Chiral Chemicals Market Size, Share, Trends and Forecast by Technology, Application, and Region, 2025-2033

Chiral Chemicals Market Size and Share:

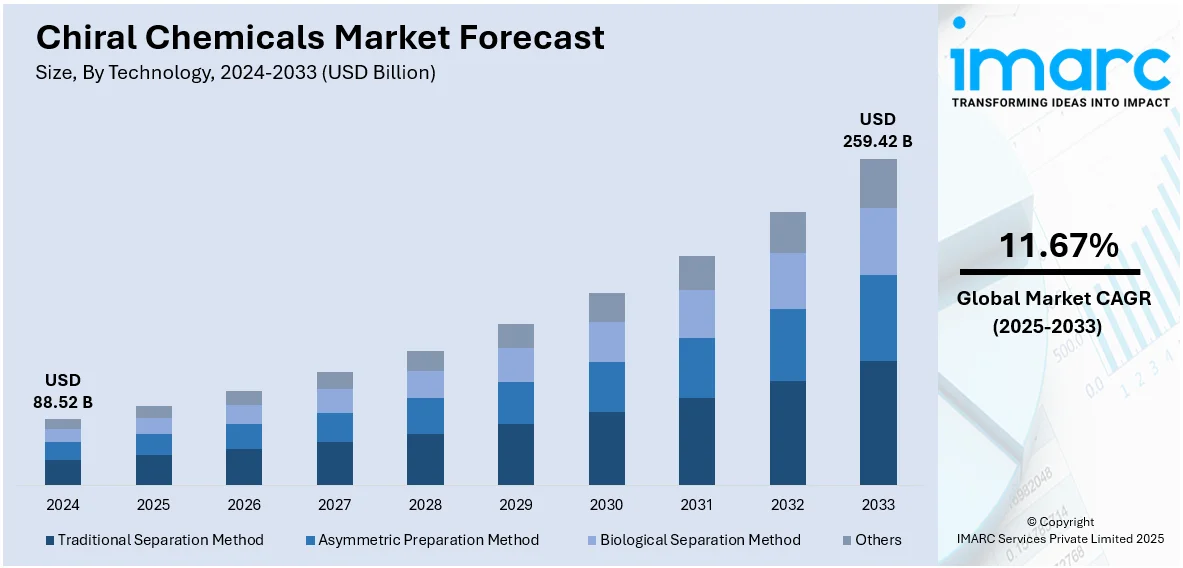

The global chiral chemicals market size was valued at USD 88.52 Billion in 2024. The market is projected to reach USD 259.42 Billion by 2033, exhibiting a CAGR of 11.67% from 2025-2033. North America currently dominates the market, holding a market share of over 42.1% in 2024. The increased demand for chiral chemical compounds in the pharmaceutical sector is driving the market. Besides this, the high demand for efficient pesticides because of their increased efficiency and lower environmental footprint is providing a positive market scenario. This trend, coupled with the global transition towards sustainable and environment-friendly practices, is expanding the chiral chemicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 88.52 Billion |

|

Market Forecast in 2033

|

USD 259.42 Billion |

| Market Growth Rate 2025-2033 | 11.67% |

The market for chiral chemicals is seeing significant growth, fueled by the increasing need for chiral chemicals in the pharmaceutical, agrochemical, and fine chemical sectors. Pharmaceutical firms are progressively utilizing chiral compounds due to their enhanced effectiveness and reduced side effects, particularly in drug products necessitating enantiomerically pure compounds. Regulatory agencies are concentrating on developing single-enantiomer medications, which is also promoting the use of chiral technologies and synthesis methods. Simultaneously, agrochemical producers are incorporating chiral molecules into pesticides and herbicides to improve target selectivity and minimize environmental impact. Emerging technologies such as asymmetric synthesis and chiral chromatography are becoming more prominent for offering more efficient and cost-effective production methods.

The United States market for chiral chemicals is witnessing strong growth, owing to higher research and development (R&D) activities in the pharmaceuticals industry. As per the chiral chemicals market report, firms are concentrating on manufacturing drugs of enantiomerically pure nature for adhering to the strict regulatory guidelines of the US Food and Drug Administration (FDA). Therefore, the requirement for sophisticated chiral synthesis technologies is growing, especially for therapeutic areas including oncology, cardiovascular diseases, and central nervous system disorders. Moreover, agrochemical firms are using chiral compounds to create more selective and eco-friendly pesticides. This is happening in tandem with increasing regulatory pressure to minimize the environmental impact of farm inputs. Simultaneously, universities and private research institutions are heavily investing in asymmetric synthesis and chiral resolution technologies, which are making production more efficient and scalable. The IMARC Group predicts that the US agrochemicals market size is expected to reach USD 52.2 Billion by 2033. This is expected to increase the demand for chiral chemicals in the country.

