China Online Accommodation Market Size, Share, Trends and Forecast by Platform, Mode of Booking, and Region, 2026-2034

China Online Accommodation Market Overview:

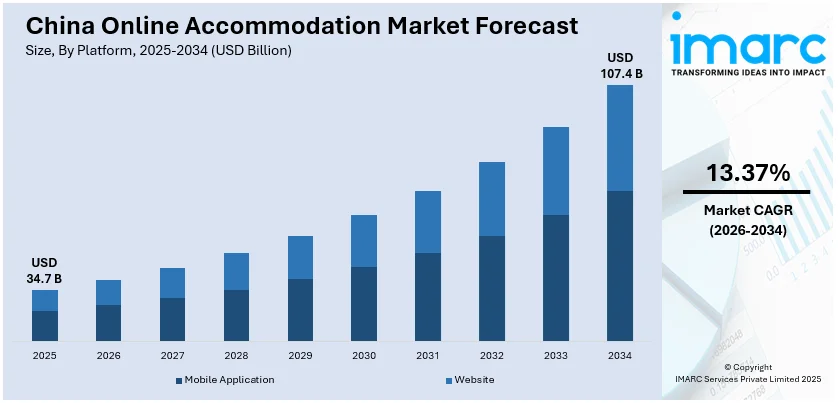

The China online accommodation market size reached USD 34.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 107.4 Billion by 2034, exhibiting a growth rate (CAGR) of 13.37% during 2026-2034. Rising domestic tourism, increasing smartphone penetration, digital payment adoption, AI-driven personalized booking, competitive pricing, government support for tourism, growth of budget and luxury hotels, platform loyalty programs, and expanding rural and alternative accommodations are driving China's online accommodation market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 34.7 Billion |

| Market Forecast in 2034 | USD 107.4 Billion |

| Market Growth Rate 2026-2034 | 13.37% |

China Online Accommodation Market Trends:

Growth of AI-driven personalization and Smart Booking Technologies

China's online accommodation space is transforming with the use of AI-driven personalization, which allows travelers to be offered customized suggestions based on preference, past booking history, and current trends. Large online travel agencies such as Ctrip, Meituan, and Fliggy are using machine learning, big data analysis, and predictive algorithms to drive customer engagement. Based on a report by China Internet Network Information Center, 2024, AI recommendations boosted booking conversion rates by 22% in 2023, and personalized search results and dynamic pricing are on the rise. Apart from this, by 2025, more than 75% of online hotel reservations in China will be impacted by AI suggestions and chatbot conversations, offering a promising picture for market growth. Additionally, according to the report China Hospitality Association, 2024, the number of hotels using smart pricing algorithms to maximize room rates depending on demand grew 30% YoY in 2023. Businesses are incorporating AI-powered chatbots and voice search features to simplify customer inquiries. Such platforms as Ctrip's AI Butler utilize natural language processing (NLP) to offer real-time travel information. Also, facial recognition check-in technology, innovated by hotels under Alibaba's FlyZoo brand, is cutting down waiting times and enhancing guest experiences. The move to AI-driven services is making online travel bookings even more seamless, further driving the adoption of online travel.

To get more information on this market Request Sample

Expansion of Rural and Alternative Accommodations

With increased government investment in rural tourism, demand for homestays, eco-lodges, and boutique countryside hotels is surging on online booking platforms. Platforms like Tujia, Airbnb China, and Xiaozhu are capitalizing on this trend by offering localized travel experiences, particularly in historical villages and eco-friendly retreats. For instance, data from China Tourism Academy, 2024 revealed that rural accommodation bookings on OTAs grew by 48% YoY in 2023, driven by demand for unique travel experiences. Moreover, China’s rural tourism market is projected to reach ¥1.2 trillion ($170 billion) by 2025, supported by digital infrastructure upgrades. In line with this, the China Homestay Industry Report 2024 revealed that the number of registered boutique homestays in rural China rose to 85,000 in 2023, marking a 35% increase from 2022. As consumers seek nature-centric, culturally immersive travel, platforms are curating high-end rural stays with premium services, including private hot springs, farm-to-table dining, and wellness retreats. Government-backed initiatives, such as China’s Beautiful Countryside Development Plan, are further driving rural travel growth. Digital platforms are enhancing visibility for underdeveloped regions, promoting lesser-known destinations through interactive content and influencer marketing.

