Coffee Pods and Capsules Market Report by Type (Pods, Capsules), Packaging Material (Conventional Plastic, Bioplastics, Fabric, and Others), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Stores, and Others), and Region 2026-2034

Coffee Pods and Capsules Market Size:

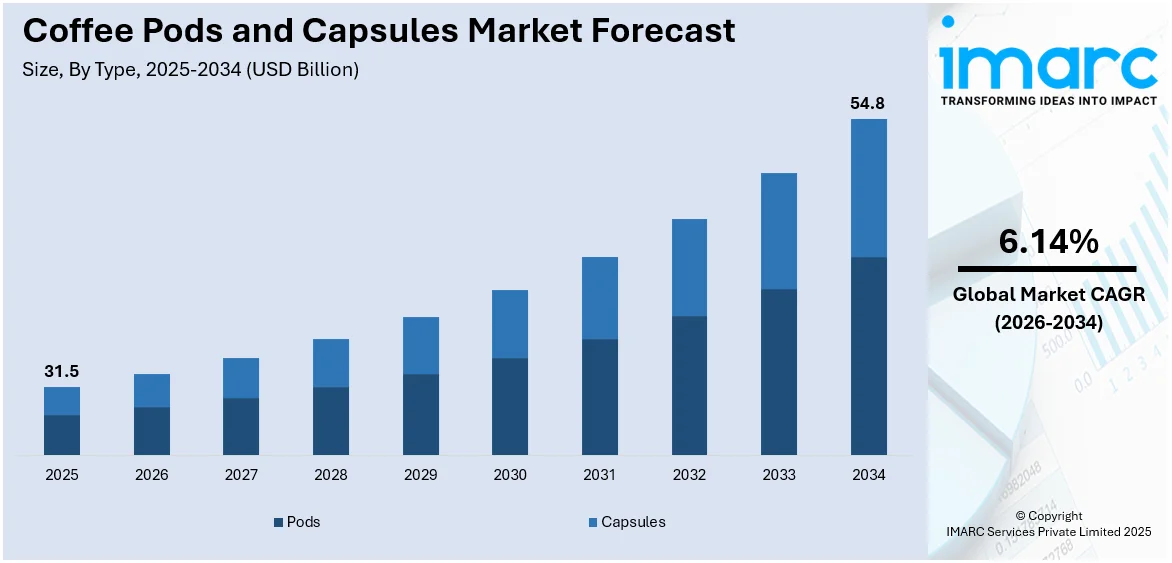

The global coffee pods and capsules market size reached USD 31.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 54.8 Billion by 2034, exhibiting a growth rate (CAGR) of 6.14% during 2026-2034. The market is experiencing robust growth, driven by the growing need for convenience in the fast-paced lifestyle of consumers, rising disposable income of consumers and heightened focus on premiumization, increasing prevalence of coffee consumption in households, and the availability of a variety of flavors and options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 31.5 Billion |

|

Market Forecast in 2034

|

USD 54.8 Billion |

| Market Growth Rate 2026-2034 | 6.14% |

Coffee Pods and Capsules Market Analysis:

- Major Market Drivers: According to coffee pods and capsules market trends, important drivers include consumers' increasingly fast-paced lifestyles, rising disposable income and heightened attention on premiumization, expanding coffee consumption in households throughout the world, and the introduction of new flavors and choices.

- Key Market Trends: According to the coffee pods and capsules market forecast, prominent trends include a continued shift toward sustainable and eco-friendly solutions, with consumers and producers focusing on biodegradable and compostable capsules to address environmental issues.

- Geographical Trends: According to the coffee pods and capsules market outlook, Europe is the largest market, owing to a strong coffee culture and customer desire for convenient coffee solutions. Other regions are also developing, driven by rising urbanization, increasing disposable incomes, and the popularity of global coffee brands.

- Competitive Landscape: Based on the coffee pods and capsules market forecast, some of the major market players in the coffee pods and capsules industry include Caffè d'Italia Srl, Caffè Nero (Nero Holdings Limited), Dualit, illycaffè S.p.A, Keurig Green Mountain, Inc., Luigi Lavazza SpA, Melitta, Nestlé Nespresso SA, Peet's Coffee, Tim Hortons, and Trilliant Food and Nutrition, LLC, among many others.

