Commercial Kitchen Appliances Market Size, Share, Trends and Forecast by Type, Distribution Channel, Application, and Region, 2026-2034

Commercial Kitchen Appliances Market Size and Share:

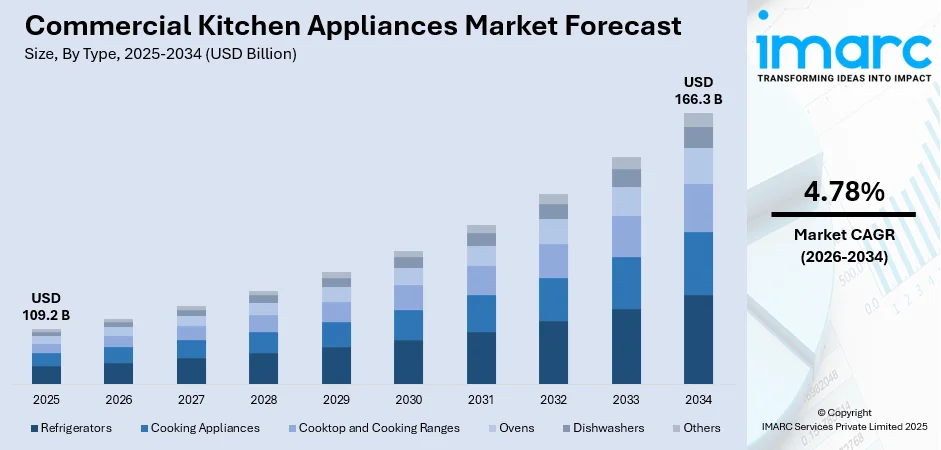

The global commercial kitchen appliances market size was valued at USD 109.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 166.3 Billion by 2034, exhibiting a CAGR of 4.78% during 2026-2034. North America currently dominates the market, holding a significant market share of 35.0% in 2025. The growing adoption of energy-efficient, cost-effective, and time-saving kitchen solutions, wide availability through various distribution channels, rising domestic and international tourism increasing their foodservice operations to accommodate varied culinary needs and technological advancements represent some of the key factors driving the commercial kitchen appliances market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 109.2 Billion |

|

Market Forecast in 2034

|

USD 166.3 Billion |

| Market Growth Rate 2026-2034 | 4.78% |

The market for commercial kitchen appliances is driven by growth in the foodservice industry, such as restaurants, hotels, and catering services. Advances in technology have created intelligent appliances that increase operational efficiency and lower labor costs. Moreover, the increasing focus on sustainability and energy efficiency is encouraging businesses to invest in energy-efficient and eco-friendly appliances that reduce energy usage and operating expenses. Government regulations and safety measures also contribute significantly to the market, as they need commercial kitchen businesses to incorporate approved and certified equipment. In addition, the increasing popularity of cloud kitchens and online food ordering is driving the demand for customized appliances that are designed specifically for high-speed operations and large orders. These factors are hence collectively contributing to the commercial kitchen appliances market growth.

To get more information on this market Request Sample

The United States stands out as a key market disruptor, driven by the rapid adoption of advanced technologies and changing consumer requirements. The use of smart appliances with IoT capability, including remote monitoring and predictive maintenance, boosts operational efficiency and cuts downtime. This change in technology is specifically reflected in the popularity of ghost kitchens and QSRs, which focus on space efficiency and high-volume output. Furthermore, the US market is also seeing growth in demand for energy-efficient, multifunctional appliances. Since commercial kitchens use 2.5 times more energy per square foot compared to other commercial areas, there is a strong emphasis on equipment that reduces energy usage and operational expenses. The US also excels in regulatory innovation, with strict guidelines from such organizations as the Occupational Safety and Health Administration (OSHA) and state sanitation regulations. These guidelines promote adoption of certified high-performance equipment, further making the US a major market innovator.

