Commercial Satellite Imaging Market Size, Share, Trends and Forecast by Technology, Application, End User, and Region, 2025-2033

Commercial Satellite Imaging Market Size and Share:

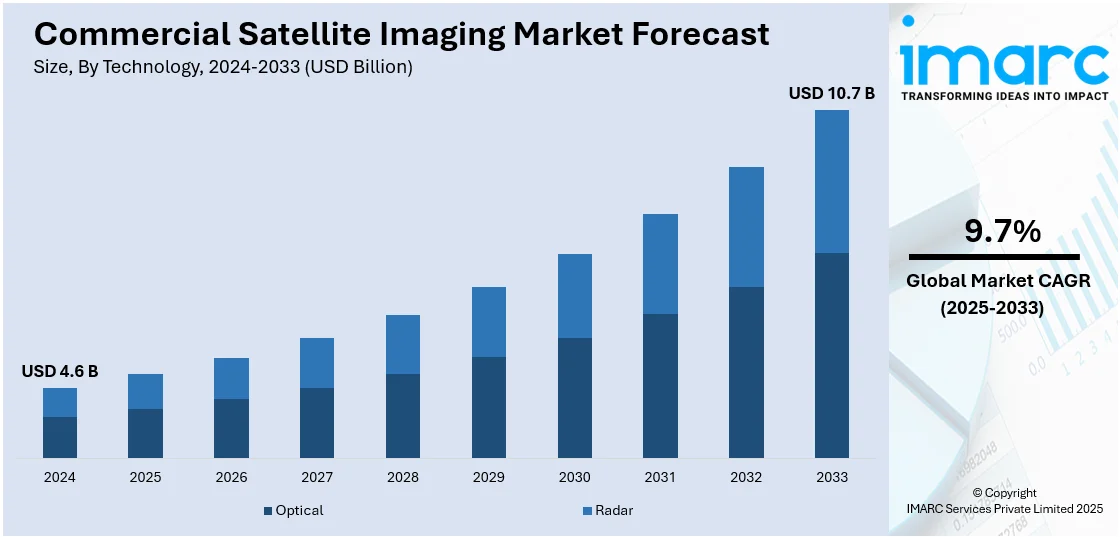

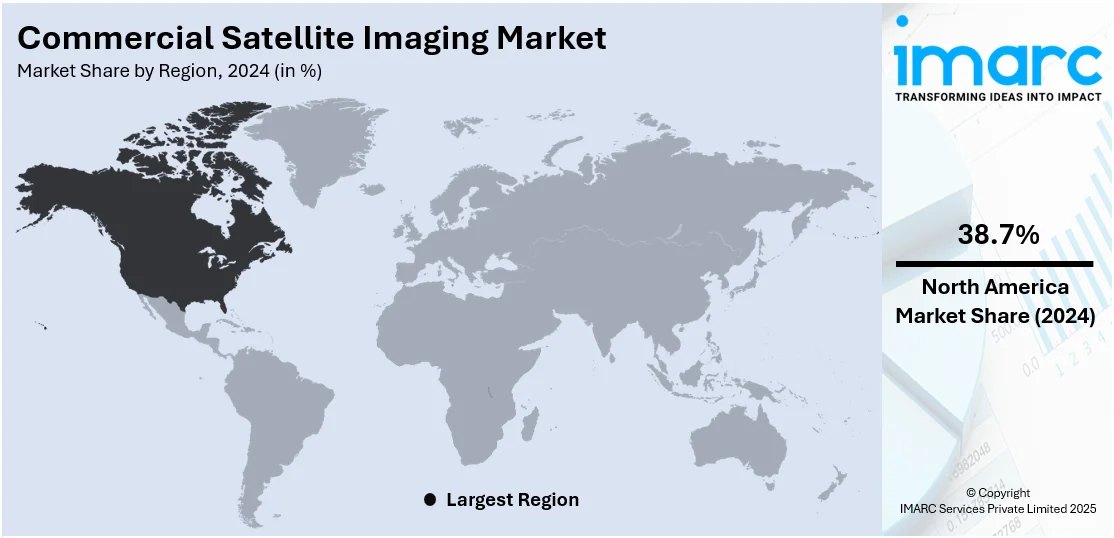

The global commercial satellite imaging market size was valued at USD 4.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.7 Billion by 2033, exhibiting a CAGR of 9.7% from 2025-2033. North America currently dominates the market, holding a market share of 38.7% in 2024. The dominance of the region is accredited to high government and private sector investment in space-based technologies, widespread adoption of advanced geospatial solutions, and a well-established research and development ecosystem. The region's strong regulatory support, infrastructure readiness, and continuous innovation in imaging and data processing technologies are further reinforcing its leadership. The growing demand for real-time data across multiple industries and an active focus on satellite-based services further contribute to the expansion of commercial satellite imaging market share in North America.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.6 Billion |

|

Market Forecast in 2033

|

USD 10.7 Billion |

| Market Growth Rate 2025-2033 | 9.7% |

Organizations are progressively depending on near real-time satellite imagery to track dynamic events, such as natural disasters, agricultural health, unlawful deforestation, and maritime operations. These visuals facilitate quicker decision-making and response strategies, particularly in emergency and monitoring situations. Additionally, contemporary satellites provide improved resolution, quicker data transfer, and superior imaging features. The miniaturization of parts is making small satellites more affordable, while reusable launch vehicles are greatly lowering launch expenses. These advancements render satellite imaging more available to end users. Furthermore, defense agencies utilize satellite images for monitoring borders, tracking troop movements, identifying targets, and overseeing infrastructure. This sector frequently demands high-resolution, high-frequency images, positioning it as one of the most reliable and valuable users of commercial satellite services.

