Container Fleet Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Container Fleet Market 2024, Size and Trends:

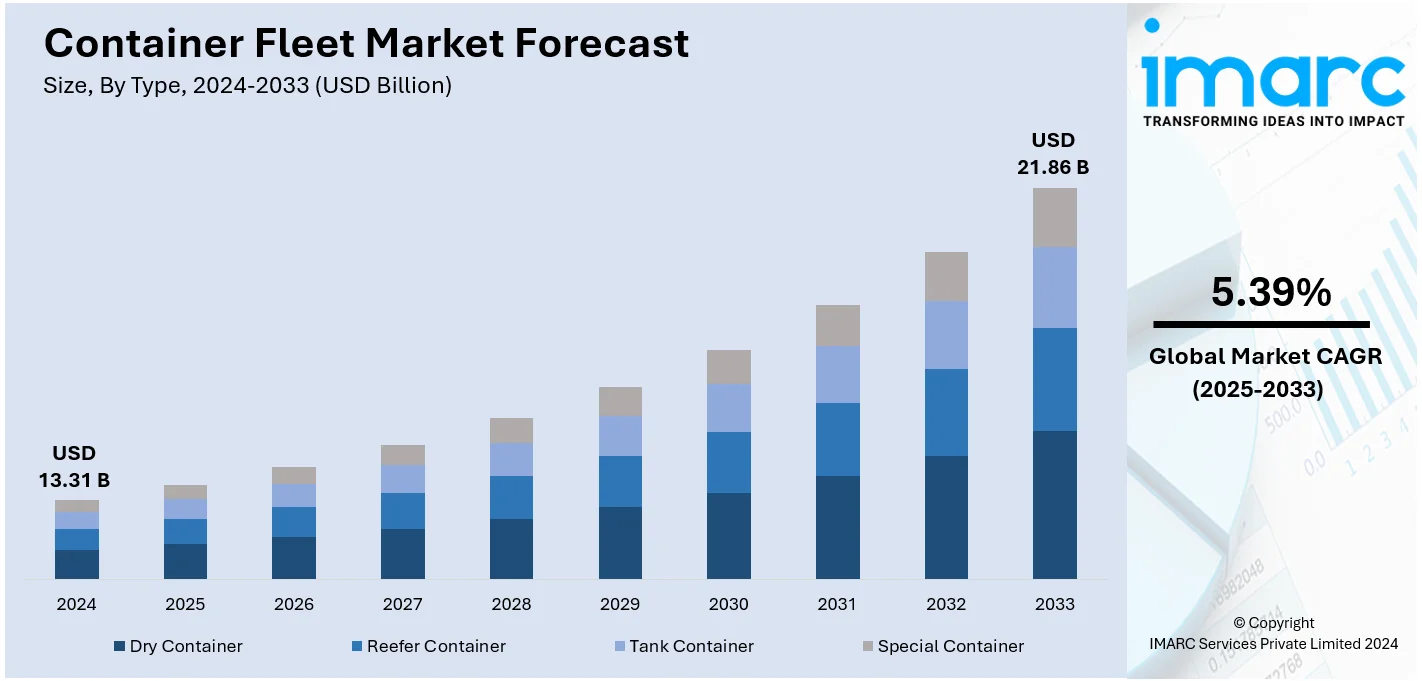

The global container fleet market size was valued at USD 13.31 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 21.86 Billion by 2033, exhibiting a CAGR of 5.39% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant container fleet market share of over 38.9% in 2024. The market is driven by global trade expansion, technological advancements, the rise in e-commerce, stringent environmental regulations and the development of port infrastructure and intermodal transport systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 13.31 Billion |

|

Market Forecast in 2033

|

USD 21.86 Billion |

| Market Growth Rate (2025-2033) | 5.39% |

The container fleet market share is experiencing growth driven by expanding global trade, the surge in e-commerce, and the rising demand for intermodal transport solutions. According to industry reports, global trade is set to reach a record $33 trillion in 2024 marking a $1 trillion increase from last year. Services trade grew 7% ($500 billion) while goods trade rose 2%. The increasing investments in port infrastructure and fleet modernization are enhancing efficiency and capacity. The adoption of smart containers with IoT integration for real-time tracking and monitoring is boosting operational effectiveness.

