Cooling Fabrics Market Size, Share, Trends and Forecast by Type, Application, and Region 2025-2033

Cooling Fabrics Market Size and Share:

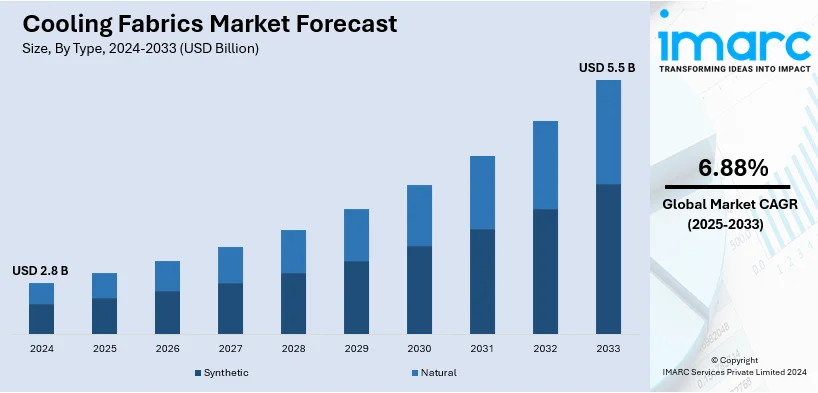

The global cooling fabrics market size reached USD 2.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.5 Billion by 2033, exhibiting a growth rate CAGR of 6.88% during 2025-2033. North America currently dominates the market, holding a market share of over 34.5% in 2024. The market growth is driven by rapid advancements in the textile industry and increasing research and development initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.8 Billion |

|

Market Forecast in 2033

|

USD 5.5 Billion |

| Market Growth Rate 2025-2033 | 6.88% |

The global market is majorly driven by the increasing demand for innovative textiles that enhance comfort and performance in the manufacturing of activewear as well as healthcare applications. According to a research report by IMARC, the global activewear market size reached USD 414.2 Billion in 2024. The market is expected to reach USD 672.0 Billion by 2033, exhibiting a growth rate (CAGR) of 5% during 2025-2033. In line with this, the rising awareness regarding health and fitness is positively influencing the adoption of moisture-wicking, breathable, and temperature-regulating fabrics among consumers. Furthermore, continual advancements in textile technology, including phase-change materials and microencapsulation techniques, have significantly improved the functionality of cooling fabrics, which are impelling the market. The growing prevalence of heat-related health issues, coupled with the rising trend of sustainable and eco-friendly materials, are also propelling market growth. Additionally, increased demand for lightweight, durable fabrics in military and industrial sectors supports market expansion. These factors, coupled with changing consumer preferences, are sustaining robust growth in the cooling fabrics market globally.

The United States is becoming a significant regional market, mainly fueled by the increasing use of smart textiles in high-end sportswear and fitness clothing. The increasing popularity of performance-enhancing materials among professional athletes and fitness lovers is also driving the need for cooling textiles made for harsh weather environments. Moreover, the rising emphasis on workplace safety is boosting the adoption of cooling fabrics in protective clothing and uniforms for employees in high-temperature settings. Government regulations that advocate for sustainable manufacturing are additionally driving the adoption of eco-friendly cooling fabrics in the U.S. Additionally, a significant increase in individual awareness about the advantages of advanced textiles, along with a growing e-commerce platform for specialty clothing, is boosting market growth throughout the region.

Cooling Fabrics Market Trends:

Increasing Application Areas

Cooling fabrics are used in heavy protective clothing or armor, which are worn by military personnel, firefighters, and staff working with hazardous material cleanup. Apart from this, with the increasing number of sports enthusiasts across the globe, several manufacturers are offering cooling garments that maximize oxygen uptake, increase blood flow to the working muscles, and reduce the risk of inflammation during events. Furthermore, leading manufacturers are also investing in research and development (R&D) activities to produce a practical cooling garment that can lower the temperature of the brain in stroke and head trauma patients. Additionally, significant growth in the real estate sector is influencing the application of cooling fabrics in furniture upholstery.

