Container Security Market Size, Share, Trends, and Forecast by Component, Deployment, Enterprise Size, Vertical, and Region, 2025-2033

Container Security Market Size and Share:

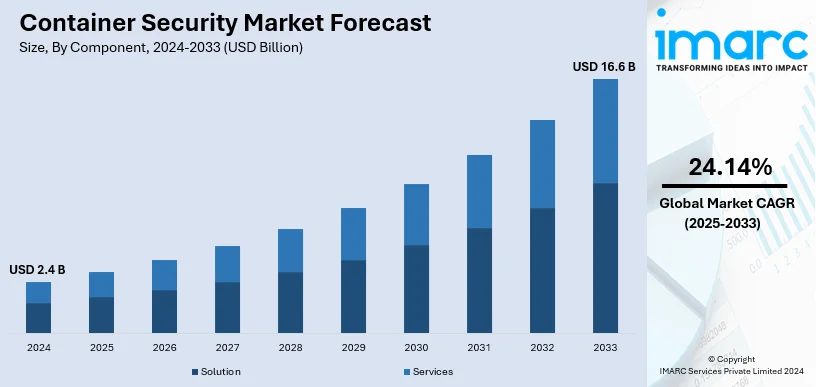

The global container security market size was valued at USD 2.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 16.6 Billion by 2033, exhibiting a CAGR of 24.14% during 2025-2033. North America currently dominates the market, holding a significant market share of over 31.8% in 2024. The increasing adoption of container technology, rapid digital transformation, rising complexity and sophistication of cyber threats, extensive research and development (R&D) activities, and the implementation of strict government policies are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.4 Billion |

| Market Forecast in 2033 | USD 16.6 Billion |

| Market Growth Rate 2025-2033 | 24.14% |

The global container security market is majorly driven by the growing adoption of containerized applications in DevOps and cloud-native environments. According to a research report by IMARC Group, the global DevOps market size reached USD 13.2 Billion in 2024. The market is expected to reach USD 81.1 Billion by 2033, exhibiting a growth rate (CAGR) of 19.95% during 2025-2033. With more organizations relying on containers for scalability, efficiency, and cost-effectiveness, the demand for robust security solutions is also increasing to safeguard these environments. In addition, rising cyber threats, data breaches, and compliance requirements are driving business growth to secure containerized infrastructure. Advancements in automation, integration capabilities with CI/CD pipelines, and artificial intelligence-powered threat detection are also propelling innovation in this sector. Additionally, the growing usage of hybrid cloud strategies, as well as a greater need to manage unified security across these multi-cloud environments, strengthens the requirement for container security, ensuring consistency in the protection, visibility, and control of those containerized workloads.

The United States stands out as a key market, driven by the rapid adoption of cloud-native technologies and containerized applications across industries. This can be attributed to the country's strong focus on digital transformation. Enterprises in the U.S. are increasingly deploying containers to enhance agility, scalability, and efficiency, necessitating advanced security solutions to mitigate risks. In addition, the growing concerns over cybersecurity threats, stringent regulatory frameworks such as HIPAA and CCPA, and compliance mandates are driving the need for robust container security measures. Additionally, the U.S. market benefits from innovation in automated security tools, integration with CI/CD pipelines, and AI-based threat detection capabilities. Moreover, the growing adoption of hybrid cloud strategies and the push for centralized security management are also positively influencing the demand for container security solutions in the region.

Container Security Market Trends:

The increasing adoption of container technology

Container technologies are being increasingly adopted as they encapsulate an application and its features in a single, self-contained unit that can run anywhere. In addition, compared to traditional virtual machines, they are lightweight and start up very fast, allowing more applications to run on the same hardware. They can also be spun up or down in seconds, which makes it easier to scale applications and services and makes them an attractive option for organizations looking to achieve higher operational agility. According to a recent survey by Red Hat, 60% of respondents expressed concerns about vulnerabilities, misconfigurations, and exposures in their container and Kubernetes environments. However, the widespread use of containers also opens up new vectors for potential security threats. Containers share the host's operating system, and if a single container is compromised, the entire host, and consequently all the containers running on it, could be at risk. This intrinsic security risk that comes with containers necessitates robust container security measures, hence driving the growth of the market.

