Contactless Payment Market Size, Share, Trends and Forecast by Technology, Device, Solution, Application, and Region, 2025-2033

Contactless Payment Market 2024, Size and Trends:

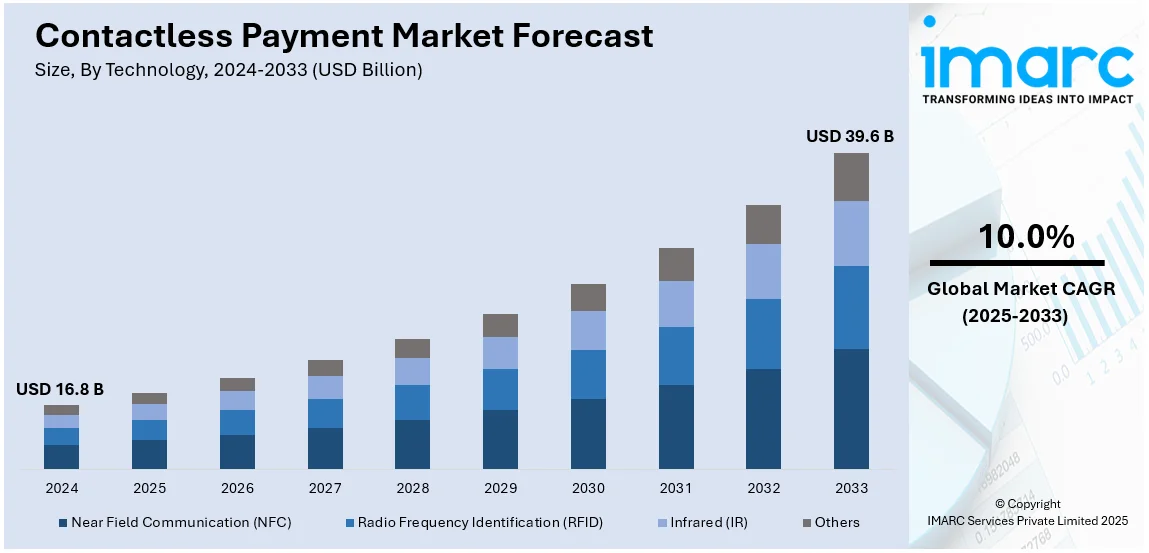

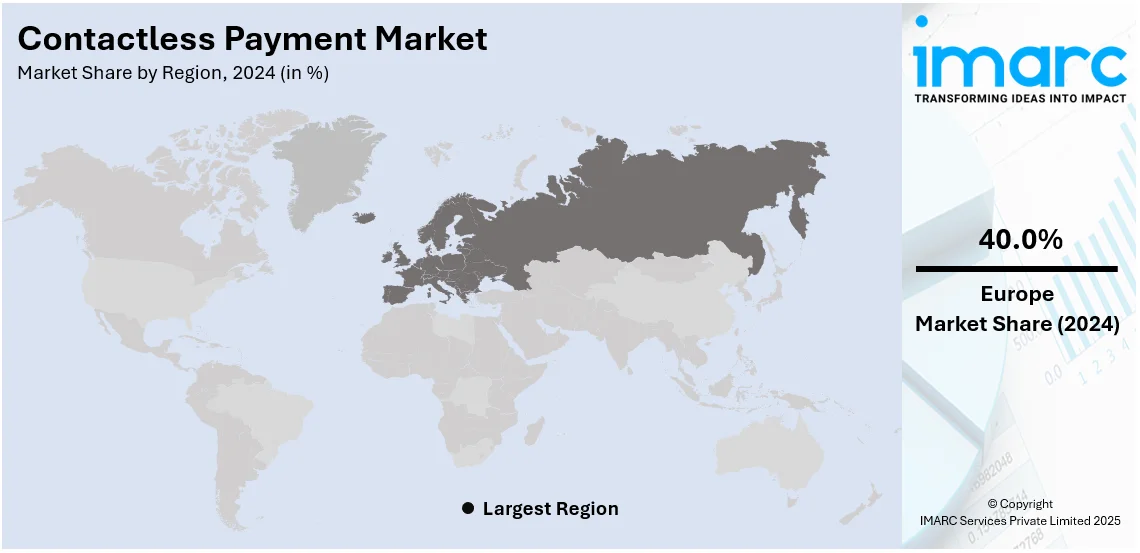

The global contactless payment market size was valued at USD 16.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 39.6 Billion by 2033, exhibiting a CAGR of 10.0% from 2025-2033. Europe currently dominates the market, holding a market share of over 40.0% in 2024. The increasing demand for convenient and hygienic payment methods, widespread adoption of smartphones and wearable devices, and advancements in secure payment technologies such as NFC and tokenization, are some of the key factors, facilitating the expansion of the contactless payment market share.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.8 Billion |

| Market Forecast in 2033 | USD 39.6 Billion |

| Market Growth Rate (2025-2033) | 10.0% |

The transition from traditional payment methods such as cash and cards to contactless payment solutions is primarily fueled by the increasing demand for convenience, speed, and security in financial transactions. The adoption of this technology is accelerated by the convergence of mobile devices, digital wallets, and near-field communication (NFC) technology, alongside broader societal trends such as the move towards cashless economies. The global shift towards cashless economies has also played a pivotal role in fostering the adoption of contactless payment solutions. Governments and financial institutions in various countries have been encouraging the use of digital payments to reduce the reliance on cash, combat tax evasion, and increase financial transparency.

The United States has emerged as a major region in the contactless payment market owing to various factors. The proliferation of smartphones and other mobile devices in the US is a primary driver of the contactless payment market. Smart devices serve as the backbone for digital wallets which have become widely adopted for both in-store and online purchases. The convenience of tapping a smartphone or smartwatch at a point-of-sale (POS) terminal has resonated with individuals, who increasingly prefer faster and hassle-free payment methods over traditional cash or card-based systems. Furthermore, the integration of NFC technology into most modern smartphones and wearable devices has provided a seamless and secure way to conduct contactless transactions, further increasing their popularity. As per the predictions of the IMARC Group, the US mobile payment market is expected to reach USD 3,901.8 billion by 2032. This will further drive the contactless payment market demand.

Contactless Payment Market Trends:

Increased Adoption of Mobile Wallets