Technology Integration

The incorporation of sensors and electronics into cooling fabrics enables real-time monitoring of body temperature and adjusts the fabric's cooling properties accordingly. Further, the emergence of phase change materials (PCM)-infused fabrics that can store and release heat to offer a sustained cooling effect, is revolutionizing the market dynamics. The market's expansion depends on ongoing technical collaboration. For instance, a scalable coaxial extrusion process was used by ACS Materials to continuously produce core-sheath fibres, resulting in a woven, thermally adaptable smart textile (TAST) with high solar reflectance and selective infrared emittance and transmission. While maintaining good mechanical strength, breathability, and washability, TAST allows passive outdoor radiative cooling by 6–10 °C as compared to everyday materials. This technology is being increasingly used by athletes and outdoor enthusiasts. Some smart fabrics can also connect to external devices such as smartphones or fitness trackers, enabling efficient data tracking and customization. Such technological advancements have opened up new possibilities for cooling fabrics, making them more comfortable, functional, and adaptable to various needs of users.

Rise in Sustainable Practices

The rise in sustainable practices is a significant driver for the cooling fabrics market, as consumers and manufacturers increasingly prioritize eco-friendly and ethically sourced materials. The growing awareness of environmental issues, such as climate change and textile waste, is encouraging the adoption of biodegradable, recycled, and organic materials in fabric production. Advanced manufacturing processes, such as waterless dyeing and low-energy fabrication, further enhance the sustainability of cooling fabrics. Regulatory pressures and industry certifications emphasizing sustainable practices have also incentivized brands to incorporate green solutions into their products. This shift aligns with consumer demand for durable, high-performance textiles that minimize environmental impact, creating a competitive edge for companies offering sustainable cooling fabrics in various applications.

Cooling Fabrics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global keyword market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Synthetic

- Natural

Synthetic leads the market with around 70.2% of market share in 2024, driven by their superior performance, affordability, and versatility. Materials like polyester and nylon are widely used due to their excellent moisture-wicking, durability, and lightweight properties, making them ideal for activewear and sportswear applications. Advanced synthetic textiles can be engineered to incorporate cooling technologies such as phase-change materials or enhanced breathability, offering enhanced comfort and functionality. Moreover, the cost-effectiveness of synthetic fabrics compared to natural counterparts has further strengthened their adoption in mass-market products. Continuous innovations in synthetic fabric production, including the integration of recycled fibers and sustainable practices, are also expanding their applications, maintaining their leadership in the cooling fabrics market.

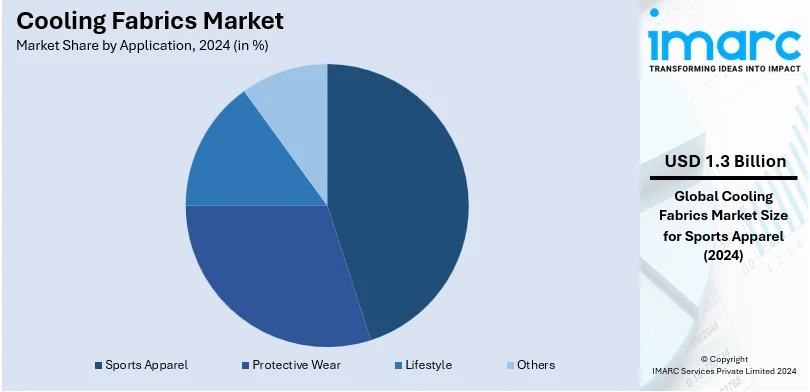

Analysis by Application:

- Sports Apparel

- Protective Wear

- Lifestyle

- Others

Sports apparel leads the market with around 46.2% of market share in 2024. Sports apparel finds support in the rising demand for high-performance textiles among athletes and fitness enthusiasts. Cooling fabrics are considered to enhance comfort and performance during physical activities due to temperature regulation, moisture management, and breathability. The increasing popularity of fitness trends, such as yoga, running, and high-intensity training, is positively influencing the adoption of cooling fabrics in sportswear. Advances in fabric technology are offering moisture-wicking and quick-drying capabilities that meet consumer demand for functionality and durability. The increased attention to athleisure wear, which combines athletic and leisurewear, is broadening the scope of the appeal of cooling fabrics beyond professional sports.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 34.5%. According to the global cooling fabrics market overview, The region's dominance in the global market is attributed to the strong presence of advanced textile manufacturers and high consumer demand for innovative, performance-oriented apparel. The region's well-established sportswear and athleisure markets significantly contribute to this dominance, with consumers prioritizing comfort, functionality, and temperature-regulating properties in clothing. Rising health consciousness and participation in fitness activities further amplify the demand for cooling fabrics in North America. In addition, growing investments in research and development of advanced cooling technologies, along with positive governmental policies that encourage sustainable practices, are driving the market growth further. The availability of premium cooling fabric products through strong retail and e-commerce channels has further placed North America at the leading position in the global cooling fabrics market.

