Compressor Rental Market Size, Share, Trends and Forecast by Technology Type, Compressor Type, End Use Industry, and Region, 2025-2033

Compressor Rental Market Size and Share:

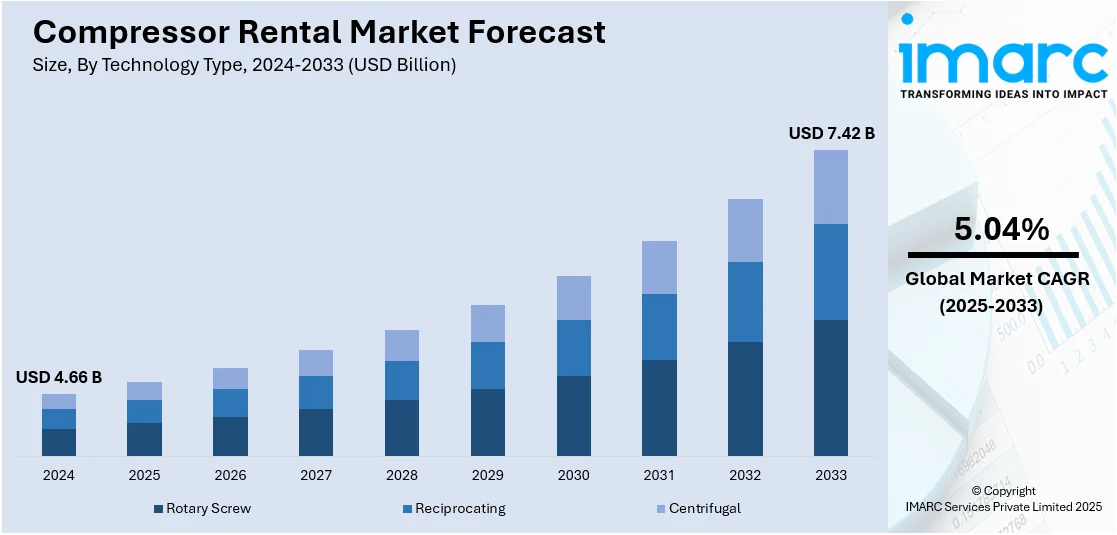

The global compressor rental market size was valued at USD 4.66 Billion in 2024. The market is projected to reach USD 7.42 Billion by 2033, exhibiting a CAGR of 5.04% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 37.6% in 2024. The market is fueled by growing needs for short-term and flexible equipment solutions across industries like construction, mining, and oil and gas. Along with this, the mounting focus on cost-effectiveness, coupled with the desire to minimize capital spending, also leads to the increased usage of rental services versus buying. Furthermore, technological advancements in compressors and an uptick in infrastructure development projects worldwide are key drivers augmenting the compressor rental market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.66 Billion |

|

Market Forecast in 2033

|

USD 7.42 Billion |

| Market Growth Rate 2025-2033 | 5.04% |

The market growth is significantly influenced by the increased demand for temporary solutions in industries like construction, mining, and oil and gas. Moreover, the need for efficient and flexible equipment, combined with cost-effective rental options, has further driven market expansion. In addition to this, the rise in infrastructure development and industrial activities across emerging economies adds to the demand for rented compressors. Besides, technological advancements that improve performance, coupled with ease of transportation and installation, enhance the appeal of renting. For instance, on February 10, 2025, ELGi Equipments announced the launch of its proprietary STABILISOR technology, aimed at transforming air compressor operations in industrial settings with fluctuating air demand. The system introduces a unique "Recirculate and Recover" principle to dynamically align compressor output with plant requirements, reducing load/unload cycles, enhancing reliability, and delivering up to 15% energy savings. Furthermore, one of the significant compressed rental market trends is the shift toward compressed air solutions for various applications.

In the United States, the market is driven by the robust infrastructure in the country and the increasing number of infrastructure and industrial projects, which are increasing the demand for compressors. For instance, on June 26, 2024, U.S. Transportation Secretary Pete Buttigieg of USD 1.8 billion in grants through the RAISE program. This funding supports 148 projects across the country, further elevating the need for temporary equipment solutions such as compressors. As construction and infrastructure projects expand, the requirement for reliable, on-demand compressor rentals continues to increase, fueling the growth of the market. Apart from this, the need for temporary, on-demand equipment, paired with the cost-effectiveness of renting versus purchasing, stimulates market development. Additionally, the increasing adoption of energy-efficient, eco-friendly compressors aligns with environmental regulations and sustainability goals.