Chiral Chemicals Market Trends:

Increasing Demand in Pharmaceutical Industry

The pharmaceutical industry's relentless need for chiral chemicals is contributing to the market growth. Chiral compounds tend to have varying pharmacological activities depending on their stereochemistry. Due to this, the industry needs enantiopure compounds for the development of safe and effective drugs. Chiral chemicals are pivotal in the synthesis of these compounds, and they form the bedrock of drug development. According to India Brand Equity Foundation, aggregate FDI equity inflow during the Indian pharmaceuticals and drug industry in the period April 2000 to March 2024 stood at USD 22.52 Billion, roughly 3.4% of overall inflow in all sectors received. Drug-producing companies are persistently looking towards introducing new, better drugs in the market. Whether it's a pain reliever, a cancer treatment, or a cholesterol-lowering medication, chiral chemicals play a crucial role in the creation of these drugs, thereby impelling the chiral chemicals market growth.

Regulatory Emphasis on Drug Safety and Growing Interest in Green Chemistry

Regulatory bodies are putting significant emphasis on drug efficacy and safety, which is contributing to the market growth. As a result, pharmaceutical organizations are under mounting pressure to create drugs with clearly defined stereochemistry. Chiral chemicals are at the centre of addressing such regulatory requirements. These regulations allow the production of chiral drugs possessing established and reproducible stereochemistry, decreasing the occurrence of unforeseen side effects and ensuring the security of patients. In addition, the worldwide transition toward sustainable and environment friendly practices is projecting a favorable chiral chemicals market outlook. For example, individuals are willing to pay an average of 9.7% more for sustainably sourced or produced products, even as cost-of-living and inflationary pressures weigh, PwC's 2024 Voice of the Consumer Survey reports. Apart from this, eco friendly chiral synthesis techniques like biocatalysis are becoming more popular. Green chemistry principles are influencing the design of chiral processes that minimize waste and decrease the use of harmful chemicals.

Significant Growth of the Agrochemical Sector

The agrochemical industry is leading the way catalyzing the need for chiral chemicals. For example, Syngenta agrochemical is marching steadily towards its USD 2 Billion investment in industry-leading sustainable and regenerative innovation by 2025. Chiral pesticides and herbicides are increasingly popular due to their superior effectiveness and minimal environmental footprint. Agriculturalists are now relying more on chiral agrochemicals to guard crops and increase yields with minimal damage to the environment. Chiral chemicals offer a means to produce more effective and targeted farm products. They enable the production of compounds that specifically target weeds or pests without harming beneficial organisms. According to the chiral chemicals market forecast, as the global agriculture strives to become more sustainable and efficient, the chiral chemicals demand is expected to rise steadily.

Sectoral Influence on Chiral Chemical Consumption

The market is witnessing notable growth, primarily driven by rising demand from end-use industries. A significant factor is the increasing consumption of single-enantiomer compounds across various sectors. According to an industry report from April 2025, major pharmaceutical companies have committed over USD 150 billion toward U.S.-based manufacturing and R&D facilities. This wave of investment aligns with the sector’s shift toward high-precision therapeutics, where the demand for enantiomerically pure drugs continues to accelerate. These trends are reinforcing the role of chiral synthesis in pharmaceutical pipelines and are reshaping production strategies globally. Moreover, in agrochemicals, producers are increasingly using chiral molecules to improve target specificity and reduce environmental impact. Herbicides and insecticides with chirality-based activity allow for lower application volumes and better biodegradability. As agriculture pushes toward more sustainable practices, chiral agrochemicals are becoming more commercially attractive.

Chiral Chemicals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global chiral chemicals market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology and application.

Analysis by Technology:

- Traditional Separation Method

- Asymmetric Preparation Method

- Asymmetric Synthesis Method

- Asymmetric Catalysis Method

- Biological Separation Method

- Others

Traditional separation method stands as the largest component in 2024, holding 45.2% of the market. traditional separation techniques have historically formed the foundation of the chiral chemicals market. These techniques mainly encompass processes such as crystallization, fractional distillation, and traditional resolution methods. They depend on the physical and chemical characteristics of enantiomers to separate them successfully. Crystallization, for example, takes advantage of the different solubilities of enantiomers in various solvents. Fractional distillation takes advantage of the varying boiling points of enantiomers. Traditional resolution techniques utilize chiral auxiliaries or resolving agents to differentiate enantiomers. In addition to this, conventional techniques are regularly enhanced with innovations to improve their efficiency and minimize waste production. Consequently, they are utilized in situations where affordable and environmentally friendly materials are required, which is enhancing chiral chemicals market outlook.