China Online Accommodation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on platform and mode of booking.

Platform Insights:

- Mobile Application

- Website

The report has provided a detailed breakup and analysis of the market based on the platform. This includes mobile application and website.

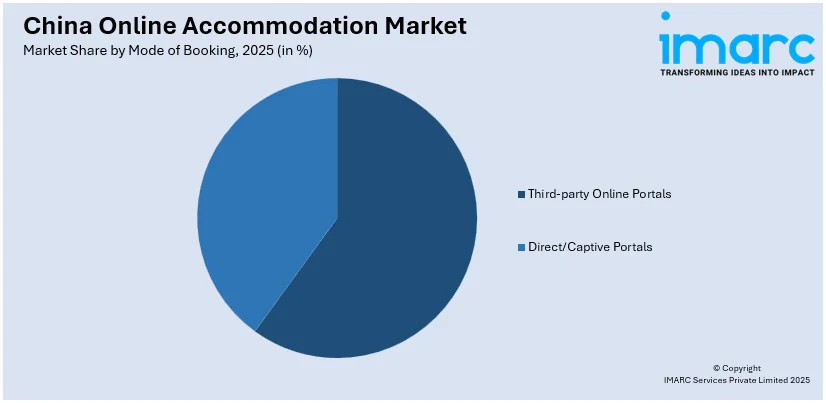

Mode of Booking Insights:

Access the comprehensive market breakdown Request Sample

- Third-party Online Portals

- Direct/Captive Portals

A detailed breakup and analysis of the market based on the mode of booking have also been provided in the report. This includes third-party online portals and direct/captive portals.

Regional Insights:

- North China

- East China

- South Central China

- Southwest China

- Northwest China

- Northeast China

The report has also provided a comprehensive analysis of all the major regional markets, which include North China, East China, South Central China, Southwest China, Northwest China, and Northeast China.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

China Online Accommodation Market News:

- November 2024: IHG Hotels & Resorts introduced Atwell Suites in Greater China, (a lifestyle brand) targeting young travelers with a sophisticated experience. Based on the "new territorial home" idea, the brand focuses on aesthetics, emotional connection, and spirituality. The brand also provides hotel investors with a high-return, low-cost business model.

- November 2024: Sheraton Hotels & Resorts launched the 'Gatherings by Sheraton' program in Greater China, collaborating with the 'Genius Mom' project to showcase nearly 400 cultural heritage-inspired crafts across 100 hotel lobbies. This initiative enriches guest experiences by highlighting Chinese cultural heritage, potentially enhancing Sheraton's appeal in the online accommodation market. By offering culturally immersive experiences, Sheraton differentiates itself, attracting travelers seeking unique stays, which may drive bookings through online platforms.increased

China Online Accommodation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platforms Covered | Mobile Application, Website |

| Mode of Bookings Covered | Third-party Online Portals, Direct/Captive Portals |

| Regions Covered | North China, East China, South Central China, Southwest China, Northwest China, Northeast China |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the China online accommodation market performed so far and how will it perform in the coming years?

- What is the breakup of the China online accommodation market on the basis of platform?

- What is the breakup of the China online accommodation market on the basis of mode of booking?

- What are the various stages in the value chain of the China online accommodation market?

- What are the key driving factors and challenges in the China online accommodation market?

- What is the structure of the China online accommodation market and who are the key players?

- What is the degree of competition in the China online accommodation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China online accommodation market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the China online accommodation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China online accommodation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)