Key Regional Takeaways:

United States Cooling Fabrics Market Analysis

In 2024, the US accounted for around 87.00% of the total North America cooling fabrics market. Technological developments, rising consumer demand for comfortable clothing, and a greater emphasis on sports and outdoor activities are driving the cooling fabrics market in the US. With about 57 million Americans participating in outdoor activities each year, the need for sportswear composed of cooling textiles has increased due to the growing popularity of sports and fitness activities. Health-conscious buyers looking for fabrics with moisture-wicking, UV-resistant, and temperature-regulating qualities are drawn to innovations in fabric technology like phase-change materials and microencapsulation. Demand is further increased by the U.S. military's investment in performance clothing for troops who must operate in extremely hot conditions. Another major contributor is the market for outdoor recreational gears and apparel. According to the latest data from the Bureau of Economic Analysis (BEA) Outdoor Recreation Satellite Account of the U.S. Department of Commerce, outdoor recreation created USD 1.2 Trillion in economic production in 2023 (2.3% of GDP), employed 3.1% of American workers, and supported 5 Million employment. Customers' growing awareness of thermal comfort is being met by the growing use of cooling textiles in upholstery and bedding. Demand is also driven by regulatory requirements that support ecologically friendly materials, as eco-friendly cooling fabrics become more popular among consumers who care about the environment.

Europe Cooling Fabrics Market Analysis

Strong demand for high-performance textiles in sportswear and a growing emphasis on sustainability are driving the cooling fabrics industry in Europe. Due to their robust sportswear industries, which were valued at €11.7 Billion (USD 12.3 Billion) and an average growth of 4.6% between 2016 and 2021, as per the data by Centre for the Promotion of Imports from developing countries (CBI), European countries—especially Germany, the United Kingdom, and France—dominate the industry. One significant factor is the region's increasing use of cooling textiles in medical textiles to ensure patient comfort during treatment. Demand is further increased by the growing popularity of "athleisure" as a fashion trend, as buyers look for adaptable, temperature-regulating apparel. The use of environmentally friendly cooling fabrics composed of recycled or biodegradable materials has increased due to Europe's strict environmental requirements, such as the REACH standards. The market's expansion is further supported by significant investments in wearable technology integration and smart textile research & development. To achieve carbon neutrality by 2050, the European Union's Green Deal places a high priority on sustainable production. These goals are met by cooling textiles composed of environmentally friendly ingredients, like recycled fibres or bio-based polymers, which propels market expansion.

Asia Pacific Cooling Fabrics Market Analysis

Rapid urbanization, a thriving sports industry, and rising disposable incomes are driving the Asia-Pacific cooling fabrics market, which is led by China, India, and Japan, with China exporting about 42.1% of the world's textiles in 2023 as per the data by the World Trade Organization. Increased adoption of sports and fitness, fueled by major events, Asian Games, and local marathons, has driven demand for cooling fabrics in activewear. Along with this, the growing awareness of heat stress, particularly in tropical climates of South Asia, and temperature-related health issues are also impacting the market. In addition, the growing demand for cooling fabric-based apparel due to the increased access created due to new e-commerce platforms that are both rural and urban is favoring the market. The market's expansion is also aided by developments in smart fabrics and partnerships between IT companies and manufacturers. The sector is further supported by government programs that encourage domestic textile manufacture, such as India's manufacture Linked Incentive (PLI) program.

Latin America Cooling Fabrics Market Analysis

The market for cooling fabrics in Latin America is driven by the region's hot and humid climate, growing sports culture, and increasing investments in functional textiles. Brazil, Argentina, and Mexico are also considered significant markets, in particular, due to the international sporting events held in Brazil. That is increasing the demand for performance-oriented activewear. Moreover, athleisure wear reflects new urban lifestyles, and growing demands in that area also benefit the market. The cooling fabrics' demand in workwear is further accelerating. There is high demand in the manufacturing, construction, and agricultural sectors where individuals are exposed to temperatures. Moreover, significant increase in disposable incomes and consumer awareness of thermal comfort is positively influencing the market.

Middle East and Africa Cooling Fabrics Market Analysis

Growing investments in sports infrastructure, like the Qatar 2022 FIFA World Cup, have also increased demand for cooling sportswear; the healthcare sector's adoption of cooling fabrics for patient care in high-temperature environments is another significant driver; increasing urbanisation and the rising popularity of Western fashion trends among the younger population further stimulate market growth; and sustainability-focused initiatives, like Saudi Arabia's Vision 2030, encourage the use of eco-friendly cooling textiles in the Middle East and Africa (MEA) cooling fabrics market. The market is driven primarily by the region's extreme climate, with temperatures frequently exceeding 40°C, necessitating creative attire solutions in various industries.