The United States container fleet market growth is witnessing trends such as increased adoption of smart containers with IoT and AI for real-time monitoring and improved logistics efficiency. The push towards sustainability is driving the use of eco-friendly and lightweight container materials. Growth in e-commerce is accelerating demand for rapid and flexible shipping solutions. Additionally, investments in automated ports and intermodal transport networks are enhancing operational capabilities while advanced tracking technologies are addressing supply chain transparency and security concerns. For instance, in November 2024, the Biden-Harris Administration unveiled an investment of nearly $580 million for 31 port enhancement initiatives in 15 states and one territory.

Container Fleet Market Trends

Global trade expansion

As international trade volumes rise mainly driven by globalization and the expanding economies of developing countries there is an increased demand for efficient and cost-effective shipping solutions. According to reports, international trade in goods and services accounted for 22.4% of the EU's GDP in 2023. Containerization is known for its ability to standardize cargo transport and facilitate seamless handling across various modes of transportation is a direct beneficiary of this trend. This growth is further supported by the development of international trade agreements and the expansion of global supply chains which require robust and reliable shipping solutions to move goods across borders. By increasing its capacity and efficiency, the container fleet industry adapts and so aligns its expansion with the direction of international trade.

Continual technological advancements

New developments like IoT-enabled smart containers, automated port operations, and improved ship designs for increased capacity and fuel efficiency are essential. According to reports, it is predicted that the number of connected IoT devices will increase by 13% to 18.8 Billion by the end of 2024 following a 15% growth to 16.6 Billion in 2023. These technologies increase the dependability and speed of transportation services by enabling real-time cargo tracking, enhanced safety, and better routing. This adoption of technology addresses the evolving demands of shippers for greater transparency and efficiency and plays a crucial role in environmental sustainability. By lowering emissions and increasing fuel efficiency, the container fleet industry supports international initiatives for sustainable shipping methods, making it a desirable choice for stakeholders who care about the environment.

Evolving consumer demand and e-commerce growth:

The container fleet market is impacted by the growth of e-commerce and shifting consumer expectations. The rise of online shopping has led to an increase in smaller more frequent shipments necessitating a more dynamic and flexible container fleet. Consumers now expect faster delivery times which has led to changes in logistics strategies including nearshoring and diversifying supply chains. The container fleet industry is directly impacted by this change since it needs a more adaptable and responsive fleet that can handle a range of cargo sizes and offer quicker transit times. The global e-commerce market size reached USD 26.8 Trillion in 2024. The growth in e-commerce also augments innovation in the container fleet market with companies investing in better fleet management systems and technologies to meet these evolving demands.

Container Fleet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global container fleet market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and end user.

Analysis by Type:

- Dry Container

- Reefer Container

- Tank Container

- Special Container

Dry container stand as the largest type in 2024, holding around 58.9% of the market. Dry containers dominate the market due to their versatility and wide-ranging applications. These standard containers are used for transporting a variety of dry cargo including manufactured goods, electronics and textiles. Their popularity is attributed to their cost-effectiveness and ability to protect goods from external elements. Dry containers play a pivotal role in global trade accommodating a vast array of goods across different industries. Advancements in container design have improved durability and stacking efficiency maximizing space utilization on ships and in storage facilities. The scalability and reliability of dry containers further enhance their indispensability in modern supply chains ensuring seamless and secure transportation worldwide.