Compressor Rental Market Trends:

Environmental Sustainability and Energy Efficiency

The global emphasis on sustainability and energy efficiency is acting as another significant growth-inducing factor. An industry survey highlights the strong importance placed on sustainability by industrial companies, with approximately 80 percent having already developed a dedicated sustainability strategy. With increasing environmental regulations and a growing commitment to reducing carbon footprints, companies are actively seeking more energy-efficient compressor solutions, creating a positive outlook for market expansion. Moreover, rental providers often offer modern, eco-friendly compressor models that meet stringent efficiency standards. These machines consume less energy while delivering the required compressed air, translating into cost savings and a smaller environmental impact. As sustainability becomes a core concern for businesses worldwide, the availability of environmentally friendly compressor rental options has become a critical factor driving the compressor rental market growth.

Infrastructure Development and Emerging Markets

The bolstering expansion of infrastructure development and construction activities, particularly in emerging economies, is contributing to the increasing demand for compressor rental. For instance, in India, total expenditure on infrastructure development has increased significantly, with budget allocations reaching INR 10 Lakh Crore (about USD 120 Billion) in 2023-24, according to an industry report. As these regions experience rapid urbanization and industrialization, there is a growing demand for compressed air in various applications, ranging from construction equipment to manufacturing processes. This is positively impacting the compressor rental market outlook. Compressor rental services provide an accessible and convenient solution to meet these demands. Apart from this, emerging economies often lack the necessary infrastructure and resources to support large-scale compressor purchases, making rentals an attractive option. As these markets continue to evolve and develop, the demand for compressor rentals is expected to rise significantly, driving market expansion.

Flexibility and Cost-efficiency in Industrial Operations

One of the key factors driving the growth of the market is the growing need for cost-friendly and versatile solutions in different industries. In addition to this, industries like construction, manufacturing, and oil and gas tend to have variable air compression requirements. Compressor rentals provide companies with the convenience of accessing compressors for particular projects or at times of high demand without the major initial capital required to buy new equipment. This flexibility allows companies to effectively utilize their assets and respond to evolving operational demands. It also decreases the cost of equipment ownership, such as maintenance, which can be considerable for intricate industrial compressors.

Compressor Rental Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global compressor rental market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology type, compressor type, and end use industry.

Analysis by Technology Type:

- Rotary Screw

- Reciprocating

- Centrifugal

Rotary screw leads the market with around 67.7% of market share in 2024. The design of rotary screw compressors offers superior efficiency and reliability in delivering a continuous and consistent supply of compressed air, making them particularly appealing for critical industrial processes where uninterrupted operation is paramount, which is strengthening the market growth. In confluence with this, the surging use of these compressors, known for their quiet and vibration-free operation, in noise-sensitive environments, such as hospitals and research facilities, are presenting lucrative opportunities for market expansion. Additionally, continuous technological advancements have led to the development of oil-free rotary screw compressors, essential in pharmaceuticals and food production industries, where air quality standards are stringent, supporting the market growth. The availability of these specialized rotary screw compressors for rent provides industries with tailored solutions that address their specific operational needs, further driving the demand for compressor rentals in this technology segment.

Analysis by Compressor Type:

- Air Compressor

- Gas Compressor

The rising demand for air and gas compressors in various specialized applications, such as oil and gas exploration, petrochemical processing, and offshore drilling, where they are required to handle specific gases and varying pressure conditions, is influencing the market growth. Besides this, compressor rental services offer access to a diverse range of air and gas compressor models, allowing industries to select equipment tailored to their precise gas compression needs, providing impetus to the market growth. Moreover, safety and compliance standards in industries dealing with hazardous gases are stringent, and rental providers often ensure that their equipment meets these standards, alleviating regulatory compliance concerns and aiding in market expansion. This specialized equipment can be costly to purchase and maintain, making rental a cost-effective and convenient solution for short-term projects or when equipment customization is necessary to accommodate specific gas types and compression requirements.

