Commercial Refrigeration Market Report by Product Type (Chest Refrigeration, Deep Freezers, Bottle Coolers, Storage Water Coolers, Commercial Kitchen Refrigeration, Medical Refrigeration, and Others), End User (Full Service Restaurant, Quick Service Restaurant & Hotels, Food Processing Industry, Hospitals, Retail Pharmacies, Supermarket/Hypermarket, Convenience Stores, and Others), and Region 2026-2034

Commercial Refrigeration Market Size:

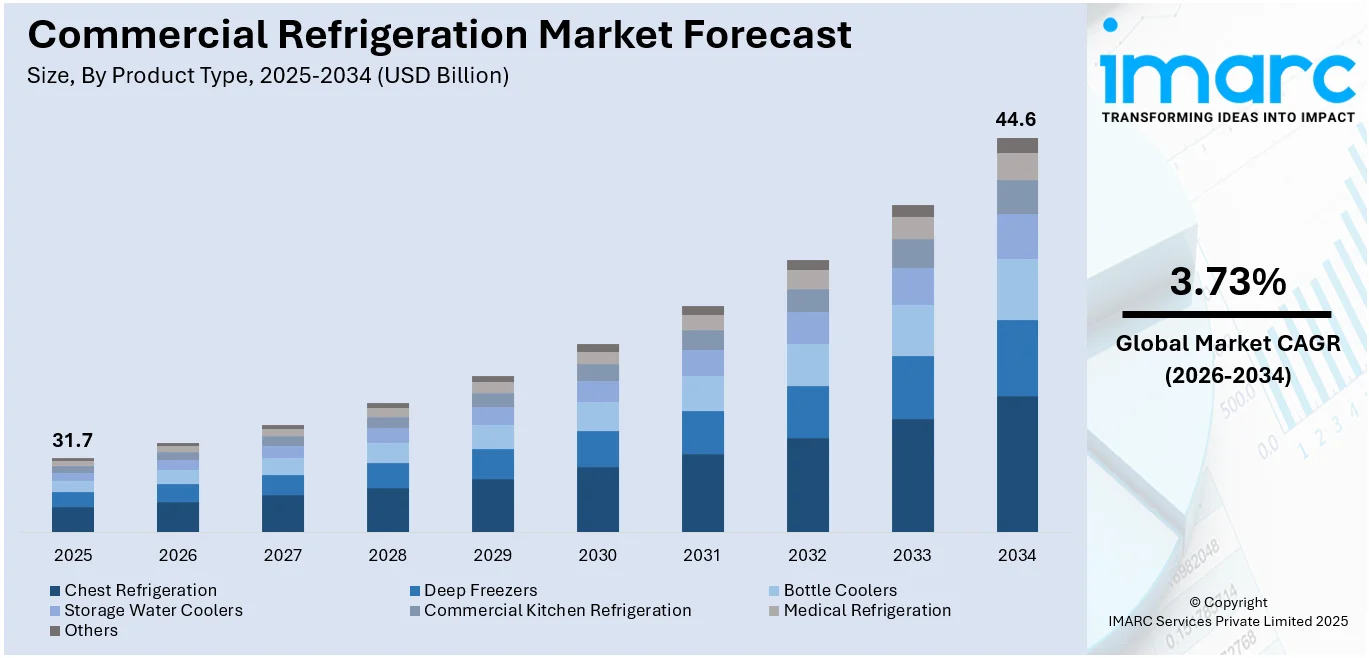

The global commercial refrigeration market size reached USD 31.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 44.6 Billion by 2034, exhibiting a growth rate (CAGR) of 3.73% during 2026-2034. The market is experiencing steady growth driven by the expanding global food and beverage industry. Moreover, the high need for robust cold chain solutions for food safety, growing consumer demand for fresh and processed foods, and continual technological advancements in energy efficiency and eco-friendly refrigerants are expanding the commercial refrigeration market share. At present, Asia Pacific represents the largest region in the market owing to the growth in the F&B industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 31.7 Billion |

|

Market Forecast in 2034

|

USD 44.6 Billion |

| Market Growth Rate 2026-2034 | 3.73% |

Commercial Refrigeration Market Analysis:

- Market Growth and Size: The market is experiencing significant growth, driven by the expanding food and beverage industry and technological innovations. The market is characterized by a rising demand for energy-efficient and sustainable refrigeration solutions, particularly in sectors such as food service, retail, and hospitality. This demand is reflected in market projections indicating substantial growth in both value and volume over the coming years.

