Global Commercial Vehicles Market Size is Anticipated to Reach USD 1,169.0 Billion by 2033 - IMARC Group

Global Commercial Vehicles Market Statistics, Outlook and Regional Analysis 2025-2033

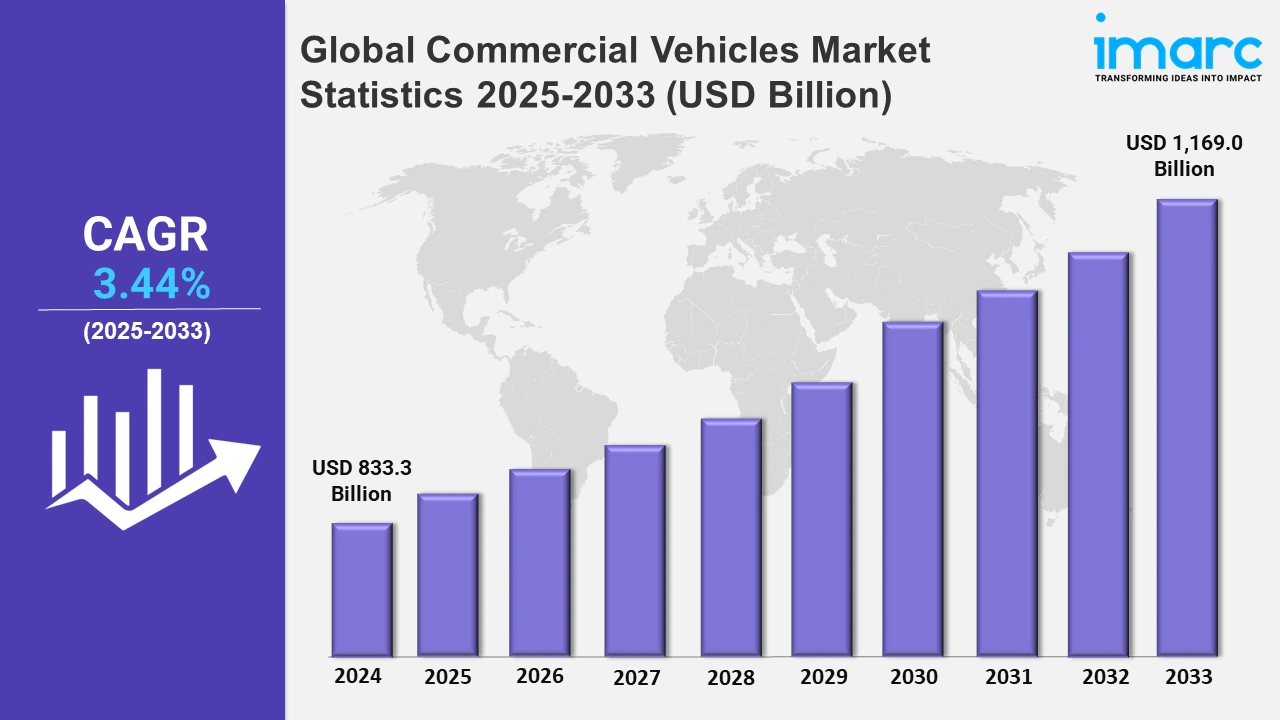

The global commercial vehicles market size was valued at USD 833.3 Billion in 2024, and it is expected to reach USD 1,169.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.44% from 2025 to 2033.

To get more information on this market, Request Sample

The rise in e-commerce is significantly impacting the demand for commercial vehicles. Online shopping platforms and customer expectations for same-day or next-day delivery are fueling the need for efficient last-mile transport. According to Sellers Commerce, the e-commerce sector is expanding globally, supported by 2.71 billion online shoppers in 2024, accounting for 33% of the global population. This marks a 2.7% increase from the previous year, showcasing the growth of digital consumerism. The number of e-commerce sites is also rising, with 26.6 million sites worldwide in 2024, a 3.83% increase from 2023, equating to approximately 2,685 new e-commerce websites launched daily between 2023 and 2024. Projections for 2025 indicate the number of online shoppers is anticipated to reach 2.77 billion. Vans and light-duty trucks have become crucial for urban deliveries, with optimized designs for cargo space and fuel efficiency to meet logistics demands.

Governments are enforcing stricter emission standards to address environmental concerns. For instance, as per 2024 report by UN environment programme (UNEP), nations must collectively commit to cutting 42% off annual greenhouse gas emissions by 2030 and 57% by 2035 in the next round of Nationally Determined Contributions (NDCs). Failure to meet these targets and start immediate action could lead to a 2.6-3.1°C temperature increase over this century, resulting in severe consequences for people, the planet, and economies. The commercial vehicle sector is facing immense pressure to comply with regulations aimed at pollutants and greenhouse gases. As a result, the leading manufacturers are focusing on fuel efficiency, low-emission engines, and alternatives such as compressed natural gas (CNG) and hydrogen fuel cells. Compliance technologies, such as exhaust after-treatment systems and smart fuel management, are advancing, promoting investment in sustainable transport solutions aligned with global environmental goals.

Global Commercial Vehicles Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of rapid industrialization and urbanization, increasing vehicle ownership, and the growing demand for commercial vehicles due to e-commerce growth.