- Challenges and Opportunities: According to the coffee pods and capsules market report, the sector has various challenges, including the rising environmental effect of single-use coffee pods and capsules. However, this opens up chances for innovation in the creation of more sustainable packaging options, thereby boosting the coffee pods and capsules market demand.

To get more information on this market Request Sample

Coffee Pods and Capsules Market Trends:

Growing need for convenience

In today's fast-paced life, customers are increasingly looking for quick, hassle-free solutions to their everyday tasks. Increased urbanization has resulted in longer commutes for many individuals, which consume large amounts of their day and contribute to a hurried lifestyle. According to Our World in Data, Tokyo (Japan) had the world's highest capital city population in 2018, with over 37 million inhabitants. This was followed by Delhi (India) at over 28 million, Mexico City (Mexico) at 21 million, and Cairo (Egypt) at 20 million, all of which contributed to a sense of overpopulation and rivalry for resources, hastening the pace of life even more. According to a Pew Research Center poll, 60% of U.S. people stated they were sometimes too busy to enjoy life, while 12% said they felt this way all or most of the time. Coffee pods and capsules are a simple and effective way to make a single cup of coffee, bringing convenience to customers' busy lifestyles. In the United Kingdom, 47% of homes buy coffee pods for convenience.

Rising disposable income of consumers and premiumization

The growth of disposable incomes globally has led to a shift towards premium products, including coffee pods and capsules. The household disposable income in the EU rose by 14 % between 2013 and 2021. Also, India's per capita disposable income grew 8% in FY24 and 13.3% in the previous year. This has led to increased spending on organic food and beverages (F&B), projecting its growth rate at 12.5% annually. The demand for organic coffee is also rising and is expected to reach US$ 18.9 billion by 2032, with an 8.1% growth rate. Coffee brands have responded by offering a range of premium options, such as single-origin coffees, limited-edition blends, and collaborations with renowned coffee houses and roasters. For instance, in February 2020, Nestle S.A. and Starbucks Corporation partnered to launch a new range of coffee capsules for the Nespresso Original Systems. These products included developmental expertise and flavors of the two companies to expand their product offering and portfolio.

Increasing prevalence of coffee consumption in households

As per the report of the US National Coffee Association, past-day coffee consumption by those aged 40-59 has climbed by 6% since 2020, while it has increased by approximately 5% among those aged 25–39. Those 60 and older had a 1.5% rise, while those 18-24 years old maintained their past-day coffee intake. Amongst those, 83% said they drank coffee at home. Likewise, according to research by the World Coffee Portal, 57% of UK consumers drink coffee in their homes more than thrice each day. This data is accelerating the launch of pods and capsules which operate with current in-house devices. For example, in August 2022, Tim Hortons introduced four new espresso capsules compatible with Nespresso (classic, bright, bold, and decaf).

Coffee Pods and Capsules Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on type, packaging material, and distribution channel.

Breakup by Type:

- Pods

- Capsules

Capsules accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes pods and capsules. According to the report, capsules represented the largest segment.

Capsules emerged as the largest segment, reflecting a strong consumer preference for convenience, consistency, and variety in their coffee experiences. They offer unparalleled ease of use, enabling users to enjoy high-quality coffee with minimal effort and time. Moreover, the widespread availability of a variety of flavors, intensities, and coffee origins in capsule form that cater to various taste preferences and exploratory desires of consumers, is enhancing the coffee pods and capsules market growth. Along with this, the heightened focus of manufacturers on expanding their range of capsules to include a wide array of coffee options, teas, and hot chocolates is boosting the market growth. Furthermore, the growing consumer interest in sustainability, leading to innovations in biodegradable and recyclable capsules, is favoring the coffee pods and capsules market share.

Breakup by Packaging Material:

- Conventional Plastic

- Bioplastics

- Fabric

- Others

A detailed breakup and analysis of the market based on the packaging material have also been provided in the report. This includes conventional plastic, bioplastics, fabric, and others.

