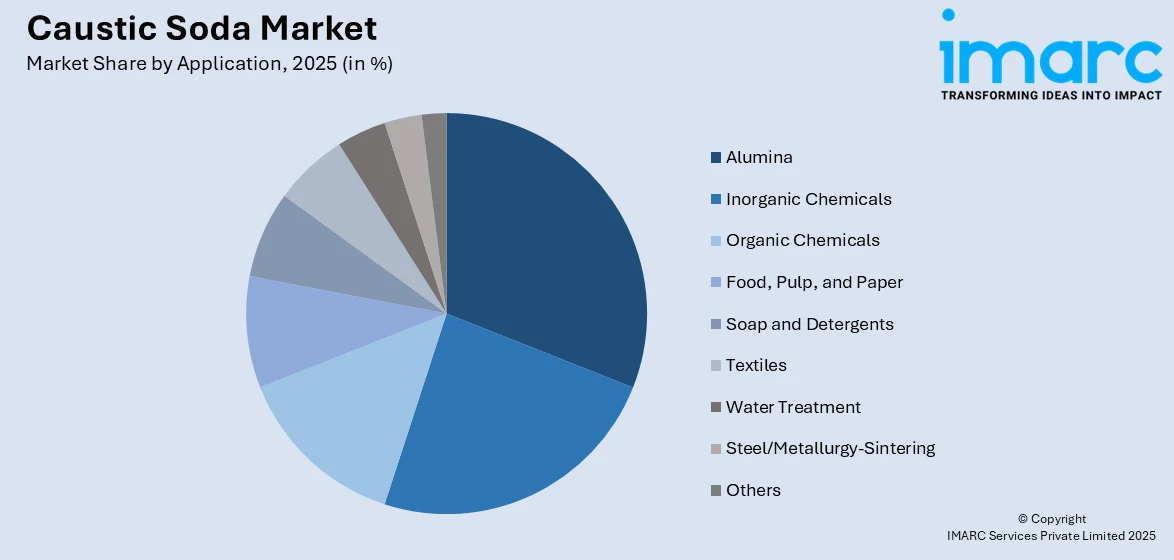

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Alumina

- Inorganic Chemicals

- Organic Chemicals

- Food, Pulp, and Paper

- Soap and Detergents

- Textiles

- Water Treatment

- Steel/Metallurgy-Sintering

- Others

According to the report, alumina accounts for the largest market share. The demand for caustic soda in alumina production primarily increases due to the necessity of aluminum construction materials. Rapid urbanization and industrialization across the world create infrastructural demands. Moreover, there is an increase in the utilization of aluminum in construction, automotive, aerospace, and packaging industries on account of its durability and corrosion resistance properties, which is driving the need for alumina extraction. Another significant factor driving the demand for caustic soda in alumina production is the automotive industry's shift toward manufacturing lightweight vehicles, reducing greenhouse gas emissions and enhancing fuel efficiency, which influences caustic soda market price trends. In addition, aluminum is used considerably in green packaging solutions due to its recyclability. With increasing tendencies of businesses towards sustainability, demand increases for aluminum in packaging due to which caustic soda demand increased in alumina production. Additionally, the report compiled by the Aluminium Association about North America's light vehicle aluminum content has indicated that increasing demand for more sustainable means of transportation will lead to around 100 net pounds of PPV market share gains for aluminum content between the years 2020-2030.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

According to the report, Asia Pacific represented the largest market. The Asia Pacific region exhibits a clear dominance in the caustic soda market due to rapid urbanization and the expansion of various industries in the region. Additionally, the growing population is resulting in the increasing construction activities of residential and commercial buildings, which, in turn, is driving the demand for aluminum-based construction materials. Moreover, the expansion of the textile industry is accelerating the adoption of caustic soda in the region, as highlighted in the caustic soda market report, thereby offering a favorable outlook. Apart from this, according to the research conducted by the United Nations, Asia’s population is anticipated to grow to 4.9 Billion by 2030. As a result, many countries in the region will be investing in improving their water treatment facilities to ensure the provision of clean and safe water for the growing population. This will also increase the sales of caustic soda in the water treatment process across the Asia Pacific region.