The United States is a crucial segment in the market, driven by increasing interest in off-Earth imaging. Agencies are looking for commercial methods to track space-based entities, improving situational awareness in space as orbital congestion, satellite activity, and debris-related dangers grow in low-Earth and geostationary orbits. In 2024, the US National Geospatial-Intelligence Agency issued a request for information to explore commercial non-Earth imaging (NEI) capabilities. NEI involved capturing satellite imagery of objects in space, such as spacecraft and debris. This initiative aimed to enhance space situational awareness amid growing orbital threats. Besides this, with advanced digital infrastructure and a strong culture of data-driven decision-making, US organizations are adopting satellite imaging solutions that are faster and integrate them easily into operational systems, thereby supporting the market growth.

Commercial Satellite Imaging Market Trends:

Increased Adoption of Climate Monitoring and Environmental Applications

Satellite imagery is becoming essential for environmental observation, providing a scalable method for monitoring deforestation, glacier retreat, ocean temperature variations, air quality, and carbon output. With the growing impacts of climate change, there is a higher need from environmental regulators, research organizations, non-governmental organizations (NGOs), and businesses for reliable data to support sustainability reporting and ensure compliance with regulations. Satellites deliver reliable, extensive area observations that ground-based systems frequently fall short of, which is essential for detecting forest degradation, illegal mining activities, water-level changes, and the spread of wildfires. This ability is particularly beneficial for organizations monitoring biodiversity, assessing ecosystem threats, or incorporating climate considerations into their operational plans. A notable instance supporting this trend is Hydrosat's 2024 announcement of its VanZyl-1 satellite, which was launched in early July through SpaceX’s Transporter-11. VanZyl-1 was the initial commercial satellite to provide high-resolution thermal imagery with worldwide coverage, aimed at evaluating crop health and identifying water stress. The data from the satellite was directly used in climate models and agricultural strategies, tackling issues of food security and environmental risk. These initiatives demonstrate how satellite imaging is transitioning from visual observation to operational climate intelligence. With governments enforcing climate disclosure regulations and businesses adapting to international sustainability standards, the need for thermal, multispectral, and atmospheric information is growing, establishing commercial satellite imaging as a lasting supporter of environmental monitoring and climate adaptability.

