Computer on Module Market Size, Share, Trends and Forecast by Architecture Type, Standard, Application, and Region, 2025-2033

Computer on Module Market Size and Share:

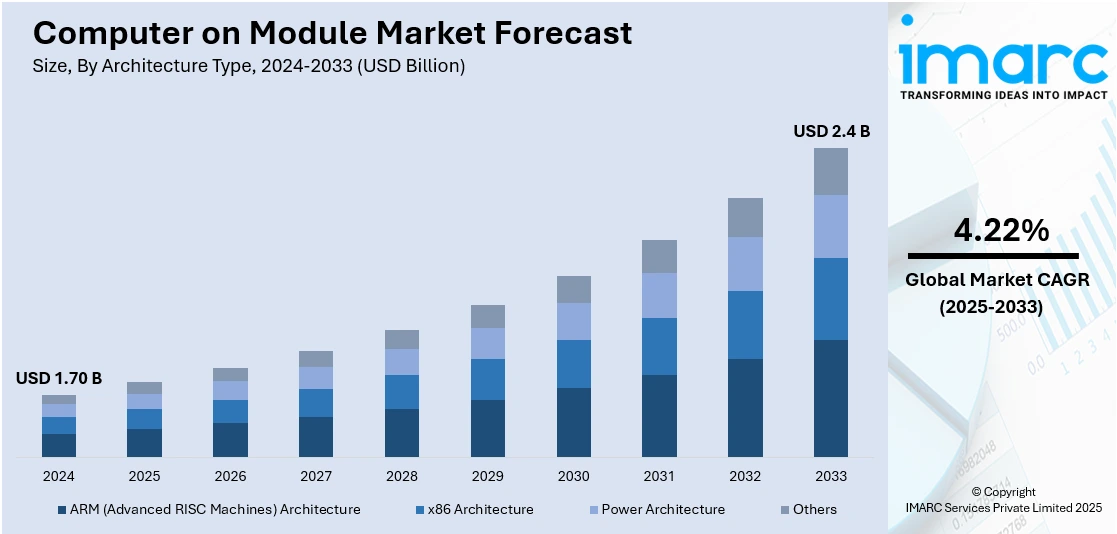

The global computer on module market size was valued at USD 1.70 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.4 Billion by 2033, exhibiting a CAGR of 4.22% from 2025-2033. Asia Pacific currently dominates the market due to the rising demand from various industries, increasing automation, and the expanding product utilization in unmanned aerial vehicles (UAVs), and robotics represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.70 Billion |

|

Market Forecast in 2033

|

USD 2.4 Billion |

| Market Growth Rate 2025-2033 | 4.22% |

The increasing adoption of industrial automation and Internet of Things (IoT)-driven solutions is a key driver for the Computer on Module (CoM) market. Manufacturing, healthcare, and transportation industries require compact, scalable, and high-performance computing solutions for real-time data processing, predictive maintenance, and machine control. CoMs enable seamless integration with IoT devices, supporting artificial intelligence (AI)-based analytics, edge computing, and industrial robotics. Their modular design allows customization based on application needs, reducing development time and costs. As Industry 4.0 adoption accelerates, the demand for CoMs with enhanced processing power, low latency, and ruggedized designs continues to grow, driving market expansion across various industrial sectors.

The U.S. remains a key market for CoM solutions, driven by industrial automation, AI, and edge computing advancements. The strong presence of semiconductor manufacturers and high adoption in aerospace, defense, and healthcare sectors fuel demand for CoMs with enhanced processing power and connectivity. The rise of IoT and Industry 4.0 accelerates CoM deployment in smart factories and autonomous systems. According to the U.S. Census Bureau, 30% of workers face exposure to advanced automation technologies, highlighting a growing shift toward intelligent manufacturing. Additionally, government investments in AI and fifth generation (5G) infrastructure support market expansion, reinforcing the U.S. as a leading hub for CoM innovation and adoption.