Key Regional Takeaways:

United States Caustic Soda Market Analysis

The US market for caustic soda is growing based on some constantly changing factors across a variety of different types of industries. In general, the chemical industry has a growing demand for caustic soda as a feedstock used to produce ethylene oxide and propylene oxide both of which are necessary in the formulation of detergents and antifreeze solutions. Growing sustainable practices are visible in higher caustic soda usage by paper and pulp mills for chemical pulping besides recycling paper. The aluminum industry has become highly active in the usage of caustic soda for processing bauxite ore in the production of alumina with the help of constant investments in infrastructural expansion. To meet high regulatory standards for wastewater treatment management, water treatment plants have raised the usage of caustic soda in pH regulating and neutralization processes. The textile industry is increasing its usage of caustic soda in fabric processing and dyeing to meet demands for more textiles from customers. According to the International Trade Administration, in 2019, a total amount of USD 1.8 Billion was invested in the U.S. textile mill sector. These trends are being supported by the improvements in the production method and increased capacity by major companies to ensure a consistent supply of high-purity caustic soda for industrial applications.

Asia Pacific Caustic Soda Market Analysis

Asia-Pacific holds a market for caustic soda that is rapidly developing due to various reasons. There are local industries which produce alumina to meet the demands from car and construction industries, for which caustic soda is used. As the need for paper and pack increases, paper and pulp mills utilize caustic soda to bleach and pulp their products. Chemical manufacturers use caustic soda in the synthesis of goods such as propylene oxide and ethylene dichloride in order to meet the rise in the demand for downstream petrochemicals. Caustic soda is widely used in textile industries for dyeing and finishing purposes to support the rapidly expanding fashion and apparel sectors, especially in Bangladesh and India. The India Brand Equity Foundation reported that 2.15 Million tones of fiber were produced in India in the year 2022–2023. In addition, as governments increase their efforts toward better infrastructure and water quality, treatment plants are increasingly relying on caustic soda to neutralize and regulate pH. As soap and detergent manufacturers gear up to meet the rising demands of hygienic consumers, they are using caustic soda for saponification. Since caustic soda is used in increasing regions for different industrial purposes, its production requirement is also growing significantly, and chlor-alkali companies are widening their span by using technical improvement that can yield more production efficiency.

Europe Caustic Soda Market Analysis

European caustic soda market is currently supported by growing adoption in alumina production, which witnesses increasing requirement for lightweight materials from numerous end-use industries such as automotive and aerospace. Manufacturers are optimally optimizing production processes to reduce carbon emissions as per the stringent EU environmental regulation, which is increasing the adoption of membrane cell technology in caustic soda production. The market is also experiencing growth because of the increasing use of caustic soda in the textile industry for mercerizing cotton and improving fabric strength and dye affinity, as the European fashion industry focuses on sustainable and quality textile production. Reports say that the textile sector employs 1.3 Million jobs in UK. Concurrently, the increasing demand for caustic soda in water treatment processes is gaining momentum as the European governments are focusing on pure water projects to cater to the urban population and reduce pollution. Moreover, the chemical sector is increasingly using caustic soda for the production of organic chemicals and processing of derivatives of petrochemical, led by the region's efforts to modernize its industrial sector. Increasing utilization of caustic soda in the food and beverage sector for cleaning and pH regulation is further assisting the market to benefit in light of the tightening of hygiene standards across Europe.

Latin America Caustic Soda Market Analysis

The market in Latin America is driven by the growing demand for it in alumina production, mainly in countries such as Brazil, where bauxite mining and aluminum production are growing. Manufacturers are investing in high-tech chlor-alkali technologies that increase efficiency while consuming less energy to meet increased demand from the paper and pulp, textiles, and detergent industries. With the market seeing a boom in caustic soda usage in wastewater treatment applications, governments and companies are increasingly emphasizing the adoption of strict environmental rules. Due to the strong expansion of the construction industry in urbanizing regions, regional chemical firms are expanding their product lines by incorporating the production of caustic soda into downstream uses, such as PVC. According to the 2022 Population Census, out of the total population of the country, 203.1 Million people, 177.5 Million resided in urban areas. Companies are also increasingly looking for export opportunities, taking advantage of the region's access to North American and European markets in times of fluctuating global supply chains. The higher consumption of caustic soda in oil refining and biodiesel is also contributing to the growth of the market, especially in economies that are energy diversification-oriented. While so, improvements in logistics in addition to better port facilities support the steady supply of caustic soda to domestic and international markets, supporting better market dynamics in general.

Middle East and Africa Caustic Soda Market Analysis

Caustic soda is widely used for pH regulation and water purification; therefore, the demand is being driven by governments and commercial organizations spending more in water treatment infrastructure. The regional chemical manufacturing enterprises are increasing their production capacities, especially in chlorine-alkali products, which will make caustic soda more widely available for different industrial uses. The modernization of the paper and pulp industry to meet international export standards is increasing the need for caustic soda in pulping and bleaching operations. Moreover, the growth of textile manufacturing, especially in countries including Egypt and South Africa, is driving up the consumption of caustic soda for mercerizing and dyeing processes. As the South African government states, it has allocated USD 126.54 Million and supported 154 entities, employing nearly 24 000 people. Energy companies are using caustic soda in the desulfurization of fuels and other petrochemical processes to comply with the global clean fuel production drive. At the same time, regional participants are entering joint ventures with international caustic soda producers, facilitating technology transfer and securing steady supplies to further stimulate market expansion.

