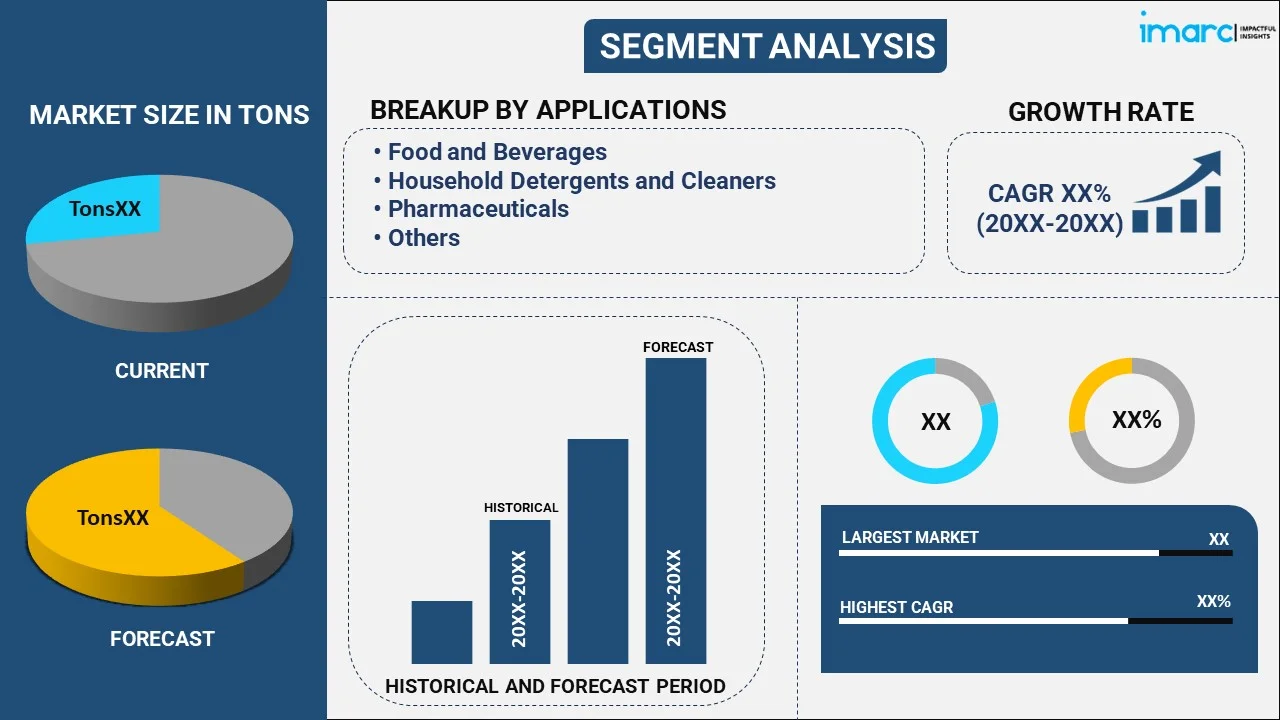

Citric Acid Market Report by Application (Food and Beverages, Household Detergents and Cleaners, Pharmaceuticals, and Others), Form (Anhydrous, Liquid), and Region 2025-2033

Citric Acid Market Summary:

The global citric acid market size reached 3.0 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 3.7 Million Tons by 2033, exhibiting a growth rate (CAGR) of 2.5% during 2025-2033. The widespread product adoption as a preservative, flavor enhancer, and stabilizer in a wide array of processed foods and drinks, the growing consumer preference for convenience foods, and advancements in biotechnology are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 3.0 Million Tons |

| Market Forecast in 2033 | 3.7 Million Tons |

| Market Growth Rate 2025-2033 |

2.5%

|

Citric acid is a natural compound found in various fruits, particularly citrus fruits, such as oranges, lemons, and limes. It is widely used in the food and beverage industry as a flavor enhancer, preservative, and acidity regulator. This organic acid is known for its tart taste and is commonly added to products such as soft drinks, jams, and candies to provide a tangy flavor. In addition to its culinary applications, it also serves as a crucial ingredient in cleaning agents and personal care products due to its chelating properties, which help to remove mineral deposits and improve solubility. Its versatile nature and safe consumption make it an essential component in both the food and non-food sectors, demonstrating its significance in various industries.

