Connected Gym Equipment Market Size, Share, Trends and Forecast by Equipment Type, Connectivity Type, Distribution Channel, End User, and Region, 2025-2033

Connected Gym Equipment Market Size and Overview:

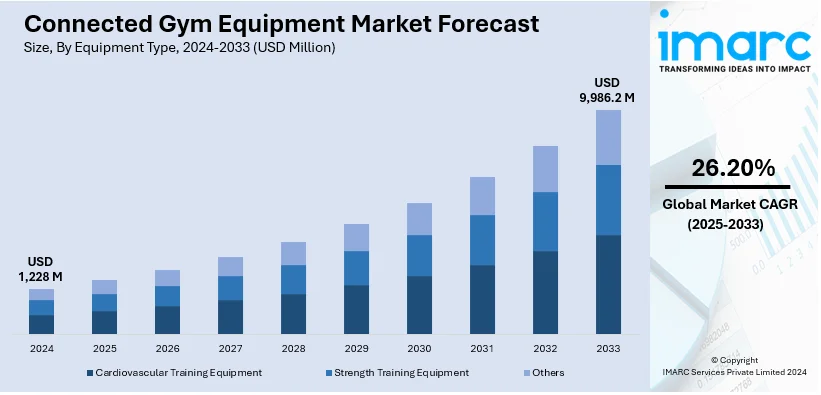

The global connected gym equipment market size was valued at USD 1,228 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 9,986.2 Million by 2033, exhibiting a CAGR of 26.20% during 2025-2033. North America currently dominates the market, holding a significant market share of over 39.8% in 2024. The connected gym equipment market share is experiencing significant growth driven by rising fitness awareness and the demand for personalized workout experiences. Increasing integration of IoT and AI enables real-time tracking and interactive features. Expanding adoption in smart homes and commercial gyms further fuels the market demand across the world.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,228 Million |

|

Market Forecast in 2033

|

USD 9,986.2 Million |

| Market Growth Rate 2025-2033 | 26.20% |

The connected gym equipment market demand is mainly driven by the rising global health consciousness and the surge in fitness trends. Technological advancements particularly in IoT and artificial intelligence enable seamless data tracking and personalized workout experiences. For instance, in September 2024, iFIT launched a new lineup of smart fitness equipment featuring an updated operating system and an AI Coach in beta. With over 40 products including the X24 Treadmill and X24 Bike users can enjoy personalized workouts and access engaging content from a library of over 10,000 sessions. The growing demand for at-home fitness solutions accelerated by the pandemic further propels connected gym equipment market share. Integration with digital platforms and fitness apps enhances user engagement while the desire for convenience and flexibility in workout routines encourages both consumers and fitness facilities to adopt connected equipment.

The United States connected gym equipment market growth is propelled by several key drivers including heightened health awareness and the booming fitness culture among Americans. Technological advancements in IoT, artificial intelligence, and data analytics enable personalized and interactive workout experiences that attract both consumers and fitness centers. The surge in at-home fitness solutions accelerated by the pandemic continues to sustain market growth. Additionally, seamless integration with popular fitness apps and digital platforms enhances user engagement and convenience. For instance, in December 2024, Echelon Fitness announced its plans to launch its innovative Cable Crossover featuring digital resistance and noise-free operation. The brand is also expanding with updates to its Strength Pro and Strength Home systems and has launched ActiveMD for telehealth services. Investments from leading equipment manufacturers and the expansion of smart gyms further bolster the market growth while widespread access to high-speed internet and mobile technology supports the adoption of connected fitness devices across the country.

Connected Gym Equipment Market Trends:

Integration with Digital Platforms and Mobile Apps

Integration with digital platforms and mobile apps allows users to connect their fitness routines with technology creating a streamlined and personalized experience. Fitness apps provide tools to track workouts, monitor progress, set goals, and access tailored training programs. This connectivity enhances motivation by offering real-time feedback, progress charts and achievement badges. For instance, in February 2024, EGYM and Virtuagym announced their partnership to integrate their fitness management technologies enhancing member management and operational efficiency for gyms. This collaboration allows seamless access to EGYM’s training equipment via Virtuagym’s platform streamlining administrative tasks and improving the overall member experience for fitness operators worldwide. Additionally, the integration supports synchronization with wearable devices such as smartwatches and fitness trackers for a holistic view of health metrics. For gym operators these platforms offer valuable insights into member preferences and performance enabling data-driven decisions. Seamlessly connecting equipment and apps fosters user engagement and operational efficiency benefiting all stakeholders.

