Coffee Machine Market Size, Share, Trends and Forecast by Product, Technology, Application, Distribution Channel, and Region, 2025-2033

Coffee Machine Market Size and Share:

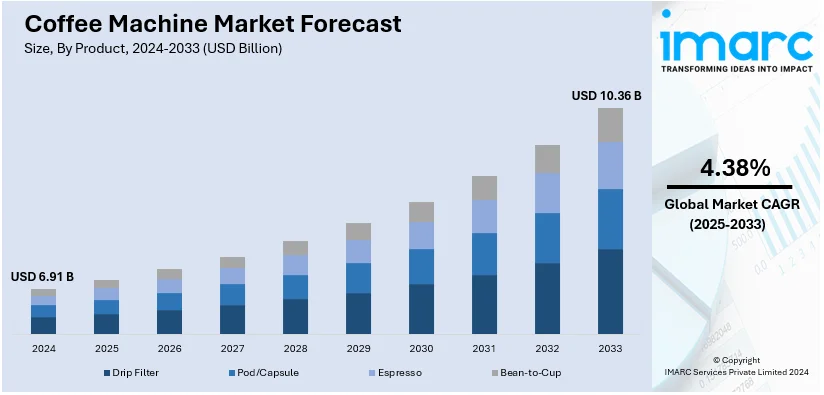

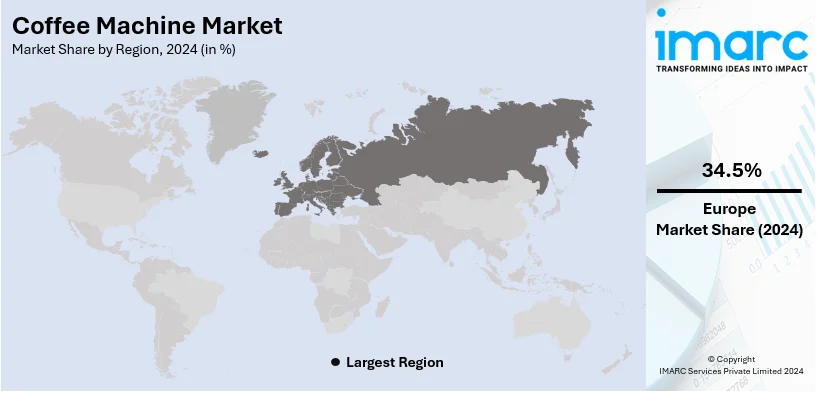

The global coffee machine market size was valued at USD 6.91 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.36 Billion by 2033, exhibiting a CAGR of 4.38% from 2025-2033. Europe currently dominates the market, holding a market share of over 34.5% in 2024. The surge in the number of individuals opting for coffee over other drinks, the growing preference for instant coffee machines, especially in workplaces, and the inflating disposable income levels are some factors driving the market in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.91 Billion |

| Market Forecast in 2033 | USD 10.36 Billion |

| Market Growth Rate 2025-2033 | 4.38% |

The global coffee machine market is witnessing strong growth that can be attributed to an increase in demand for premium coffee experiences from consumers at home, offices, and commercial setups. An increase in disposable income and changing coffee cultures worldwide, especially in developing economies, have enhanced the adoption of sophisticated coffee machines. Growing preference for specialty coffee and single-serve brews, coupled with technological advancement in automatic and smart coffee machines, enhances convenience and user experience. In addition, the increase in the number of coffee shops and cafes worldwide has strengthened commercial demand for high-performance machines.

The United States is emerging as one of the key markets holding 82.80% share. This growth is encouraged by growing coffee consumption and the trend of home barista among youth. Americans drink about 491 million cups of coffee every day, and 62% of adults drink coffee on any given day. This preference is catered to through innovations like the bean-to-cup models and advanced espresso makers that seek to bring café-style beverages of high quality into home markets. Smart coffee machines, which allow customization and scheduling via mobile apps, are also gaining traction, adding a technological edge to the market. Additionally, cost savings from brewing at home versus purchasing from coffee shops is a significant driver of residential segment growth.

Coffee Machine Market Trends:

Health Awareness and Coffee Consumption Trends

The growing awareness of health benefits associated with coffee, which include reducing risks of liver diseases, heart failure, and type 2 diabetes, are some of the driving factors for market growth. As indicated by the International Diabetes Federation, 10.5% of adults aged 20-79 were living with diabetes in 2021, which is becoming ever more important in choosing food for better health. Coffee's antioxidant ability and possible role in controlling chronic diseases have made this product more appealing to health-conscious consumers. This leads to the growing demand for top-class coffee machines as most are trying to add more health-conscious beverage options to their lifestyle. In the meantime, U.S. coffee consumption still grows with 491 million cups per day.