Asia-Pacific Commercial Vehicles Market Trends:

Asia Pacific leads the commercial vehicle market due to rapid urbanization, industrial growth, and high demand for logistics and last-mile delivery services. The booming e-commerce sector and increased investment in electric vehicle (EV) technology to meet emission standards are significant drivers. For instance, on November 16, 2024, Vecmocon Technologies, a Delhi-based vehicle intelligence company, raised USD 10 million (INR 83 Crore) in Series A funding led by Ecosystem Integrity Fund (EIF), with Blume Ventures and British International Investment. This investment augments research and development (R&D) in high-voltage systems, ESS, 5G automotive connectivity, and Zonal ECU-compliant architectures, supporting EV solutions and market expansion. China and India are key markets in the industry with strong domestic manufacturing bases.

North America Commercial Vehicles Market Trends:

Strong infrastructure development, robust logistics demand, and a notable move towards electric and hybrid trucks are the major factors fueling the commercial vehicles market in North America. Improvements in self-driving technology and connectivity are enhancing fleet management efficiency. Tough emission regulations are motivating companies to prioritize cleaner technologies are further leading to the rapid expansion of the regional market.

Europe Commercial Vehicles Market Trends:

Strict environmental regulations in Europe are influencing the market, which is resulting in the development of eco-friendly technologies such as electric and hydrogen fuel cell vehicles. The area's dedication to sustainability, along with government rewards for environmentally friendly transportation, drives the acceptance of cleaner fleet options. Moreover, the growth of logistics and e-commerce industries continues to drive a strong need for effective commercial vehicles.

Latin America Commercial Vehicles Market Trends:

In Latin America, the commercial vehicle market is seeing gradual growth due to the rising urbanization and the growing number of infrastructure projects. The augmenting demand for transport and construction vehicles is significant, especially in growing economies such as Brazil and Mexico. However, the market is also focusing on adopting cleaner and more fuel-efficient models in response to environmental concerns and regional policies.

Middle East and Africa Commercial Vehicles Market Trends:

The market in the Middle East and Africa is largely influenced by large-scale infrastructure projects and a focus on strengthening logistics networks. While traditional fuel-powered vehicles dominate, there is a budding interest in adopting cleaner technologies. The region’s economic diversification efforts and urbanization are driving the need for efficient transportation solutions.

Top Companies Leading in the Commercial Vehicles Industry

Some of the leading commercial vehicles market companies include AB Volvo, Ashok Leyland (Hinduja Group), Ford Motor Company, General Motors Company, Hyundai Motor Company, ISUZU Motors Limited, Mahindra & Mahindra Limited, Mercedes-Benz Group AG, Mitsubishi Motors Corporation, Robert Bosch GmbH, Tata Motors Limited, Toyota Motor Corporation, and Volkswagen AG., among many others. On September 16, 2024, Hyundai Motor Company, in partnership with IVECO Group, debuted the eMoovy, an electric light commercial vehicle (eLCV) for the European market, at IAA Transportation 2024 in Hannover, Germany. The eMoovy features Hyundai’s EV platform with IVECO’s cargo design, offering an 800V ultra-fast charging system and a range of up to 320 km per charge. Equipped with advanced driver-assistance systems (ADAS) and a smart battery management system, it caters to logistics operators, highlighting both companies' commitment to zero-emission commercial mobility.

Global Commercial Vehicles Market Segmentation Coverage

- On the basis of the vehicle type, the market has been categorized into light commercial vehicle, and medium and heavy-duty commercial vehicle, wherein light commercial vehicle represents the leading segment. Their popularity is due to their capacity to adjust, conserve fuel, and perform effectively in urban logistics and final mile transportation. The rise in e-commerce is enhancing the demand for agile, small vehicles that can maneuver through crowded city streets and effectively deliver goods. LCVs offer cost-effective choices for businesses by combining the capacity to carry goods with the convenience of being easy to navigate, a key element for efficient distribution and local transport activities.

- Based on the propulsion type, the market is classified into IC engine and electric vehicle, amongst which IC engine dominates the market due to their established infrastructure, proven reliability, and widespread availability. The easy access to gas and diesel stations offers users convenience, making internal combustion engines a favored choice for various purposes. Additionally, continuous advancements in engine technology are improving the fuel efficiency and emissions control, underscoring their significance in regions with limited or underdeveloped electric vehicle infrastructure.

- On the basis of the end use, the market has been divided into industrial, mining and construction, logistics, passenger transportation, others, wherein logistics represented the largest segment. The domination in the market is due to the rise in global trade, rapid urbanization, and the exponential growth of e-commerce. The demand for efficient, timely delivery services is fueling the need for advanced commercial vehicles and logistics solutions. Investments in technology, such as real-time tracking and automated warehousing, further enhance operational efficiency. This sector’s critical role in supply chain management ensures continuous growth and dominance as businesses prioritize fast and reliable transportation.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 833.3 Billion |

| Market Forecast in 2033 | USD 1,169.0 Billion |

| Market Growth Rate (2025-2033) | 3.44% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Vehicle Types Covered | Light Commercial Vehicle, Medium and Heavy-duty Commercial Vehicle |

| Propulsion types Covered | IC Engine, Electric Vehicle |

| End Uses Covered | Industrial, Mining and Construction, Logistics, Passenger Transportation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB Volvo, Ashok Leyland (Hinduja Group), Ford Motor Company, General Motors Company, Hyundai Motor Company, ISUZU Motors Limited, Mahindra & Mahindra Limited, Mercedes-Benz Group AG, Mitsubishi Motors Corporation, Robert Bosch GmbH, Tata Motors Limited, Toyota Motor Corporation, Volkswagen AG., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Commercial Vehicles Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)