The escalating demand in the food and beverage sector majorly drives the citric acid market size. Citric acid is often used as a preservative, flavor enhancer, and stabilizer in a wide array of processed foods and drinks. Along with this, the rise in the global fast-food market, coupled with a growing consumer preference for convenience foods, is significantly supporting the market. As consumers become more health-conscious, there is a shift towards natural additives, and citric acid, derived from citrus fruits, fits this preference. The global organic food market is anticipated to grow at an accelerated pace, and as a result, natural citric acid will continue to gain traction. In addition, the rise in e-commerce platforms has contributed significantly to the citric acid market's growth. Online retailing offers a broader exposure to various applications and products where citric acid is used. Apart from this, the accelerating environmental awareness and the push for sustainable practices are driving industries to adopt eco-friendly raw materials, contributing to the market. Moreover, continuous advancements in biotechnology enabling the production of citric acid through fermentation processes, using sugar substrates and specific strains of microorganisms are creating a positive market outlook.

Citric Acid Market Trends/Drivers:

Growing Pharmaceutical Applications

Significant growth in pharmaceuticals is also acting as a major driver. Citric acid is commonly used as an excipient in pharmaceutical formulations to improve taste, control pH levels, and enhance the solubility of active pharmaceutical ingredients (APIs). The rising incidence of lifestyle-related diseases, such as diabetes and cardiovascular ailments, has led to an increase in demand for medications that incorporate citric acid. Furthermore, as the global population ages, there is a higher need for age-related healthcare treatments and preventive medication, which utilize citric acid as a formulation agent. With advancements in medical research, the potential uses of citric acid in pharmaceuticals continue to expand. It is also finding its way into topical applications like creams and ointments, increasing its scope within the sector. Moreover, government initiatives for healthcare access and rising healthcare spending globally also contribute to this growth trend. The ongoing research in drug development and formulation is likely to keep the demand for citric acid high in the pharmaceutical sector.

Rising Demand for Eco-friendly Cleaning Agents

Environmental concerns are driving the shift towards eco-friendly cleaning agents, and citric acid plays a crucial role in this transformation. Traditional cleaning agents often contain chemicals that can be harmful to both humans and the environment. Citric acid, being a natural and biodegradable substance, serves as an effective yet environmentally friendly alternative. It's used in household cleaning products like detergents, soaps, and surface cleaners, as well as industrial cleaning agents. Additionally, increasing awareness among consumers regarding sustainable living practices, coupled with stringent government regulations against hazardous cleaning agents, has bolstered the demand for eco-friendly products. As a result, more manufacturers are switching to citric acid-based cleaning agents, driving market growth. Furthermore, public and private initiatives to promote green cleaning products, along with accelerating consumer willingness to pay a premium for sustainable options, will continue to drive the demand for citric acid in this application. This also aligns with global sustainability goals, further strengthening citric acid's position in the market.

Emergence in the Personal Care and Cosmetic Industry

Citric acid has carved a niche for itself in the rapidly growing personal care and cosmetics industry. Its properties as a natural preservative, pH adjuster, and exfoliating agent make it a popular ingredient in products such as shampoos, conditioners, lotions, and skincare creams. In addition, the increasing consumer trend towards natural and organic personal care products has further fueled demand. Moreover, the rise in disposable income and heightened awareness about skincare and grooming, particularly in emerging economies, has led to a growing market for personal care products. With increasing research and development in cosmetics formulation, citric acid is poised to expand its application range. The industry also benefits from positive regulatory stances. Most health and safety organizations globally have approved the use of citric acid in personal care products, making it easier for manufacturers to incorporate this ingredient into their offerings.

Citric Acid Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the citric acid market report, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on application and form.

Breakup by Application:

- Food and Beverages

- Household Detergents and Cleaners

- Pharmaceuticals

- Others

Food and beverages represent the largest market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes food and beverages, household detergents and cleaners, pharmaceuticals, and others. According to the report, food and beverages accounted for the largest market share.

The food and beverage sector serves as a significant market driver for the citric acid industry. One of the primary reasons is the versatile functionality of citric acid, which includes its use as a preservative, flavor enhancer, and pH regulator. Along with this, the increasing consumer preference for convenience foods and ready-to-drink beverages has led to a rise in the demand for ingredients that can extend shelf life and improve taste, roles that citric acid excels. Additionally, the growing health consciousness among consumers is driving the demand for natural and organic food products, giving citric acid an edge due to its natural origins in citrus fruits. In addition, regulatory support further propels its usage; and organizations have recognized citric acid as a safe food additive. This has streamlined its integration into various food and beverage products, from soft drinks and juices to packaged snacks and dairy products. As the global food and beverage industry continues to expand, especially in emerging markets, the demand for citric acid is expected to grow correspondingly.

Breakup by Form:

- Anhydrous

- Liquid

Anhydrous accounts for the majority of the market share

A detailed breakup and analysis of the market based on the form has also been provided in the report. This includes anhydrous and liquid. According to the report, anhydrous accounted for the largest market share.