Technological Innovation in Smart Coffee Machine

Smart coffee machines with Wi-Fi connectivity and voice assistants have transformed consumer expectations. This convenience, personalization, and efficiency are what appeal to tech-savvy households as well as busy families. Premium coffee machines now standardize features such as automatic brewing, programmable settings, and built-in grinders, driving their adoption. In this regard, the trend also aligns with premiumization in coffee, wherein consumers seek café-style experiences at home. Additionally, manufacturers are developing advanced designs to appeal to environmentally aware consumers, leading to the launch of power-saving versions that have limited environmental damage.

Growing Food and Beverages Industry and Disposable Earnings

The exponential growth in the food and beverage industry, along with increasing disposable incomes, is further driving the market. Personal incomes in the U.S. increased by $147.4 billion in 2024, allowing more consumers to spend money on premium kitchen appliances. Moreover, the growing number of cafés and quick-service restaurants (QSRs) has increased demand for commercial-grade coffee machines that can handle high-volume orders. The expanding café culture in urban and suburban areas also contributes to this demand, as consumers increasingly seek premium coffee experiences outside the home. Furthermore, drive-thru coffee chains are investing heavily in state-of-the-art coffee equipment to maintain consistency, reduce wait times, and meet the growing expectations of their customers, thereby impelling the market growth.

Coffee Machine Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global coffee machine market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, technology, application, and distribution channel.

Analysis by Product:

- Drip Filter

- Pod/Capsule

- Espresso

- Bean-to-Cup

In 2024, drip filter coffee machines are the largest segment in the coffee machine market, taking up about 43.9% of the market share. This is mainly due to their ease of use, affordability, and ability to brew large volumes of coffee, making them popular for both residential and commercial use. These machines are particularly favored in regions where traditional coffee consumption is high, such as North America and Europe. Moreover, the flexibility of drip filter machines to accommodate different tastes in coffee, from light to strong brews, makes them more attractive. In addition, growth in the segment is fueled by growing disposable incomes and increasing demand for energy-efficient and eco-friendly appliances in contemporary homes and workplaces.

Analysis by Technology:

- Semi-Automatic

- Automatic

Semi-automatic coffee machines will lead the market in 2024, holding approximately 56% of the market share. These machines are highly preferred due to their balance of control and convenience, allowing users to manually adjust key brewing parameters like grind size and water flow while automating others, such as temperature and pressure. This combination caters to both coffee enthusiasts seeking customization and casual users desiring consistent quality. The premiumization trend in coffee consumption also fuels the growth of the segment, as consumers invest in advanced machines to replicate café-style beverages at home. Semi-automatic machines are particularly popular in residential and small commercial settings, where increasing disposable incomes and rising demand for energy-efficient, user-friendly appliances support growth.

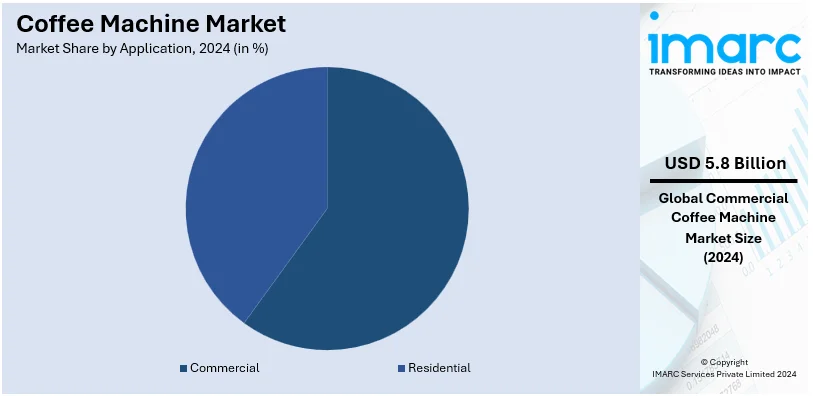

Analysis by Application:

- Commercial

- Residential

Commercial leads the coffee machine market in 2024, accounting for around 83.7% of the market share. This is largely due to the fast expansion of coffeehouse chains, quick-service restaurants, and the culture of coffee at work. As the number of cafés and eat-outs increases worldwide, so does the demand for high-capacity coffee machines that can handle large volumes efficiently. Commercial coffee machines also fulfill the growing preference for specialty and premium coffee beverages that require advanced brewing technologies. Another aspect contributing to the growth of this segment is the growth in the hospitality industry coupled with growing customer expectations in terms of quality coffee experiences. Energy efficiency and sustainability have become a feature of commercial coffee machines, thus better aligned with the trend toward environmentally friendly operations.

