Construction Drone Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Construction Drone Market Size and Share:

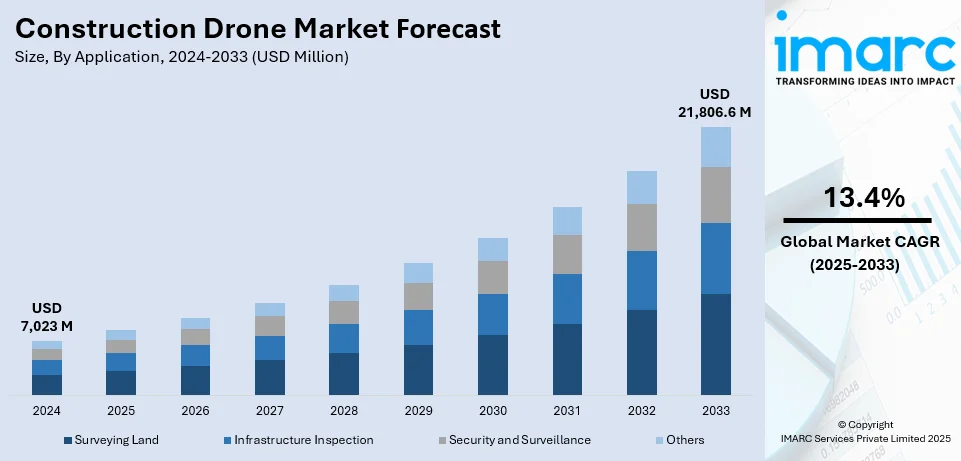

The global construction drone market size was valued at USD 7,023 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 21,806.6 Million by 2033, exhibiting a CAGR of 13.4% from 2025-2033. North America currently dominates the market, holding a market share of over 42.7% in 2024. This market is chiefly driven by early adoption of leading-edge drone technologies across the construction industry and resilient infrastructure development initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7,023 Million |

|

Market Forecast in 2033

|

USD 21,806.6 Million |

| Market Growth Rate (2025-2033) | 13.4% |

The global construction drone market is witnessing substantial expansion, mainly propelled by magnifying utilization of automation in the construction sector and increasing innovations in drone technology. Drones improve project effectiveness by facilitating accurate data collection, rapid surveys of sites, and real-time progress surveillance, consequently lowering both labor costs and time. Moreover, the magnifying requirement for sustainable construction methods further bolsters drone deployment, as they ensure waste minimization and resource optimization. In addition, regulatory policies endorsing drone utilization and the accelerating incorporation of machine learning and artificial intelligence (AI) in drone applications are supporting the market’s growth trajectory, guaranteeing enhanced precision and decision-making abilities for construction ventures globally.

The United States is significantly contributing to the growth in the global construction drone market, majorly because of growing adoption of automation technologies and its leading-edge infrastructure base. Drones are notably improving operational efficacy by facilitating accurate site mapping, progress assessment, and safety evaluations, hence minimizing expenditure as well as project timelines. In addition to this, elevating investments in mega-scale construction ventures, mainly including infrastructure and smart cities upgrades, are further magnifying need. For instance, in March 2024, the U.S. Department of Transportation announced the availability of applications for four significant grant initiatives, collectively offering funding of approximately USD 7.5 billion for transportation and infrastructure projects. Furthermore, favorable regulatory policies and technological innovations, encompassing incorporation of data analytics or AI, solidify the market growth. Such crucial factors establish the United States as a critical contributor to both adoption and advancements in the construction drone industry.

Construction Drone Market Trends:

Increased Efficiency and Cost Savings in Construction Projects

Drones significantly enhance the efficiency and reduce costs associated with construction projects. They provide a faster and more accurate method for surveying and mapping, replacing traditional ground-based methods. For instance, drones can capture high-resolution aerial images and generate detailed 3D models of construction sites, which aids in better planning and decision-making. According to a study by PwC India, drones can reduce construction project costs by up to 20%. Moreover, their ability to perform tasks such as site inspections, progress monitoring, and volume measurements quickly and accurately leads to time savings and reduced labor costs. Additionally, drones can access hard-to-reach areas, minimizing the need for scaffolding or other equipment, thereby further cutting expenses. Besides, their capacity to gather data in real-time allows for prompt adjustments and corrections, preventing costly mistakes and delays, resultantly driving a positive constriction drone market growth. This efficiency gain translates into significant financial benefits for construction firms, making drones a valuable investment in the long run.