Analysis by Application:

- Pharmaceuticals

- Agrochemicals

- Flavors and Fragrances

- Others

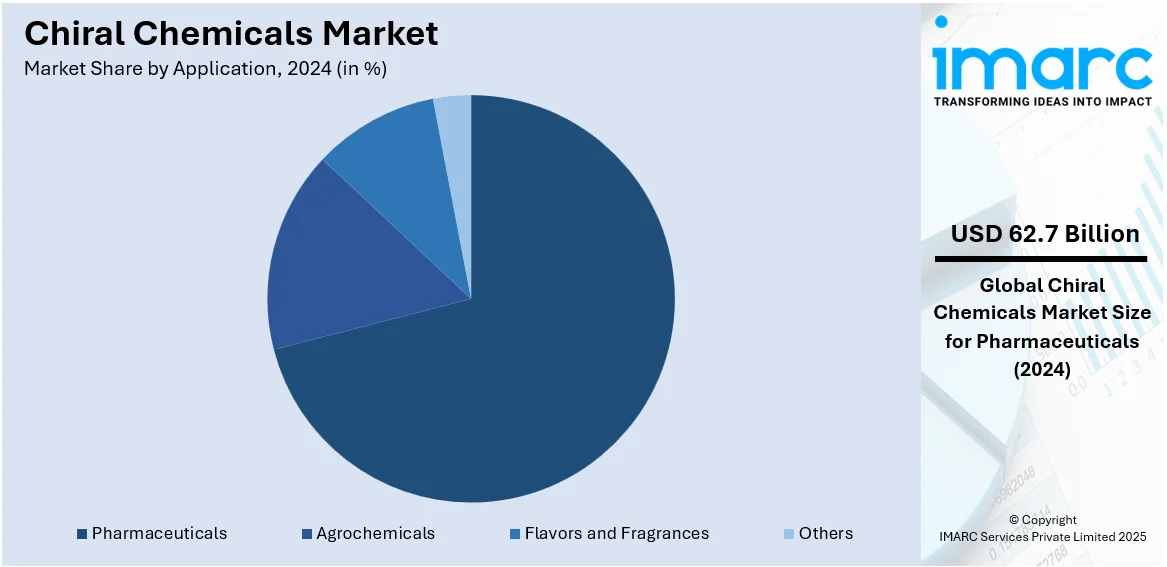

Pharmaceuticals lead the market with 70.8% of market share in 2024. Chiral chemicals are crucial in the use of pharmaceuticals because most drugs are enantiopure. During drug design, the slightest variation in the stereochemistry of a molecule can greatly affect its activity and safety. Chiral chemicals are thus called upon to help synthesize enantiopure drug substances. Chiral chemicals exist in many types of pharmaceuticals, ranging from analgesics to antibiotics and anticancer agents. The constant demand for chiral chemicals in the pharmaceutical sector to create effective and safe drugs guarantees the expansion of chiral chemicals market share. Also, the strict regulatory conditions for the stereochemistry of drugs further stress the significance of chiral chemicals in the sector. In addition, chiral chemicals play a key role in optimizing the production processes of intricate drug molecules. With increasingly sophisticated asymmetric synthesis and chiral resolution methods, pharmaceutical companies can produce high-quality, enantiomerically pure drugs cost-effectively on a large scale. This not only enhances the overall therapeutic quality of drugs but also lowers the cost of production and increases competitiveness in the marketplace.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 42.1%. North America is the leading player in the chiral chemicals sector. The region's highly developed agrochemical and pharmaceutical sectors drive the demand for enantiopure products. The United States is a prominent country among them, with a highly developed pharmaceutical industry that is always on the lookout for chiral chemicals as materials for drug synthesis. Strict regulatory standards for drug safety also increase demand for accurate stereochemistry. Furthermore, expenditure on R&D, together with technological evolution in chiral separation methods, continues to lead North American market. Furthermore, North American CMOs are witnessing mounting demand as pharma and chemicals seek to contract out production of chiral products. This follows a need to minimize production expenditures without affecting standards. As per the chiral chemicals market research report, the need for precision manufacturing coupled with the expanding R&D efforts is fueling innovation and enhancing the overall market situation.