Commercial Kitchen Appliances Market Trends:

Integration of Automation and Smart Technologies

One of the key trends transforming the commercial kitchen appliances industry is the quick integration of automation and smart technologies. As per a report published by the IMARC Group, the global internet of things (IoT) market reached USD 1,022.6 Billion in 2024 and is expected to grow at a CAGR of 14.6% during 2025-2033. Hence, foodservice operators are looking for means to simplify operations, minimize human error, and enhance consistency, which facilitates the increased use of intelligent kitchen appliances. These appliances have IoT functionality, touchscreen displays, programmable controls, and real-time monitoring, enabling more accurate cooking, maintenance notification, and energy consumption tracking. Automation enables labor optimization, which is especially beneficial in areas with staff shortages or turnover in the hospitality sector. Smart appliances also enable greater food safety levels through consistent temperatures and cleanliness standards. As the need for quick, high-quality service grows—particularly in fast-casual food, catering, and institutional restaurants—automated systems are increasingly necessary. With continued development in AI and machine learning, commercial kitchens are being transformed into highly efficient, technologically advanced facilities that can achieve speed, precision, and quality at the same time.

Sustainability and Energy Efficiency in Equipment Design

Sustainability is one of the defining characteristics that shape the commercial kitchen appliances market outlook. Companies throughout the foodservice and hospitality industries are focusing on equipment that operate efficiently while also reflecting environmentally conscious practices. Appliances with high energy efficiency that cut down the use of electricity, water, and gas are very popular, as is equipment constructed using recyclable materials and environmentally friendly constituents. Pressure from both regulatory instructions and customers demanding more sustainable practices, fuel the development of these trends. Most food companies are proactively striving for green certifications and selecting appliances that will aid in their carbon footprint reduction efforts. Manufacturers are reacting with technologies like low-emission burners, environmentally friendly refrigeration systems, and modular designs that maximize product life cycles. Apart from the environmental benefits, energy-efficient appliances reduce long-term operating costs, making them an economically safe option. With sustainability becoming a non-negotiable imperative, it is also impacting aspects of appliance design, buying decisions, and long-term kitchen planning strategies.

Impact of the Travel and Tourism Industry

The success of the travel and tourism industry has a direct impact on the commercial kitchen appliances market forecast. As international mobility rises and domestic and inbound tourism continue to grow, hotels, resorts, and cruise ships are increasing their foodservice operations to accommodate varied culinary needs. This expansion is fueling demand for large-volume, long-lasting, and flexible kitchen appliances capable of delivering large quantities without compromising quality or efficiency. According to the United Nations World Tourism Organization (UNWTO), in the year 2024, there were approximately 1.4 Billion international tourists worldwide, recording a growth of 11% in comparison to the previous year. Apart from this, in hospitality environments, there is an increasing demand for appliances that accommodate diverse cuisines and dietary requirements, spurring the use of multifunctional cooking equipment and specialist utensils. Upscale tourism establishments are focusing more on guest experience, such as open kitchen designs and live cooking, both of which call for contemporary, design-driven appliances that fuse performance with beauty. As the tourism sector continues to boom, particularly in destinations known for culinary tourism, investment in advanced commercial kitchen appliances becomes a necessity, as well as a competitive advantage.

Commercial Kitchen Appliances Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global commercial kitchen appliances market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, distribution channel, and application.

Analysis by Type

- Refrigerators

- Cooking Appliances

- Cooktop and Cooking Ranges

- Ovens

- Dishwashers

- Others

Refrigerators stand as the largest component in 2025, holding around 16.8% of the market. According to the report, refrigerators represented the largest segment, as they are widely utilized to maintain food products cooler and fresh over a longer period. They are widely available in different capacities and can be easily customized as per the customer cooling requirement. They are not expensive, require less space, and provide more energy-efficient technology. Moreover, they assist in slowing down the growth of bacteria and preventing the deterioration of food.