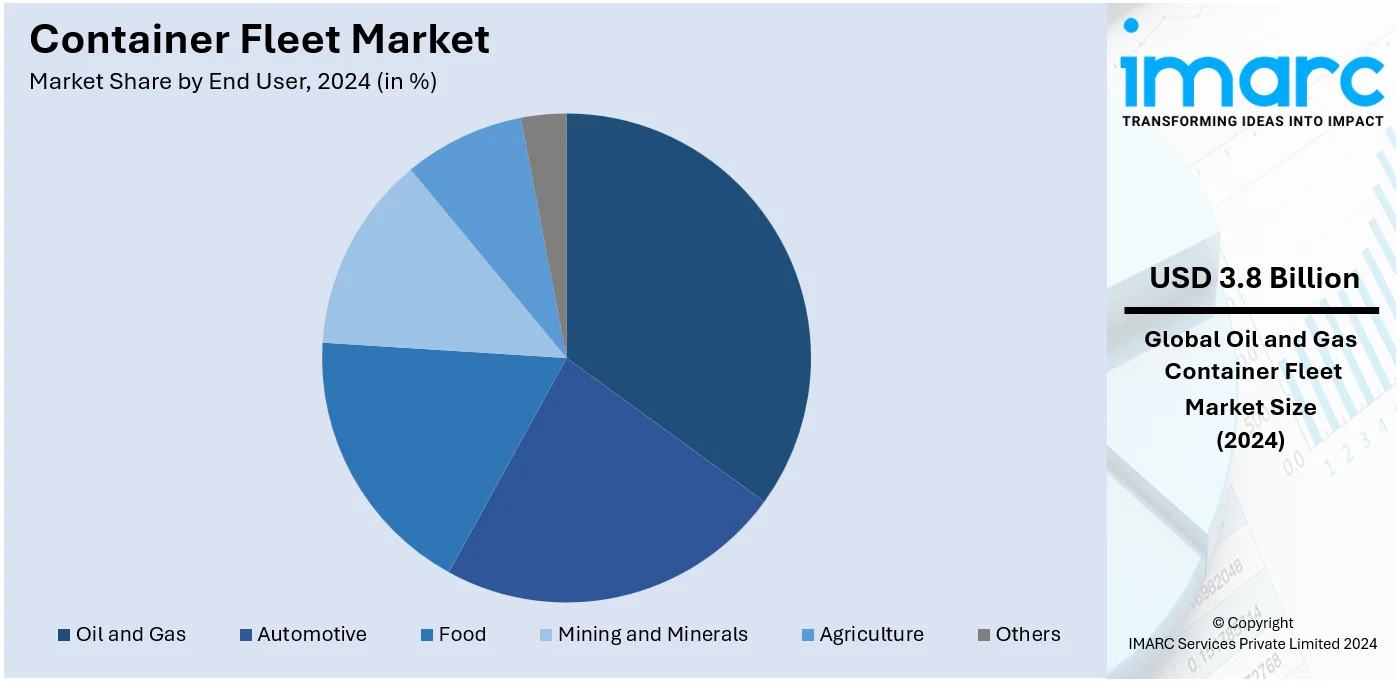

Analysis by End User:

- Automotive

- Oil and Gas

- Food

- Mining and Minerals

- Agriculture

- Others

Oil and gas lead the market with around 28.7% of container fleet market share in 2024. The oil and gas industry constitutes the largest end-user segment of the container fleet market. It relies heavily on containers for the transportation of various materials including crude oil, natural gas, chemicals and drilling equipment. The industry's demand for specialized tank containers to transport hazardous liquids and gases is significant. With global energy demands continuing to rise the oil and gas segment plays a pivotal role in the container fleet market ensuring the efficient movement of critical resources. Additionally, containers used in this sector must adhere to strict safety and regulatory standards incorporating advanced technologies for leak prevention and temperature control. Investments in durable, high-performance containers enhance reliability and reduce maintenance costs supporting uninterrupted supply chains. As the industry evolves the demand for innovative container solutions that can handle diverse and challenging transportation needs continues to grow further strengthening its dominance in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 38.9%. The Asia Pacific region stands as the largest and most dynamic segment in the container fleet market. Boasting major economies such as China, Japan and South Korea this region is a global hub for manufacturing and trade. The Asia Pacific's robust export-oriented industries including electronics, textiles and automotive drive a substantial demand for containerized cargo transportation. Additionally, the region's vast consumer base fuels imports making it a pivotal market for container fleet operators and logistics providers. Moreover, significant investments in port infrastructure and intermodal facilities are enhancing operational efficiency and capacity. The rapid growth of digital technologies and automation in logistics further streamlines supply chains while increasing focus on sustainable practices ensures long-term market resilience and environmental compliance. These advancements collectively reinforce the Asia Pacific's leadership and continuous expansion in the container fleet market.

Key Regional Takeaways:

North America Container Fleet Market Analysis

The North America container fleet market outlook is propelled by strong trade dynamics among the United States, Canada and Mexico under the USMCA agreement. Major ports such as Los Angeles, Long Beach, Toronto and Veracruz facilitate significant North-South and transcontinental trade flows. The booming ecommerce sector with projected user growth and increased online shopping drives demand for efficient and rapid containerized shipping solutions. Investments in port infrastructure and the expansion of intermodal transport networks enhance fleet capacity and operational efficiency. Technological innovations including advanced container tracking, automation and digital logistics platforms streamline supply chains and reduce costs. Additionally, stringent environmental regulations are encouraging the adoption of sustainable practices and green technologies within container fleets. The integration of smart container solutions and focus on reducing carbon footprints further support container fleet market growth making North America a pivotal region in the global container fleet landscape.