Key Regional Takeaways:

United States Chiral Chemicals Market Analysis

The United States holds 88.40% share in North America. The United States is experiencing growing chiral chemicals uptake as a result of expanding demand from the pharmaceutical industry. Increasing cases of chronic illnesses and advances in drug discovery are spurring demand for enantiomerically pure compounds. Heavy investment in pharmaceutical R&D is also driving market growth, with companies aiming to improve drug efficacy and minimize side effects. As per reports, in the US pharma sector, 25 announced deals took place between private equity investors and pharma companies during Q3 2024, with a total value of USD 2.3 Billion. Government support for chiral drugs is also stimulating production capacity expansions. Demand for high-purity chiral intermediates and active pharmaceutical ingredients in the pharma industry is driving synthesis technology innovations. Additionally, the availability of a robust base of drug-making facilities, together with collaborations between biotech companies and chemical firms, is expanding chiral chemicals market size. This trend is likely to hold as investments in the drug-making sector continue to rise.

Asia Pacific Chiral Chemicals Market Analysis

Asia-Pacific is experiencing rising chiral chemicals adoption due to growing demand from the agrochemical sector. For instance, India’s agrochemical sector experienced a trade surplus of INR 289.08 Billion (USD 3.46 Billion) in FY 2022-23 owing to heightened export activities. The expansion of the agricultural industry and the need for high-efficiency crop protection solutions are driving the demand for chiral pesticides and herbicides. Increasing concerns over pest resistance and environmental impact have led to a shift toward enantiomerically pure agrochemicals, which offer enhanced effectiveness with reduced ecological harm. Rapid industrialization and economic growth are further accelerating agrochemical production, increasing the need for advanced chiral synthesis methods. Governments and regulatory bodies are promoting the use of sustainable pesticides, pushing manufacturers to adopt chiral technologies. Growing research and development activities in agrochemical formulations are also contributing to market growth, ensuring a steady rise in demand for chiral chemicals.

Europe Chiral Chemicals Market Analysis

Europe is seeing a growing shift toward sustainable and eco-friendly manufacturing practices, driving the adoption of chiral chemicals. According to the European Environmental Agency, the European Commission’s eco-innovation index increased by 27.5% from 2014 to 2024, mainly driven by improvements in resource efficiency. Strict environmental regulations and policies promoting green chemistry are encouraging manufacturers to implement energy-efficient and waste-reducing chiral synthesis techniques. As per the chiral chemicals market research report, the chemical industry is focusing on biocatalysis and asymmetric synthesis to produce high-purity chiral compounds with minimal environmental impact. Growing consumer preference for sustainable products is pushing industries, including pharmaceuticals and agrochemicals, to integrate eco-friendly production methods. Government incentives for green manufacturing are also supporting this transition, enabling companies to invest in research and innovation. The emphasis on reducing carbon footprints and complying with stringent regulatory standards is fostering the development of environmentally responsible chiral chemical processes.

Latin America Chiral Chemicals Market Analysis

Latin America is experiencing rising chiral chemicals adoption due to the rapid expansion of the healthcare sector. According to the Brazilian Federation of Hospitals (FBH) and the National Confederation of Health (CNSaúde), of Brazil’s 7,191 hospitals, 62% were private, as of 2023. Increasing healthcare expenditures and the demand for high-quality pharmaceutical ingredients are driving the market. Growing pharmaceutical manufacturing activities, along with rising government support for local drug production, are encouraging the use of chiral intermediates. Expanding chemical production infrastructure and foreign investments in pharmaceutical research are further supporting chiral chemicals market growth. As industrialization progresses, the need for advanced chemical synthesis techniques, including chiral synthesis, is increasing. The region's evolving healthcare landscape and rising demand for effective medicines are reinforcing the adoption of chiral technologies.

Middle East and Africa Chiral Chemicals Market Analysis

The Middle East and Africa are witnessing increased chiral chemicals adoption due to growing demand from the flavors and fragrances sector. As per IMARC Group, the UAE perfume market is expected to reach USD 1,724.0 Million by 2033, exhibiting a CAGR of 9.22% from 2025-2033. Expanding consumer preferences for high-quality, natural, and enantiomerically pure ingredients in perfumes and food products are fueling market growth. Rising investments in the region’s fragrance industry, along with increasing disposable income, are driving demand for chiral compounds in luxury goods. The shift toward high-performance aroma chemicals in personal care and food applications is pushing manufacturers to develop advanced chiral synthesis methods. Regulatory support for safer and more sustainable ingredients is also contributing to the adoption of chiral chemicals in the flavors and fragrances sector.