Computer on Module Market Trends:

Growing Demand for Edge Computing Integration

Rising use of edge computing is promoting demand for CoM solutions. Automation, medical, and telecommunications industries need network edge data to be processed in real time for efficiency improvement and latency minimization. Solutions provided by CoM are in the form of miniature, scalable, and low power designs well-suited for use in edge AI, IoT gateways, and industrial automation networks. As workloads of artificial intelligence move towards decentralization, Communication Modules with high-performance computing, low power requirements, and AI acceleration capabilities are becoming increasingly popular. By integrating innovative processors, GPUs, and NPUs in CoMs, inferencing is made faster, and analytics happen in real-time. This is further driven by increasing deployment of 5G and Industry 4.0 applications where edge devices have to process huge volumes of data autonomously.

Increasing Adoption of ARM-Based CoM Solutions

The transition towards ARM-based Computer on Modules is becoming a ruling trend because they are power efficient, cost-efficient, and scalability in performance. ARM-based CoMs are adopted extensively in consumer electronics, automotive, and embedded systems, where energy efficiency and small form factor are essential. With the progression of ARM architecture, these modules are now empowered with high-performance computing, AI acceleration, and secure processing capabilities, which also make them an ideal choice for medical devices, robotics, and industrial automation. Leading chipmakers are continuously upgrading ARM-based CoMs with enhanced processing capacity, built-in security, and increased connectivity features. With industries focusing on low-power, high-performance computing solutions, ARM-based CoMs are likely to substitute conventional x86-based modules across applications, stimulating computer on module market growth.

Expansion of CoMs in AI and Machine Learning Applications

Computer on Modules are being widely used for AI and machine learning (ML) applications in various industries such as healthcare, automotive, and retail. AI applications need high-performance computing in limited spaces, and hence CoMs are the perfect fit because of their compact size and power-optimized consumption. AI-focused CoMs have specialized hardware accelerators like GPUs, TPUs, and FPGAs to improve inference speed and efficiency. These modules are commonly employed in autonomous cars, medical imaging, predictive maintenance, and intelligent surveillance systems. With increasing adoption of AI, CoM manufacturers are placing emphasis on the inclusion of sophisticated neural processing features, support for real-time analytics, and higher memory configurations to meet the growing computational needs of AI applications.

Computer on Module Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global computer on module market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on architecture type, standard, and application.

Analysis by Architecture Type:

- ARM (Advanced RISC Machines) Architecture

- x86 Architecture

- Power Architecture

- Others

ARM (Advanced RISC Machines) architecture holds a strong position in the market for Computer on Module (CoM) products owing to energy efficiency, reduced costs, and scalability. CoMs based on ARM are extremely common in applications related to embedded systems, industrial control, and consumer electronics due to their increased processing capabilities using lesser power and their suitability in battery-powered as well as size-restricted products. Increased use of IoT, AI, and edge computing has further increased the demand for ARM architectures since they enable real-time data processing and AI acceleration. Moreover, the advancements in ARM cores have further increased their performance in processing complex computing tasks while keeping thermal efficiency intact. With industries looking for lightweight and high-performance computing solutions, ARM-based CoMs remain in a commanding position in the market space.

Analysis by Standard:

- COM Express

- SMARC (Smart Mobile Architecture)

- Qseven

- ETX (Embedded Technology Extended)

- Others

According to the computer on module market forecast, the COM Express is accounting for the majority of shares due to its versatility, scalability, and compatibility with high-performance computing applications. It enables a broad processor range, both x86 and ARM architectures, to seamlessly integrate into industrial automation, medical equipment, and military-grade computing applications. Its modularity enables simple upgrade and customization, lowering the cost of development and speeding up the time-to-market for OEMs. COM Express also boasts high-speed connection interfaces such as PCIe, USB, and Ethernet, thus finding applications in data-intensive uses, AI workloads, and edge computing uses. As the requirement for dependable, future-proof computer solutions rises, COM Express remains the industry favorite among industries requiring scalable and dependable embedded computing modules.

