Cold Insulation Market Size, Share, Trends and Forecast by Insulation Type, Material Type, Application, and Region, 2025-2033

Cold Insulation Market Size and Share:

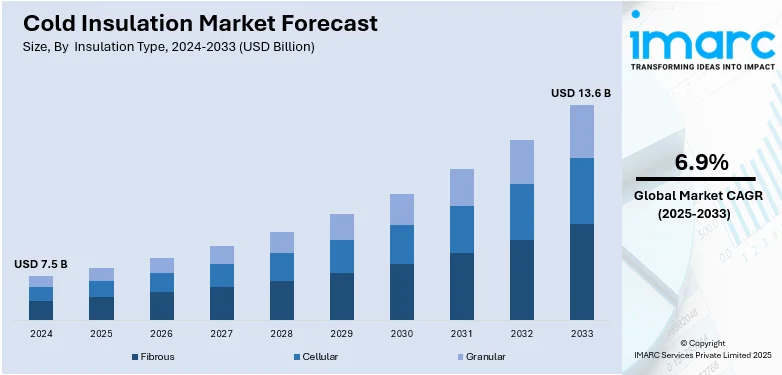

The global cold insulation market size was valued at USD 7.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.6 Billion by 2033, exhibiting a CAGR of 6.9% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of over 38.0% in 2024. The cold insulation market share is expanding, driven by the rising investments in construction projects, where cold insulation is required to optimize the performance of refrigeration and industrial piping, along with the growing implementation of stringent government regulations for environment protection, encouraging firms to adopt reliable cold insulation materials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.5 Billion |

|

Market Forecast in 2033

|

USD 13.6 Billion |

| Market Growth Rate (2025-2033) | 6.9% |

The increasing demand for energy efficiency is impelling the market growth. Many businesses focus on reducing energy costs and carbon emissions, which encourages them to use better and efficient cold insulation. Government agencies are also introducing strict energy regulations, making companies invest in high-performance materials. Besides this, the expansion of cold chain logistics, especially for perishable goods and vaccines, further drives the demand. Additionally, construction projects, particularly in colder regions, require insulation to maintain indoor temperatures. New materials like aerogels and polyurethane foams offer better thermal resistance and durability, making them popular choices.

The United States has emerged as a major region in the cold insulation market owing to many factors. The rising energy efficiency demand is offering a favorable cold insulation market outlook. Increasing investments in clean energy, coupled with the implementation of strict environmental regulations are encouraging the usage of cold insulation solutions. The US Department of Agriculture (USDA) Secretary Tom Vilsack stated that USDA allocated USD 207 Million towards renewable energy and domestic fertilizer initiatives to reduce energy costs and create additional revenue for US farmers, ranchers, and agricultural producers. As countries and companies focus on reducing carbon emissions, they invest in renewable energy projects such as liquified natural gas (LNG) terminals, hydrogen storage, and solar-powered cold storage facilities, all of which require high-performance cold insulation to minimize energy loss. Cold storage and logistics also play a big role, especially with the high demand for frozen and refrigerated goods. Moreover, the healthcare sector also promotes the employment of cold insulation materials, as vaccines and medicines need controlled temperatures.

Cold Insulation Market Trends:

Growing Investments in Construction and Industrial Activities

Increasing investments in construction and industrial activities, particularly in developing regions, is impelling the cold insulation market growth. Cold insulation materials are important for enhancing the performance of heating, ventilation, and air conditioning (HVAC) systems, refrigeration, and industrial piping, ensuring efficient temperature control in climate-sensitive environments, such as buildings, warehouses, and manufacturing facilities. As reported by an industry report in 2023, the architecture, engineering, and construction (AEC) industry was worth USD 12 Trillion and was still growing. It is one of the largest industries worldwide, yet the AEC sector has always been slow in digitization and innovations. But the recent trends of sustainable building practices and advanced construction technologies have catalyzed the demand for cold insulation materials. These materials save a lot of energy but also tally the industry's growing focus on green building standards and eco-friendly construction. The continuing infrastructure development and modernization around the world are likely to promote further usage of cold insulation solutions.