The growing use of smartphones and mobile wallet applications, such as Apple Pay, Google Wallet, and Samsung Pay, is primarily driving the adoption of contactless payments. For instance, the volume of mobile wallet transactions was about four billion in the financial year 2021, a significant increase from about 32.7 million transactions in the financial year 2013, as per reports. Additionally, the mobile wallet transaction volume in India is expected to reach around 71 billion by 2025. Moreover, the mobile rate penetration in India was 15.7% in 2020 and is expected to reach 30% in 2025. Significant growth in the adoption of smartphones is expected to propel the contactless payment market share in the coming years. Furthermore, the integration of contactless payment technology, such as near-field communication (NFC) technology, into wearable devices like smartwatches and fitness trackers is enhancing convenience and user adoption. Besides this, the growth in contactless debit card and credit card transactions in retail stores and outlets is anticipated to catalyze the market demand for contactless terminals in the retail sector over the forecast period. For example, the most popular payment method in the UK last year was debit cards, which accounted for 45% and 28%, respectively, of all payments made at POS terminals, according to statistics from Worldplay.

Technological Advancements

Continuous advancements in near-field communication (NFC) and radio-frequency identification (RFID) technologies are enhancing the efficiency and reliability of contactless payments. Various key market players are increasingly investing in facilitating smooth contactless payment processes. For instance, in October 2023, Softpay and Dotykacka collaborated to introduce a Tap-to-phone Payment Solution in the Czech Republic and Slovakia, utilizing Nexi as an Acquirer. Tap-to-phone technology provider SoftPay announced a strategic partnership with multifunctional POS system solution provider Dotykacka to meet the growing demand for contactless payment acceptance in the Czech Republic and Slovakia. Additionally, advancements in blockchain technology promise to further secure transactions and streamline processes. These innovations collectively drive the growth and adoption of contactless payment solutions, offering enhanced security, efficiency, and user experience. For instance, in May 2024, VeChain, a leading blockchain platform, announced its plan to revolutionize the integration of blockchain technology with Near Field Communication (NFC) chips to enhance data authenticity and unlock new market opportunities. This strategic move aims to reshape the retail landscape by leveraging blockchain’s inherent trust and immutability. Such innovations are anticipated to propel the contactless payment market size in the coming years.