Analysis by Distribution Channel:

- Multi-branded Stores

- Specialty Stores

- Online Stores

- Others

In 2024, specialty stores will be the dominant distribution channel for coffee machines, accounting for a significant portion of the market. These stores offer the customer the chance to personally examine and compare many coffee machines, from entry-level to high-end models. Personalized customer service and expert advice available in specialty stores further enhance the buying experience. Specialty retailers often have exclusive models, promotions, and loyalty programs, which attract coffee enthusiasts who want high-quality appliances. The rising demand for premium and customized coffee machines further supports the popularity of specialty stores, which are in a good position to meet this demand. Online platforms also contribute to market growth, but the in-store experience remains dominant, particularly for those seeking expert guidance and immediate product availability.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe dominated the global market share of coffee machines, at more than 34.5% in 2024. The strong culture of coffee in countries like Italy, Germany, and France mainly drives this region's dominance as the consumption of coffee is deeply ingrained into everyday life. Increasing demand for premium coffee machines and home brewing, along with specialty coffee, helps the market grow. Coffee chain expansion and the popularity of café and restaurant businesses are more additional sources of strong demand for European commercial coffee machines. The tendency in Europe to focus on using environmentally efficient and sustainable appliances is among the key factors driving growth. Further, access through specialty outlets as well as other online platforms in Europe bolsters and pushes into expanded retail reach and territory.

Key Regional Takeaways:

North America Coffee Machine Market Analysis

The coffee machine market in North America is experiencing robust growth, driven by the rising consumer demand for convenience and premium coffee experiences. With more people working from home, the residential sector is a major contributor to market expansion, especially as consumers invest in high-end machines for crafting café-quality coffee at home. The growing popularity of single-serve pod machines, such as those from Keurig and Nespresso, is a key trend, due to their ease of use and customization options. Furthermore, the rise in specialty coffee consumption and the growing preference for sustainable, eco-friendly products are encouraging manufacturers to innovate with energy-efficient and recyclable coffee machines. Online sales channels are also expanding, offering consumers easy access to a variety of coffee machine options. The North American market is expected to grow significantly in the coming years, with revenues in the U.S. projected to rise due to growing demand from both residential and commercial users.

United States Coffee Machine Market Analysis

Presently, the US-based coffee machines market is growing because of the growth in need for high quality coffee at home. High-end, tech-savvy customers who prepare coffee are thus the targeted customers for innovative features that include smart connections and auto-brew procedures. The increase in demand for home brewing solutions by consumers to seek café-style coffee from their homes due to the increased trend of remote working has really improved. The U.S. Bureau of Labor Statistics has reported that in 2019, 6.5% of employees in the private sector did most of their work from home. Producers are also constantly finding ways to incorporate sustainability into their products, such as offering energy-efficient models and using eco-friendly materials, which appeals to the growing environmental conscience of American consumers. The growing selection of premium pods and specialty coffee blends is also encouraging consumers to spend money on expensive equipment that can provide personalized brewing options. As people are increasingly prioritizing on their well-being and health they are keenly interested in devices which are capable of offering temperatures for hot-brewed coffee to warm up cold-brewed coffee or vice versa; personalization, by means of allowing them to create brews tailored to health aspirations. For instance, a survey conducted by Nutrisystem and OnePoll revealed that more than 70% of Americans have become more aware of their physical health after the COVID pandemic. The manufacturers make it a point to design these machines so that it does well as far as modern-day designs of the kitchen is concerned. It makes them aesthetically pleasing machines with functionality appeal.