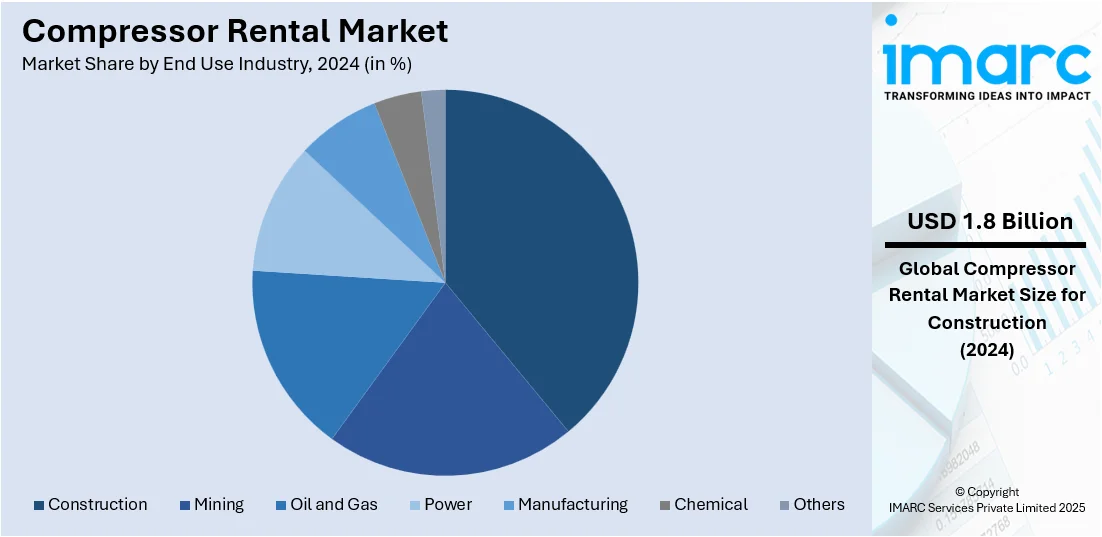

Analysis by End Use Industry:

- Construction

- Mining

- Oil and Gas

- Power

- Manufacturing

- Chemical

- Others

Construction leads the market with around 38.9% of market share in 2024. Construction projects often exhibit varying air compression needs throughout their lifecycle, from pneumatic tools and machinery during the initial construction phase to air-powered equipment required for tasks such as sandblasting and concrete spraying. Renting compressors allows construction companies to match the right equipment to each project's specific requirements without committing to the long-term costs of ownership and maintenance, thereby impelling the market growth. Concurrently, the construction sector frequently operates in dynamic and competitive environments where tight deadlines are the norm. Compressor rental services offer a quick and convenient solution, ensuring that construction projects can access the necessary compressed air equipment promptly, minimizing downtime, and keeping projects on schedule. Apart from this, as environmental regulations become more stringent, rental providers often offer modern, energy-efficient compressors that align with sustainability goals, further incentivizing the construction industry to opt for compressor rentals.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 37.6%. Rapid urbanization and infrastructure development across the Asia Pacific region, particularly in emerging economies, such as India, China, and Southeast Asian nations, are driving significant demand for compressed air in the construction, manufacturing, and mining sectors. The rising need for versatile compressor solutions to meet diverse project requirements, encouraging businesses to turn to rental services, as they offer flexibility without the substantial capital investment of purchasing equipment, is fueling the market growth. In addition to this, the increasing adoption of advanced technologies in Asia Pacific industries is pushing the demand for specialized compressors, such as oil-free and energy-efficient models, which rental providers often offer to meet stringent quality and efficiency standards, thus fostering the market growth. Moreover, the region's commitment to sustainability and environmental regulations is prompting businesses to explore eco-friendly compressor rental options, contributing to the market growth as industries seek to balance operational efficiency with environmental responsibility.