Regulatory Initiatives and Framework

The government authorities of various nations are taking initiatives to establish security standards and safeguard against fraud, thereby building trust in the contactless payment market. Regulatory frameworks, such as the General Data Protection Regulation (GDPR) in Europe, enforce stringent data protection measures. Guidelines from bodies like the Payment Card Industry Data Security Standard (PCI DSS), set standards for secure transactions. Government authorities are also supporting the adoption of contactless payments through initiatives that encourage digital transactions and reduce reliance on cash. For instance, in February 2024, the Reserve Bank of India (RBI) released a major policy statement outlining several developmental and regulatory initiatives covering financial markets, regulations pertaining to lending institutions, and payment systems, including digital currency and fintech. On the financial markets front, RBI announced that it would comprehensively review the existing regulatory guidelines for Electronic Trading Platforms (ETPs) that enable transactions in financial instruments regulated by RBI, such as foreign exchange and government securities. Such initiatives by the government authorities of various nations are anticipated to catalyze the growth in the contactless payment industry over the forecasted period.

Contactless Payment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global contactless payment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, device, solution, and application.

Analysis by Technology:

- Near Field Communication (NFC)

- Radio Frequency Identification (RFID)

- Infrared (IR)

- Others

Near field communication (NFC) leads the market. Near field communication (NFC) is a short-range wireless technology that enables communication between devices within a few centimeters. It is widely used in contactless payments, allowing secure transactions by simply tapping a smartphone or contactless card near an NFC-enabled terminal. NFC enables fast transaction speeds, enhanced security through encryption, and convenience, as it eliminates the need for physical contact or swiping. NFC is a fundamental technology behind mobile wallets and tap-to-pay systems. Devices equipped with NFC chips, such as smartphones, wearable devices, and contactless cards, enable users to make secure transactions simply by tapping their device on an NFC-enabled point-of-sale (POS) terminal. Payment services leverage NFC technology to provide seamless and secure payment experiences.

Analysis by Device:

- Smartphones and Wearables

- Point-of-Sales Terminals

- Smart Cards

Smartphones and wearables lead the market with 55.7% of market share in 2024. Contactless payments are gaining significant traction due to their convenience and preference. As a result, various wearable device manufacturers are incorporating near-field communication (NFC) technology as a standard into most smart devices, like smartphones and wearables, to provide greater convenience by removing the need to fumble with a wallet, purse, or phone. Furthermore, the increasing penetration of smartphones and wearables is also offering lucrative growth opportunities to the contactless payment market. For instance, in India, in 2018, around 36% of households had a smartphone, which increased to 74.8% in 2022. Similarly, from 2016 to 2019, connected wearable devices increased by 325 million to 722 million respectively. 30% of middle-income households used fitness trackers in the U.S. in 2020. Such a significant rise in smartphones and wearables is positively impacting the contactless payment market outlook.

Analysis by Solution:

- Payment Terminal Solution

- Transaction Management

- Security and Fraud Management

- Hosted Point-of-Sales

- Payment Analytics

Payment terminal solution leads the market with 43.8% of market share in 2024. Payment terminal solutions in the contactless payment market are devices that enable merchants to accept payments without physical contact between the card or device and the terminal. These terminals use Near Field Communication (NFC) technology to communicate with contactless cards, smartphones, and wearables. They provide a fast, secure, and convenient transaction process by simply tapping or waving the payment device near the terminal. Additionally, these terminals often support multiple payment methods, including mobile wallets and traditional chip cards, making them versatile and future-proof in a rapidly evolving payment landscape. Transaction management solutions in the contactless payment market encompass the systems and software that oversee, process, and track financial transactions conducted through contactless methods. These solutions ensure the secure and efficient handling of payments from initiation to completion.

