Computing Mouse Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033

Computing Mouse Market Size and Share:

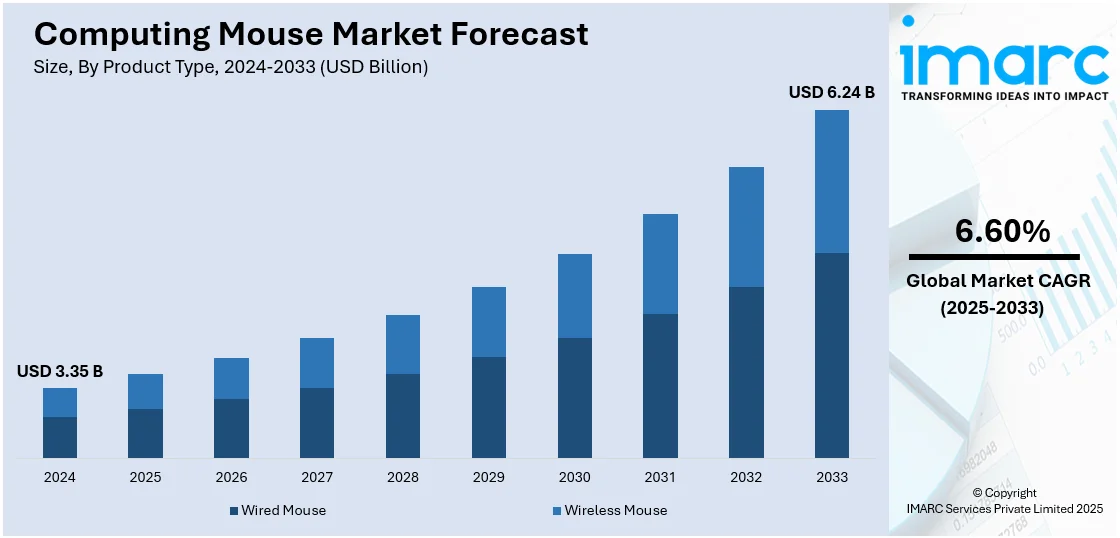

The global computing mouse market size was valued at USD 3.35 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.24 Billion by 2033, exhibiting a CAGR of 6.60% from 2025-2033. North America currently dominates the market, holding a market share of 33.5% in 2024. The market is witnessing steady growth driven by the widespread adoption of personal computers and laptops by industries, such as education, healthcare, and business. The growth in remote work and online learning has also driven demand for ergonomic and comfortable input devices, as customers are increasingly looking for mouses that provide added comfort, accuracy, and customizability to enhance productivity in long-term usage. These factors further increase the computing mouse market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.35 Billion |

| Market Forecast in 2033 | USD 6.24 Billion |

| Market Growth Rate 2025-2033 | 6.60% |

The market for computing mice is powered by a mix of changing user requirements, advances in technology, and shifting work and lifestyle habits. With increasing centralization of personal and professional computing in everyday life, users look for input devices that provide comfort as well as accuracy. The escalating usage of remote work, online learning, and digital leisure has increased the need for ergonomic and high-performance mice. Moreover, growing popularity of professional gaming and creative work has instigated demand for specialty mice featuring customizable buttons, high DPI speeds, and smoother tracking. Smart features like gestures and multi-pairing on devices, coupled with wireless communication and rechargeable batteries, also play a crucial role in dictating buying. People now require their computing periphery to perfectly suit their customized usage patterns – whether productive, design-centric, or leisure oriented. The market is also influenced by an increasing focus on design aesthetic, brand image, and device compatibility, which is further adding to the computing mouse market growth and transformation.

The United States stands out as a key market disruptor, driven by technology, consumer-centric design, and integration. American companies are spearheading the creation of mouses that transcend the functionality of basic interfaces, with ergonomic designs that are specific to long-term use, high-sensitivity sensors for gaming and professional applications, and wireless connectivity without interruption. The growth of remote work and gaming culture in the United States has driven demand for high-end peripherals that support user experience and productivity. In addition, American consumers prefer quality, brand name reliability, and performance, driving manufacturers to invest in high-end, customizable solutions. Smart technologies like gesture control, programmable macros, and adaptive DPI settings are also redefining product expectations. Moreover, robust distribution channels, e-commerce expansion, and strategic partnerships among hardware and software firms enable the US to remain a trendsetter.