Key Regional Takeaways:

United States Compressor Rental Market Analysis

The market in the United States is primarily driven by the increasing requirement for temporary, cost-effective, and flexible equipment in sectors such as construction, manufacturing, and oil and gas. Rental compressors provide businesses with the advantage of accessing high-quality, up-to-date machinery without the large capital expenditure, making it an appealing option for short-term projects or when equipment is required intermittently. The rising expenditure on construction and infrastructure development projects across the country has significantly boosted the need for portable compressors to power tools and machinery. For instance, construction expenditure in the United States during March 2025 reached a seasonally adjusted annual rate of USD 2,196.1 Billion, recording a 2.8% increase in comparison to the March 2024 estimate of USD 2,135.8 Billion, according to an industry report. Additionally, the rental market is significantly supported by the increasing focus on minimizing equipment downtime and maintenance costs as businesses prefer renting to avoid the ongoing maintenance associated with owning compressors. Furthermore, technological advancements in energy-efficient, eco-friendly compressor models are contributing substantially to industry expansion as companies seek sustainable solutions without committing to long-term investments. Overall, the flexibility, affordability, and access to advanced technology provided by rental services continue to drive the demand for compressors in various industries, ensuring market growth in the United States.

Asia Pacific Compressor Rental Market Analysis

The Asia Pacific market is expanding due to rapid industrial growth across countries such as China, India, and Southeast Asian nations. For instance, in November 2024, the Index of Industrial Production in India recorded a growth of 5.2%, highlighting a significant increase in comparison to October 2024 at 3.5%, as per the Press Information Bureau (PIB). The region's booming construction, manufacturing, and mining sectors require reliable and efficient compressed air solutions, making rental compressors an ideal choice for temporary and specialized needs. For instance, the manufacturing sector in India recorded a growth rate of 5.8% in November 2024, while the mining industry recorded a growth rate of 1.9%, as per an industry report. The demand for flexibility and cost-effectiveness in these industries is a major driver of market growth as renting allows businesses to avoid large capital expenditures associated with purchasing equipment. The region’s focus on energy efficiency and reducing operational costs is also encouraging businesses to rent modern, eco-friendly compressors.

Europe Compressor Rental Market Analysis

The growth of the Europe market is largely driven by the region’s increasing focus on sustainability. Stringent regulations on emissions and energy efficiency in Europe are prompting businesses to seek rental solutions that adhere to environmental standards without the burden of retrofitting owned equipment. For instance, in 2023, the European Union announced a set of Commission proposals in order to reduce net GHG emissions by at least 55% by 2030 in comparison to 1990 levels, according to an industry report. As a result, a 2.6% decrease in GHG emissions was recorded in Q2 2024 in comparison to Q2 2023. As European industries increasingly prioritize green initiatives, the demand for energy-efficient, low-emission compressors is growing. As companies prioritize operational efficiency, cost savings, and compliance, the demand for compressor rental services continues to grow, positioning the market for sustained expansion across the region.

Latin America Compressor Rental Market Analysis

The Latin America market is significantly influenced by the region’s rapid urbanization and infrastructure development. As cities expand and new commercial and residential projects emerge, the demand for reliable and portable compressed air solutions is steadily rising. High-demand sectors such as mining, construction, oil and gas, and events management are fueling rental services, helping firms avoid capital expenditures and maintenance costs. According to a an industry report, mining has historically contributed between 13% and 19% of Latin America’s foreign direct investment. Besides this, the region’s fluctuating economic conditions also make rental models more appealing as they provide flexibility and cost control during uncertain times.

Middle East and Africa Compressor Rental Market Analysis

The Middle East and Africa market is experiencing robust growth, driven by the rapid expansion of the construction, oil and gas, and mining sectors, which require reliable and efficient air solutions for short-term and specialized projects. For instance, the oil and gas market in the UAE reached 3.4 BPD in 2024 and is expected to reach 4.9 BPD by 2033, growing at a CAGR of 3.7% during 2025-2033, according to an industry report. The robust oil and gas industry in the region often requires high-powered compressors for exploration and maintenance operations, contributing substantially to industry expansion. Furthermore, the increasing focus on sustainability and eco-friendly equipment solutions is driving businesses to rent modern, energy-efficient compressors, supporting market growth across the region.