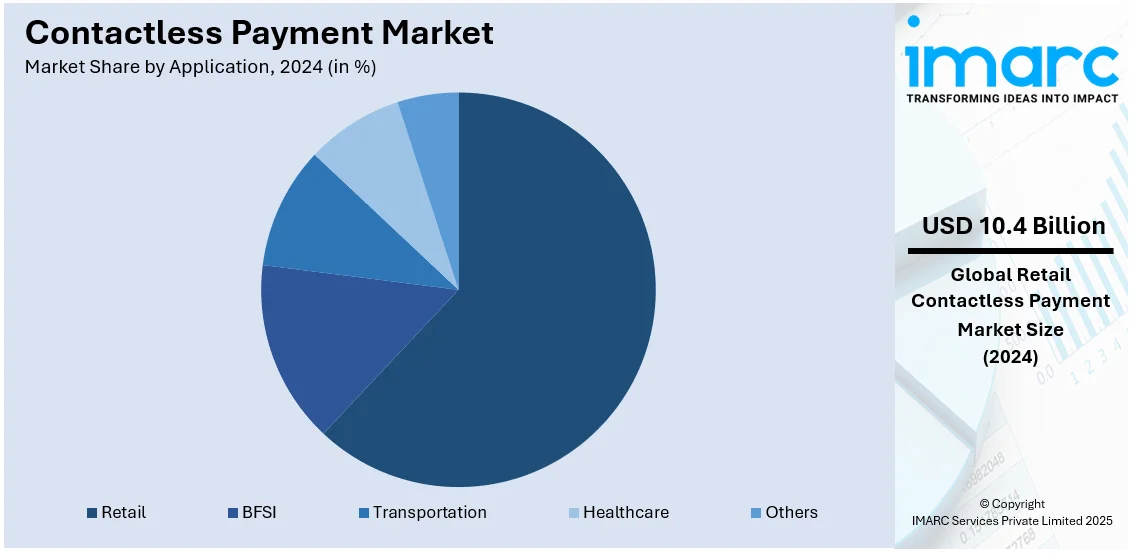

Analysis by Application:

- BFSI

- Retail

- Transportation

- Healthcare

- Others

Retail leads the market with 62.0% of market share in 2024. In the retail sector, contactless payments offer faster checkout processes, reducing wait times and enhancing customer satisfaction. Retailers provide a contactless payment option to enhance the speed and efficiency of the checkout process, fostering customer loyalty through smoother and quicker transactions. Market players are offering innovative and smart solutions for retailers, which is expected to drive the adoption of contactless payment terminals in the retail segment. For instance, in September 2022, Square, a financial services platform, announced its plan to launch a Tap To Pay service for iPhone in the U.S. This service enabled all sizes of vendors to accept contactless payments directly from their iPhones without any hardware or additional costs.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of 40.0%. One of the primary drivers of contactless payment adoption in Europe is the increasing demand for convenience and speed in transactions. People appreciate the ability to complete purchases quickly by simply tapping a card or mobile device at a point-of-sale (POS) terminal. This has been particularly impactful in high-frequency, low-value transactions such as those in quick-service restaurants, public transportation, and grocery stores. One of the most notable trends in the European contactless payment market is the rising adoption of contactless cards. According to industry reports, the vast majority of debit and credit cards in Europe are now equipped with NFC technology, enabling tap-and-pay functionality. This has been particularly influential in high-frequency, low-value transactions such as those made in supermarkets, quick-service restaurants (QSRs), and public transportation systems. As individuals have become accustomed to faster and more efficient checkout processes, contactless payments have steadily replaced traditional card-based or cash transactions in many sectors. Financial institutions and payment providers have actively supported this transition by issuing contactless-enabled cards as the default option for people. In 2024, Rome become the first city in Europe to introduce contactless payment system to JCB Card members.