Regulatory Standards and Environmental Concerns

Government agencies and regulatory commissions across the world are taking prominent steps, such as stricter government regulations for environmental protection and the conservation of energy. In various industries, using cold insulation is often mandatory or is at least required to fit the regulatory and compliance standards and requirements. Many of these firms need cold insulation mainly in the transport and storage process of pharmaceutical goods, food stuffs, chemical products, etc. In addition, the sustainability factor is increasing pressure on industries to use environment-friendly insulation materials to minimize their destructive interference with the environment. Environmental laws hold a considerable influence over the market, with key bodies including ‘The American Society for Testing and Materials (ASTM), Construction Products Regulation 2011 (CPR), and the British Standards Institution (BSI)’ in charge of supervising the standards for thermal insulation in buildings. These regulations are leading to a higher demand for energy-efficient cold insulation solutions since companies strive to meet adherence requirements while lowering their carbon footprint in order to ensure the safe storage and transportation of sensitive items.

Increasing Focus on Energy Efficiency

The rising emphasis on energy efficiency is fueling the market growth. As worldwide energy usage continues to increase, industries are increasingly adopting cold insulation materials to reduce energy loss and maintain optimal temperatures in cold storage facilities, refrigeration units, and pipelines. This trend is especially significant in sectors like food and beverage (F&B), pharmaceutical, and chemical, where temperature control is critical for both product quality and energy cost savings. Expansion of the international cold chain infrastructure is also promoting the employment of cold insulation solutions. As per the Global Cold Chain Alliance, the worldwide refrigerated warehousing capacity experienced a growth rate of 16.7%. In 2020, these warehouses expanded to 719 Million Cubic Meters compared to 2018. This suggests that the increasing demand for reliable storage options should allow sustainability in product delivery within global supply chains.

Cold Insulation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cold insulation market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on insulation type, material type, and application.

Analysis by Insulation Type:

- Fibrous

- Cellular

- Granular

Cellular leads the market with 33.6% of the market share in 2024. It is popular because of its excellent thermal insulation, lightweight nature, and moisture resistance. It includes materials like polyurethane foam, polyisocyanurate, and elastomeric foam, which provide superior insulation for refrigeration, cold storage, and pipelines. These materials trap air within their structure, reducing heat transfer and maintaining low temperatures efficiently. Cellular insulation is also easy to install, durable, and cost-effective, making it a popular choice across industries like F&B and chemical. It helps to prevent condensation and corrosion, which is crucial for industrial and commercial applications. Compared to other types, cellular insulation offers better flexibility and can be used in various shapes and sizes, making it suitable for complex piping systems. As industries focus on energy efficiency and sustainability, cellular insulation is high in demand due to its ability to minimize energy costs while maintaining reliable temperature control in critical areas.

Analysis by Material Type:

- Fiber Glass

- Polyurethane Foam

- Polystyrene Foam

- Phenolic Foam

- Others

Polyurethane foam holds 45% of the market share. It is preferred due to its exceptional thermal efficiency, lightweight characteristics, and high moisture resistance. It has a low thermal conductivity, which helps to maintain stable temperatures in refrigeration, cold storage, and industrial piping systems. The material is highly durable and can withstand extreme temperatures, making it ideal for industries like chemical and pharmaceutical. Its flexibility allows it to be utilized in various applications, ranging from building insulation to cryogenic storage. Polyurethane foam is simple to install and proviides long-lasting energy savings by minimizing heat transfer and preventing condensation. Compared to other insulation materials, it offers a great balance of cost-effectiveness, reliability, and longevity. As industries promote better energy efficiency and sustainability, polyurethane foam remains the top choice because of its ability to reduce energy usage while ensuring effective thermal insulation.

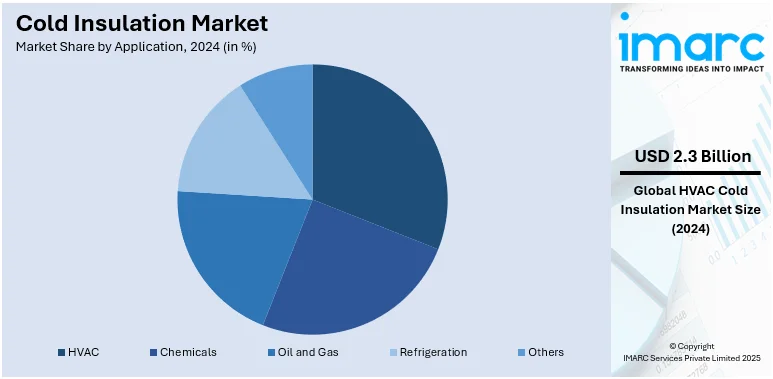

Analysis by Application:

- HVAC

- Chemicals

- Oil and Gas

- Refrigeration

- Others

HVAC holds 30.5% of the market share. In HVAC systems, cold insulation solutions play an essential role in maintaining temperature control in buildings, industries, and cold storage facilities. HVAC relies on high-quality insulation to prevent energy loss, reduce operational costs, and improve reliability. Proper insulation in HVAC systems helps to maintain consistent indoor temperatures, prevents condensation, and enhances overall performance. With rising energy costs and stricter regulations on energy efficiency, businesses and homeowners wager on better insulation to lower electricity usage. The demand for HVAC systems is growing in commercial, residential, and industrial sectors, especially in regions with extreme climates. Cold insulation materials, such as polyurethane foam and elastomeric foam aid these systems in working more effectively by minimizing heat transfer. As smart buildings, green construction, and sustainable practices gain popularity, HVAC insulation is adopted to reduce carbon footprints and ensure long-term energy savings.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific, accounting for 38.0%, enjoys the leading position in the market. The region is noted for its increasing industrial activities and expanding cold chain logistics. Nations, such as China, India, and Japan invest significantly in industries like food processing, pharmaceutical, and chemical, all of which require advanced cold insulation solutions. The high investments in construction projects also drive the demand for cold insulation products, as modern buildings focus on energy-saving HVAC systems. According to the Reserve Bank of India (RBI), in the last 4 years leading up to March 2024, Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) raised USD 15.60 Billion (INR 1.3 Lakh Crore). Moreover, India's infrastructure industry is poised for significant expansion, with anticipated spending of USD 1.4 Trillion by 2025. Apart from this, government regulations on energy efficiency and carbon emissions encourage companies to adopt better insulation materials like polyurethane foam and aerogels. Additionally, the region's strong manufacturing base and availability of raw materials make insulation production more cost-effective.

Key Regional Takeaways:

United States Cold Insulation Market Analysis

The United States hold 74.40% of the market share in North America. The increasing emphasis on energy efficiency in residential and commercial buildings is a key driver for the market. Rising summer cooling costs encourage businesses and homeowners to look for ways to improve power optimization and reduce expenses. According to forecasts from the National Energy Assistance Directors Association (NEADA), the expense for summer cooling increased from USD 476 in 2014 to an anticipated USD 719 in 2024. As industries seek to enhance energy efficiency and lower carbon footprints, the demand for cold insulation materials is high. Insulation materials, such as polyurethane (PU) foam and fiberglass, are essential in minimizing energy loss in HVAC systems, as well as in cold storage facilities. The growing adoption of eco-friendly and energy-efficient insulation solutions aligns with the encouragement for sustainability and compliance with environmental regulations. As energy costs continue to rise, the requirement for effective cold insulation in buildings and industrial applications is expected to fuel further market growth in the United States.

Europe Cold Insulation Market Analysis

The European market is growing at a significant rate, as the demand for sustainable insulation solutions increases and people adopt energy-efficient technologies. In this regard, one of the developments was Rockwool International A/S opening a new production facility in Soissons, France in June 2021. This plant not only provided 130 jobs but also had low-carbon electric melting technology to manufacture stone wool insulation material specially designed for the French market. The rising energy efficiency needs in insulation due to high energy costs and ever-tightening environmental regulations across Europe are leading to higher utilization of cold insulation solutions. Low-carbon technologies will be more in line with the region's objective to reduce carbon emissions and achieve standards for green building. The user demand for sustainable advanced cold insulation materials is set to grow, keeping the market at an all-time high.

Asia-Pacific Cold Insulation Market Analysis

Asia has emerged as the worldwide hub for processing, manufacturing, and assembly, which significantly drives the demand for cold insulation materials in the region. According to industry reports, the value added by Asia's manufacturing sector increased from 29% to 53% of the global total between 1992 and 2021, highlighting the area's expanding industrial base. This growth has brought with it the need for more energy-efficient solutions and cold insulation in many industries, such as refrigeration, food processing, and pharmaceutical storage. The Asian manufacturing capacity continues to broaden. F&B and chemical industries rely heavily on cold insulation for maintaining temperature-sensitive products and achieving energy efficiency. Following the rapid pace of industrialization, advanced cold insulation technologies are expected to be in high demand in the coming years, especially among energy-conscious and sustainable-focused countries in this region. This sets well for continued growth in the market.

Latin America Cold Insulation Market Analysis

Brazil’s strong economic growth is a key driver for the Latin America cold insulation market. In 2023, Brazil’s real GDP expanded by 2.9%, and it is anticipated to increase by 2.8% in 2024, according to the World Bank. This steady economic growth contributes to a higher number of industrial and commercial activities across various sectors, including manufacturing, construction, and cold chain logistics. As industries, such as food processing and pharmaceutical, continue to grow, the requirement for cold insulation materials to maintain optimal temperatures for sensitive goods is rising. Additionally, Brazil’s high investments in construction projects, driven by economic development, create the need for energy-efficient solutions in HVAC systems and refrigeration. This is further supported by the Brazilian government's focus on sustainability and energy conservation, which promotes the use of advanced insulation technologies.