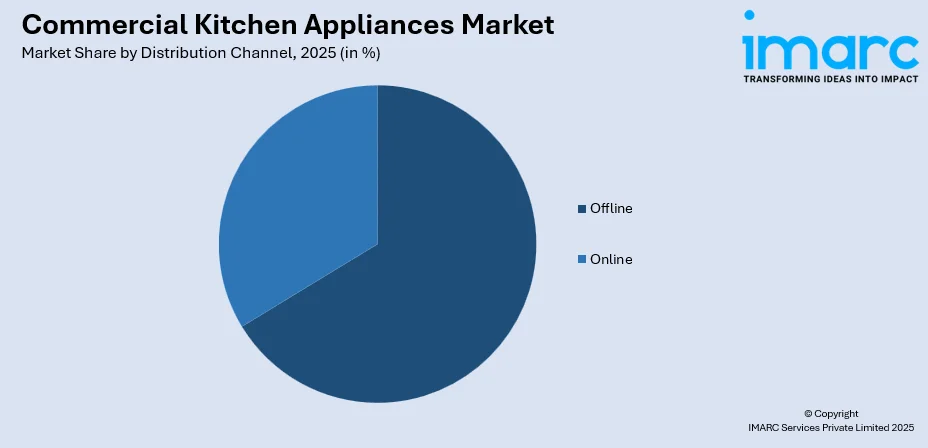

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

Offline leads the market with around 78.7% of market share in 2025. According to the report, offline accounted for the largest market share as it has a wide availability of products of different brands and offers special discounts, schemes, and cashback and assists in enhancing customer experience. The increasing demand for offline distribution channel, as people can easily try and test the products prior to purchasing, is contributing to the growth of the market.

Analysis by Application:

- Quick Service Restaurant (QSR)

- Railway Dining

- Institutional Canteen

- Resort and Hotel

- Hospital

- Full Service Restaurant (FSR)

- Others

Quick service restaurant (QSR) leads the market with around 30.2% of market share in 2025. According to the report, quick service restaurants (QSRs) accounted for the largest market share as they offer certain food items that require minimal preparation time and are delivered through quick services. Moreover, they focus more on menu innovation, customer convenience, and competitive pricing. The rising demand for fine dining among individuals across the globe is strengthening the growth of the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 35.0%. According to the report, North America (the United States and Canada) was the largest market for commercial kitchen appliances. The growing demand for commercial kitchen appliances due to the increasing number of restaurants, hotels, cafes, bars, resorts, and other food chains represents one of the key factors influencing the market positively in the region. In addition, the rising adoption of technologically advanced commercial kitchen appliances for smooth workflow and reduced wastage is supporting the growth of the market. Furthermore, the increasing popularity of different cuisines and changing lifestyle of people, along with the inflating income levels of individuals, is strengthening the growth of the market.

Key Regional Takeaways:

United States Commercial Kitchen Appliances Market Analysis

In 2025, the United States accounted for over 89.80% of the commercial kitchen appliances market in North America. The United States commercial kitchen appliances market is primarily driven by the increasing demand for food service establishments and the growing trend of dining out. According to the United States Department of Agriculture (USDA), in 2023, food service establishments contributed about USD 1.5 Trillion to the U.S. economy. Moreover, in 2024, dining and drinking establishments were calculated to contribute approximately USD 1.4 Trillion in sales to the U.S. economy, equating to 6% of the country’s GDP. As consumer preferences shift toward convenience and unique dining experiences, the need for advanced kitchen equipment is rising, prompting restaurant owners to invest in high-quality, energy-efficient appliances. Furthermore, technological innovations also play a significant role, with smart kitchen appliances that offer improved functionality, such as automated cooking and temperature controls, gaining popularity. Additionally, the rise of fast-casual dining and food delivery services creates a demand for high-volume, durable appliances that can handle the increased throughput. Health and safety regulations also contribute to market growth, as restaurants and food businesses require equipment that meets stringent standards for food safety and sanitation. Other than this, sustainability concerns have led to a preference for energy-efficient and eco-friendly appliances, which reduce operating costs and also appeal to environmentally conscious consumers.

Asia Pacific Commercial Kitchen Appliances Market Analysis

The Asia Pacific commercial kitchen appliances market is expanding due to urbanization, changing consumer preferences, and the growing food service industry. As per industry estimates, 52.9% of the population in Asia lived in urban areas in 2024, equating to 2,545,230,547 individuals. As urban population expand and disposable incomes rise, there is a heightened demand for dining out, leading to a rise in the number of restaurants, hotels, and catering services. This boosts the need for advanced, energy-efficient kitchen appliances to streamline operations, improve food quality, and reduce costs. Additionally, the growing trend of food delivery services and cloud kitchens in the region is further propelling the demand for commercial kitchen equipment. Stricter food safety regulations are also prompting businesses to adopt modern kitchen appliances that ensure compliance with hygiene and safety standards. As a result, the increasing focus on convenience, sustainability, and innovation continues to fuel growth in the Asia Pacific commercial kitchen appliances market.