Analysis by Application:

- Industrial Automation

- Medical

- Transportation

- Gaming

- Communication

- Others

Based on the computer on module market outlook, the Industrial automation dominates the market demand due to the increasing need for high-performance, compact, and scalable computing systems in manufacturing and industrial processes. CoMs enable real-time data processing, machine vision, and predictive maintenance, enhancing efficiency and reducing downtime. The rise of Industry 4.0 has accelerated the adoption of IoT, AI-driven analytics, and edge computing, where CoMs play a crucial role in connecting smart sensors and automated systems. Their modular design allows for easy integration into robotic systems, PLCs, and industrial PCs. Additionally, the demand for rugged, low-power, and high-reliability computing solutions in harsh environments further strengthens the dominance of industrial automation in driving computer on module market demand.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the computer on module market share due to rapid industrialization, strong electronics manufacturing capabilities, and increasing adoption of automation across industries. China, Japan, South Korea, and India are leading the world in smart manufacturing, IoT implementation, and AI-based applications, fueling the demand for CoM solutions. The region is home to prominent semiconductor and embedded system makers, providing a strong supply chain and low-cost manufacturing. Increased investments in 5G infrastructure, automotive electronics, and medical devices also enhance market growth. Government programs promoting digital transformation and smart city initiatives also drive the adoption of CoM. With industries looking for efficient, scalable, and high-performance computing, Asia Pacific remains a superior player in the global market for CoM.

Key Regional Takeaways:

North America Computer on Module Market Analysis

North America's CoM market is being propelled by growth in industrial automation, edge computing, and artificial intelligence (AI) software applications. High-performance computing solutions demand is fueled by the region's vast pool of semiconductor manufacturers, technology companies, and embedded system designers. High growth in sectors such as aerospace, defense, healthcare, and automotive is fueling market growth. The increased adoption of AI-based applications, IoT-based systems, and autonomous technologies has also increased CoM adoption across several industries. Government investments in 5G infrastructure, smart manufacturing, and digital transformation efforts fuel market growth. The region's focus on cybersecurity and secure computing also fuels demand for CoMs with advanced encryption and real-time processing. The shift towards modular and scalable computing solutions allows companies to maximize performance with decreased development time and expense. As there is a growing need for robust, power-efficient, and compact computing solutions in mission-critical applications, North America remains the key driver of the world's CoM market. Continued advances in AI acceleration, high-speed communication, and thermal management technologies continue to reinforce the position of the region's market.

United States Computer on Module Market Analysis

United States experiences a computer on module boom adoption due to the rising Internet of Things (IoT) adoption, driving embedded computing solution demand across all industries. For instance, as of 2024 year-end, the global number of IoT devices will be more than 17 Billion, and 5.4 Billion in North America alone. Rising IoT-based solutions in manufacturing, automotive, and retail sectors are fueling demand for high-performance, space-saving computing modules. Edge computing integration speeds up real-time data processing and fuels adoption of modular computing platforms. Rising smart infrastructure programs leverage computer on module technology to facilitate efficient connectivity and automation. Growing demand for scalable, energy-efficient computing solutions drives the use of sophisticated modules in industrial applications. The advent of IoT analytics and cloud computing further enhances adoption, providing effective communication and data transfer. Increased system dependability and flexibility appeal to companies for incorporating computer on module solutions in their IoT platforms.

Asia Pacific Computer on Module Market Analysis

Asia-Pacific witnesses rapid digitalization, fuelling the growing adoption of computer on module across diverse industries. For instance, the digital India initiative was bolstered by a significant investment of approximately USD 1.8 Billion between 2021 and 2026, thus favoring the market. Expanding smart manufacturing initiatives drive the demand for modular computing systems to support automated processes and high-speed data analysis. Emerging digital transformation strategies encourage industries to integrate scalable computing modules for enhanced processing power and energy efficiency. The proliferation of consumer electronics and industrial automation accelerates the implementation of modular computing solutions in real-time applications. Rising demand for compact, power-efficient embedded systems enables widespread deployment in robotics, retail automation, and edge computing devices. Continuous advancements in semiconductor technology enhance computing performance, making modular solutions viable for evolving digital infrastructures. The need for efficient computing in smart cities, transportation, and telecommunication networks promotes the integration of high-performance computer on module systems.