Advanced Imaging Technologies

The growing adoption of advanced technologies is a crucial factor offering a favorable commercial satellite imaging market outlook. Significant developments, including global positioning system (GPS) satellites, electric propulsion technologies, high-resolution optical sensors, remote sensing features, and light detection and ranging (LiDAR), are improving the accuracy, speed, and adaptability of satellite images. These technologies allow enhanced spatial resolution, immediate updates, and more extensive data layers, rendering satellite imaging essential in various fields, such as transportation, infrastructure, agriculture, and environmental surveillance. A significant illustration highlighting this trend is the Indian Railways initiative in October 2024, which released tenders valued at ₹3,200 crore for the installation of LiDAR systems on trains and railway tracks. The goal was to produce extremely precise digital elevation models and identify obstacles, erosion, or intrusions with limited human involvement. This action demonstrates the increasing need from public infrastructure initiatives for imaging solutions driven by cutting-edge remote sensing technologies. As governments and businesses aim for efficiency, automation, and safety, the use of these advanced imaging tools is expanding. These developments enhance the range of satellite data gathering while facilitating integration with geographic information systems (GIS) systems, AI analytics, and cloud services, promoting quicker decision-making and broadening the practical application of satellite imagery in extensive, real-time operations.

Commercial Satellite Imaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global commercial satellite imaging market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, application, and end user.

Analysis by Technology:

- Optical

- Radar

Optical stands as the largest component in 2024, holding 65.5% of the market, owing to its capability to obtain high-resolution, true-color images that are straightforward to analyze and broadly useful across various sectors. Optical sensor gathers information in the visible and near-infrared spectrum, which makes it ideal for uses like land cover mapping, agricultural tracking, urban planning, and environmental evaluation. The clarity and detail provided by optical imaging facilitate accurate analysis and visualization, generating high demand from both government and commercial sectors. Ongoing improvements in sensor design, image resolution, and onboard data processing are greatly enhancing the quality and usefulness of optical imagery. Additionally, its cost-effectiveness and simple integration with different data analytics platforms enhance its favorability compared to other technologies. This dominance of optical technology is a key highlight in the commercial satellite imaging market report, reflecting its wide adoption and value across industries.

Analysis by Application:

- Geospatial Data Acquisition and Mapping

- Urban Planning and Development

- Disaster Management

- Energy and Natural Resource Management

- Surveillance and Security

- Defense and Intelligence

- Others

Geospatial data acquisition and mapping represents the largest segment, as these applications are widely used across various sectors that need precise spatial information. Sectors like urban planning, environmental oversight, infrastructure growth, and natural resource management largely rely on satellite-based mapping to enhance decision-making, planning, and operational effectiveness. The capacity of satellite imagery to gather extensive, high-resolution information across broad and distant regions allows for thorough topographical assessment, land-use categorization, and continuous observation. This application is crucial in disaster response, with quick mapping aiding evaluation and recovery initiatives. Improvements in data processing, cloud platforms, and integration with GIS are increasing the accessibility and significance of geospatial data. With governments and private entities focusing on digital mapping and spatial intelligence for sustainable growth and operational strategies, the domain of geospatial data collection and mapping continues to dominate the market.