The rapid digital transformation across the globe

Digital transformation is one strategic initiative that businesses use nowadays to stay competitive in the fast-paced modern world. It applies digital technologies to a business firm's different domains, dramatically changing how it operates and delivers value to its customers. One of the most common transformations has been the migration of applications and data to the cloud, where the adoption of container technologies has been undertaken for better scalability and agility. Cloud-native technologies have been at the forefront, including containers and microservices, to help organizations create and run scalable applications in the dynamic, modern environments found in private, public, and hybrid clouds. However, as businesses become more digitized and cloud migration takes place, they are also at greater exposure to cyber threats. For instance, in 2023, 50% of UK businesses experienced some form of cyberattack, according to AAG IT, emphasizing the widespread vulnerability of organizations. Nearly 1 in 2 American internet users had their accounts breached in 2021. Data breaches have become increasingly costly, with the average financial impact reaching USD 4.88 Million per incident in 2024. Globally, ransomware attacks surged to 236.1 Million in just the first half of 2022. As a result, there is a need for strong security measures that can protect sensitive information, prevent data breaches, and ensure the integrity of applications. Container security, as part of a larger cybersecurity strategy, plays an important role in addressing these risks.

The rising complexity and sophistication of cyber threats

The digital space is becoming increasingly complex, and with this complexity comes a rise in security threats. Cybercriminals are continuously finding new ways to exploit vulnerabilities in systems and applications, and the rise of container technology has given them a new target. Malware-based threats surged in the first half of 2024, up by 30% compared to the same period in 2023, according to SonicWall's 2024 Mid-Year Cyber Threat Report. There was a particular spike in malware attacks from March to May, with a 92% year-on-year increase in May alone. While providing numerous benefits, containers introduce new security challenges. Containers present a larger attack surface than traditional monolithic applications since each of them can potentially be compromised. Moreover, it is rather challenging to track down containers for potential security issues since they have an ephemeral nature. Furthermore, with more cyberattacks and data breaches surfacing, organizations have lately been getting more watchful and are an important necessity in cybersecurity. In this context, the need for security solutions that focus on containerized applications is significant, and the investment that businesses are making in this area has seen a substantial rise. All these solutions offer container image scanning, runtime security, network segmentation, and the enforcement of security policies for the effective detection and prevention of threats.

Container Security Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global keyword market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment, enterprise size, and vertical.

Analysis by Component:

- Solution

- Services

Solution stands as the largest component in 2024, holding around 61.1% of the market. Container security solutions comprise the largest market share since containerized applications are dependent at all stages of the process, from development to deployment, on them for security. A typical container security solution would encompass elements such as vulnerability scanning, runtime protection, incident response, and compliance management, thus providing an all-inclusive approach to securing the application lifecycle. As more and more organizations adopt container technologies, the risks involved with them, including image vulnerabilities, misconfigurations, and runtime threats, also grow. This necessitates advanced security solutions that can solve these problems. Moreover, the solutions' ability to integrate with existing continuous integration and continuous deployment (CI/CD) operations enhances the overall security posture without disrupting the speed of software delivery. Apart from this, the increasing emphasis on development, security, and operations (DevSecOps) practices has prompted organizations to implement security solutions that allow seamless integration into their development operations.

Analysis by Deployment:

- Cloud-based

- On-Premises

Cloud-based leads the market with around 54.5% of market share in 2024. The cloud-based deployment models hold the largest market share since they are scalable, flexible, cost-effective, and easy to manage. The trend of digital transformation and adoption of cloud-native technologies has made way for an increase in the number of containerized applications that find their home in the cloud. This trend, therefore, has also correspondingly motivated the demand for cloud-based container security solutions. Additionally, they secure containers in numerous cloud environments like public, private, and hybrid clouds. Further, they provide real-time monitoring and protection of containerized applications irrespective of the scale and deliver an extent of agility that matches the dynamic nature of cloud environments. One more way the pay-as-you-go model of cloud services is more efficient is by allowing organizations to control the costs better by scaling security services up and down according to the needs of the organization. Other than this, the providers of cloud services continuously update their security features so that the users always receive the latest security measures available for protection.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises lead the market with around 51.0% of market share in 2024. Large enterprises represent the largest market segment as they have more complex information technology (IT) infrastructures, dealing with vast amounts of sensitive data, multiple applications, and a wide range of interconnected systems. This complexity, coupled with a greater surface area for potential attacks, necessitates robust container security solutions. Furthermore, large enterprises are often early adopters of innovative technologies, including containers, to stay competitive and drive operational efficiency. The increased adoption of containerization and microservices in such large-scale environments escalates the demand for effective container security. Additionally, they have more regulatory compliance requirements due to the scale and nature of their operations, which is further contributing to the market growth. Moreover, the potential impact of a security breach in a large enterprise, both financially and reputationally, is massive. This high risk drives them to prioritize and invest heavily in advanced security measures, including container security.