Europe Computer on Module Market Analysis

Europe experiences rising demand for computer on module adoption due to growing communication sector and increasing demand for smart devices. Expanding telecommunication infrastructure accelerates the need for scalable and energy-efficient embedded computing solutions. For instance, European telecoms investment reached approximately USD 64.06 Billion in 2022, up from approximately USD 61.00 Billion the previous year. The increasing proliferation of 5G networks supports real-time data processing and seamless connectivity, fuelling the demand for high-performance modular computing systems. The growing consumer electronics market enhances the adoption of compact, power-efficient computing modules in smart home automation and portable devices. Industrial automation initiatives leverage modular computing for optimized performance in robotics and IoT-driven applications. Rising automotive advancements demand sophisticated embedded systems to enhance vehicle connectivity and autonomous functionalities. The demand for high-speed computing solutions in communication and smart device industries strengthens the reliance on advanced modules.

Latin America Computer on Module Market Analysis

Latin America sees increasing computer on module adoption due to growing medical sector and healthcare privatization. According to the Brazilian Federation of Hospitals (FBH) and the National Confederation of Health (CNSaúde), of Brazil’s 7,191 hospitals, 62% are private. Expanding digital healthcare systems require efficient computing modules for real-time patient monitoring and data analytics. Rising demand for telemedicine and wearable medical devices supports the integration of modular computing solutions in healthcare applications. Advancements in medical imaging and diagnostic equipment drive the need for high-performance embedded computing systems. Increasing healthcare automation fosters the adoption of compact, power-efficient computing modules for streamlined operations. Strengthening investment in private healthcare facilities accelerates the integration of embedded computing solutions in advanced medical technologies. The rising need for scalable computing platforms in clinical research and hospital management systems supports widespread adoption.

Middle East and Africa Computer on Module Market Analysis

Middle East and Africa witness increasing investment in industrial automation, driving the demand for computer on module adoption. For instance, Saudi Arabia’s Advanced Manufacturing Hub Strategy has identified more than 800 investment opportunities totalling USD 273 Billion, all of which are aimed at diversifying the industrial sector. By 2035, Saudi Arabia aims to increase the number of factories from around 10,000 currently to 36,000, including 4,000 of which will be fully automated. Expanding manufacturing and oil & gas sectors require robust embedded computing solutions for real-time monitoring and automation. Rising focus on smart factories and process optimization fosters the integration of modular computing systems in industrial applications. Advancements in robotics and AI-driven automation increase the demand for compact, high-performance computing solutions.

Competitive Landscape:

CoM market is intensely competitive, marked by ever-advancing technologies and differentiation driven by innovation. The competition involves developing modules that are smaller, power-hungry, and high-performing to suit a wide range of applications in industrial automation, IoT, AI, and embedded computing. The competition is boosted through the implementation of sophisticated processors, AI accelerators, and upgraded connectivity options. Customization, scalability, and extended life support are central considerations for determining the buying choices. The industry also witnesses strategic alliances, mergers, and acquisitions to broaden product offerings and reach. As there is growing demand for ruggedized and application-specialized modules, firms focus on research and development to stay ahead in the constantly changing industry scene.

The report provides a comprehensive analysis of the competitive landscape in the computer on module market with detailed profiles of all major companies, including:

- AAEON Technology Inc.

- Advantech Co. Ltd.

- Axiomtek Co. Ltd.

- congatec AG

- Digi International Inc.

- iWave Systems Technologies Pvt. Ltd.

- Kontron S&T AG (S&T AG)

- PHYTEC Embedded Pvt. Ltd.