Competitive Landscape:

The global cooling fabrics market is highly competitive, with key players focusing on innovation, sustainability, and strategic partnerships to gain a competitive edge. Leading companies are investing heavily in research and development (R&D) activities to create advanced materials with enhanced cooling properties, such as phase-change technologies and microencapsulation. Many are adopting eco-friendly practices, utilizing recycled fibers, and implementing water- and energy-efficient manufacturing processes to meet rising sustainability demands. Collaborations with sportswear brands, healthcare providers, and industrial sectors help expand product applications. Additionally, businesses are leveraging digital platforms to increase market reach and customer engagement. The development of patented technologies and frequent product launches targeting specific end-user needs also emphasize the dynamic and competitive nature of the market.

The report provides a comprehensive analysis of the competitive landscape in the keyword market with detailed profiles of all major companies, including:

- Adidas AG

- Ahlstrom-Munksjö Oyj

- Asahi Kasei Corporation

- Coolcore LLC

- Formosa Taffeta Co. Ltd.

- HexArmor

- Nan Ya Plastics Corporation

- Nike Inc.

- Nilit Ltd.

- Polartec LLC (Milliken & Company)

- Tex-Ray Industrial Co. Ltd.

Latest News and Developments:

- February 2025: Directa Plus announced a collaboration with Heathcoat Fabrics to integrate its G+ Planar Thermal Circuit technology into Heathcoat's textiles. The collaboration aims to enhance thermal dissipation and surface resistivity for applications in industries like aerospace and healthcare.

- March 2024: Dream Valley launched its Cooling Comforter featuring Outlast® temperature-regulating technology, originally developed by NASA. The comforter uses phase-changing materials to regulate temperature, helping hot sleepers maintain an optimal sleep temperature. It is designed to reduce sweating, improve deep sleep, and ensure a cooler, more restful night.

- November 2024: Noble Biomaterials, a global supplier of conductive and antimicrobial solutions for soft surface applications, says that its innovative CoolPro fabric technology will be unveiled at Functional Fabric Fair Fall in collaboration with Coolcore.

- August 2024: The researchers at the University of Massachusetts unveiled the development of a chalk-based fabric coating, made with calcium carbonate and barium sulfate, which can cool underneath air by over 8°F.

- August 2024: HeiQ and GQ Apparel entered into a strategic partnership to co-develop cooling jeans for the Southeast Asian market. The bio-based HeiQ Cool was tested on 500+ prototypes.

- July 2024: HEST announced the launch of the HEST Cooling Bedding Collection. These beddings absorb heat and enable a comfortable and consistently cool sleeping environment.

Cooling Fabrics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Synthetic, Natural |

| Applications Covered | Sports Apparel, Protective Wear, Lifestyle, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adidas AG, Ahlstrom-Munksjö Oyj, Asahi Kasei Corporation, Coolcore LLC, Formosa Taffeta Co. Ltd., HexArmor, Nan Ya Plastics Corporation, Nike Inc., Nilit Ltd., Polartec LLC (Milliken & Company), Tex-Ray Industrial Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, cooling fabrics market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global cooling fabrics market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cooling fabrics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Cooling fabrics are innovative textiles designed to regulate body temperature, providing enhanced comfort during hot conditions. They achieve this through moisture-wicking, breathability, or advanced technologies such as phase-change materials and microencapsulation, making them ideal for activewear, sportswear, and healthcare applications.

The cooling fabrics market was valued at USD 2.8 Billion in 2024.

IMARC estimates the global cooling fabrics market to exhibit a CAGR of 6.88% during 2025-2033.

The global cooling fabrics market is driven by rising demand for high-performance textiles in activewear and healthcare, advancements in textile technologies such as phase-change materials, increased awareness of health and fitness, and growing preferences for sustainable and eco-friendly materials.

Synthetic fabrics represented the largest segment by type, driven by their superior performance, affordability, and versatility in applications including activewear and sportswear.

Sports apparel leads the market by application due to the growing demand for high-performance, moisture-wicking, and breathable textiles among athletes and fitness enthusiasts.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the global cooling fabrics market include Adidas AG, Ahlstrom-Munksjö Oyj, Asahi Kasei Corporation, Coolcore LLC, Formosa Taffeta Co. Ltd., HexArmor, Nan Ya Plastics Corporation, Nike Inc., Nilit Ltd., Polartec LLC (Milliken & Company) and Tex-Ray Industrial Co. Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)