Claddings Market Report by Material Type (Masonry and Concrete, Brick and Stone, Stucco and EIFS, Fiber Cement, Metal, Vinyl, Wood, and Others), Component Type (Walls, Roof Cladding, Windows and Doors, and Others), End User (Residential, Non-Residential), and Region 2025-2033

Market Overview:

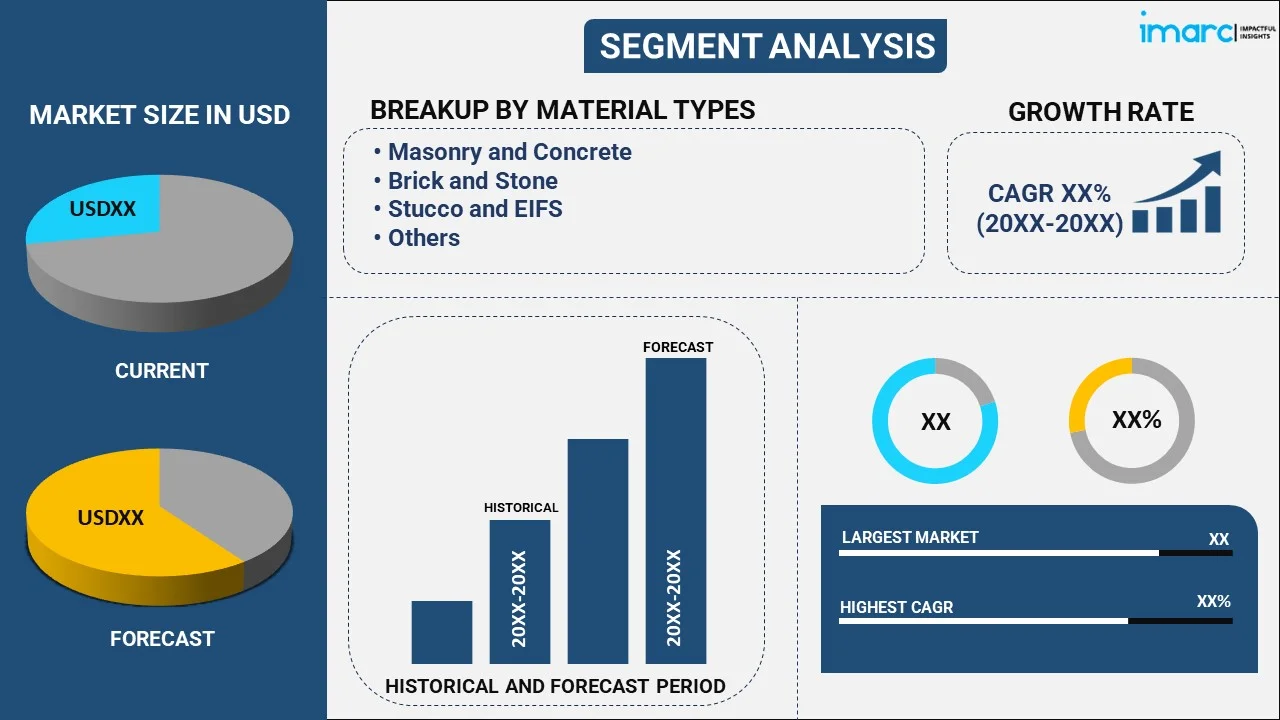

The global claddings market size reached USD 272.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 434.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.08% during 2025-2033. The market is being driven by the thriving construction industry, along with the rising focus on protecting vertical and roof-top gardens. At present, Asia Pacific holds the largest market share, driven by favorable government initiatives and the integration of smart technologies in building design.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 272.2 Billion |

|

Market Forecast in 2033

|

USD 434.9 Billion |

| Market Growth Rate 2025-2033 | 5.08% |

Cladding is a non-loadbearing construction material attached to the exterior and interior of the building to act as a moisture barrier and protective layer. It is usually manufactured using wood, natural stone, metal, aluminum, zinc, copper, plastic, terracotta, vinyl and other composite materials. Cladding is lightweight, fireproof, thermal- and water-resistant, soundproof and energy-efficient. It is also added to the floors, walls, facades, plateaus, baseboards and planters to enhance their aesthetic appeal and is directly attached to the steel frame of the building. Novel cladding materials are manufactured with dichromatic window films to provide ultraviolet (UV) protection to the interiors of the building and minimize maintenance requirements.