Europe Commercial Kitchen Appliances Market Analysis

The Europe commercial kitchen appliances market is driven by several factors, including the region’s thriving food service and hospitality industries. With an increasing number of restaurants, hotels, and catering services, there is a rising demand for high-quality and energy-efficient kitchen appliances. The ongoing recovery of the tourism and hospitality sector post-pandemic contributes to the market’s growth, as these establishments reinvest in upgrading their kitchen facilities to meet consumer expectations and improve operational efficiency. According to reports, in 2022, 62% of residents in the European Union took at least one personal tourism trip, recording a growth of 23% in comparison to 2021 and 51% in comparison to 2020. Additionally, according to the European Travel Commission (ETC), in 2024, tourists were calculated to spend about €742.8 Billion in Europe, recording an increase of 14.3% in comparison to 2023. Moreover, expenditure on food and drinks in 2024 was also estimated to rise by 30% in comparison to 2023. Besides this, the rise of food trucks and pop-up restaurants, which require portable and easy-to-install kitchen equipment, is expanding the demand for flexible and versatile appliances in the European market. The increasing popularity of food delivery services and cloud kitchens in urban areas further boosts demand for commercial kitchen appliances that can handle high volumes efficiently.

Latin America Commercial Kitchen Appliances Market Analysis

The commercial kitchen appliances market in Latin America is significantly influenced by the region’s increasing focus on sustainability and eco-friendly practices. As businesses prioritize reducing energy consumption and minimizing waste, there is a rising demand for energy-efficient and environmentally friendly kitchen equipment. Additionally, the rise in tourism and hospitality services across Latin America contributes to greater demand for commercial kitchen appliances as hotels and resorts upgrade their facilities to meet the expectations of international visitors. For instance, Brazil set a new record for international tourism in February 2025, with foreign travelers contributing USD 823 million to the Brazilian economy during the year's second month. This represents a 22% rise compared to the identical month in 2024, when expenditures totaled USD 673 million, based on information published by the Central Bank (Banco Central do Brasil) and gathered by the Ministry of Tourism (Ministério do Turismo). Besides this, innovations in appliance design, along with improved after-sales services and financing options, further support industry expansion, enabling small and medium-sized businesses to invest in modern kitchen solutions.

Middle East and Africa Commercial Kitchen Appliances Market Analysis

The Middle East and Africa commercial kitchen appliances market is being increasingly propelled by the growing trend of modernizing kitchen operations across various sectors. The rapid development of shopping malls, food courts, and luxury restaurants is also driving the market, as these establishments require state-of-the-art equipment to meet customer expectations. Additionally, the region's expanding retail sector has further heightened the demand for advanced kitchen appliances for in-house food preparation and ready-to-eat meals. For instance, according to the IMARC Group, the Saudi Arabia retail market size reached USD 270.8 Billion in 2024 and is expected to grow at a CAGR of 4.2% during 2025-2033. Besides this, the growing focus on health-conscious eating and the rise in demand for organic, healthy food options are encouraging businesses to invest in appliances that support fresh food preparation and healthier cooking methods.

Competitive Landscape:

Several major companies in the commercial kitchen appliances sector are proactively adopting various strategic initiatives to promote growth, innovation, and competitiveness. A significant area of emphasis is technological innovation—firms are making significant investments in smart and connected appliances that integrate IoT, automation, and AI for improved performance, energy efficiency, and ease of use. These technologies enable foodservice companies to streamline operations, lower labor expenses, and ensure consistent food quality. To meet mounting sustainability requirements, top manufacturers are creating energy and water-efficient appliances, and products that meet worldwide environmental regulations. They are also using recyclable materials and providing modular equipment to extend product lifespans. Furthermore, industry leaders are increasing their international presence through strategic alliances, mergers and acquisitions, and strengthening distribution networks to meet expanding demand in emerging markets. Customization and customer-focused design also take precedence to enable appliances to address the wide-ranging requirements of hotels, restaurants, cloud kitchens, and institutional foodservice. Additionally, industry leaders are introducing value-added offerings like training, after-sales assistance, and digital integration platforms in order to create a complete customer experience. By incorporating innovation, sustainability, and customer support as its core approach, these initiatives guarantee that major players are addressing the present needs of the marketplace and are also defining the future of the commercial kitchen appliance market.