Integration of Artificial Intelligence and Machine Learning

As per the latest connected gym equipment market outlook, artificial intelligence and machine learning are transforming fitness by delivering highly personalized workout experiences. These technologies analyze user data including fitness levels, goals, and preferences to create tailored workout plans. Real-time feedback powered by AI ensures users maintain proper form, adjust intensity and optimize performance during sessions. For instance, in October 2024, DXFactor and EGYM announced their partnership to enhance fitness industry solutions. By leveraging AI and customization they aim to improve member satisfaction and operational efficiency for fitness brands providing intuitive platforms for seamless engagement and personalized experiences. ML algorithms continually refine recommendations by learning from past performance helping users achieve better results over time. For gyms, AI-driven solutions improve member satisfaction and retention making them indispensable in modern fitness ecosystems.

Enhanced Data Analytics and Performance Tracking

Based on the recent connected gym equipment market forecast, enhanced data analytics and performance tracking have become pivotal in modern fitness experiences offering users advanced metrics to monitor their progress effectively. Smart gym equipment now captures detailed data points such as heart rate, calorie burn, workout intensity and recovery time providing actionable insights. For instance, in December 2023, Core Health & Fitness announced its partnership with EGYM to enhance the cardio workout experience by integrating advanced technology and equipment. This collaboration aims to provide gym-goers with seamless connectivity and real-time data tracking through new Android-based displays. This technology empowers users to set realistic fitness goals, adjust training plans in real-time, and maximize workout efficiency. Integrated platforms analyze historical trends and offer personalized recommendations ensuring continuous improvement. Such capabilities are especially valuable for trainers and gyms enabling them to deliver tailored programs while fostering user engagement and long-term fitness adherence.

Connected Gym Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global connected gym equipment market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on equipment type, connectivity type, distribution channel, end user.

Analysis by Equipment Type:

- Cardiovascular Training Equipment

- Strength Training Equipment

- Others

Cardiovascular training equipment stands as the largest equipment type in 2024, holding around 51% of the market. Cardiovascular training equipment dominates the connected gym equipment market due to its widespread adoption and technological advancements. Devices like treadmills, stationary bikes, and elliptical trainers now feature smart displays, fitness tracking and app connectivity making them indispensable for both gyms and home setups. Their ability to monitor heart rate, calorie burn and workout progress aligns with the growing demand for personalized fitness experiences. Integration with virtual training programs and real-time feedback further enhances user engagement. For instance, in October 2024, Centr launched nine premium treadmills combining stylish design with advanced technology and comfort. The treadmills include a free three-month membership to the Centr app for personalized coaching. As consumers prioritize health and cardio fitness the popularity of these devices continues to grow, securing their position as the largest segment in the connected gym equipment market.

Analysis by Connectivity Type:

- Bluetooth

- Wi-Fi

- Ethernet

- RFID/NFC

- Others

Bluetooth connectivity holds the largest share in the connected gym equipment market due to its reliability, ease of use and cost-effectiveness. It enables seamless pairing of gym devices with smartphones, wearables and other fitness tracking tools enhancing user convenience. Bluetooth facilitates real-time data synchronization allowing users to monitor metrics like heart rate, calorie burn and workout progress directly on their devices. Its widespread compatibility across various platforms and low energy consumption make it an attractive option for both manufacturers and users. Bluetooth ability to function without internet connectivity adds to its appeal especially in regions with limited network access.

Analysis by Distribution Channel:

- Online

- Offline

Online leads the market with around 55.0% of market share in 2024. The online segment leads the connected gym equipment market in distribution due to its accessibility, convenience and wide product availability. Ecommerce platforms provide users with the ability to compare features, prices and reviews empowering informed purchasing decisions. The rise of direct-to-consumer models has further boosted online sales with manufacturers offering exclusive discounts and promotions. Additionally, the shift in consumer behavior toward home fitness solutions especially post-pandemic has amplified online demand. Virtual showrooms, detailed product demonstrations and seamless delivery services enhance the online shopping experience making it the preferred channel for purchasing connected gym equipment globally.