Key Regional Takeaways:

United States Contactless Payment Market Analysis

The United States hold 86.80% share in North America. The growing requirement for digital wallets and increasing use of near-field communication payment terminals are leading to the development of the contactless payment market in the US. According to an industry report, Visa has more than 300 million contactless-capable cards. In the United States, over 51% of consumers have either used or plan to use contactless payments. Contactless purchases have accounted for 85% of transactions in supermarkets, 39% at pharmacies, 38% at merchants, and 36% at dining establishments in the United States. Consumer preferences for speed, convenience, and hygiene, especially in the wake of COVID-19, have hastened the move to contactless technologies. According to Digital Commerce 360 data, over USD 5 Trillion has been used by the retail and e-commerce industries to improve customer experience using contactless technology. The banking industry has also assisted growth by issuing more credit and debit cards with contactless functionality. Contactless payment options have been added to public transit systems in big cities such as New York and Chicago, which has increased acceptance even further. Many consumers prefer to pay with smartwatches.

Europe Contactless Payment Market Analysis

European, led by its relatively strong infrastructure support, favorable legislations, and wide acceptance amongst customers, holds the top ranking in contactless payment adoption. According to reports, over 90% of UK and France nations' card payments are contactless, with further increase in a transaction limit raised to £100 (USD 122.09). The programmes of cashlessness in Eurozone are supported by the European Central Bank, leading to the systematic elimination of the use of physical cash to favor contactless more. Contactless payments accounted for 53.8% of all card-based transactions in the region in the second half of 2022, according to data by European Union portal. There was high demand for contactless technology across the euro area, as the fact that over half of all card payments in 13 of the 19 nations that comprised the region at the time were contactless clearly shows. Europe's over €900 billion (USD 922.93 Billion) in e-commerce operate primarily through the use of contactless and other digital forms of payment according to Eurocommerce data, while the partnerships between technology companies and the banks, such as Visa and Mastercard with regional banks, enhance access to contactless solutions across the region.

Asia Pacific Contactless Payment Market Analysis

The fastest-growing market is Asia-Pacific due to wide acceptance of smartphone use and availability of digital wallets, such as GrabPay, Paytm, PhonePe and Alipay, etc. According to an industry report, there is more than 60 percent transaction in those regions, in which China, India, and Japan are ranked high, with steady adoption of NFC-enabled as well as QR code-based payment modes. In China, reports say that digital payments were conducted by 85% of people in retail transactions whilst India handled over 131 billion UPI transactions in 2023-2024 as reported by media report, most of which are contactless. Japan's cashless goals for the Osaka Expo 2025 and India's "Digital India" campaign are two examples of how governments throughout the region are promoting digital change. The region's young, tech-savvy population, with over 2 billion smartphone owners (as per reports), further accelerates adoption. Contactless payments have been adopted by the retail industry, especially convenience stores and QSRs, in response to customer demand for quicker checkout times.

Latin America Contactless Payment Market Analysis

The Latin American market for contactless payments is growing due to increasing financial inclusion initiatives and smartphone adoption. Reports say that over 60% of people today carry a smartphone, which enables them to have digital wallets such as Nubank and MercadoPago. A report states that nearly half of all POS terminals in the region are already contactless-ready. A World Bank survey indicates that 11% of Latin American individuals have recently adopted contactless payments, and 42% of them use them in retail establishments. Regional impetus on financial inclusion also supports the implementation of digital payment systems, like contactless transactions, through such initiatives as "CoDi" by the government of Mexico. This is supported by the highly burgeoning e-commerce sector, within which platforms deploy contactless transactions for enhanced consumer convenience. Innovative access, such as tap-and-go cards, also is being given to the more vulnerable communities due to partnerships that fintech organizations and retailers now form.

Middle East and Africa Contactless Payment Market Analysis

Contactless payments are growing rapidly in the Middle East and Africa (MEA) region due to increased urbanization, mobile phone penetration, and government-backed digitalization initiatives. Contactless payments account for over half of all in-store transactions in the Gulf Cooperation Council (GCC), with Saudi Arabia and the United Arab Emirates having the highest rates of adoption, as per reports. The fintech companies and the conventional banks facilitate cashless transactions through the UAE Smart City programs and Saudi Arabia's Vision 2030. GSMA's State of the Industry report on Mobile Money 2024 states that in 2023, more than 856 million Africans registered mobile money accounts, making 62 billion transactions valued at USD 919 billion. M-Pesa and other services dominate the continent's mobile money ecosystem. Contactless technologies are being introduced in the urban retail and transit sectors to streamline operations.