Analysis by Vertical:

- BFSI

- IT and Telecom

- Retail

- Healthcare

- Manufacturing

- Government

- Others

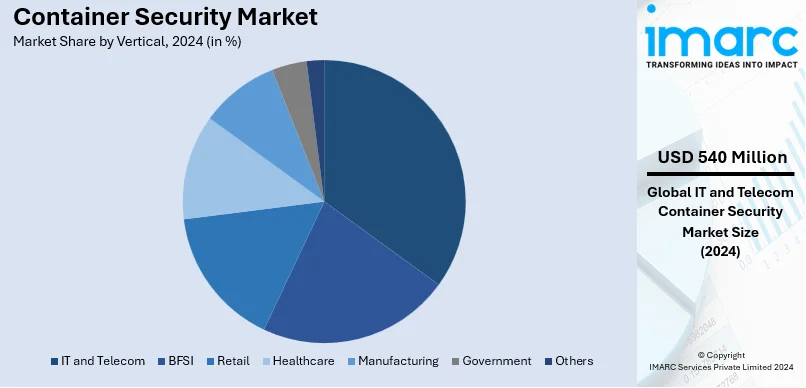

IT and telecom leads the market with around 22.8% of market share in 2024. The information technology (IT) and telecom sectors represent the leading vertical segment in the market due to the utilization of new technologies to enhance their services, reduce costs, and improve operational efficiency. The use of container technology aligns perfectly with these goals, offering the benefits of agility, scalability, and faster deployment of applications. Additionally, the adoption of containers introduces new vulnerabilities and complexities, and therefore, a strong container security strategy is required to ensure data integrity and system availability. In addition, the IT and telecom industries handle a large amount of sensitive data, including personal customer information, which makes them high-value targets for cybercriminals. The requirement to protect such data, along with the need to adhere to multiple data protection and privacy regulations, also fuels the growth of the market. Apart from this, the emerging trends towards digital transformation, network modernization, and the increasing utilization of cloud services are acting as another growth-inducing factor.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 31.8%. North America is primarily leading the global market for container security due to its technological advancement, robust infrastructure, and the presence of many leading players in the IT industry. The region has a high adoption rate of new technologies and trends, such as containerization and microservices, driven by the continuous pursuit of operational efficiency and competitive advantage. Moreover, the strong regulatory environment for financial organizations and health care institutions requires stronger security controls, including container security, to protect the private information of customers. Additionally, high investment in research and development by North American companies, coupled with government policies to improve cybersecurity infrastructure, also contribute to this fact. High-profile attacks within the last few years also increased the awareness regarding possible risks and costs with the breach of data; as a result, companies took proactive steps to invest in better security solutions.

Key Regional Takeaways:

United States Container Security Market Analysis

In 2024, US accounted for around 80.5% of the total North America container security market. The container security market in the United States is being driven by several key factors. The rapid adoption of containerized applications across industries, particularly in IT, telecommunications, and healthcare, is one of the primary drivers. As organizations transition to cloud-native technologies and microservices architectures, securing containerized environments has become essential to prevent data breaches and ensure compliance with regulatory requirements. For instance, according to the 2023 Annual Data Breach Report, the number of data compromises in 2023 which is 3,205 increased by 78 percentage points compared to 2022 which is 1,801. Additionally, the shift towards hybrid and multi-cloud infrastructures has heightened the need for security solutions that can protect both cloud and on-premises systems. Another significant factor is the increasing sophistication of cyber threats targeting containerized environments, driving demand for advanced security tools. The rise of DevSecOps practices, which integrate security throughout the development lifecycle, is also pushing the need for automated and scalable security solutions in the region. Moreover, the use of AI and machine learning to enhance real-time threat detection is gaining traction, making these technologies integral to container security platforms. Together, these drivers are fueling the growth of the container security market in the U.S., as businesses seek comprehensive solutions to secure their containerized applications and workloads.