Claddings Market Trends:

Significant growth in the construction industry across the globe is one of the key factors creating a positive outlook for the market. Moreover, the increasing requirement of metallic claddings in commercial and industrial buildings is providing a thrust to the market growth. Claddings are widely used as effective protective systems in residential and non-residential constructions against exposure to harsh climatic conditions, dust, pollution and changes in temperatures. In line with this, the widespread adoption of claddings for the protection of vertical and roof-top gardens is also contributing to the growth of the market. Additionally, the increasing utilization of fiber cement in cladding systems is acting as another growth-inducing factor. Product manufacturers are also developing bio-based and sustainable cladding materials using agricultural and paper waste, which are widely utilized in green buildings. Other factors, including rising expenditure capacities of the consumers and the implementation of favorable government policies, along with extensive infrastructural development, especially in the developing economies, are anticipated to drive the market toward growth.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global claddings market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on material type, component type, and end user.

Breakup by Material Type:

- Masonry and Concrete

- Brick and Stone

- Stucco and EIFS

- Fiber Cement

- Metal

- Vinyl

- Wood

- Others

Masonry and concrete account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the material type. This includes masonry and concrete, brick and stone, stucco and EIFS, fiber cement, metal, vinyl, wood, and others. According to the report, masonry and concrete represented the largest segment.

Masonry and concrete aid in offering enhanced durability and structural benefits. They can withstand harsh weather conditions, fire, and pests. They offer good thermal mass properties, helping to regulate indoor temperatures and reduce energy consumption for heating and cooling. In addition, they can be customized in various ways textured, painted, or stained, providing aesthetic flexibility to architects and builders. Once installed, masonry and concrete require minimal maintenance, appealing to both residential and commercial property owners. Changing living standards of individuals is impelling the market growth.

Breakup by Component Type:

- Walls

- Roof Cladding

- Windows and Doors

- Others

Walls hold the largest share of the industry

A detailed breakup and analysis of the market based on the component type have also been provided in the report. This includes walls, roof cladding windows and doors, and others. According to the report, walls account for the largest market share.

Walls cladding enhances the structural stability of buildings, protecting against weather elements and contributing to energy efficiency. A wide range of materials such as brick, stone, vinyl, and metal and designs cater to diverse architectural styles. Insulated wall cladding systems help improve the thermal performance of buildings. Besides this, the rising focus on adhering to sustainability goals and energy regulations is contributing to the market growth. Furthermore, the increasing number of commercial and residential spaces across the globe is supporting the market growth.

Breakup by End User:

- Residential

- Non-Residential

Non-residential represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential and non-residential. According to the report, non-residential represents the largest segment.

The non-residential segment includes commercial buildings, industrial facilities, educational institutions, healthcare facilities, and government structures. Rapid urbanization and the need for new infrastructure in both developing and developed regions are driving claddings market demand. Moreover, non-residential buildings are often subject to stricter energy efficiency regulations. Cladding materials that provide better insulation and energy performance are increasingly required to comply with these regulations. Furthermore, the non-residential sector values aesthetics and functionality, with cladding materials available in various styles and finishes that cater to modern architectural trends. This versatility allows businesses to create visually appealing buildings that also meet functional requirements.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest claddings market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for claddings.

The growing focus on modern architectural designs is offering a favorable market outlook. Moreover, governing agencies in the region are implementing policies to promote sustainable building practices. They are also providing numerous incentives for energy-efficient construction of spaces. Besides this, the diverse climates across the Asia Pacific region necessitate the use of cladding materials that can withstand local environmental conditions, ranging from tropical storms to high humidity. Additionally, the integration of smart technologies in building design is becoming more common, driving demand for cladding systems that can accommodate features like solar panels and energy-efficient systems.

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

- Acme Brick (Berkshire Hathaway Inc.)

- Alcoa Corporation

- Armstrong World Industries

- Boral

- CSR Limited

- Etex Group

- James Hardie Building Products Inc

- Kingspan Group

- NICHIHA Co. Ltd

- ROCKWOOL International A/S

- Tata BlueScope Steel

- Trespa International B.V

- Westlake Chemical Corporation.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Material Type, Component Type, End User, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acme Brick (Berkshire Hathaway Inc.), Alcoa Corporation, Armstrong World Industries, Boral, CSR Limited, Etex Group, James Hardie Building Products Inc, Kingspan Group, NICHIHA Co. Ltd, ROCKWOOL International A/S, Tata BlueScope Steel, Trespa International B.V and Westlake Chemical Corporation |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How big is the global cladding market?

- What has been the impact of COVID-19 on the global claddings market?

- What are the key regional markets?

- What is the breakup of the market based on the material type?

- What is the breakup of the market based on the component type?

- What is the breakup of the market based on the end user?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the global claddings market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)