United States Container Fleet Market Analysis

In 2024, the United States accounted for a share of 85.00% of the North American market. The container fleet market trends in the United States is driven by a combination of robust trade activities and evolving consumer demands. Major ports like Los Angeles, Long Beach and New York/New Jersey play a crucial role in supporting the country's significant trade flows. The increasing demand for goods particularly with the rise of ecommerce is one of the key market drivers. According to reports, the number of e-commerce users in the US is projected to grow by 60 Million by 2029, marking a 21.94% increase and reaching a record high of 333.5 Million. Technological advancements in digitalization, automation, and container tracking are also improving operational efficiency while driving cost reductions[PB1] . Environmental regulations such as those from the Environmental Protection Agency (EPA) are pushing fleets to adopt sustainable practices including fuel-efficient vessels and green technologies. Trade agreements notably the United States-Mexico-Canada Agreement (USMCA) are fostering cross-border trade contributing to further market growth. The focus on port infrastructure improvements also helps accommodate larger vessels and ensures quicker turnaround times supporting the expansion of container fleets. Together, these factors are driving the growth of the container fleet market in the US.

Europe Container Fleet Market Analysis

The container fleet market demand in Europe is influenced by several critical factors including the region's strategic position as a global trade hub. Major ports such as Rotterdam, Hamburg and Antwerp serve as essential gateways for goods traveling between Europe, Asia, and the Americas. Additionally, the demand for containerized shipping services is driven by Europe's export-oriented economies in sectors like automotive, pharmaceuticals and machinery. The European e-commerce market has also experienced rapid growth reaching USD 3.4 billion in 2023. This surge in online shopping continues to increase the demand for more efficient and larger container fleets to ensure timely deliveries. Sustainability plays a significant role as well with stringent environmental regulations necessitating greener shipping solutions. The European Union is focused on reducing carbon emissions and promoting the use of alternative fuels such as LNG and hydrogen which are shaping fleet operations. Technological advancements in digitalization and automation further enhance the efficiency of the region's fleet management systems. Geopolitical factors including Brexit and trade agreements like the EU-Japan Economic Partnership Agreement are also affecting trade flows and influencing changes in fleet deployment across Europe.

Latin America Container Fleet Market Analysis

The container fleet market forecast in Latin America is primarily driven by increasing trade activities with the U.S., Europe and Asia. In the first half of 2023, Latin America and the Caribbean accounted for 22% of U.S. foreign trade according to the Economic Commission for Latin America and the Caribbean (ECLAC). This growing trade volume is boosting the demand for efficient containerized shipping services, especially for raw materials and manufactured goods. Key ports like Santos and Veracruz are benefiting from infrastructure upgrades while regional trade agreements such as MERCOSUR continue to facilitate cross-border trade supporting fleet expansion across the region.

Middle East and Africa Container Fleet Market Analysis

The container fleet market in the Middle East and Africa is significantly influenced by the region's critical role in global trade. The Middle East holds 67.3% of the total oil reserves in OPEC Member Countries which together account for 79.1% of the world’s proven crude oil reserves according to OPEC. This vast oil production contributes to the demand for containerized shipping services particularly for energy exports and associated goods. Key ports such as Jebel Ali, Port Said and Durban continue to drive the region's fleet market while infrastructure investments and regional trade agreements further fuel growth.

Competitive Landscape:

The container fleet market is highly competitive with players striving to expand their market presence through innovative technologies, operational efficiency, and sustainability initiatives. Companies focus on integrating advanced digital solutions such as IoT and AI for real-time tracking and improved fleet management. Investments in eco-friendly containers and fuel-efficient shipping practices are gaining prominence due to regulatory and environmental pressures. For instance, in September 2024, COSCO Shipping created a record order for 54 new vessels including 42 bulk carriers and 12 methanol dual-fuel ships. The $2 billion investment emphasizes sustainability with advanced features like energy-saving devices and air lubrication systems. Market players also prioritize strategic collaborations and partnerships to enhance global trade connectivity and expand service portfolios. The increasing demand for specialized containers such as refrigerated and tank containers is driving differentiation within the market. Additionally, the emphasis on expanding intermodal transport capabilities and improving port infrastructure creates further opportunities for competitive advantage in this rapidly evolving sector.

The report has also analysed the competitive landscape of the market with some of the key players being:

- A.P. Møller – Mærsk A/S

- China COSCO Shipping Corporation Limited

- CMA CGM S.A.

- Evergreen Marine Corporation

- Hapag-Lloyd AG

- Matson Inc.

- MSC Mediterranean Shipping Company S.A.

- Ocean Network Express Pte. Ltd.

- Orient Overseas Container Line Limited

- Pacific International Lines Pte. Ltd.