Conventional plastic remains a prevalent choice for packaging material due to its durability, moisture resistance, and ability to preserve the freshness of the product. It caters to a broad consumer base by providing an economical and practical solution for single-serve coffee products. Conventional plastic packaging offers lightweight, flexible, and strong solutions that ensure product safety during transportation and extend shelf life, thereby boosting the coffee pods and capsules market demand.

Bioplastic is gaining traction as a more sustainable alternative to conventional plastic. It is created from renewable resources, such as corn starch, sugarcane, or biodegradable polymers. Bioplastic packaging aims to reduce the environmental impact and address the growing consumer demand for eco-friendly products by offering packaging solutions that are biodegradable and derived from more sustainable sources.

Fabric-based packaging presents an innovative and niche segment that is focused on sustainability and reusability. Some specialty coffee brands have begun exploring fabric pouches for capsules and pods, emphasizing organic and natural materials like cotton, hemp, or jute. Fabrics are biodegradable and add a unique aesthetic appeal to the product, enhancing the unboxing experience for consumers.

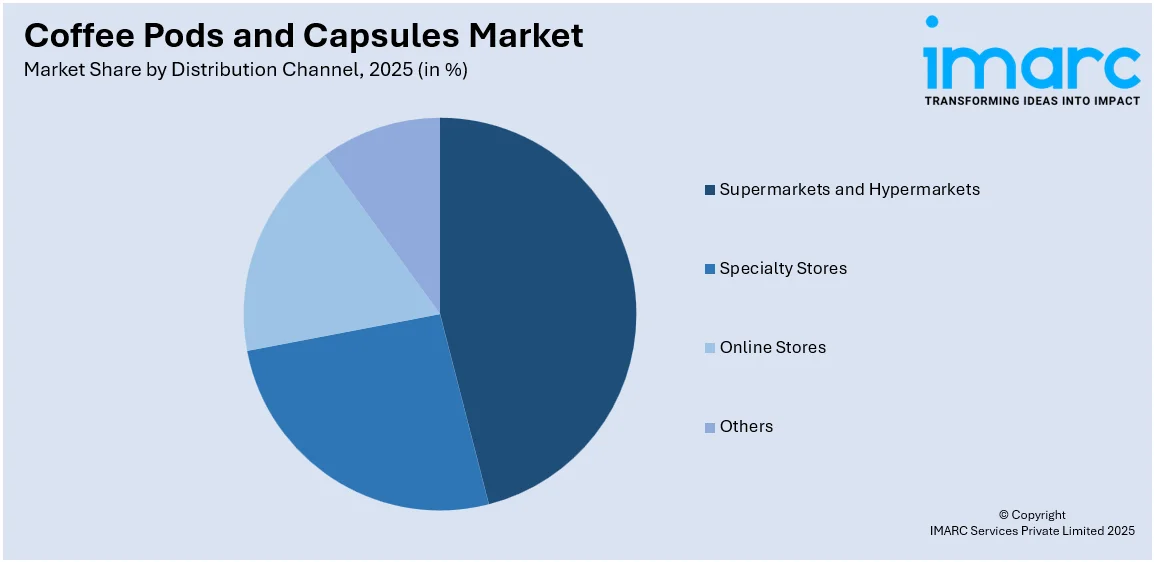

Breakup by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialty stores, online stores, and others. According to the report, supermarkets and hypermarkets represented the largest segment.

As per the coffee pods and capsules market overview, supermarkets and hypermarkets stand out as the largest segment, attributed to the extensive reach and convenience these retail formats offer to consumers. They provide a wide variety of coffee pods and capsules from different brands and regions, catering to diverse consumer preferences under one roof. Supermarkets and hypermarkets also benefit from high foot traffic, making them an ideal platform for product discovery and impulse purchases. Furthermore, they run promotions and discounts, enhancing the attractiveness of purchasing coffee pods and capsules from their stores. Besides this, the convenience of being able to select from a broad array of products, along with the ability to evaluate packaging and quality physically, is positively impacting the coffee pods and capsules revenue.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe leads the market, accounting for the largest coffee pods and capsules market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe represents the largest regional market for coffee pods and capsules.