Asia Pacific Container Security Market Analysis

In the Asia Pacific region, the container security market is driven by the rapid adoption of cloud-native technologies and containerized applications, particularly in IT, telecommunications, and manufacturing sectors. As businesses embrace hybrid and multi-cloud environments, security solutions are needed to protect containers across diverse infrastructures. According to HashiCorp’s 2022 State of Cloud Strategy Survey, over 80% of APAC respondents choose multi-cloud, with 46% already using it and 38% planning to adopt it within the next year. Additionally, rising regulatory compliance requirements in countries like India and China, along with digital transformation initiatives, are pushing organizations to implement advanced security measures. The growing use of DevOps and CI/CD practices further emphasizes the need for container-specific security tools to safeguard software development pipelines and ensure business continuity.

Europe Container Security Market Analysis

In Europe, the container security market is significantly influenced by the growing adoption of containerized applications, driven by industries such as IT, telecom, and healthcare, which are scaling their environments. This trend heightens the need for secure, compliant IT infrastructures to mitigate risks like container escapes, vulnerabilities, and misconfigurations. As businesses increasingly embrace cloud-native technologies and hybrid cloud environments, ensuring robust security becomes a priority. The market is further propelled by rising awareness of cyber threats, underscored by a surge in ransomware attacks (from 112 in 2022 to 175 in 2023) and phishing campaigns in Europe, according to the European DIGITAL SME Alliance. In Q1 2023 alone, 7,772 new Common Vulnerabilities and Exposures (CVEs) were published, emphasizing the dynamic nature of cyber threats. High-profile data breaches and attacks that compromise sensitive data have raised alarms across sectors. The evolving regulatory landscape, including stringent standards like GDPR, drives companies to implement comprehensive security measures. As a result, the demand for container security solutions is on the rise, with a focus on automation, advanced monitoring tools, and solutions that protect against potential breaches, safeguarding sensitive data and minimizing financial and reputational risks.

Latin America Container Security Market Analysis

The container security market in Latin America is driven by concerns over cargo theft and organized crime, particularly in key ports like those in Brazil and Mexico. This has spurred investments in advanced technologies, such as GPS tracking and video surveillance. Growing international trade and the need for better supply chain visibility are also fueling demand for robust security solutions. Additionally, governments are introducing stricter regulations, promoting the adoption of container security systems. The rise of cloud-based services is further boosting the market. The Cyber Readiness in Latin American Public Sectors: Lessons from the Frontline report, jointly produced by the Digi Americas Alliance and its LATAM CISO Network in collaboration with Duke University, highlights the development of advanced cybersecurity measures in the region and according to the survey, around 78% of respondents are planning to implement cloud-based cybersecurity infrastructure to strengthen digital defenses.

Middle East and Africa Container Security Market Analysis

In the Middle East and Africa (MEA), the container security market is driven by the region’s strategic position as a global trade hub, particularly in ports across the UAE, Saudi Arabia, and Egypt. The increasing trade volume highlights the need for enhanced security, spurring investments in technologies like IoT, blockchain, and real-time tracking. Additionally, government initiatives to improve port security and align with international standards are further accelerating market growth.

Competitive Landscape:

The leading companies are constantly enhancing their offerings to provide more comprehensive and effective container security solutions. They are enhancing features such as vulnerability scanning, runtime protection, and automated compliance checks and integrating machine learning and artificial intelligence to improve threat detection and response. In addition, numerous players are entering strategic partnerships with other technology companies to improve their capabilities and make use of the combined strengths to deliver more robust security solutions. Additionally, several market leaders are acquiring startups or smaller companies offering innovative container security solutions to enhance their product portfolio and include unique technologies developed by smaller companies. In addition, key players are also investing in customer education and training by providing resources, tutorials, webinars, and workshops to enable customers to understand the need for container security.