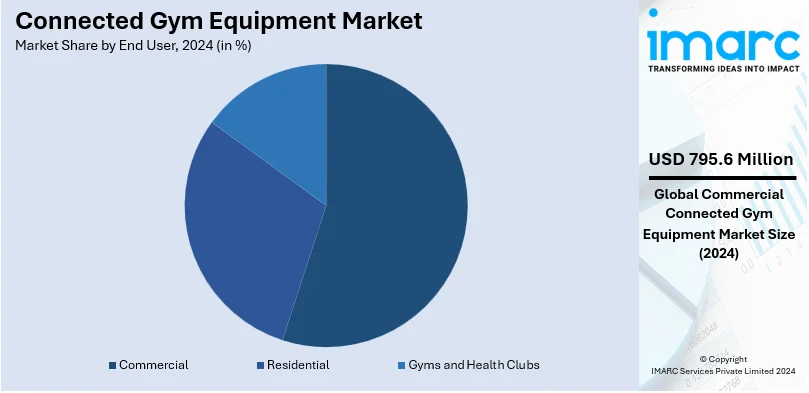

Analysis by End User:

- Residential

- Gyms and Health Clubs

- Commercial

Commercial leads the market with around 64.8% of market share in 2024. The commercial segment leads the connected gym equipment market due to the high demand from gyms, fitness centers and health clubs seeking to enhance customer experiences. These establishments invest heavily in advanced fitness technologies to attract and retain members offering personalized workouts, performance tracking and interactive training sessions. Connected equipment in commercial settings supports data integration allowing trainers to monitor progress and customize programs effectively. The trend of corporate wellness programs and partnerships with fitness chains further drives the demand. With increasing focus on technology-driven fitness solutions the commercial sector continues to dominate the market catering to a tech-savvy and health-conscious clientele.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 39.8%. North America holds the largest share of the connected gym equipment market driven by high consumer awareness and strong adoption of advanced fitness technologies. The region's robust fitness culture coupled with a high prevalence of health and wellness programs fuels demand for connected equipment in gyms and homes. Industry reports indicate that 46.9% of adults aged 18 and older meet the Physical Activity Guidelines for aerobic exercise. In addition, 24.2% of adults in this age group achieve the Guidelines for both aerobic and muscle-strengthening activities in the United States. Significant investments in smart fitness technologies by manufacturers and the widespread availability of advanced products through online and offline channels further contribute to market dominance. The growing popularity of personalized fitness solutions and integration with digital platforms also enhances user engagement. Corporate wellness initiatives and tech-savvy consumers solidify North America's leadership in this market.

Key Regional Takeaways:

United States Connected Gym Equipment Market Analysis

In 2024, US accounted for around 84.80% of the total North America connected gym equipment market. United States fitness enthusiasts are embracing smart gym solutions to elevate health and wellness experiences. Connected gym equipment such as treadmills with live streaming classes or strength machines tracking performance metrics is redefining workout routines. This technology offers personalized fitness insights helping individuals achieve goals more efficiently. Enhanced data analytics in these systems contribute to improved health outcomes by allowing users to monitor progress and adjust routines dynamically. For instance, according to the 2024 Fitness Industry Report, over 60% of Americans are prioritizing health and fitness a 29% increase from last year driving a surge in gym memberships. This growth presents a significant opportunity for connected gym equipment to enhance user engagement and deliver personalized fitness experiences. These advancements promote inclusivity by catering to various fitness levels and health conditions. With integrated connectivity users can synchronize devices for seamless health tracking across platforms fostering long-term fitness habits. The integration of these tools is bolstering the fitness industry's economic growth by attracting tech-savvy consumers and creating opportunities for innovation. These benefits are driving healthier lifestyles and improving access to fitness solutions making the nation a leader in blending technology with wellness.