Increased Data Collection and Analytics Capabilities

Drones are empowered with revolutionary imaging technologies and sensors that notably improve both data collection and analytics attributes in the construction segment. They are highly capable of capturing high-definition thermal images, photos, and videos, offering in-depth data sets that can be assessed for wide range of applications. For instance, drones can be deployed for topographic mapping, generating accurate elevation models, and surveilling environmental parameters. According to a report by JOUAV, drones can complete a survey in 60-70% lesser time and reduce risks to individuals in rugged terrain. This data can be analyzed by leveraging high-tech software to offer expertise into project growth, pinpoint viable issues, and upgrade resource allocation. In addition, the capability of analyzing large sets of data assists in formulating informed decisions, enhancing project outcomes, and improving overall productivity, thus creating a positive construction drone market outlook. Furthermore, drones enable continuous monitoring, allowing construction managers to track progress and make necessary adjustments instantly, guaranteeing projects remain on track and within financial limits.

Increasing Adoption of Drones for Surveying and Mapping

The use of drones for surveying and mapping is becoming increasingly common in the construction industry due to their accuracy and efficiency. Traditional surveying methods are time-consuming and labor-intensive, whereas drones can cover large areas quickly and provide highly accurate data. According to McKinsey, the number of drone-delivered packages increased by more than 80% from 2021 to 2022, reaching nearly 875,000 worldwide. This speed and efficiency translate into significant cost savings and improved project timelines. Moreover, drones equipped with LiDAR (Light Detection and Ranging) and other advanced construction drone technology can produce detailed topographic maps and 3D models, which are essential for site planning and design. These maps and models help in identifying potential issues early in the project, reducing the risk of costly changes and delays. Furthermore, the ability to quickly and accurately survey and map construction sites is driving the widespread adoption of drones in the industry, leading to improved project outcomes and increased competitiveness for construction firms.

Construction Drone Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global construction drone market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end user.

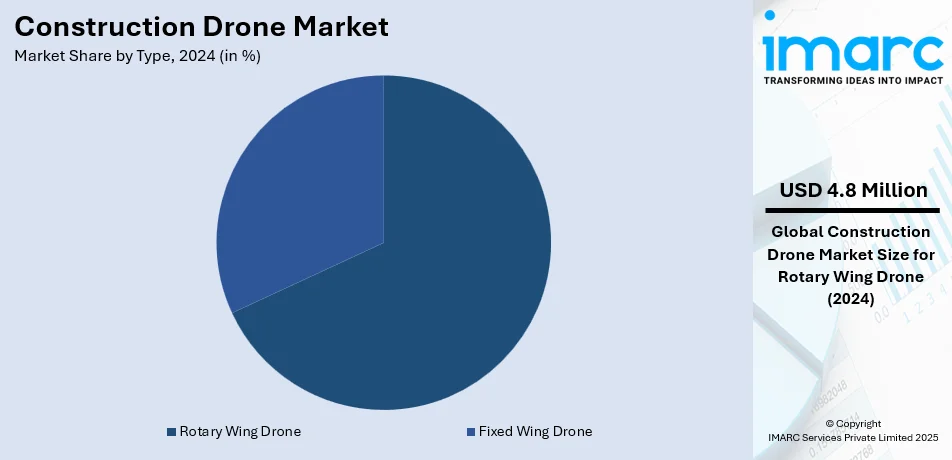

Analysis by Type:

- Fixed Wing Drone

- Rotary Wing Drone

Rotary wing drone is the leading type in 2024, holding around 68.3% of the market share. Rotary wing drones have emerged as the largest segment in the market breakup by type due to several key factors that underscore their versatility and widespread applicability. Unlike fixed-wing drones, rotary wing drones, such as quadcopters and hexacopters, are capable of vertical takeoff and landing (VTOL), which allows them to operate in confined and complex environments without the need for runways. This capability makes them ideal for a variety of applications, from aerial photography and surveillance to agricultural monitoring and delivery services. One of the primary reasons for the dominance of rotary wing drones is their superior maneuverability. They can hover in place, fly in any direction, and perform agile movements, which is crucial for tasks that require precision and stability, such as infrastructure inspection, search and rescue missions, and filming. Their ability to maintain a stable position in the air also makes them suitable for collecting high-quality data and imagery, a feature highly valued in industries such as real estate, media, and environmental research, thus positively contributing to the construction drone industry revenue.