The anhydrous form of citric acid has become increasingly important in various industries, serving as a crucial market driver for the overall citric acid market. Unlike its monohydrate counterpart, anhydrous citric acid has no water molecules, making it particularly useful in environments where moisture control is critical. Its low moisture content makes it highly desirable in pharmaceutical applications, where it's used as an excipient to stabilize and preserve the quality of active pharmaceutical ingredients (APIs). Additionally, it also has specialized uses in industrial applications such as metal finishing and cleaning, where its lower water content results in a more concentrated solution, offering better performance and cost-efficiency. Moreover, the anhydrous form is increasingly preferred in food and beverages for its longer shelf-life and stability. With advancements in manufacturing technology allowing for the more efficient production of anhydrous citric acid, its cost has become more competitive, making it an attractive option for manufacturers. Regulatory approvals further bolster its market position, as it is generally recognized as safe (GRAS) by key international health agencies.

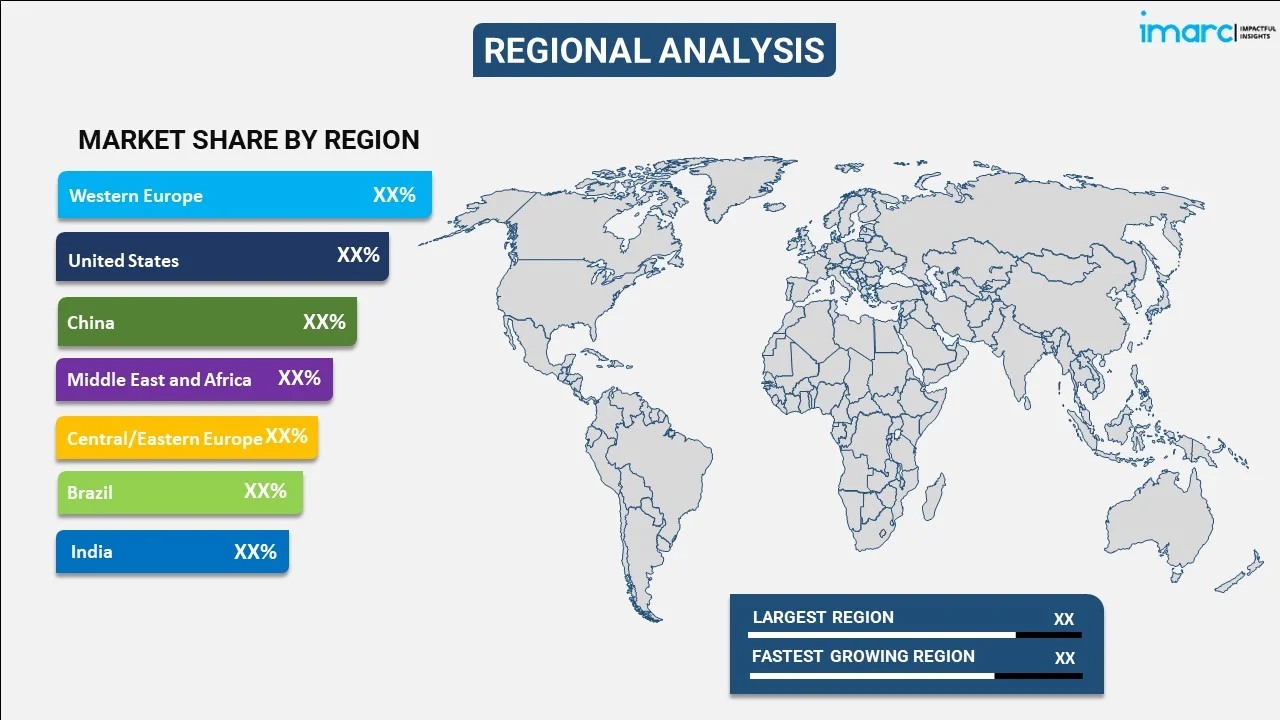

Breakup by Region:

- Western Europe

- United States

- China

- Middle East and Africa

- Central/Eastern Europe

- Brazil

- India

Western Europe exhibits a clear dominance, accounting for the largest citric acid market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Western Europe, the United States, China, the Middle East and Africa, Central/Eastern Europe, Brazil, and India. According to the report, Western Europe exhibited the largest market share.

In Western Europe, the citric acid industry is experiencing notable growth, driven by the well-established food and beverage sector, where citric acid is extensively used as a preservative and flavor enhancer. Along with this, the growing trend towards natural and organic products in countries, such as Germany, France, and the UK offers opportunities for citric acid, given its natural origins and perceived safety. Moreover, the pharmaceutical sector in Western Europe is highly advanced and rigorously regulated, creating a demand for trusted and high-quality ingredients, including citric acid for use in medications and health supplements.