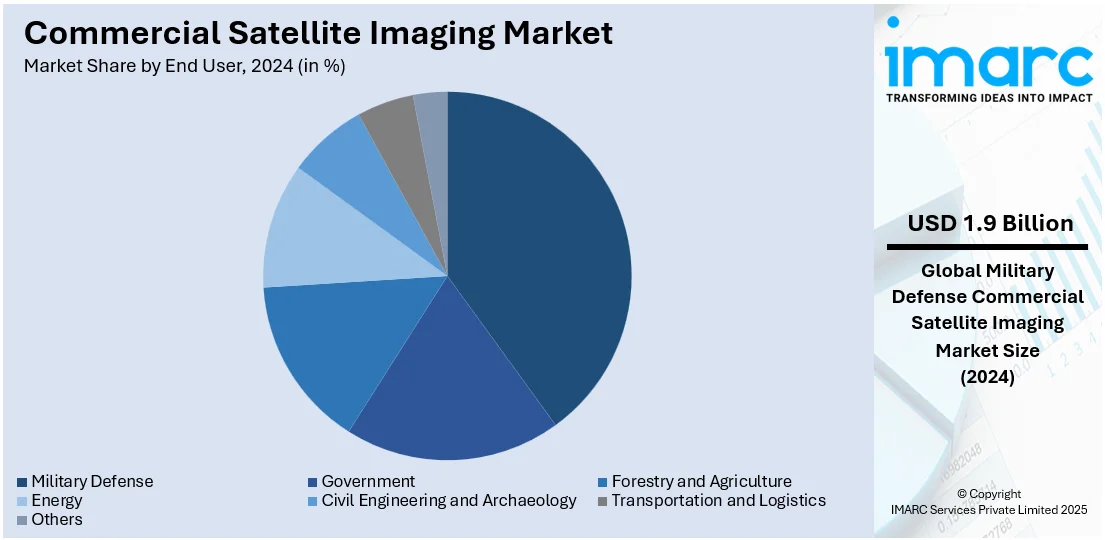

Analysis by End User:

- Government

- Military Defense

- Forestry and Agriculture

- Energy

- Civil Engineering and Archaeology

- Transportation and Logistics

- Others

Military defense leads the market with 40.0% of the market share in 2024, owing to its ongoing and substantial need for high-resolution, real-time images to aid national security, surveillance, and tactical missions. Military forces worldwide depend significantly on satellite information for intelligence gathering, target surveillance, mission strategizing, and oversight of border and maritime operations. The requirement for continuous global coverage, nighttime and all-weather imaging abilities, and fast data transmission make satellite imaging an essential asset for contemporary military tactics. Defense agencies make substantial investments in procuring commercial satellite services and enhancing advanced imaging technologies suited to their operational needs. Furthermore, combining satellite imagery with other intelligence sources improves situational awareness and decision-making. With increasing geopolitical tensions, cross-border threats, and the rising importance of space in defense strategy, military users continue to be the primary drivers of demand, sustaining their leading position in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America held the biggest market share of 38.7% because of robust institutional backing, technological progress, and considerable financial investment in space and geospatial technologies. The area features a developed ecosystem with prominent satellite manufacturers, service providers, and data analytics companies, allowing smooth integration of imaging services across multiple industries. Satellite imagery is widely used in various applications, including resource monitoring, infrastructure planning, navigation, and emergency response. The existence of sophisticated data processing abilities and the initial embrace of technologies, such as AI and ML in geospatial analysis improves the usefulness and precision of satellite-derived data. Moreover, a supportive regulatory landscape and steady financing for space initiatives further strengthen the growth of the market. For instance, in 2024, Canada’s federal budget announced $8.6 million in new funding for the Lunar Exploration Accelerator Program (LEAP) and the creation of a National Space Council. The budget also allocated $6.9 billion toward space-based defense initiatives, including Arctic surveillance and communications systems.

Key Regional Takeaways:

United States Commercial Satellite Imaging Market Analysis

In North America, the market portion held by the United States was 85.90%, attributed to the increasing worries about climate change, environmental damage, and the necessity for efficient disaster observation. The rising occurrence and intensity of natural disasters are making it crucial to depend on advanced imaging technologies for immediate data and analysis. In 2024, the United States encountered 27 different climate-related disasters, each resulting in damages exceeding USD 1 billion, highlighting the increasing effects of environmental disturbances. Satellite images are essential for enhancing early warning systems, facilitating quicker and more precise emergency responses, and assisting in recovery efforts after disasters. It is utilized to observe forest coverage, monitor urban expansion, identify changes in land use, evaluate water body levels, and investigate glacial retreat, among various other uses. These abilities are crucial for assisting agencies in formulating mitigation strategies and enhancing climate resilience. Moreover, as collaboration between public and private sectors increases, investment in commercial satellite technology keeps rising, promoting innovation and enhancing access to high-resolution imagery. The changing function of satellite imaging in aiding sustainability objectives, infrastructure development, and disaster readiness positions it as an essential instrument in US comprehensive environmental approach.