- Technological Advancements: Advancements in technology are a cornerstone of the market's growth. Innovations focus on energy efficiency, integration of IoT for monitoring and control, and advanced cooling technologies that promote food safety. These technological improvements comply with stringent environmental regulations and offer cost savings and operational reliability, appealing to a broad spectrum of commercial users.

- Industry Applications: The market serves a diverse range of industries, with significant applications in supermarkets, hypermarkets, food service establishments, and the hospitality sector. The growing demand for frozen and processed foods, coupled with an increase in dining out and food delivery services, further amplifies the need for advanced refrigeration systems across these sectors.

- Key Market Trends: Key trends include a shift towards eco-friendly refrigerants, driven by regulatory changes, and the adoption of smart refrigeration systems with real-time monitoring capabilities. There's also an increasing focus on custom refrigeration solutions tailored to specific industry needs, reflecting a move towards more specialized and efficient systems.

- Geographical Trends: Geographically, the market shows strong growth in regions such as North America and Europe, attributed to stringent food safety and environmental regulations. Emerging markets in Asia-Pacific are also experiencing rapid growth due to urbanization, rising disposable incomes, and expansion of the food and beverage sector, particularly in countries such as China and India.

- Competitive Landscape: The market is competitive, with a mix of well-established players and emerging companies. Competition is based on factors including technological innovation, product range, pricing, and global distribution networks. Mergers and acquisitions are common as companies strive to expand their market presence and product portfolios.

- Challenges and Opportunities: Challenges include adhering to diverse and stringent regulatory standards across different regions and the high cost of advanced refrigeration systems. However, these challenges also present opportunities for market players to innovate and develop cost-effective, environmentally friendly refrigeration solutions. The expanding global food and beverage industry and the rising demand for quality cold chain solutions offer significant growth opportunities in this market.

To get more information on this market Request Sample

Commercial Refrigeration Market Trends:

Growing Demand from Supermarkets, Hypermarkets, and Food Retail Chains

The market for commercial refrigeration is growing strongly as supermarkets, hypermarkets, and food retail chains are constantly increasing their footprints and enhancing their storage capacity. Retailers are giving more emphasis to keeping perishable products fresh and safe like dairy, meat, seafood, and frozen food, and this is driving greater adoption of energy-saving and technologically advanced refrigeration systems. In cities and semi-cities, organized retail chains are opening new stores aggressively, thus generating perpetual demand for walk-in coolers, display refrigerators, and multi-deck units. Retailers are also adding smart technologies like Internet of ThingsIoT-based temperature control and real-time monitoring in refrigeration units to meet food safety guidelines and minimize waste. This trend is playing a major role in the driving the market, as firms are investing in durable cold storage facilities in order to provide constant customer satisfaction, adhere to health parameters, and minimize operational loss through food wastage. The IMARC Group predicts that the global perishable goods transportation market is projected to attain USD 32.0 Billion by 2033.

Increasing Demand in Food Service Industry

The market for commercial refrigeration is growing at a fast pace owing to increasing demand from restaurants, hotels, cloud kitchens, and catering services. The hospitality and food service sector are depending on high-performance and dependable refrigeration equipment to store ingredients, maintain food safety, and improve the efficiency of the kitchen. With consumers increasingly going out to eat as well as ordering food online in greater numbers, food delivery services as well as restaurants are continuously advancing their cold storage capacity. The growth in quick-service restaurants (QSRs) and international tourism and hospitality growth are also adding to the demand for compact and adaptable refrigeration units. Companies are fitting under-counter refrigerators, blast chillers, prep tables, and reach-in freezers in order to streamline operations and minimize food spoilage. Further, hotels are progressively using green and energy-efficient refrigeration systems to achieve their sustainability objectives and lower energy use, which is also driving innovation and encouraging producers to create more sophisticated systems. In 2025, Voltas Limited, part of the Tata Group, showcased its energy-efficient commercial refrigeration offerings at AAHAR 2025. Through advanced and high-quality solutions, the company aids businesses in lowering operational expenses, enhancing their environmental footprint, and streamlining their refrigeration and cold chain strategies.