Computing Mouse Market Trends:

Emergence of Ergonomic and Customizable Models

With rising awareness about health and comfort, consumers are opting for ergonomic mice that are intended to minimize strain and avoid repetitive stress injuries. As per the industry report, from March 2023, 35% of employees in the United States who have the choice to work remotely are preferring to do it full-time. Another 41% utilize a hybrid work model, and the majority of these hybrid employees express a preference for their home workspace over the office. Hence, to meet the demand for hybrid and remote workspace accessories, producers are designing mice with contoured shapes, programmable buttons, and adjustable sensitivity levels, giving users a greater degree of personalization. The trend is widely used by working professionals who are glued to their computers for long hours. The interest in ergonomic models mirrors a general movement toward computers that emphasize user well-being and comfort. Also, the use of customizable functionality provides users the ability to optimize their devices to suit particular purposes, increasing productivity and satisfaction. As these phenomena progress, they present opportunities for business professionals and online retailers alike to serve a marketplace that sees value in both form and function in their computer devices.

Wireless Technology Advancements

The market for computing mice is undergoing a tremendous change, mainly driven by the fast development of wireless technologies. Wireless connectivity, especially Bluetooth and RF (radio frequency), has transformed user convenience by removing cable clutter and improving mobility. According to the IMARC Group, the global wireless connectivity market size reached USD 135.8 Billion in 2024, and is further expected to reach USD 335.2 Billion by 2033, exhibiting a growth rate (CAGR) of 10.56% during 2025-2033. The availability of low-energy Bluetooth mice has increased battery life along with responsiveness, which makes them suitable for both casual users and professionals who need precision. This has made wireless mice more accessible and desirable to a wider population. The further development of wireless technology will continue to make computing mice increasingly more powerful and desirable, making it a standard feature in homes and offices alike.

Smart Features Integration and Multi-Device Support

There is growing demand for computing mice that provide smooth integration with multiple devices. Customers today prefer mice that would connect seamlessly across all platforms, a testament to the longing for multifunctionality in their technology devices. Bluetooth connectivity and multi-device pairing are now mere expectations, as the common use is switching between different devices without any inconvenience. This is mostly true among professionals and technically inclined consumers who need smooth workflows across different devices. Moreover, the incorporation of intelligent features like programmable buttons and onboard memory further improves user experience by offering customized settings and features. With the market constantly changing, brands that are proactive in interacting with their consumer base through feedback and customization features are most likely to succeed.

Computing Mouse Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global computing mouse market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, application, and distribution channel.

Analysis by Product Type:

- Wired Mouse

- Wireless Mouse

Wireless mouse stands as the largest component in 2024, holding around 62.5% of the market. The wireless mouse segment has become the most prominent product type in the computing mouse market due to developments in connectivity, the need for mobility by the users, and changing work environments. Wireless mice provide the advantage of cable elimination, allowing users an uncluttered workplace and more mobility. Technologies like 2.4 GHz radio frequency (RF) and Bluetooth Low Energy (BLE) have improved the responsiveness and reliability of wireless mouses to a level suitable for all manner of applications, ranging from mere browsing to work-related activities and gaming. Increased usage of laptops, tablets, and other handheld devices has contributed to the heightened demand for wireless peripherals that augment these devices. Moreover, the growth of remote working and e-learning has created the demand for flexible and comfortable input devices, making wireless mice integral pieces of equipment in contemporary computing environments.