Competitive Landscape:

The competition in the market is dominated by several key players that focus on capacity expansions and technological advancements to establish strategic partnerships. Major players are also modernizing manufacturing facilities for greater efficiency and to minimize environmental impacts, due to the growing emphasis on sustainable development. Collaborative ventures and acquisitions become common strategies in the expansion of geographical reach and improvement in the market position. Key players are also prioritizing research and development to improve product quality and meet the specific demands of end-use industries. Innovations in energy-efficient manufacturing processes are further driving competition. Additionally, some companies are entering long-term supply agreements with industrial users to secure a stable revenue stream, intensifying the competitive dynamics in the global caustic soda market.

The report provides a comprehensive analysis of the competitive landscape in the caustic soda market with detailed profiles of all major companies, including:

- Dow Inc

- Olin Corporation

- Tata Chemicals Limited

- Solvay SA

- Occidental Petroleum Corporation

- Formosa Plastics Corporation

- Ineos Group Limited

- Xinjiang Zhongtai Chemical Co., Ltd.

- Hanwha Solutions Chemical Division Corporation

- BASF SE

- Covestro AG

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- November 2020: Meghmani Finechem, a material company under Meghmani Organics, has expanded its Gujarati caustic soda plant. The firm has increased the capacity of its caustic soda factory from 2,94,000 tpa to 4,00,000 tpa.

- March 2021: Vynova started delivering renewable caustic soda which is manufactured from renewable energy. Compared to conventionally produced caustic soda, Vynova's renewable caustic soda has a massively lower carbon footprint and will help consumers from various industries produce products that are more environmentally friendly.

- June 2022: Nobian, the leading company in salt, essential chemicals, and energy, began to deliver chlorine and caustic soda from 100% renewable electricity supply in the Netherlands and Germany successfully. It's a great indicator of how seriously Nobian is engaged in raising the share of environmental-friendly products from the portfolio.

- May 2024: DCM Shriram has positioned an increase of 850 Tons per day (TPD) in Gujarat. The company has achieved this milestone with the commissioning of its caustic soda expansion project. The company has taken its annual caustic capacity at Kota, Rajasthan and Bharuch, Gujarat to 1 Million metric Tons per annum (TPA), with the company's installed capacity at Bharuch alone reaching 2225 TPD.

Caustic Soda Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lye, Flake, Others |

| Manufacturing Process Covered | Membrane Cell, Diaphragm Cell, Others |

| Grades Covered | Reagent Grade, Industrial Grade, Pharmaceutical Grade, Others |

| Applications Covered | Alumina, Inorganic Chemicals, Organic Chemicals, Food, Pulp, and Paper, Soap and Detergents, Textiles, Water Treatment, Steel/Metallurgy-Sintering, Others. |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Dow Inc, Olin Corporation, Tata Chemicals Limited, Solvay SA, Occidental Petroleum Corporation, Formosa Plastics Corporation, Ineos Group Limited, Xinjiang Zhongtai Chemical Co., Ltd., Hanwha Solutions Chemical Division Corporation, BASF SE, Covestro AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the caustic soda market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global caustic soda market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the caustic soda industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The caustic soda market size reached 84.4 Million Tons in 2025.

The caustic soda market is projected to exhibit a CAGR of 1.39% during 2026-2034, reaching a volume of 95.9 Million Tons by 2034.

Key factors driving the caustic soda market include increasing demand in industries like aluminum production, paper and pulp, water treatment services, and textiles. Additionally, eco-friendly production techniques and innovations in manufacturing processes, along with a focus on sustainable development, are contributing to market growth.

Asia Pacific currently dominates the caustic soda market. This dominance is fueled rapid urbanization, industrial expansion, and increasing demand for aluminum, textiles, and water treatment services in the region.

Some of the major players in the caustic soda market include Dow Inc, Olin Corporation, Tata Chemicals Limited, Solvay SA, Occidental Petroleum Corporation, Formosa Plastics Corporation, Ineos Group Limited, Xinjiang Zhongtai Chemical Co., Ltd., Hanwha Solutions Chemical Division Corporation, BASF SE, and Covestro AG, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)