Analysis by Application:

- Surveying Land

- Infrastructure Inspection

- Security and Surveillance

- Others

Surveying land leads the market with around 57.5% of market share in 2024. Surveying land holds the largest segment in market breakup by application due to several key factors that underscore its fundamental importance across various industries. Primarily, land surveying is critical for infrastructure development, which includes the construction of roads, bridges, buildings, and other essential public works. Accurate land surveys ensure that these structures are built on solid ground, comply with legal property boundaries, and adhere to safety regulations. This foundational role in construction and urban planning drives a consistent demand for land surveying services. Another significant factor is the real estate sector, where land surveying is indispensable for property transactions. Accurate surveys are crucial for determining property boundaries, resolving disputes, and providing legal documentation for sales and purchases. This necessity in the real estate market ensures a steady flow of business for surveying professionals.

Analysis by End User:

- Residential

- Commercial

- Industrial

The residential market segment primarily encompasses private dwellings, including single-family homes, apartments, townhouses, and condominiums. This segment is driven by various factors such as population growth, urbanization, and the increasing demand for housing. Homeownership trends, mortgage rates, and government policies related to housing also significantly impact this market. Innovations in smart home technologies have revolutionized the residential sector, enhancing convenience, security, and energy efficiency for homeowners. This includes the adoption of smart thermostats, security systems, and home automation devices.

The commercial market segment includes office buildings, retail spaces, hotels, restaurants, and other establishments primarily used for business activities. This sector is heavily influenced by economic conditions, business investments, and consumer spending patterns. Commercial real estate trends are closely tied to the overall health of the economy; when businesses expand, the demand for office space, retail outlets, and hospitality facilities increases. Technological advancements are also shaping the commercial sector, with the rise of e-commerce impacting the demand for traditional retail spaces while increasing the need for warehouses and distribution centers, thereby leading to a positive market growth.

The industrial market segment covers facilities used for manufacturing, production, storage, and distribution, including factories, warehouses, and logistics centers. This segment is influenced by industrial production trends, global trade dynamics, and technological advancements. The rise of Industry 4.0, characterized by the integration of automation, IoT, and AI in manufacturing processes, is transforming the industrial sector. Smart factories and warehouses utilize advanced robotics, real-time data analytics, and connected devices to optimize efficiency and productivity.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 42.7%. North America holds the position as the leading regional market in the global construction drone industry, principally propelled by cutting-edge technological adoption and resilient infrastructure development. The region's robust presence of major industry giants and magnifying investments in drone technology for construction ventures significantly foster its dominance. In addition, amplifying requirement for drones in project management, surveying, and monitoring bolsters market expansion, facilitated by beneficial policies and government programs endorsing drone deployment. The construction sector’s strong emphasis on improving operational efficacy and lowering project timelines has further fueled adoption. Furthermore, the accelerating prevalence of wide-ranging urbanization and smart city initiatives boosts the adoption of drones for 3D modeling and precision mapping. For instance, as per industry reports, in 2024, 82.2% of the North American population, or 316,678,341 individuals, reside in urban areas. Besides, The U.S. is a crucial nation in this regional market, with Canada also witnessing notable expansion, positioning North America as a pivotal hub for drone advancements and product proliferation n the construction drone industry.