Based on the coffee pods and capsules market statistics, Europe emerged as the largest segment due to its deep-seated coffee culture, as consumers exhibit a strong preference for high-quality, convenient coffee solutions that align with their fast-paced lifestyles. Moreover, the advanced retail infrastructure that supports the widespread availability and accessibility of coffee pods and capsules through supermarkets, hypermarkets, and online channels, making it easier for consumers to purchase various products, is fueling the market growth. Additionally, the presence of leading coffee pod and capsule brands in Europe, along with a high penetration of coffee machines in households and offices, is catalyzing the coffee pod and capsule market recent price.

Competitive Landscape:

Leading coffee pods and capsule companies are actively engaging in a variety of strategies to solidify their market positions and cater to the changing preferences of consumers. They are investing in research and development (R&D) to innovate and improve the quality and sustainability of their products. Moreover, some firms are pioneering the development of biodegradable and compostable materials to minimize their ecological footprint. Additionally, they are expanding their product range to include a broader variety of flavors, intensities, and specialty options to cater to a diverse global palate and tap into the trend of premiumization. Besides this, key players are also enhancing their distribution networks through physical retail partnerships with supermarkets and hypermarkets and by strengthening their online presence to tap into the e-commerce boom. Furthermore, they are collaborating with renowned coffee brands and investing in marketing campaigns to increase brand visibility and consumer loyalty, thereby enhancing the coffee pod and capsule market recent opportunities.

The report provides a comprehensive analysis of the competitive landscape in the global coffee pods and capsules market with detailed profiles of all major companies, including:

- Caffè d'Italia Srl

- Caffè Nero (Nero Holdings Limited)

- Dualit

- illycaffè S.p.A

- Keurig Green Mountain, Inc.

- Luigi Lavazza SpA

- Melitta

- Nestlé Nespresso SA

- Peet's Coffee

- Tim Hortons

- Trilliant Food and Nutrition, LLC

Coffee Pods and Capsules Market News:

- In July 2021, Pret A Manger, a UK based sandwich and coffee chain, partnered with JDE Peet's to introduce a new line of aluminum coffee pods that are designed to use Pret's 100% organic coffee. This new range is compatible with Nespresso and is available in over 500 Tesco supermarkets across the United Kingdom, as well as online via Ocado.

- In November 2022, Nespresso part of Nestle S.A., announced the launch of its new line of single-serve coffee capsules which are made from compostable material. This launch is expected to expand its product offering and strengthen its business in paper-based coffee capsules.

Coffee Pods and Capsules Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pods, Capsules |

| Packaging Materials Covered | Conventional Plastic, Bioplastics, Fabric, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Caffè d'Italia Srl, Caffè Nero (Nero Holdings Limited), Dualit, illycaffè S.p.A, Keurig Green Mountain, Inc., Luigi Lavazza SpA, Melitta, Nestlé Nespresso SA, Peet's Coffee, Tim Hortons, Trilliant Food and Nutrition, LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the coffee pods and capsules market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global coffee pods and capsules market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the coffee pods and capsules industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global coffee pods and capsules market was valued at USD 31.5 Billion in 2025.

We expect the global coffee pods and capsules market to exhibit a CAGR of 6.14% during 2026-2034.

The rising demand for instant non-alcoholic drinks, along with the growing utilization of coffee pods and capsules, as they are convenient to carry and travel, disposable, hygienic, etc., is primarily driving the global coffee pods and capsules market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of coffee pods and capsules.

Based on the type, the global coffee pods and capsules market has been segregated into pods and capsules. Currently, capsules exhibit a clear dominance in the market.

Based on the distribution channel, the global coffee pods and capsules market can be bifurcated into supermarkets and hypermarkets, specialty stores, online stores, and others. Among these, supermarkets and hypermarkets hold the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Europe currently dominates the global market.

Some of the major players in the global coffee pods and capsules market include Caffè d'Italia Srl, Caffè Nero (Nero Holdings Limited), Dualit, illycaffè S.p.A, Keurig Green Mountain, Inc., Luigi Lavazza SpA, Melitta, Nestlé Nespresso SA, Peet's Coffee, Tim Hortons, and Trilliant Food and Nutrition, LLC.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)