- Unifeeder A/S (DP World)

- Wan Hai Lines Ltd.

- Yang Ming Marine Transport Corporation

- ZIM Integrated Shipping Services Ltd. (Kenon Holdings Ltd)

Latest News and Developments:

- November 2024: Pacific International Lines (PIL) has launched its first two 14,000 TEU container vessels Kota Eagle and Kota Emerald at Jiangnan Shipyard. These vessels the largest in PIL’s fleet are the company’s first to operate on Liquefied Natural Gas (LNG) underscoring its commitment to sustainability.

- June 2024: India is set to launch a new shipping company with the goal of adding at least 1,000 vessels to its fleet over the next ten years. This initiative aims to cut freight expenses and secure a greater share of revenue from the growing trade sector. The venture will be a collaborative effort involving state-owned oil, gas, and fertilizer companies, alongside the state-run Shipping Corporation of India and international partners. The objective is to reduce foreign freight payments by at least one-third by 2047.

- September 2023: Hamburg and MSC Mediterranean Shipping have formed a strategic partnership for Hamburger Hafen und Logistik Aktiengesellschaft (HHLA). MSC will acquire HHLA's free-floating A-Shares with the City of Hamburg holding 50.1% and MSC 49.9%. MSC plans to increase container volumes at HHLA terminals to 1,000,000 TEU annually by 2031 and establish a new German headquarters in Hamburg. A long-term investment plan will also be developed with HHLA.

- April 2023: Ocean Network Express (ONE) has introduced the ONE Eco Calculator to measure CO2 emissions from its container fleet. The tool calculates emissions using Tank-to-Wake (TTW) and Well-to-Wake (WTW) metrics, supporting the company’s decarbonization efforts.

- February 2023: The China Electric Ship Innovation Alliance was launched on February 8 at COSCO Shipping Plaza to support China’s carbon neutrality goals. Organized by COSCO SHIPPING Development it brings together over 80 stakeholders in electric propulsion, shipbuilding and related sectors to promote green, low-carbon solutions in China’s shipping industry. The alliance focuses on fostering collaboration and innovation in the container fleet and maritime sectors.

Container Fleet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dry Container, Reefer Container, Tank Container, Special Container |

| End Users Covered | Automotive, Oil and Gas, Food, Mining and Minerals, Agriculture, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A.P. Møller – Mærsk A/S, China COSCO Shipping Corporation Limited, CMA CGM S.A., Evergreen Marine Corporation, Hapag-Lloyd AG, Matson Inc., MSC Mediterranean Shipping Company S.A., Ocean Network Express Pte. Ltd., Orient Overseas Container Line Limited, Pacific International Lines Pte. Ltd., Unifeeder A/S (DP World), Wan Hai Lines Ltd., Yang Ming Marine Transport Corporation, ZIM Integrated Shipping Services Ltd. (Kenon Holdings Ltd), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the container fleet market from 2019-2033.

- The container fleet market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the container fleet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A container fleet refers to a collection of standardized shipping containers used for transporting goods across various modes, including sea, road, and rail. These containers are essential in global trade, facilitating secure, efficient, and cost-effective cargo movement.

The container fleet market was valued at USD 13.31 Billion in 2024.

IMARC Group estimates the market to reach USD 21.86 Billion by 2033, exhibiting a CAGR of 5.39% during 2025-2033.

The market is driven by expanding global trade, the rise of e-commerce, technological advancements, increasing investments in port infrastructure, and stricter environmental regulations.

In 2024, dry containers represented the largest segment by type, driven by their versatility and wide-ranging applications in transporting dry cargo.

The oil and gas sector leads the market by end user, owing to its reliance on specialized tank containers for hazardous liquids and gases.

Asia Pacific is expected to dominate the market, driven by their robust export-oriented industries including electronics, textiles and automotive, vast consumer base that fuels imports, and significant investments in port infrastructure and intermodal facilities.

Some of the major players in the global container fleet market include A.P. Møller – Mærsk A/S, China COSCO Shipping Corporation Limited, CMA CGM S.A., Evergreen Marine Corporation, Hapag-Lloyd AG, Matson Inc., MSC Mediterranean Shipping Company S.A., Ocean Network Express Pte. Ltd., Orient Overseas Container Line Limited, Pacific International Lines Pte. Ltd., Unifeeder A/S (DP World), Wan Hai Lines Ltd., Yang Ming Marine Transport Corporation, ZIM Integrated Shipping Services Ltd. (Kenon Holdings Ltd), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)