- TechNexion, Toradex Systems (India) Pvt. Ltd.

- Variscite

Latest News and Developments:

- November 2024: Fibocom launched the FG370-KR 5G module at AIoT Korea 2024 to enhance South Korea’s 5G AIoT market. The module supported local 5G frequency bands, enabling faster deployment in industries like FWA, live streaming, and automation. South Korea's 5G subscribers reached 33 Million by March 2024, with SK Telecom leading at 15.9 Million. Fibocom’s solution provided seamless 5G connectivity with SA and NSA support for high-speed, low-latency applications.

- September 2024: Advantech launched the UNO-148 V2, a DIN-rail automation controller with advanced AI capabilities. The device featured 13th Gen Intel® Core™ processors and supported embedded MXM GPUs based on NVIDIA Ada Lovelace and Ampere architecture. Its innovative second-stack extension kit enabled seamless integration for real-time control and automation. This release aimed to enhance AI-driven industrial applications by unlocking edge AI potential.

- September 2024: Acrosser announced its first SMARC 2.1 modules, iEC-N141 and iEC-N148, featuring NXP i.MX 8M Plus processors. These modules integrated a Quad-core Cortex-A53/M7 and an optional NPU with up to 2.3 TOPS. They were designed to enhance machine learning and industrial IoT applications. The launch reinforced Acrosser’s role in advanced intelligent edge computing.

- August 2024: Toradex launched the Aquila iMX95 System on Module (SoM), the second in its Aquila family. As an NXP Platinum partner, Toradex also shipped the i.MX 95 Verdin Evaluation Kit (EVK). The SoM, based on the NXP i.MX 95 SoC, offered high processing power and advanced features. It was compatible with Torizon, simplifying industrial Linux development and maintenance.

- April 2024: Digi International unveiled the Digi ConnectCore® MP25 System-on-Module at Embedded World 2024. The module, powered by the STMicroelectronics STM32MP25 processor, enhanced efficiency and reduced costs. It offered secure, wireless capabilities for next-gen computer vision applications. The innovation enabled advanced edge processing for new device development.

Computer on Module Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Architecture Types Covered | ARM (Advanced RISC Machines) Architecture, x86 Architecture, Power Architecture, Others |

| Standards Covered | COM Express, SMARC (Smart Mobile Architecture), Qseven, ETX (Embedded Technology Extended), Others |

| Applications Covered | Industrial Automation, Medical, Transportation, Gaming, Communication, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AAEON Technology Inc., Advantech Co. Ltd., Axiomtek Co. Ltd., congatec AG, Digi International Inc., iWave Systems Technologies Pvt. Ltd., Kontron S&T AG (S&T AG), PHYTEC Embedded Pvt. Ltd., TechNexion, Toradex Systems (India) Pvt. Ltd. and Variscite |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the computer on module market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global computer on module market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the computer on module industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The computer on module market was valued at USD 1.70 Billion in 2024.

The Computer on Module market was valued at USD 2.4 Billion in 2033 exhibiting a CAGR of 4.22% during 2025-2033.

The CoM market is driven by increasing demand for industrial automation, IoT integration, and edge computing. Advancements in AI and machine learning, rising adoption in healthcare and automotive sectors, and the need for compact, power-efficient computing solutions further propel market growth, fostering continuous innovation and customization.

Asia Pacific dominates the CoM market due to rapid industrial automation, strong semiconductor manufacturing, and increasing adoption of IoT and AI-driven applications. Government initiatives supporting smart factories and 5G expansion further drive demand, while cost-effective production and a robust supply chain strengthen the region’s market leadership.

Some of the major players in the CoM market include AAEON Technology Inc., Advantech Co. Ltd., Axiomtek Co. Ltd., congatec AG, Digi International Inc., iWave Systems Technologies Pvt. Ltd., Kontron S&T AG (S&T AG), PHYTEC Embedded Pvt. Ltd., TechNexion, Toradex Systems (India) Pvt. Ltd. and Variscite, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)