Competitive Landscape:

One of the primary ways market players are improving their business is by investing heavily in research and development (R&D) to introduce innovative technologies and diversify their product offerings. In particular, advancements in NFC technology, biometric authentication, and tokenization have enhanced the functionality and security of contactless payment systems. For instance, in 2024, Intesa Sanpaolo launched a payment bracelet in partnership with MasterCard to facilitate effortless contactless payments in Italy. In developed markets, players are focusing on increasing contactless payment penetration in industries that have been slower to adopt the technology, such as healthcare, education, and small businesses. Security is a top priority for market players seeking to improve their business in the contactless payment industry. With the growing prevalence of digital payments, consumers are increasingly concerned about fraud and data privacy.

The report provides a comprehensive analysis of the competitive landscape in the contactless payment market with detailed profiles of all major companies, including:

- Giesecke & Devrient GmbH

- Heartland Payment Systems (Global Payments Inc.)

- IDEMIA (Advent International)

- Ingenico Group (Worldline S.A.)

- On Track Innovations Ltd.

- Pax Technology

- Setomatic Systems

- Thales Group

- Valitor

- Verifone Systems Inc. (Francisco Partners)

- Visa Inc.

Latest News and Developments:

- May 2024: RuPay, a product of the National Payments Corporation of India (NPCI), announced a collaboration with TATA IPL. The organization unveiled an exclusive wristband and other accessories available for a select few attendees of the TATA IPL 2024 playoffs and final.

- March 2024: IndusInd Bank announced the launch of its contactless payments wearable 'Indus PayWear.' It is said to be India's first all-in-one tokenizable wearable for both debit and credit cards.

- March 2024: The Federal Bank launched a RuPay smart key chain called 'Flash Pay' for contactless NCMC (National Common Mobility Card) payments at enabled metro stations and PoS terminals. Customers can make payments up to INR 5,000 without a PIN, whereas those over ₹5,000 will require PIN authentication.

Contactless Payment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Near Field Communication (NFC), Radio Frequency Identification (RFID), Infrared (IR), Others |

| Devices Covered | Smartphones and Wearables, Point-of-Sales Terminals, Smart Cards |

| Solutions Covered | Payment Terminal Solution, Transaction Management, Security and Fraud Management, Hosted Point-of-Sales, Payment Analytics |

| Applications Covered | BFSI, Retail, Transportation, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Giesecke & Devrient GmbH, Heartland Payment Systems (Global Payments Inc.), IDEMIA (Advent International), Ingenico Group (Worldline S.A.), On Track Innovations Ltd., Pax Technology, Setomatic Systems, Thales Group, Valitor, Verifone Systems Inc. (Francisco Partners), Visa Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the contactless payment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global contactless payment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the contactless payment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The contactless payment market was valued at USD 16.8 Billion in 2024.

The contactless payment market is projected to exhibit a CAGR of 10.0% during 2025-2033, reaching a value of USD 39.6 Billion by 2033.

The key factors driving the contactless payment market include rising consumer demand for fast and convenient transactions, widespread adoption of NFC-enabled devices, increased smartphone penetration, regulatory support for cashless economies, advancements in payment security technologies like tokenization, and the growing popularity of digital wallets and wearable payment solutions.

Europe currently dominates the contactless payment market, accounting for a share of 40.0%, driven by strong regulatory support like PSD2, widespread adoption of NFC-enabled cards and terminals, growing demand for secure and convenient transactions, rising use of digital wallets, increased smartphone penetration, and the integration of contactless payments in public transportation and retail sectors.

Some of the major players in the contactless payment market include Giesecke & Devrient GmbH, Heartland Payment Systems (Global Payments Inc.), IDEMIA (Advent International), Ingenico Group (Worldline S.A.), On Track Innovations Ltd., Pax Technology, Setomatic Systems, Thales Group, Valitor, Verifone Systems Inc. (Francisco Partners), Visa Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)