Competitive Landscape:

The key players in the market are actively engaging in strategically investing in research and development to advance their chiral synthesis techniques. They are focusing on enhancing the efficiency of chiral separation methods, reducing production costs, and expanding their product portfolios to meet diverse industry demands. These companies are also emphasizing compliance with stringent regulatory standards, ensuring the delivery of high-quality, enantiopure compounds to the pharmaceutical, agrochemical, and chemical industries. Furthermore, many key players are exploring greener and more sustainable chiral synthesis methods, aligning with global trends in eco-friendly manufacturing practices. According to the chiral chemicals market forecast, companies are actively innovating, which is expected to drive further market competition and cater to the evolving needs of clients and industries.

The report provides a comprehensive analysis of the competitive landscape in the chiral chemicals market with detailed profiles of all major companies, including:

- BASF SE

- Chiracon GmbH

- Chiral Technologies Inc. (Daicel Corporation)

- Codexis Inc.

- Johnson Matthey Plc

- PerkinElmer Inc.

- Solvias AG

- Strem Chemicals, Inc.

- Toray Industries, Inc.

- W.R. Grace & Co.

Latest News and Developments:

- June 2025: XtalPi announced its acquisition of Liverpool ChiroChem (LCC), a specialist in automated chiral chemistry. The deal strengthens XtalPi’s AI-driven R&D platform by integrating LCC’s chiral synthesis automation and virtual chiral library, enhancing the development of novel compounds. This merger expands XtalPi's global operations across the US, Europe, and Asia, enabling faster and more secure innovation in pharmaceuticals, materials, and specialty chemicals.

- April 2025: Researchers working with Nobel laureate Fraser Stoddart developed a compact cationic catenane—a molecule with interlocked rings—whose mechanical chirality can be tuned using chiral sulfonate anions. This advancement allows for reversible control over the molecule's handedness without altering its covalent structure. Such tunable chiral chemicals hold promise for applications in asymmetric catalysis, molecular sensing, and the development of chiral materials.

- February 2025: Bristol Myers Squibb researchers unveiled a novel technique using supercritical fluid chromatography–tandem mass spectrometry (SFC–MS/MS) for chiral bioanalysis. Their study, focusing on chiral chemicals and their stereoisomer interactions, offers significant insights into differentiating pharmacokinetic and pharmacodynamic behaviors in enantiomers, especially within racemic or single-enantiomer drug formulations.

- February 2025: Ecovyst Inc. and ChiralVision B.V. signed a Memorandum of Understanding to collaborate on enzyme immobilization technologies, aiming to enhance industrial biocatalysis processes. By combining Ecovyst's expertise in advanced silica materials with ChiralVision's specialization in enzyme immobilization, the partnership seeks to develop efficient and sustainable solutions for various industries.

- January 2025: Terahertz pulses enabled researchers at the Max Planck Institute and the University of Oxford to induce chirality in non-chiral crystals, challenging the long-held belief that chiral chemicals must be synthesized as either left- or right-handed forms. This breakthrough allows dynamic control over chiral states without altering the material’s structure, paving the way for novel applications in chiral chemical interactions and advanced optoelectronics.

Chiral Chemicals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered |

|

| Applications Covered | Pharmaceuticals, Agrochemicals, Flavors and Fragrances, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF SE, Chiracon GmbH, Chiral Technologies Inc. (Daicel Corporation), Codexis Inc., Johnson Matthey Plc, PerkinElmer Inc., Solvias AG, Strem Chemicals, Inc., Toray Industries, Inc., W.R. Grace & Co., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the chiral chemicals market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global chiral chemicals market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the chiral chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The chiral chemicals market was valued at USD 88.52 Billion in 2024.

The chiral chemicals market is projected to exhibit a CAGR of 11.67% during 2025-2033, reaching a value of USD 259.42 Billion by 2033.

The key factors driving the chiral chemicals market include increasing demand for enantiopure drugs in the pharmaceutical industry, rising use of chiral agrochemicals for sustainable crop protection, growing regulatory emphasis on drug safety, and advancements in chiral synthesis technologies that enhance production efficiency.

North America currently dominates the chiral chemicals market, accounting for a share of over 42.1%, driven by a highly developed pharmaceutical and agrochemical sector.

Some of the major players in the chiral chemicals market include BASF SE, Chiracon GmbH, Chiral Technologies Inc. (Daicel Corporation), Codexis Inc., Johnson Matthey Plc, PerkinElmer Inc., Solvias AG, Strem Chemicals, Inc., Toray Industries, Inc., W.R. Grace & Co., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)