The report provides a comprehensive analysis of the competitive landscape in the container security market with detailed profiles of all major companies, including:

- Anchore

- Aqua Security Software Ltd.

- Check Point Software Technologies Ltd.

- Fortra LLC

- NeuVector Inc. (SUSE)

- Palo Alto Networks Inc.

- Qualys Inc.

- Synopsys Inc.

- Sysdig Inc.

- Trend Micro Incorporated

- VMware Inc.

- Zscaler Inc.

Latest News and Developments:

- November 2024: At KubeCon, Edera launched Am I Isolated, an open-source container security benchmark. The Rust-based runtime scanner detects gaps in container isolation and provides guidance to improve security. It aims to address the financial impact of container escapes by offering visibility into vulnerabilities, helping organizations enhance container security without relying on outdated tools or separate environments.

- September 2024: Oracle launched the limited (beta) release of OCI Kubernetes Engine (OKE) Container Governance through Oracle Cloud Guard’s Container Security, providing a unified platform for managing compliance in large-scale containerized environments. Container governance ensures that containers operate securely, efficiently, and meet organizational and regulatory standards. As containerization becomes more prevalent, especially with Kubernetes, implementing a strong governance model is essential to manage security, compliance, and operational efficiency in cloud-native infrastructures.

- October 2023: Kaspersky launched Kaspersky Container Security (KCS) to secure containerized applications throughout their lifecycle. The solution offers cost-effective, easy deployment and integrates seamlessly with IT systems. On pairing with Kaspersky Hybrid Cloud Security, it creates a unified ecosystem to enhance security for hybrid and cloud infrastructures, addressing the growing demand for advanced container protection.

- October 2023: Net Feasa has launched a patent-pending security upgrade for its IoTPASS™ Smart Container Tracking solution. The new device, leveraging Context Aware AI, detects security breaches and anomalies. It easily installs onto the container’s locking bar and transmits key data. The solution supports both single journey and permanent installation models and integrates with the 2023 Mobile Satellite release for satellite reporting in areas lacking mobile coverage.

Container Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployments Covered | Cloud-based, On-Premises |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Verticals Covered | BFSI, IT and Telecom, Retail, Healthcare, Manufacturing, Government, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Anchore, Aqua Security Software Ltd., Check Point Software Technologies Ltd., Fortra LLC, NeuVector Inc. (SUSE), Palo Alto Networks Inc., Qualys Inc., Synopsys Inc., Sysdig Inc., Trend Micro Incorporated, VMware Inc., Zscaler Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the container security market from 2019-2033.

- The container security market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the container security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Container security refers to the practice of implementing protective measures to secure containerized applications throughout their lifecycle. This includes image scanning, runtime protection, network segmentation, and compliance management, ensuring the safety of containers from vulnerabilities, misconfigurations, and malicious threats.

The container security market was valued at USD 2.4 Billion in 2024.

IMARC estimates the global container security market to exhibit a CAGR of 24.14% during 2025-2033.

The global container security market is driven by the growing adoption of containerized applications in DevOps and cloud-native environments, the rising complexity of security challenges in hybrid and multi-cloud environments, and advancements in automation, AI-powered threat detection, and CI/CD pipeline integrations.

In 2024, solutions represented the largest segment by component, driven by their comprehensive functionality, including image scanning, runtime protection, and compliance management.

Cloud-based deployment leads the market by deployment due to its scalability, cost-effectiveness, and ability to secure containerized applications across diverse cloud environments.

The large enterprises segment is the leading segment by enterprise size, driven by their complex IT infrastructures and high regulatory compliance requirements.

The IT and telecom sector is the leading segment by vertical, due to its reliance on container technologies for agility, scalability, and secure management of large volumes of sensitive data.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global container security market include Anchore, Aqua Security Software Ltd., Check Point Software Technologies Ltd., Fortra LLC, NeuVector Inc. (SUSE), Palo Alto Networks Inc., Qualys Inc., Synopsys Inc., Sysdig Inc., Trend Micro Incorporated, VMware Inc., and Zscaler Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)