Asia Pacific Connected Gym Equipment Market Analysis

Asia Pacific is emerging as a key region embracing advanced fitness technologies transforming how people approach health and wellness. Connected gym equipment is enhancing accessibility allowing users to track performance metrics in real-time through integrated apps and smart devices. Examples like personalized workout plans tailored to individual needs or virtual coaching sessions are redefining the fitness experience. This innovation benefits the region by fostering health awareness addressing lifestyle-related health concerns such as obesity and diabetes. It also aligns with the growing digital infrastructure ensuring seamless integration of devices for a more engaging fitness journey. According to the study, 66.3% of the Chinese population meets WHO's physical activity recommendations but only 21.8% of urban adults are active with leisure-time activity participation as low as 7.9% in urban areas. This highlights a significant opportunity for connected gym equipment to encourage engagement and bridge gaps in urban fitness behaviour. Additionally, the trend supports the burgeoning fitness culture among younger populations who seek technology-driven solutions to align with their active lifestyles. With these advancements Asia Pacific stands at the forefront of a fitness revolution promoting a healthier society while meeting the demands of a tech-savvy audience.

Europe Connected Gym Equipment Market Analysis

Europe is witnessing a fitness revolution through advanced gym technology transforming traditional workout experiences. Connected gym equipment is integrating seamlessly with wearable devices, apps and cloud-based systems offering personalized fitness plans, real-time feedback and virtual coaching. A notable example includes smart treadmills that sync with heart rate monitors and track performance metrics enabling users to achieve fitness goals efficiently. This trend aligns with Europe's emphasis on sustainable lifestyles as such equipment promotes energy-efficient operations and longevity through preventive maintenance alerts. For instance, more than half of German adults (52%) engage in regular sports activities with cycling, football and hiking leading the way. These active lifestyles highlight a growing market for connected gym equipment offering personalized fitness solutions to complement Germany's strong sports culture. Another key benefit is accessibility these innovations cater to individuals of varying fitness levels ensuring inclusivity in gyms and home setups. Furthermore, the digital integration facilitates remote health monitoring a significant step in promoting public health initiatives across the region. With smart features designed for convenience and precision Europe is leveraging these advancements to redefine fitness enhance user engagement and support long-term wellness strategies for its population.

Latin America Connected Gym Equipment Market Analysis

Connected gym equipment is transforming fitness experiences in Latin America by integrating smart technology with health goals. For example, devices track real-time metrics like heart rate and calorie burn enabling users to personalize their workouts effectively. Another benefit lies in the convenience of remote fitness monitoring allowing gym members to access data through apps encouraging consistency. The 2023 fitness trends survey in Brazil involving 985 respondents highlights key insights for commercial, corporate and community health sectors reflecting 539,710 registered fitness professionals and 65,665 companies. These trends present opportunities for leveraging connected gym equipment to enhance training methodologies and promote physical activity in diverse settings including medical, academic and wellness industries. Enhanced connectivity supports fitness centers in offering tailored training programs boosting client satisfaction and retention. Additionally, such advancements foster a tech-driven fitness culture making exercise more engaging and data-driven. These developments cater to evolving lifestyles meeting the region's growing demand for innovative wellness solutions.

Middle East and Africa Connected Gym Equipment Market Analysis

Connected gym equipment is reshaping fitness in the Middle East and Africa by integrating technology into workouts. Smart treadmills in Dubai track performance metrics while AI-driven bikes in South Africa provide personalized training programs. This innovation supports healthier lifestyles in regions where obesity and lifestyle diseases are growing concerns. For instance, Abu Dhabi’s survey on community sports trends revealed that 37.3% of residents meet WHO's physical activity guidelines based on responses from 10,854 participants including 57% male and 43% female. These insights can drive the adoption of connected gym equipment by aligning with government initiatives like the Abu Dhabi 360 app to enhance fitness engagement and personalized health tracking. Additionally, these solutions foster convenience enabling users to monitor progress remotely. For gym operators, enhanced data analytics improve client engagement and operational efficiency tailoring services to specific preferences. These advancements align with regional goals of promoting well-being and adopting cutting-edge technologies in fitness and wellness industries.