Key Regional Takeaways:

United States Construction Drone Market Analysis

In 2024, United States accounted for the 82.70% of the market share in North America. The U.S. construction drone market is witnessing significant growth, driven by technological advancements and increasing demand for improved efficiency and safety in the sector. Drones are transforming project management by offering real-time aerial data for surveying, site inspections, and monitoring progress, which reduces costs and enhances precision. The U.S. government has played a pivotal role in supporting this growth, with initiatives like the USD 13.4 Million in Title III investments from the Department of Defense (DoD) under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). This funding aims to bolster the domestic small unmanned aerial system (sUAS) industry, helping to sustain jobs and stimulate economic recovery during the COVID-19 crisis. The FAA's regulatory support has further facilitated drone adoption in construction by streamlining flight permissions for commercial use. Additionally, drones are helping construction companies optimize resources and improve safety standards, reducing human exposure to hazardous environments. As the demand for infrastructure projects grows, the U.S. construction drone market is expected to continue expanding, driven by the need for more efficient and sustainable construction practices.

Europe Construction Drone Market Analysis

The construction drone market in Europe is experiencing robust growth, driven by a strong focus on innovation, digitalization, and sustainability in the construction sector. Nations like Germany, France, and the United Kingdom are leading the way in adopting drone technology for surveying, site monitoring, and progress tracking, providing real-time, accurate data that improves project management and decision-making. The European Union’s regulatory framework, supported by agencies like the European Union Aviation Safety Agency (EASA), is helping standardize safety guidelines and facilitate widespread drone adoption. A prime example of the region's commitment to innovation is German startup Wingcopter, which recently secured a EUR 40 Million (USD 43.3 Million) investment to boost its sustainable electric delivery drones. Currently used for both commercial and humanitarian projects, Wingcopter's technology is set to ramp up development, expanding its capabilities across various sectors, including construction. This focus on sustainability and efficiency aligns with Europe’s increasing demand for environmentally conscious solutions in construction. As the construction industry continues to embrace drones for their cost-effectiveness, safety benefits, and ability to streamline operations, Europe is positioned for continued growth in drone adoption, fostering innovation and enhancing the competitiveness of its construction sector.

Asia Pacific Construction Drone Market Analysis

The construction drone market in the Asia-Pacific (APAC) region is expanding rapidly, driven by urbanization, technological advancements, and a growing demand for efficient construction practices. Countries like China, Japan, and India are at the forefront of this growth. In India, the drone industry has "leapfrogged" in the past decade, gaining significant momentum after the COVID-19 pandemic. Companies like IdeaForge, are now entering international markets like the U.S., capitalizing on the growing reluctance to purchase Chinese-made drones. This shift highlights the increasing importance of domestic drone manufacturing in APAC, as drones are used for surveying, monitoring, and enhancing safety on construction sites. The region's growing infrastructure projects, combined with the integration of drones into emerging technologies such as AI and real-time data analytics, are accelerating adoption. Despite some regulatory challenges, APAC’s construction industry is embracing drones as critical tools for improving project efficiency and reducing operational costs.

Latin America Construction Drone Market Analysis

The construction drone market in Latin America is growing steadily, with Brazil emerging as a key player. According to ANAC, around 2,400 companies are currently registered for drone operations in Brazil, highlighting the region’s increasing adoption of drone technology. Drones are being utilized for tasks such as site surveying, progress monitoring, and real-time data collection, which improve efficiency and reduce costs in construction projects. As urbanization and infrastructure development continue to expand across the region, drones are becoming essential tools for enhancing safety and precision. Despite regulatory challenges, the market is poised for sustained growth, driven by innovation and demand.

Middle East and Africa Construction Drone Market Analysis

The construction drone market in the Middle East is gaining momentum, driven by rapid urbanization and large-scale infrastructure projects. According to UNDP, 55.8% of the Arab region's population lived in urban areas in 2015, a figure projected to rise to 58% by 2030. This urban growth fuels the demand for efficient construction practices, where drones play a critical role in tasks such as site inspections, surveying, and progress monitoring. Countries like the UAE and Saudi Arabia are leading the adoption of drone technology, leveraging it to enhance safety, reduce costs, and accelerate project timelines, particularly for smart cities and mega-projects.