Europe Coffee Machine Market Analysis

The coffee makers market in Europe is witnessing growth with more people seeking experiences at home that are high end and convenient. To fulfill the desire for customized coffee, people are opting for machine-based coffee makers that make it possible to personalize the temperature, flavor, and strength of their coffee. Also, rising health consciousness and tacking obesity have further raised the demand for coffee, thus driving the market for coffee machines. For instance, according to the European Commission, in 2022, the percentage of individuals aged 16 and above deemed overweight in the EU was 50.6%. Along with this, there has been a significant focus on the sustainability aspect because of customers' growing awareness about going green, thus the advent of energy-efficient and eco-friendly coffee machines. With the growing number of coffee lovers in Europe, the demand for high-quality espresso machines and coffee makers is constantly increasing. To give a specific example, in 2024, Lavazza Professional launched Lavazza on the Move, a novel quality self-serve coffee machine designed specifically for high-footfall public areas in the UK. As coffee culture is expanding across the continent, companies are innovating to meet diverse regional preferences and are investing in design aesthetics, blending functionality with style. These trends are continuously shaping the European coffee machine market and driving its expansion in both residential and commercial segments.

Asia Pacific Coffee Machine Market Analysis

The Asia-Pacific region coffee machine market is growing as consumers are embracing the coffee culture and enhancing their requirements for premium coffee experiences. The usage of advanced coffee machines, that deliver higher consistency quality and convenience, by coffee shops, cafes, and offices is also on a growth trajectory. Manufacturers are introducing innovative, high-tech coffee machines with features such as touchscreens, Wi-Fi connectivity, and customizable brewing options, thus attracting tech-savvy consumers. The growing preference for single-serve coffee machines is also gaining momentum as people are seeking convenience, faster preparation, and smaller, compact devices for home use. Urbanization and increasing disposable incomes are encouraging more people to enjoy café-style coffee at home, thus boosting demand for coffee machines in households. The fast-growing e-commerce industry is also playing a key role in offering higher access to a variety of coffee machines, which is boosting market growth. According to Invest India, the internet subscribers in India are over 969 Million in 2024. In addition, increasing health-conscious consumers are boosting the development of coffee machines that preserve the nutritional content of coffee, further promoting the trend of the market. For instance, according to IMF, the economy in Asia grew by 5.2 percent in 2023. Apart from this, with the growth of environmental awareness, sustainable and eco-friendly machine options are gaining momentum as they not only influence consumer behavior but also manufacturers' strategies. In this way, the market is benefiting from a convergence of technology, consumer behavior, and lifestyle changes.

Latin America Coffee Machine Market Analysis

The Latin American coffee machine market is seeing constant growth due to surging consumer demand for premium coffee experiences. This makes manufacturers of coffee machines increase the features of their products. The features included in new designs range from smart connectivity to customization of brew settings and energy efficiency. More so, the growing middle class of countries such as Brazil, Mexico, and Argentina has more disposable income for premium, personalized coffee experience. The Brazilian government said that household per capita income in Brazil grew 11.5% in 2023 compared to 2022. Coffee culture's rising popularity, especially in younger generations, is further nudging consumers to make a more significant investment in purchasing quality coffee machines for at-home use. Coffee houses and offices are also deploying automated coffee machines to meet demand as the beverage becomes increasingly convenient for people to consume on their way. At the same time, consumers are becoming more environmentally conscious, and companies are innovating by introducing machines that are energy-efficient and use sustainable materials. The expansion of e-commerce platforms and online retailers further facilitates access to a wide range of coffee machines, which makes it easier for consumers to make informed purchasing decisions. Latin America coffee machine market grows as consumers increasingly focus on individualized coffee experiences.

Middle East and Africa Coffee Machine Market Analysis

The Middle East and Africa coffee machine market is experiencing high growth due to the increased number of specialty coffee shops. The specialty coffee shops are opening at an increased rate across the major cities in the region such as Dubai, Riyadh, and Cape Town. Consumers are embracing high-quality coffee experiences, and businesses are now investing in advanced coffee-making equipment to cater to the increasing demand for barista-style beverages. Hotels and restaurants are increasingly integrating coffee machines into their offerings to enhance customer experience and stay competitive in the flourishing hospitality sector. The tourism sector of UAE experienced steady growth, as reported by the Ministry of Economy, as revenues of hotel establishments increased by 7 percent in the first quarter of 2024. Meanwhile, corporate offices are investing in premium coffee machines to improve workplace satisfaction and productivity as part of evolving employee welfare initiatives. Adoption of home brewing is also on the rise, as consumers are seeking compact, user-friendly, and visually appealing coffee machines for personal use. At the same time, manufacturers innovate with smart features such as app connectivity and customization options that appeal to the region's tech-savvy and affluent consumers. In addition, the market is also experiencing benefits of growing preference for energy-efficient and environment-friendly models in these regions where focus on environmental consciousness is also increasing. Retailers and distributors are increasing their online presence, which provides the customer with easy access to a wide variety of coffee machines, thereby further boosting market growth.