Strict Food Safety Regulations and Cold Chain Development

Countries and regulatory authorities are making stricter food safety regulations, which is heavily catalyzing the demand for commercial refrigeration systems. Food manufacturing, storage, and transportation companies are making more investments in high-tech refrigeration units to meet temperature control, hygiene, and traceability regulations. Cold chain logistics is continually on the rise across markets including pharmaceuticals, dairy, processed foods, and fresh fruits and vegetables, demanding strong and scalable refrigeration solutions at each phase of the supply chain. Logistics companies and manufacturers are adding temperature tracking technologies, data logging, and automation to their infrastructures to achieve consistent conditions and prevent regulatory fines. Private and public partnerships in emerging markets are facilitating the construction of cold chain infrastructure to lessen post-harvest losses and preserve product quality. In 2025, Cold Chain Technologies (CCT) introduced a reusable universal temperature-controlled pallet shipper, the firm's initial innovation for the life sciences industry following its acquisition of reusable pallet expert, Tower Cold Chain, in 2024.

Limited Number of Purification Brands

In the commercial refrigeration market, purification companies are playing a crucial role by supplying high-quality refrigerants like ammonia and carbon dioxide (CO₂), which are gaining popularity due to their low environmental impact and compliance with evolving regulations. These refrigerants are increasingly favored for their energy efficiency and sustainability benefits. However, a major challenge impacting the market's growth is the limited availability of specialized purification firms capable of producing and distributing these refrigerants at scale. This scarcity creates supply constraints, slows adoption, and affects cost stability across the industry. As per the commercial refrigeration market forecast, the presence of limited number of purification companies is negatively impacting the market dynamics.

Commercial Refrigeration Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on product type and end user.

Breakup by Product Type:

- Chest Refrigeration

- Deep Freezers

- Bottle Coolers

- Storage Water Coolers

- Commercial Kitchen Refrigeration

- Medical Refrigeration

- Others

Chest refrigeration accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes chest refrigeration, deep freezers, bottle coolers, storage water coolers, commercial kitchen refrigeration, medical refrigeration, and others. According to the report, chest refrigeration represented the largest segment.

Chest refrigerators represent the largest segment in the market, attributed to their widespread use across various industries. These refrigerators are known for their energy efficiency and large storage capacity, making them ideal for storing bulky items or large quantities of products. Commonly used in supermarkets, convenience stores, and the hospitality sector, chest refrigerators are favored for their durability and ease of maintenance. Their versatility in temperature control also makes them suitable for a range of products, from perishable food items to beverages.

On the other hand, deep freezers are a critical segment of the market, mainly used for long-term storage of perishable goods. They are essential in food processing and distribution, particularly in the meat and seafood industries. Deep freezers are known for maintaining consistently low temperatures, which is vital for preserving food quality over extended periods. This segment caters to both commercial establishments and healthcare facilities, where preserving biological samples at stable temperatures is crucial.

Along with this, bottle coolers are designed specifically for chilling beverages and are commonly used in bars, restaurants, and hotels. This segment benefits from the growing hospitality industry and the increasing consumption of cold drinks. These coolers are designed for easy access and attractive display, factors that enhance customer experience and drive sales in commercial establishments.

In addition, storage water coolers are a vital segment in regions with hot climates and in settings where access to chilled drinking water is essential. These units are widely used in offices, educational institutions, and commercial spaces. The demand in this segment is driven by the need for convenient and safe drinking water, with a focus on energy-efficient and space-saving designs.

Apart from this, commercial kitchen refrigeration encompasses a range of refrigeration equipment used in commercial kitchens, including under-counter units, refrigerated display cases, and walk-in coolers. These products are essential for food safety and quality in restaurants, cafes, and catering services. The demand in this segment is driven by the expanding food service industry and the need for specialized refrigeration solutions that cater to diverse culinary operations.

Concurrently, medical refrigeration is a specialized segment catering to healthcare and laboratory needs. These refrigeration units are designed to store pharmaceuticals, biological samples, and vaccines at precise temperatures. The growth in this segment is propelled by the increasing demand in the healthcare sector, particularly with the rising need for vaccine storage amidst global health challenges.

Breakup by End User:

.webp)

Access the comprehensive market breakdown Request Sample

- Full Service Restaurant, Quick Service restaurant & Hotels

- Food Processing Industry

- Hospitals

- Retail Pharmacies

- Supermarket/Hypermarket

- Convenience Stores

- Others

Full service restaurant, quick service restaurant & hotels hold the largest share of the industry

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes full service restaurant, quick service restaurant & hotels, food processing industry, hospitals, retail pharmacies, supermarket/hypermarket, convenience stores, and others. According to the report, full service restaurant, quick service restaurant & hotels accounted for the largest market share.