Analysis by Application:

- Consumer Purpose

- Commercial Purpose

Consumer purpose leads the market with around 60% of market share in 2024. Consumer purpose is the most dominant application segment in the computing mouse industry as personal computers, laptops, and tablets are extensively being used in everyday life. People are dependent on mice for various tasks like web surfing, content generation, gaming, and general computing purposes. With the growing trend of digital lifestyles, consumers look for functionality, comfort, and aesthetics in peripherals. The transition to remote work, virtual education, and home entertainment has further entrenched the mouse as a staple household appliance. Manufacturers meet these demands by providing a range of mice to suit consumer tastes, such as wireless, ergonomic, and customizable devices. The wide availability of consumer-grade mice via online and retail platforms guarantees their ongoing market dominance. This segment is also aided by regular product innovation and robust brand rivalry, and hence it is a major growth and revenue driver in the overall computing mouse market scenario.

Analysis by Distribution Channel:

- Specialty Stores

- Online Stores

- Supermarkets/Hypermarkets

- Others

Specialty stores lead the market with around 42.5% of market share in 2024. Specialty stores occupy the prime position in the distribution channel segmentation of the computer mouse market owing to their capacity to provide carefully selected product ranges, professional advice, and hands-on testing. Customers browsing specialty stores generally look for certain characteristics like ergonomic features, gaming accuracy, or wireless functionality, and specialty stores are uniquely capable of satisfying these requirements. Such stores usually have relationships with leading brands to be able to display new models and developments. Experienced personnel can take consumers through technical details and ascertain the best product for specific use scenarios, whether it is for gaming, commercial purposes, or general computing. Such stores also provide after-sales services, repair facilities, and product demonstrations, which enhance customer confidence and loyalty. Their capability to merge product variety with custom service makes them a destination of choice for value-conscious customers. As computing grows more customized, the value specialty stores offer increases their position in the market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America accounted for the largest market share of over 33.5%. North America is the dominant regional segment within the worldwide market for computing mice due to a convergence of technological infrastructure, consumerism, and industry innovation. The United States is at the center of it all, holding a strong market share. This is due to the country's strong IT sector, relatively high disposable income levels, and technology-dynamic population with a penchant for adopting new technologies. The availability of personal computers, laptops, and game consoles has also increased the demand for custom input devices such as computing mice. Moreover, the growth of remote work, online classes, and e-sports has boosted the demand for high-performance, ergonomic, and wireless mice, appealing to professionals as well as hobbyists. The established retail and e-commerce infrastructure in North America guarantees broad availability and accessibility of computing mice, solidifying the region's dominance in this market segment.

Key Regional Takeaways:

United States Computing Mouse Market Analysis

In 2024, the United States accounted for over 81.60% of the computing mouse market in North America. The United States leads the computing mouse market, as the growth of remote work and e-learning has boosted the market for ergonomic and high-performance input devices remarkably. In 2024, over 1 in 4 paid workdays in the U.S. were performed from the convenience of homes, which is an increase from only 1 in 14 before the pandemic, based on information from WFH Research. Moreover, according to recent survey results from Stanford and the Federal Reserve Bank of Atlanta, the majority of companies featuring remote and hybrid policies do not plan to alter them in the coming 12 months from March 2025. Hence, both consumers and professionals require mice that provide ease, accuracy, and ease of use, boosting demand for specialized mice like those with ergonomic shapes and wireless options. Moreover, technology improvements in the form of wireless, such as Bluetooth and RF (radio frequency), have changed the market by offering improved flexibility and convenience, without the cables. Personalization and customization have also been major trends, with numerous manufacturers providing features for users to customize mice to suit their needs through interchangeable shells, weight customization, and programmable buttons, especially for gamers who want a customized experience. In addition, sustainability efforts are increasing, with businesses emphasizing the use of environmentally friendly materials and sustainable manufacturing processes to address the rising demand for eco-friendly products.

Europe Computing Mouse Market Analysis

The Europe computing mouse industry is spurred by a number of important trends, most notably the increasing popularity of wireless and ergonomic designs. With more consumers looking for minimalistic configurations, wireless mice with Bluetooth and USB dongles are increasingly in demand in both professional and personal applications. Along with wireless technology, ergonomic designs are also on the rise as individuals value comfort during long computer sessions, resulting in a boom for mice that minimize hand and wrist strain. Another major trend is the growth of gaming peripherals, with gaming mice specifically designed for high accuracy and customizable options, targeting the region's increasing gaming population. Recently, In June 2024, SLAY, a social gaming company based in Berlin, obtained USD 5 Million in seed funding, led by Accel along with additional investors. The company intended to use the investment to create an interactive social gaming platform that would allow loyal users and developers to produce their own content and engage with its virtual game centered on pets, called Pengu. Furthermore, concerns over sustainability are forcing producers to manufacture environment-friendly products with recyclable components and energy-efficient materials. Europe's robust e-commerce infrastructure is also a driving factor, as online shopping enables customers to compare and buy easily diversified mice, increasing market accessibility and growth.