Competitive Landscape:

The global coffee machine market is highly competitive with a large number of key players trying to garner market share through innovation, product differentiation, and expansion strategies. Prominent brands dominate the market offering a wide range of coffee machines targeting both residential and commercial segments. Companies are focusing on incorporating advanced technologies such as smart connectivity, voice assistants, and energy-efficient features to attract tech-savvy consumers. With increasing sensitivity towards the environment, sustainability has emerged as an essential component, and most companies design eco-friendly products that would suit the requirements of eco-aware customers. Intensifying competition, due to increased access to e-commerce channels has further helped expand sales across markets as online channels gain increasing significance in expanding their markets. Research and development (R&D) investments help keep the competition keen, enhancing products while simultaneously building new outlets for them to distribute.

The report provides a comprehensive analysis of the competitive landscape in the coffee machine market with detailed profiles of all major companies, including:

- Breville Usa Inc.

- De’Longhi Appliances S.r.l.

- Electrolux AB

- Gruppo Cimbali SPA

- Hamilton Beach Brands Inc.

- Koninklijke Philips N.V.

- Melitta

- Nestlé Nespresso SA

- Panasonic Corporation

- Rancilio Group S.p.A (Ali Group

- Schaerer AG

- Thermoplan AG

Latest News and Developments:

- July 2023: LG Electronics Inc. unveiled its first capsule coffee machine "Duobo" with Kickstarter, the biggest crowdfunding service in the US. Apart from this, Duobo is also a two capsules extractible capsule coffee machine.

- November 2023: Costa X and Caffitaly presented the newest business-to-business proposition of Costa Coffee: an all-encompassing new range of patented coffee pod machines for hotels, workplaces, and leisure businesses of every size.

- May 2024: Bosch home appliances launched the fully automatic espresso machines. The new range including 300 and 800 Series gives barista-quality performances with personalization and delivers lots of beverage options at one touch.

- September 2024: Cumulus Coffee Company is launching cold coffee machine and premium coffee capsules. Consumers can enjoy brewing cold beverages, equal in quality to that of cafés.

- November 2024: Kaapi Machines, a pioneer in premium coffee brewing solutions in India and the exclusive distributor for the Italian brand La Carimali, announced the launch of the Carimali GLOW coffee machine. Carimali GLOW is crafted to meet the requirements of small to medium-sized coffee shops, kiosks, and specialty cafes.

Coffee Machine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Drip Filter, Pod/Capsule, Espresso, Bean-To-Cup |

| Technologies Covered | Semi-Automatic, Automatic |

| Applications Covered | Commercial, Residential |

| Distribution Channels Covered | Multi-Branded Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Breville Usa Inc., De’Longhi Appliances S.r.l., Electrolux AB, Gruppo Cimbali SPA, Hamilton Beach Brands Inc., Koninklijke Philips N.V., Melitta, Nestlé Nespresso SA, Panasonic Corporation, Rancilio Group S.p.A (Ali Group), Schaerer AG, Thermoplan AG, etc |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the coffee machine market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global coffee machine market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the coffee machine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A coffee machine is an appliance designed to brew coffee by automating or simplifying the brewing process. It is used across offices, households and commercial establishments for preparing various coffee beverages.

The coffee machine market was valued at USD 6.91 Billion in 2024.

IMARC estimates the global coffee machine market to exhibit a CAGR of 4.38% during 2025-2033.

Key drivers include rising coffee consumption, increased disposable incomes, growing demand for premium coffee experiences, and advancements in smart, energy-efficient coffee machines.

In 2024, drip filter coffee machines represented the largest segment by product, driven by their ease of use and affordability.

Semi-automatic machines lead the market by technology owing to their balance of control and convenience.

The commercial segment is the leading segment by application, driven by the growth of coffeehouses and the increasing demand for high-capacity machines.

In 2024, specialty stores represented the largest segment by product, driven by strong consumer preference for personalized experiences and access to high-quality coffee machines.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global coffee machine market include Breville Usa Inc., De’Longhi Appliances S.r.l., Electrolux AB, Gruppo Cimbali SPA, Hamilton Beach Brands Inc., Koninklijke Philips N.V., Melitta, Nestlé Nespresso SA, Panasonic Corporation, Rancilio Group S.p.A (Ali Group), Schaerer AG, Thermoplan AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)