Furthermore, environmental awareness is relatively high in Western Europe, encouraging the use of eco-friendly cleaning products and sustainable manufacturing practices, both of which can leverage citric acid as an eco-conscious choice. Technological advancements in the region also facilitate efficient production methods, contributing to the availability and affordability of citric acid. These converging factors make Western Europe a robust market for the citric acid industry.

Competitive Landscape:

The key players are actively engaged in various strategies to enhance their presence and competitiveness. These companies are focused on sourcing high-quality raw materials, optimizing production processes, and ensuring strict quality control measures to maintain the integrity of their citric acid products. Additionally, many companies are exploring sustainable and environmentally friendly practices in their operations, aiming to reduce their carbon footprint. In addition, market players are also investing in research and development efforts to innovate and expand the applications of citric acid across industries such as food and beverages, pharmaceuticals, cosmetics, and household products. This commitment to innovation enables companies to tap into new markets and cater to evolving consumer preferences. Furthermore, businesses in the citric acid market are actively engaging with customers to understand their needs and requirements. This customer-centric approach helps companies tailor their offerings to meet specific demands, resulting in stronger customer satisfaction and loyalty.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Archer Daniels Midland Company

- Cargill, Incorporated

- Citribel NV

- COFCO Biotechnology Co., Ltd.

- FBC Industries, Inc

- Foodchem International Corporation

- Gadot Biochemical Industries Ltd.

- Huangshi Xinghua Biochemical Co. Ltd.

- Jungbunzlauer Suisse AG

- RZBC Group Co. Ltd.

- Shandong Ensign Industry Co., Ltd.

- TTCA Co., Ltd

Recent Developments:

- Archer Daniels Midland Company (ADM) announces the opening of a new customer creation and innovation center in the UK. The new center in Manchester will serve as a hub for food innovation. ADM is expanding its culinary capabilities and food solutions for the UK market.

- In November 2022, Cargill, a leading food company, has recently announced its acquisition of Owensboro Grain Company. This strategic move is aimed at enhancing Cargill's position in the grain processing sector. By expanding its capabilities in grain origination, the company aims to better serve its customers while ensuring sustainable practices throughout the supply chain.

- In September 2023, Tate & Lyle, has announced the appointment of IMCD as its distribution partner in Finland, Lithuania, Latvia, and Estonia. This partnership builds on their successful cooperation in other countries and aims to provide innovative solutions for challenges in sweetening, mouthfeel, fortification, and stabilization. With this expansion, customers in the Baltic region can benefit from Tate & Lyle's solutions through IMCD's market expertise and technical capabilities.

Citric Acid Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Food and Beverages, Household Detergents and Cleaners, Pharmaceuticals, Others |

| Forms Covered | Anhydrous, Liquid |

| Regions Covered | Western Europe, United States, China, Middle East and Africa, Central/Eastern Europe, Brazil, India |

| Companies Covered | Archer Daniels Midland Company, Cargill, Incorporated, Citribel NV, COFCO Biotechnology Co., Ltd., FBC Industries, Inc, Foodchem International Corporation, Gadot Biochemical Industries Ltd., Huangshi Xinghua Biochemical Co. Ltd., Jungbunzlauer Suisse AG, RZBC Group Co. Ltd., Shandong Ensign Industry Co., Ltd., TTCA Co., Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the citric acid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global citric acid market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the citric acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global citric acid market reached a volume of 3.0 Million Tons in 2024.

We expect the global citric acid market to exhibit a CAGR of 2.5% during 2025-2033.

The rising demand for citric acid as a preservative, flavoring, and coloring agent across the Food and Beverage (F&B) industry is primarily driving the global citric acid market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary halt in numerous production activities for citric acid.

Based on the application, the global citric acid market has been segmented into food and beverages, household detergents and cleaners, pharmaceuticals, and others. Among these, the food and beverage industry currently holds the majority of the total market share.

Based on the form, the global citric acid market can be divided into anhydrous and liquid. Currently, anhydrous citric acid accounts for the largest market share.

On a regional level, the market has been classified into Western Europe, United States, China, Middle East and Africa, Central/Eastern Europe, Brazil, and India, where Western Europe currently dominates the global market.

The demand for citric acid is increasing steadily, driven by its versatility across various industries.

Some of the major producers of citric acid include Archer Daniels Midland Company, Cargill, Incorporated, Citribel NV, COFCO Biotechnology Co., Ltd., FBC Industries, Inc, Foodchem International Corporation, Gadot Biochemical Industries Ltd., Huangshi Xinghua Biochemical Co. Ltd., Jungbunzlauer Suisse AG, RZBC Group Co. Ltd., Shandong Ensign Industry Co., Ltd., TTCA Co., Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)