Asia Pacific Computing Mouse Market Analysis

The Asia Pacific computer mouse market is witnessing rapid growth due to the rising use of personal computers, laptops, and digital devices in nations such as China, India, and Southeast Asia is a key driver. The rising digitalization has resulted in increased demand for computer peripherals, including mice. Recently, in May 2025, the United States collaborated with its Indo-Pacific allies Japan and South Korea to strengthen India's digital infrastructure. The DiGi Framework for India, signed in October 2024, highlighted the three nations' collective dedication to fostering secure and resilient digital infrastructures throughout India. Apart from this, growing demand for remote work and e-learning, spurred by the COVID-19 pandemic, has increased this need further, as people look for efficient, dependable peripherals to ramp up productivity from home. The sudden growth in the gaming market in Asia Pacific, especially in nations such as South Korea, Japan, and China, has been another prominent driver. The increased popularity of online gaming, esports competitions, and game content creation has brought about a demand for gaming mice that provide better accuracy, quicker response times, and customizability. Gamers are making their way to high-performance peripherals, considering them to be absolute necessities for competitive gaming.

Latin America Computing Mouse Market Analysis

The Latin American computing mouse market forecast indicates growth, driven by the expanding usage of personal computers and laptops in the region. The growing need for wireless and ergonomic mice has also been fueled by increased remote working and e-learning, as users are looking for convenience and comfort in their computing setup. The expanding gaming community in countries like Brazil and Mexico is another significant contributor, with gamers seeking high-performance mice tailored to their needs. Moreover, the growth of e-commerce platforms has made these peripherals more accessible to a broader audience, facilitating market expansion. According to industry reports, Instagram, WhatsApp, and Facebook are transforming the shopping experience, especially in Brazil, where 43.2% of online users used social media to discover products in the third quarter of 2023. After Brazil, Chile demonstrated significant involvement with 36.6% of users, followed by Colombia (35%) and Argentina (33.7%). These factors collectively contribute to the dynamic and evolving landscape of the Latin American computing mouse market.

Middle East Computing Mouse Market Analysis

The Middle East computer mouse market is fueled by increasing digitalization and the increased adoption of technology in most sectors. With the growth of remote work and e-learning, demand for wireless and ergonomic mice also expands. Moreover, the growing gaming community, particularly in nations such as Saudi Arabia and the UAE, is a primary driver of demand for high-performance gaming mice. Its increasing e-commerce industry also provides easier access to computing mice, increasing market demand and growth as well as customer demand for innovative, easy-to-use products.

Africa Computing Mouse Market Analysis

The Africa computing mouse market is growing at a steady pace, driven by the growing use of digital technology across urban areas, which is fueling demand for computer peripherals, including mouse devices. The growth of remote work and e-learning, spurred by the COVID-19 pandemic, has also increased this demand, as users look for efficient and ergonomic input systems. Further, the growing population of gamers in nations such as Nigeria and South Africa is driving the growth of the market with customers demanding high-performance gaming mouses.

Competitive Landscape:

Major players in the computing mouse industry are fueling growth through ongoing innovation, increased functionality, and consumer-centric focus. To address the growing demand for wireless and ergonomic options, firms have launched sophisticated features such as Bluetooth connectivity, extended battery life, and adjustable DPI settings for improved accuracy. Ergonomic designs are a top priority, as users look for comfort for extended periods of use, particularly considering the increased trend of remote work and e-learning. Mice are also being designed with customizable options, appealing to gamers with high-precision, multi-button designs that enable better performance and customization. With the gaming market growing, top brands have introduced high-performance gaming mice with RGB illumination, programmable buttons, and weight-adjustment options to serve the professional gaming segment. Further, the growth of e-commerce websites has also enabled brands to expand their reach, offering convenient access to a vast range of computing mice. Collaborations with technology giants and tie-ups with gaming influencers have further increased brand visibility. These initiatives, coupled with ongoing technological innovation, are helping major players gain market share and stay competitive in the fast-changing computing mouse market outlook.