Europe Commercial Satellite Imaging Market Analysis

In Europe, the growth of commercial satellite imaging is driven by increased security worries and rising geopolitical tensions, especially those arising from ongoing conflicts and changing alliances. The continuous war in Ukraine has highlighted the economic and strategic costs of these conflicts, with projections indicating that Russia incurs expenses ranging from USD 500 million to USD 1 billion daily. These changes are encouraging European countries to reevaluate and raise their defense spending, focusing more on improving surveillance, reconnaissance, and intelligence skills. Commercial satellite imagery is becoming more essential in this situation by providing high-resolution, real-time information that allows for ongoing surveillance of borders, troop movements, and questionable activities. It enhances national security by increasing situational awareness, facilitating early identification of possible threats, and assisting in coordinated military and strategic actions. As governments focus on enhancing resilience against new threats, satellite imaging emerges as an essential part of defense systems, aiding national readiness and cooperative global security strategies.

Asia Pacific Commercial Satellite Imaging Market Analysis

In the Asia-Pacific area, the uptake of commercial satellite imagery is accelerating rapidly, primarily fueled by the rising implementation of GPS satellites and the expansion of space-based infrastructure. This expansion is particularly noticeable in India, where the GPS system comprises 31 satellites, 24 of which are operational, circling the Earth at an altitude of about 20,000 kilometers. These satellites create an essential foundation for numerous GPS-based services, aiding in accurate navigation, mapping, and extensive geospatial data gathering across wide and varied terrains. With the advancement and proliferation of GPS technology, it provides improved precision in location tracking and real-time monitoring, benefiting various industries, such as precision agriculture, smart transportation systems, streamlined logistics, and enhanced urban planning. The increase in satellite data accessibility has also aided in enhancing disaster response, monitoring the environment, and promoting sustainable land-use methods. Additionally, these developments are becoming crucial for enhancing operational efficiencies and promoting data-driven decision-making in remote or underserved areas of the Asia-Pacific.

Latin America Commercial Satellite Imaging Market Analysis

In Latin America, the use of commercial satellite imagery is increasingly advancing, especially in urban planning, infrastructure growth, and the management of energy and natural resources. Governments, local authorities, and private companies are leveraging satellite data to observe land use trends, evaluate urban expansion, and inform sustainable urban planning efforts. Furthermore, the technology is essential for monitoring mineral and agricultural resources, assessing deforestation, and enhancing management of energy use and distribution systems. The provision of high-resolution, real-time satellite images enhances data-driven decision-making, allowing for more efficient and sustainable resource management in various geographical areas.

Middle East and Africa Commercial Satellite Imaging Market Analysis

In the Middle East and Africa, there is a higher use of commercial satellite imaging as local governments and security organizations address escalating needs for surveillance and national security. Political instability, border conflicts, and the ongoing risk of terrorism are making satellite monitoring tools vital for preserving territorial integrity and ensuring public safety. These sophisticated imaging technologies allow officials to monitor distant or adversarial regions, identify illegal actions, and follow movements around critical sites in almost real-time. Satellite imagery assists in overseeing conflict areas, backing peacekeeping efforts, and strategizing military missions. With the escalation of security challenges, the dependence on satellite technology is swiftly increasing.

Competitive Landscape:

Major participants in the market are concentrating on enhancing their service offerings via strategic alliances, purchases, and technological advancements. Numerous entities are making substantial investments in advanced satellites that have high-resolution imaging and real-time data transmission capabilities to satisfy the increasing need for accurate geospatial information. Businesses are also enhancing their data analytics systems to provide value-added services, including predictive modeling and AI-driven insights. Initiatives are underway to reduce operational expenses by means of satellite miniaturization and reusable launch technologies. Moreover, key players are focusing on emerging sectors, such as insurance, maritime, and urban development, while still addressing conventional areas like defense and agriculture, with the goal of diversifying applications and expanding their user base. In 2024, Hyderabad-based Dhruva Space launched AstraView, a commercial satellite imagery service offering high-resolution, real-time Earth observation data. The service was backed by partnerships with global satellite firms to provide diverse imagery types. AstraView targeted users in academia, defense, and enterprise sectors.