Full service restaurant, quick service restaurant & hotels encompassing full-service restaurants, quick-service restaurants (QSRs), and hotels, represent the largest portion of the market. The growth in this segment is fueled by the global expansion of the hospitality and food service industries. These establishments require a range of refrigeration solutions, from walk-in coolers to display refrigerators, to ensure food safety and enhance customer experience. Additionally, the increasing consumer preference for dining out and the growth in international tourism contribute to the robust demand in this sector.

On the contrary, the food processing industry is a significant user of it. This segment requires specialized refrigeration systems for processes such as blast freezing, cold storage, and temperature-controlled transportation. The growth in this sector is driven by the rising demand for processed and packaged foods worldwide, necessitating extensive and efficient cold chain solutions to maintain food quality and safety from production to distribution.

In addition, hospitals represent a key segment in the market, primarily for medical refrigeration. This includes the storage of pharmaceuticals, vaccines, blood, and other biological samples at critical temperatures. The demand in this segment is influenced by the growing healthcare sector and the need for advanced refrigeration to comply with stringent health and safety standards.

Apart from this, retail pharmacies require them to store temperature-sensitive pharmaceuticals and vaccines. This segment has seen growth due to the increasing number of retail pharmacy outlets and the rising importance of ensuring the efficacy of drugs through proper storage. The expansion of the pharmaceutical sector and the growing focus on healthcare also drive the demand in this market segment.

Concurrently, supermarkets and hypermarkets form a substantial segment of the market. These large retail spaces use a variety of refrigeration systems, including display freezers, walk-in coolers, and beverage coolers, to store and showcase a wide range of perishable goods. The growth of organized retail and the rising consumer preference for one-stop shopping experiences contribute to the demand in this segment.

In confluence with this, convenience stores are a growing segment in the market, largely due to their proliferation globally and the extended hours of operation. These stores require efficient, space-saving refrigeration solutions for a variety of products, from beverages to frozen foods. The increasing consumer demand for on-the-go food options and the convenience offered by these stores drive the demand in this sector.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest commercial refrigeration market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

Asia Pacific stands as the largest segment in the market, driven by rapid urbanization, growth in the food and beverage sector, and increasing consumer spending power, particularly in emerging economies such as China and India. Additionally, the region's market growth is also fueled by the expanding hospitality and retail sectors, alongside growing awareness about food safety and quality. Moreover, the development of cold chain infrastructure to support the food processing and pharmaceutical industries significantly contributes to the market's expansion in this region.

North America is a key player in the market, with growth influenced by advanced technology adoption and stringent food safety and environmental regulations. The presence of major market players, coupled with a well-established retail sector, drives the demand for innovative refrigeration solutions in this region. Along with this, the growing trend of consuming fresh and frozen foods and the expansion of the food service industry further stimulate market growth in North America.

In addition, the market in Europe is driven by factors such as strict environmental regulations, leading to the adoption of energy-efficient and eco-friendly refrigeration systems. The well-established food and beverage industry, along with the rising demand for high-quality refrigeration in the healthcare sector, also contributes to the market's growth. Concurrently, the region's focus on reducing greenhouse gas emissions encourages innovation and adoption of advanced refrigeration technologies.

In Latin America, the market is experiencing growth due to the expanding retail and food service sectors. The region's growth is also attributed to urbanization and the rising demand for processed and frozen foods. Apart from this, improvements in the economic scenario of countries including Brazil and Mexico are fostering investments in the sector, further driving market expansion.

Furthermore, the market in the Middle East and Africa is growing, albeit from a smaller base compared to other regions. This growth is primarily driven by the expanding tourism and hospitality sectors, particularly in the Middle East. The need for efficient refrigeration solutions in hot climates, coupled with the growing retail and food processing industries in African countries, also contributes to market development.