The report provides a comprehensive analysis of the competitive landscape in the commercial kitchen appliances market with detailed profiles of all major companies, including:

- Alto-Shaam Inc.

- American Range Corporation

- Carrier Global Corporation

- Duke Manufacturing Company

- Electrolux AB

- G.S. Blodgett Corporation (The Middleby Corporation)

- Hamilton Beach Brands Inc.

- Hoshizaki Corporation

- Interlevin Refrigeration Ltd.

- MEIKO Maschinenbau GmbH & Co. KG

- The Vollrath Company LLC

- True Manufacturing Co. Inc.

Latest News and Developments:

- February 2025: Helios Technologies Inc., a leading provider of electronic control technologies, entered into a partnership with Alto-Shaam through Helios’s operational subsidiary, i3 Product Development, and its Cygnus Reach software platform in order to support advancements in the commercial kitchen sector. This collaboration has significantly improved Alto-Shaam’s ChefLinc remote oven management system for commercial kitchens, providing enhanced security and scalability to clients.

- November 2024: C.Kitchen.com, a leading provider of commercial kitchen equipment, exclusively launched the Hawk range of commercial kitchen appliances. The Hawk line is an innovative and durable range of products developed to meet the unique needs of professional kitchens. The products also feature a 3-year warranty program, enhancing consumer trust and ensuring long-term support and protection.

- October 2024: MKN, a global leader in commercial cooking technologies, introduced its most recent achievement, MKN SteelPlus, a near-zero carbon stainless steel, for the development of its FlexiChef line and combi-steamers. Compared to traditional stainless steel, MKN SteelPlus boasts a 40% decrease in CO2 emissions. This will allow users to effectively monitor their carbon footprint, helping to meet the rising need for sustainable practices and equipment in commercial kitchens.

- April 2024: Rockwell, a leading provider of commercial refrigeration technologies, launched its latest innovative line of commercial refrigeration appliances for kitchens and other facilities. The new collection consists of Reach under-counters, Reach-ins, Bar Refrigeration units, Confectionary Show Cases, as well as Supermarket Refrigeration appliances, providing enhanced performance and various innovative features to customers.

Commercial Kitchen Appliances Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Refrigerators, Cooking Appliances, Cooktop and Cooking Ranges, Ovens, Dishwashers, Others |

| Distribution Channels Covered | Offline, Online |

| Applications Covered | Quick Service Restaurant (QSR), Railway Dining, Institutional Canteen, Resort and Hotel, Hospital, Full Service Restaurant (FSR), Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alto-Shaam Inc., American Range Corporation, Carrier Global Corporation, Duke Manufacturing Company, Electrolux AB, G.S. Blodgett Corporation (The Middleby Corporation), Hamilton Beach Brands Inc., Hoshizaki Corporation, Interlevin Refrigeration Ltd., MEIKO Maschinenbau GmbH & Co. KG, The Vollrath Company LLC, True Manufacturing Co. Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the commercial kitchen appliances market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global commercial kitchen appliances market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the commercial kitchen appliances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial kitchen appliances market was valued at USD 109.2 Billion in 2025.

The commercial kitchen appliances market is projected to exhibit a CAGR of 4.78% during 2026-2034, reaching a value of USD 166.3 Billion by 2034.

The commercial kitchen appliances market is driven by rising demand from the expanding foodservice industry, increasing adoption of energy-efficient and smart appliances, and growing preference for automation to reduce labor costs. Urbanization, changing consumer dining habits, and the rise of cloud kitchens further fuel the need for modern, high-performance equipment.

North America currently dominates the commercial kitchen appliances market, driven by a booming foodservice sector, demand for energy-efficient and smart technologies, and the rise of ghost kitchens. Increasing regulatory standards, focus on sustainability, and diverse culinary trends also push businesses to adopt innovative, high-performance appliances that enhance efficiency and operational flexibility.

Some of the major players in the commercial kitchen appliances market include Alto-Shaam Inc., American Range Corporation, Carrier Global Corporation, Duke Manufacturing Company, Electrolux AB, G.S. Blodgett Corporation (The Middleby Corporation), Hamilton Beach Brands Inc., Hoshizaki Corporation, Interlevin Refrigeration Ltd., MEIKO Maschinenbau GmbH & Co. KG, The Vollrath Company LLC, True Manufacturing Co. Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)