The report provides a comprehensive analysis of the competitive landscape in the commercial satellite imaging market with detailed profiles of all major companies, including:

- Airbus S.A.S.

- BlackSky Technology Inc.

- EarthDaily Analytics (UrtheCast Corp.)

- European Space Imaging GmbH

- Galileo Group Inc

- L3Harris Technologies Inc.

- Maxar Technologies Inc.

- Planet Labs Inc.

- Skylab Analytics

- SpaceKnow Inc.

Latest News and Developments:

- April 2025: China announced that it is planning a space traffic management system to address the growing congestion in low Earth orbit, where projections indicate up to 100,000 satellites could operate. The China National Space Administration (CNSA) emphasizes the need to ensure space sustainability and prevent overlap and competition between satellite projects. Commercial satellite imaging is set to play a significant role in these initiatives.

- March 2025: Digantara commissioned a commercial space surveillance satellite, SCOT. Launched aboard SpaceX's Transporter-12 rocket, SCOT began its operations by capturing high-resolution commercial satellite imaging over South America. The satellite is capable of tracking objects as small as 5 centimeters in orbit.

- March 2025: SpaceEye-T, a commercial Earth observation satellite developed by South Korea’s Satrec Initiative and operated by SI Imaging Services (SIIS), was launched. It offers a native optical resolution of 25 cm, making it one of the most advanced commercial imaging satellites available. The satellite also features a 12 km swath width and supports rapid image delivery, capturing up to 300,000 km² per day.

- March 2025: BlackSky announced that its Gen-3 satellite had delivered very high-resolution imagery just five days after launching. The company provides its first light satellite images of Sydney International Airport and Sydney Harbor Bridge, surpassing customer expectations with minimal calibration. The imagery exceeds initial quality standards, and BlackSky reduces the commissioning timeline from months to just days.

Commercial Satellite Imaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Optical, Radar |

| Applications Covered | Geospatial Data Acquisition and Mapping, Urban Planning and Development, Disaster Management, Energy and Natural Resource Management, Surveillance and Security, Defense and Intelligence, Others |

| End Users Covered | Government, Military Defense, Forestry and Agriculture, Energy, Civil Engineering and Archaeology, Transportation and Logistics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Airbus S.A.S., BlackSky Technology Inc., EarthDaily Analytics (UrtheCast Corp.), European Space Imaging GmbH, Galileo Group Inc, L3Harris Technologies Inc., Maxar Technologies Inc., Planet Labs Inc., Skylab Analytics and SpaceKnow Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the commercial satellite imaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global commercial satellite imaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the commercial satellite imaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial satellite imaging market was valued at USD 4.6 Billion in 2024.

The commercial satellite imaging market is projected to exhibit a CAGR of 9.7% during 2025-2033, reaching a value of USD 10.7 Billion by 2033.

The market is driven by rising demand across defense, agriculture, and environmental monitoring sectors, a growing investment in space technology, and increasing adoption of location-based services. Advancements in high-resolution imaging, disaster response needs, and government space programs also contribute to the market growth, alongside the expanding role of private satellite operators.

North America currently dominates the commercial satellite imaging market, accounting for a share of 38.7%. The dominance of region is attributed to strong government spending on defense and intelligence, widespread adoption of geospatial technologies, and the presence of major industry players.

Some of the major players in the commercial satellite imaging market include Airbus S.A.S., BlackSky Technology Inc., EarthDaily Analytics (UrtheCast Corp.), European Space Imaging GmbH, Galileo Group Inc, L3Harris Technologies Inc., Maxar Technologies Inc., Planet Labs Inc., Skylab Analytics and SpaceKnow Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)