Middle East and Africa Cold Insulation Market Analysis

The urbanization trend in the Middle East and Africa is a significant driver for the region's cold insulation market. In 2023, the share of the urban population in the United Arab Emirates remained nearly unchanged at approximately 87.78%, marking the highest value in the observed period, according to industry reports. With increasing urban populations, the demand for energy-efficient building materials is growing, including cold insulation solutions for HVAC systems, refrigeration, and industrial applications. Besides this, the growing concern for sustainable development and energy saving in urban centers across the region, especially in fast-developing economies, is driving the demand for cold insulation materials. These materials are necessary to enhance power optimization, save cooling costs, and maintain temperature-sensitive products, which are very important in the F&B sector.

Competitive Landscape:

Key players work on developing advanced materials to meet the high cold insulation market demand. They wager on expanding their product ranges and improving energy-efficient solutions. They invest in research to create better insulation materials like aerogels and polyurethane foams, which offer higher durability and thermal resistance. Big companies focus on sustainability, producing eco-friendly insulation to adhere to strict regulations. Partnerships and acquisitions help firms to broaden their market reach and enhance their technology. They work closely with industries like construction and F&B to provide customized insulation solutions. With increasing demand for cold storage and logistics, these companies strengthen their manufacturing and distribution networks. By continuously innovating and adapting to market needs, key players help industries to reduce energy costs, maintain item quality, and attain overall efficiency in temperature-sensitive environments. For instance, in December 2023, ROCKWOOL A/S finalized the purchase of Boerner Insulation Sp. z o.o. in Poland, establishing its foothold in Europe. The site of the acquisition was set to enhance logistics and supply chain effectiveness for the market.

The report provides a comprehensive analysis of the competitive landscape in the cold insulation market with detailed profiles of all major companies, including:

- Armacell

- Aspen Aerogels Inc.

- BASF SE

- CertainTeed (Compagnie de Saint-Gobain S.A.)

- Covestro AG

- Dow Inc.

- Evonik Industries AG

- Huntsman Corporation

- Kingspan Group plc

- Owens Corning

Latest News and Developments:

- March 2024: BASF teamed up with Shandong Wiskind Architectural Steel Co., Ltd. to launch environment friendly polyurethane (PU) sandwich panels designed for cold chain use.

Cold Insulation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insulation Types Covered | Fibrous, Cellular, Granular |

| Material Types Covered | Fiber Glass, Polyurethane Foam, Polystyrene Foam, Phenolic Foam, Others |

| Applications Covered | HVAC, Chemicals, Oil and Gas, Refrigeration, Others |

| Regions Covered | North America, Asia-Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Armacell, Aspen Aerogels Inc., BASF SE, CertainTeed (Compagnie de Saint-Gobain S.A.), Covestro AG, Dow Inc., Evonik Industries AG, Huntsman Corporation, Kingspan Group plc, Owens Corning, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cold insulation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cold insulation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cold insulation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cold insulation market was valued at USD 7.5 Billion in 2024.

The cold insulation market is projected to exhibit a CAGR of 6.9% during 2025-2033, reaching a value of USD 13.6 Billion by 2033.

With industries, such as pharmaceutical, chemical, and construction, increasingly focusing on reducing energy usage and carbon emissions, the demand for high-performance cold insulation materials is on the rise. Besides this, stringent government regulations regarding energy efficiency and sustainability are encouraging industries to adopt better insulation solutions. Additionally, the expansion of cold chain logistic chains, particularly for perishable goods and vaccines, is creating the need for effective insulation to maintain low temperatures.

Asia-Pacific currently dominates the cold insulation market, accounting for a share of 38.0% in 2024, driven by rapid industrial growth, expanding cold storage, and rising demand for energy efficiency. Strong manufacturing, increasing urbanization, and government regulations are creating the need for better insulation in F&B, construction, and HVAC systems.

Some of the major players in the cold insulation market include Armacell, Aspen Aerogels Inc., BASF SE, CertainTeed (Compagnie de Saint-Gobain S.A.), Covestro AG, Dow Inc., Evonik Industries AG, Huntsman Corporation, Kingspan Group plc, Owens Corning, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)