Competitive Landscape:

The global construction drone market is marked by vigorous competition among leading players, principally influenced by innovations in drone technology and accelerating deployment in both infrastructure and construction projects. Prominent companies augment their domination in the market by leveraging advancements in autonomous navigation, drone mapping, and data analytics, to sustain a competitive lead. Furthermore, partnerships with construction enterprises and elevated investments in research and development initiatives further magnify their market foothold. For instance, in November 2024, Kier Group Limited, an infrastructure and construction firm, entered a strategic partnership with DroneDeploy, to improve its operations across construction ventures. DroneDeploy will provide its cutting-edge drone mapping services to enhance Kier's operational efficacy. Numerous regional players and start-ups are also stepping into the arena, providing cost-efficient solutions customized to local requirements. In addition, tactical acquisitions, collaborations, and mergers are significantly steering the competitive ecosystem, as various businesses strive to improve their product offerings and augment their geographic footprint. Besides, regulatory adherence and after-sales services are crucial differentiators.

The report provides a comprehensive analysis of the competitive landscape in the construction drone market with detailed profiles of all major companies, including:

- 3d Robotics Inc.

- Aerialtronics

- Delair

- Dronedeploy Inc.

- Kespry Inc.

- Parrot Drone SAS

- Precisionhawk Inc.

- Skydio Inc.

- SZ DJI Technology Co. Ltd. (iFlight Technology Company Limited)

- Teledyne Flir LLC (Teledyne Technologies)

- Yuneec International Co. Ltd.

Latest News and Developments:

- November 2024: Garuda Aerospace partnered with CYOL to launch operations in Sri Lanka, expanding its presence in South Asia and beyond. The company offers advanced drone solutions for agriculture, surveillance, mapping, and defense.

- October 2024: JSW Group has invested in Aereo, a drone technology firm specializing in mapping, surveying, and monitoring solutions, to enhance operational efficiency across its business segments.

- August 2024: Rotor Technologies unveiled two UAVs for 2025: Airtruck, a utility drone, and Sprayhawk, an agricultural drone, both with a 2,500-lb takeoff weight and priced under USD 1 Million. Developed with Robinson, these drones offer extended flight times and larger payloads.

- July 2024: DTDC, in partnership with Skye Air Mobility, introduced drone-based deliveries, completing its first delivery from Bilaspur to Gurugram (Sector 92) in 3–4 minutes, significantly reducing transit time. This initiative aims to enhance delivery efficiency while supporting eco-friendly logistics by minimizing carbon emissions and traffic congestion.

- June 2024: Blue Dart announced the launch of drone deliveries in partnership with Skye Air, initially targeting the e-commerce sector. The company has previously conducted VLOS trials in Vikarabad (Hyderabad) and BVLOS trials under Telangana's 'Medicine from the Sky' initiative, showcasing its commitment to advancing drone technology in logistics.

Construction Drone Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing Drone, Rotary Wing Drone |

| Applications Covered | Surveying Land, Infrastructure Inspection, Security and Surveillance, Others |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3d Robotics Inc., Aerialtronics, Delair, Dronedeploy Inc., Kespry Inc., Parrot Drone SAS, Precisionhawk Inc., Skydio Inc., SZ DJI Technology Co. Ltd. (iFlight Technology Company Limited), Teledyne Flir LLC (Teledyne Technologies), Yuneec International Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the construction drone market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global construction drone market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the construction drone industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The construction drone market was valued at USD 7,023 Million in 2024.

The construction drone market is projected to exhibit a CAGR of 13.4% during 2025-2033, reaching a value of USD 21,806.6 Million by 2033.

The market is driven by increasing adoption of drones for site surveying, mapping, and project monitoring, alongside advancements in drone technology offering higher precision and efficiency. Additionally, rising demand for cost-effective and time-saving construction solutions supports market growth, particularly in infrastructure development projects worldwide.

North America currently dominates the construction drone market, accounting for a share of 42.7% in 2024. The dominance is fueled by continual technological advancements, high adoption rates in construction, regulatory support, and increasing demand for efficient project monitoring and surveying solutions.

Some of the major players in the construction drone market include 3d Robotics Inc., Aerialtronics, Delair, Dronedeploy Inc., Kespry Inc., Parrot Drone SAS, Precisionhawk Inc., Skydio Inc., SZ DJI Technology Co. Ltd. (iFlight Technology Company Limited), Teledyne Flir LLC (Teledyne Technologies), and Yuneec International Co. Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)