Competitive Landscape:

The market is highly competitive and characterized by both established firms and local rental service providers. Major multinational firms are the market leaders, using their large global networks, multiline compressor offerings, and full-service portfolios. Additionally, the market leaders concentrate on providing a vast array of compressor types and sizes to suit varied industrial applications. Besides this, several local and regional players make important contributions to the market, specializing in niche segments or focusing on geographic regions. As per the compressor rental market forecast, the market is expected to witness significant growth due to continual improvements in compressor technology, such as the introduction of energy-efficient models, which support higher operational cost savings. This advancement is propelling increased competition among rental service companies to be able to provide the newest, most efficient equipment to address the growing demand.

The report provides a comprehensive analysis of the competitive landscape in the compressor rental market with detailed profiles of all major companies, including:

- Acme Fabcon India Private Limited

- Aggreko Plc

- Ar Brasil Compressores Ltda

- Ashtead Group Plc

- Atlas Copco AB

- Caterpillar Inc.

- Herc Rentals Inc.

- Ingersoll-Rand US Trane Holdings Corporation (Trane Technologies Plc)

- Ramirent Finland Oy (Loxam)

- United Rentals Inc.

Latest News and Developments:

- June 2025: Tavoron successfully acquired Arkansas Industrial Machinery (AIM), expanding Tavoron's sales, service, and rental operations into Tennessee, Louisiana, and Arkansas. With this acquisition, the company will be able to offer improved industrial air compressor rentals, solutions, and services to a larger clientele throughout the southern United States.

- June 2025: Herc Holdings Inc., a renowned supplier of rental equipment, including air compressors, across North America, successfully acquired H&E Equipment Services, Inc. This acquisition further solidifies the position of Herc Holdings as a prominent rental firm in the region, expanding the company’s lineup of general and specialty rentals.

- November 2024: The Specialty Rental Division of the Atlas Copco Group revealed that it will expand its rental services into Africa under the direction of a committed team to better serve the needs of local clients. With headquarters in Nairobi, Kenya, East Africa has been designated as the strategic initiative's initial phase. As part of this expansion project, Atlas Copco will offer an extensive range of rentals, including air compressor rental solutions, in the region.

- September 2024: SitePro Rentals, a prominent provider of various rental equipment, including air compressors, launched a new facility in Sherman, Texas. Spanning 17,000 sq. ft., this is the company’s nineteenth rental facility in the country and thirteenth in Texas.

Compressor Rental Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technology Types Covered | Rotary Screw, Reciprocating, Centrifugal |

| Compressor Types Covered | Air Compressor, Gas Compressor |

| End Use Industries Covered | Construction, Mining, Oil and Gas, Power, Manufacturing, Chemical, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acme Fabcon India Private Limited, Aggreko Plc, Ar Brasil Compressores Ltda, Ashtead Group Plc, Atlas Copco AB, Caterpillar Inc., Herc Rentals Inc., Ingersoll-Rand US Trane Holdings Corporation (Trane Technologies Plc), Ramirent Finland Oy (Loxam), United Rentals Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the compressor rental market from 2019-2033.

- The compressor rental market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the compressor rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The compressor rental market was valued at USD 4.66 Billion in 2024.

The compressor rental market is projected to exhibit a CAGR of 5.04% during 2025-2033, reaching a value of USD 7.42 Billion by 2033.

Key drivers of the global compressor rental market include rapid industrial and infrastructure growth, cost-effective rental over purchase, short-term project flexibility, and expanding oil & gas and construction sectors. Technological advancements—like IoT-enabled, energy-efficient compressors—and stricter environmental regulations further propel demand. Robust maintenance services and circular-economy benefits strengthen market appeal.

Asia Pacific currently dominates the compressor rental market due to rapid industrialization and urban infrastructure boom, booming manufacturing and construction sectors, rising oil & gas and chemical activities, strong cost-effectiveness of rentals, and growing demand for energy-efficient, IoT-enabled compressors.

Some of the major players in the compressor rental market include Acme Fabcon India Private Limited, Aggreko Plc, Ar Brasil Compressores Ltda, Ashtead Group Plc, Atlas Copco AB, Caterpillar Inc., Herc Rentals Inc., Ingersoll-Rand US Trane Holdings Corporation (Trane Technologies Plc), Ramirent Finland Oy (Loxam), United Rentals Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)