Leading Key Players in the Commercial Refrigeration Industry:

In the market, key players are actively engaged in various strategic initiatives to strengthen their market positions. These include investments in research and development to innovate and introduce energy-efficient and environmentally friendly refrigeration systems, in response to stringent regulatory standards and changing customer demands. Additionally, various key players are expanding their product portfolios through new launches and enhancements, catering to specific industry needs. Along with this, mergers and acquisitions are prevalent as companies seek to broaden their technological capabilities and global reach. These players are also focusing on improving their distribution networks and after-sales services to enhance customer experience and retention. Furthermore, the integration of advanced technologies such as IoT for smarter functionality and predictive maintenance is another area where significant efforts are being channeled, creating a positive market outlook.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Ali Group

- Baltimore Aircoil Company, Inc

- Bitzer

- CCR Commercial Refrigeration

- Danfoss A/S

- Electrolux Professional

- Haier Inc.

- Hillphoenix (Dover Corporation)

- Liebherr Appliances

- Panasonic Life Solutions India Pvt. Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- February 2025: Tecumemseh Products Company LLC, a world leader in commercial refrigeration technologies, introduced the extended AL Series Compressor platform that provides up to 25% more energy efficiency, leading to significant energy savings.

- May 2025: Arkema announced its plans to make available a variety of lower global warming potential (GWP) refrigerants to the worldwide market, expanding access to next generation refrigerant solutions. Building on Arkema's portfolio by way of a commercial agreement with Honeywell International Inc. will enhance global supply chains, meet enhanced demand for HFO blends in the HVACR market and provide assured continued supply, aligning with the HFC phasedown.

- April 2025: Liebherr USA, Co. has opened a new warehouse in the United States to better serve its presence in the commercial refrigeration industry. The facility is intended to better manage its inventory and delivery times on its scientific refrigerators, beverage coolers, and frozen food freezers, and reflects the company's dedication to supporting U.S.-based customers.

- April 2024: Blue Star Limited announced the launch of a comprehensive portfolio of commercial refrigeration products for summer 2025, tailored specifically to address varied refrigeration requirements. Focusing aggressively on growth, the Company seeks to develop its commercial refrigeration business and leverage the increasing opportunities in the nation.

- March 2024: The Arcticom Group (TAG) announced its expansion into Buffalo and Western New York with the acquisition of TDH Refrigeration, a respected industry leader with a reputation for technical know-how and excellent customer service. The acquisition enhances TAG's footprint in the Northeast and its capability to serve commercial and industrial customers with premier refrigeration solutions. It also reaffirms TAG's focus on building partnerships with companies that align with its technical excellence, customer-focused service, and leadership in the industry values.

Commercial Refrigeration Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Chest Refrigeration, Deep Freezers, Bottle Coolers, Storage Water Coolers, Commercial Kitchen Refrigeration, Medical Refrigeration, Others |

| End Users Covered | Full Service Restaurant, Quick Service restaurant & Hotels, Food Processing Industry, Hospitals, Retail Pharmacies, Supermarket/Hypermarket, Convenience Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ali Group, Baltimore Aircoil Company, Inc, Bitzer, CCR Commercial Refrigeration, Danfoss A/S, Electrolux Professional, Haier Inc., Hillphoenix (Dover Corporation), Liebherr Appliances, Panasonic Life Solutions India Pvt. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the commercial refrigeration market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global commercial refrigeration market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the commercial refrigeration industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global commercial refrigeration market was valued at USD 31.7 Billion in 2025.

We expect the global commercial refrigeration market to exhibit a CAGR of 3.73% during 2026-2034.

The rising adoption of commercial refrigeration in pharmacies, hospitals, supermarkets, hotels, restaurants, grocery and convenience stores, etc., as it ensures safe storage, enhances shelf life, maximizes freshness, etc., is primarily driving the global commercial refrigeration market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous manufacturing units for commercial refrigeration.

Based on the product type, the global commercial refrigeration market has been segregated into chest refrigeration, deep freezers, bottle coolers, storage water coolers, commercial kitchen refrigeration, medical refrigeration, and others. Among these, chest refrigeration currently holds the majority of the total market share.

Based on the end user, the global commercial refrigeration market can be bifurcated into full service restaurant, quick service restaurant & hotels, food processing industry, hospitals, retail pharmacies, supermarket/hypermarket, convenience stores, and others. Currently, full service restaurant, quick service restaurant & hotels exhibit a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global commercial refrigeration market include Ali Group, Baltimore Aircoil Company, Inc, Bitzer, CCR Commercial Refrigeration, Danfoss A/S, Electrolux Professional, Haier Inc., Hillphoenix (Dover Corporation), Liebherr Appliances, Panasonic Life Solutions India Pvt. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)