The report provides a comprehensive analysis of the competitive landscape in the computing mouse market with detailed profiles of all major companies, including:

- Apple Inc.

- ASUS

- Corsair Gaming, Inc.

- Dell Technologies Inc.

- HP Inc.

- Lenovo Group Limited

- Logitech International S.A.

- Microsoft Corporation

- Targus International LLC

- Zowie (BenQ Corporation)

Latest News and Developments:

- September 2024: Logitech G, a division of Logitech, revealed at Logi PLAY the introduction of its newest PRO Series equipment, tailored to satisfy the needs of top esports players and competitive gamers. The updated collection features the PRO X SUPERLIGHT 2 DEX Gaming Mouse, the PRO 2 LIGHTSPEED Gaming Mouse and the PRO X TKL RAPID Gaming Keyboard.

- July 2024: Logitech G, a division of Logitech and a top innovator in gaming technology and equipment, unveiled the Logitech G309 LIGHTSPEED Wireless Gaming Mouse, a high-end mouse featuring dual-wireless connectivity, accurate tracking, and dependable performance in a reimagined design for everyone.

- April 2025: Razer introduced the Pro Click V2 and V2 Vertical Mice, providing gaming accuracy and ergonomic ease, featuring AI shortcut access and extended battery life. Both mice feature outstanding specifications aimed at attracting both gamers and productivity fans. Featuring the advanced Razer Focus Pro 30K Optical Sensor for unmatched accuracy, complemented by the lively Chroma RGB lighting for a personalized flair, and the robust mechanical switches rated for up to 60 million clicks, guaranteeing enduring performance.

- June 2023: HP launched a selection of accessories in India for individuals who work in the office as well as from home. The company states that these accessories aim to boost productivity and facilitate collaboration for the contemporary workforce. Among the launches are the Poly Voyager Free 60 UC earbuds, the HP E45c 45-inch curved display, the HP 960 4K Streaming Webcam, the HP 925 Ergonomic Vertical Mouse, and the HP Thunderbolt USB-C Dock G4.

Computing Mouse Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Wired Mouse, Wireless Mouse |

| Applications Covered | Consumer Purpose, Commercial Purpose |

| Distribution Channels Covered | Specialty Stores, Online Stores, Supermarkets/Hypermarkets, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East, Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Apple Inc., ASUS, Corsair Gaming, Inc., Dell Technologies Inc., HP Inc., Lenovo Group Limited, Logitech International S.A., Microsoft Corporation, Targus International LLC, Zowie (BenQ Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the computing mouse market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global computing mouse market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the computing mouse industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The computing mouse market was valued at USD 3.35 Billion in 2024.

The computing mouse market is projected to exhibit a CAGR of 6.60% during 2025-2033, reaching a value of USD 6.24 Billion by 2033.

The computing mouse market is driven by rising digitalization, increased remote work, and demand for ergonomic, high-performance peripherals. Growth in gaming and creative industries fuels need for precision devices. Advancements in wireless technology, customization features, and multi-device compatibility further enhance consumer interest, expanding adoption across professional and personal segments.

North America currently dominates the computing mouse market, driven by the region's robust IT infrastructure and high technology adoption rates which have led to increased demand for advanced input devices. The rise of remote work and e-sports has further fueled the need for specialized, high-performance mice. Consumer preference for ergonomic and wireless designs, along with the proliferation of gaming peripherals, has also contributed to market growth.

Some of the major players in the computing mouse market include Apple Inc., ASUS, Corsair Gaming, Inc., Dell Technologies Inc., HP Inc., Lenovo Group Limited, Logitech International S.A., Microsoft Corporation, Targus International LLC, Zowie (BenQ Corporation), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)