Competitive Landscape:

As per the emerging connected gym equipment market trends, the industry is highly competitive driven by innovation and technological integration such as IoT, AI and augmented reality to enhance user experiences. Companies are differentiating through advanced features, pricing strategies and partnerships with fitness platforms. Mergers and acquisitions are shaping the landscape allowing businesses to expand portfolios, gain technological expertise and enter untapped markets. For instance, in May 2024, Johnson Health Tech Retail expanded its global presence by acquiring BowFlex, Schwinn and the JRNY digital fitness platform. This move enhances its portfolio and commitment to fitness innovation providing diverse home gym solutions and personalized digital experiences to help customers prioritize their health and wellbeing. Investments in marketing campaigns targeting fitness-conscious demographics and the integration of products into smart home ecosystems further heighten competition. Continuous R&D efforts and strategic alliances are essential for maintaining a competitive edge and profit from on the rising demand for connected fitness solutions.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Brunswick Corporation

- Core Health & Fitness LLC

- Draper Inc.

- EGYM

- Johnson Health Tech Co. Ltd.

- Les Mills International Ltd.

- Nautilus Inc.

- Paradigm Health & Wellness

- Precor Incorporated (Peloton Interactive Inc.)

- Technogym S.p.A

- TRUE Fitness Technology Inc.

Latest News and Developments:

- In March 2024, Life Fitness introduced Symbio™, an ultra-premium cardio line at the IHRSA Convention & Trade Show in Los Angeles. The Symbio series includes the Runner (treadmill), Incline Elliptical, SwitchCycle and Recumbent Cycle all designed to harmonize with the body's natural movements. These machines feature advanced biomechanics and personalized immersive experiences to enhance user engagement.

- In April 2024, Regeneration Point renews its partnership with QINGDAO INSIGHT HEALTH TECH LTD for 2024, continuing as the exclusive Italian distributor of the fast-growing Chinese fitness brand. Known for its innovative connected gym equipment and rigorous quality control Insight offers cutting-edge strength and cardio machines. This collaboration ensures Italian fitness enthusiasts access to top-tier solutions for enhanced training experiences. Regeneration Point remains committed to promoting health and wellness through advanced fitness technology.

- In January 2024, EGYM and Life Fitness expanded their global partnership to enhance cardio workouts by integrating EGYM's fitness software with Life Fitness' cardio equipment. This collaboration aims to provide real-time workout data, performance tracking and personalized exercise recommendations with the Smart Cardio integration expected to launch in the first half of 2024.

- In September 2022, Nautilus, Inc., a leader in home fitness, introduced the Bowflex BXT8J treadmill in 2022 providing a complete fitness solution at an affordable price. This treadmill is integrated with the JRNY adaptive fitness app for personalized workouts. Users can experience high-performance cardio and seamless connectivity to fitness programs. This launch helped Nautilus diversify its product range.

- In June 2022, Johnson Health Tech became the first fitness equipment manufacturer with a wholly owned subsidiary in India through its acquisition of Cravatex Brands' fitness division. This strategic move enhanced Johnson’s presence and production capabilities in India. The company also invested in advanced product development and manufacturing technologies. This acquisition has fueled its global expansion.

Connected Gym Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Cardiovascular Training Equipment, Strength Training Equipment, Others |

| Connectivity Types Covered | Bluetooth, Wi-Fi, Ethernet, RFID/NFC, Others |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Residential, Gyms and Health Clubs, Commercial |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Brunswick Corporation, Core Health & Fitness LLC, Draper Inc., EGYM, Johnson Health Tech Co. Ltd., Les Mills International Ltd., Nautilus Inc., Paradigm Health & Wellness, Precor Incorporated (Peloton Interactive Inc.), Technogym S.p.A and TRUE Fitness Technology Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the connected gym equipment market from 2019-2033.

- The connected gym equipment market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the connected gym equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The connected gym equipment market was valued at USD 1,228 Million in 2024.

IMARC estimates the connected gym equipment market to exhibit a CAGR of 26.20% during 2025-2033.

The market is driven by rising fitness awareness, demand for personalized workouts, technological advancements in IoT and AI and the increasing adoption of at-home fitness solutions post-pandemic.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the connected gym equipment market include Brunswick Corporation, Core Health & Fitness LLC, Draper Inc., EGYM, Johnson Health Tech Co. Ltd., Les Mills International Ltd., Nautilus Inc., Paradigm Health & Wellness, Precor Incorporated (Peloton Interactive Inc.), Technogym S.p.A and TRUE Fitness Technology Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)