Copper Wire Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

Copper Wire Market Size and Share:

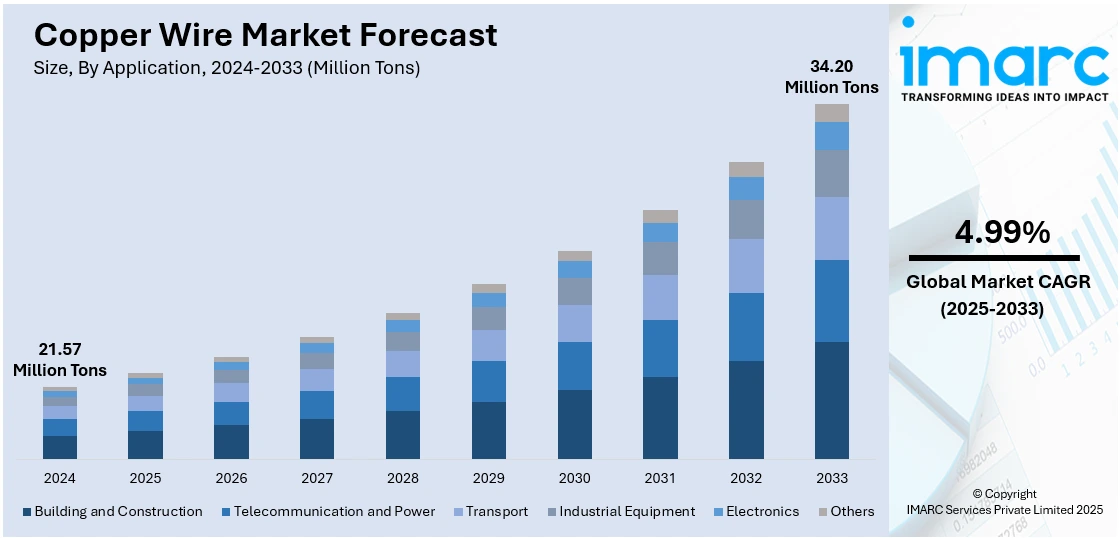

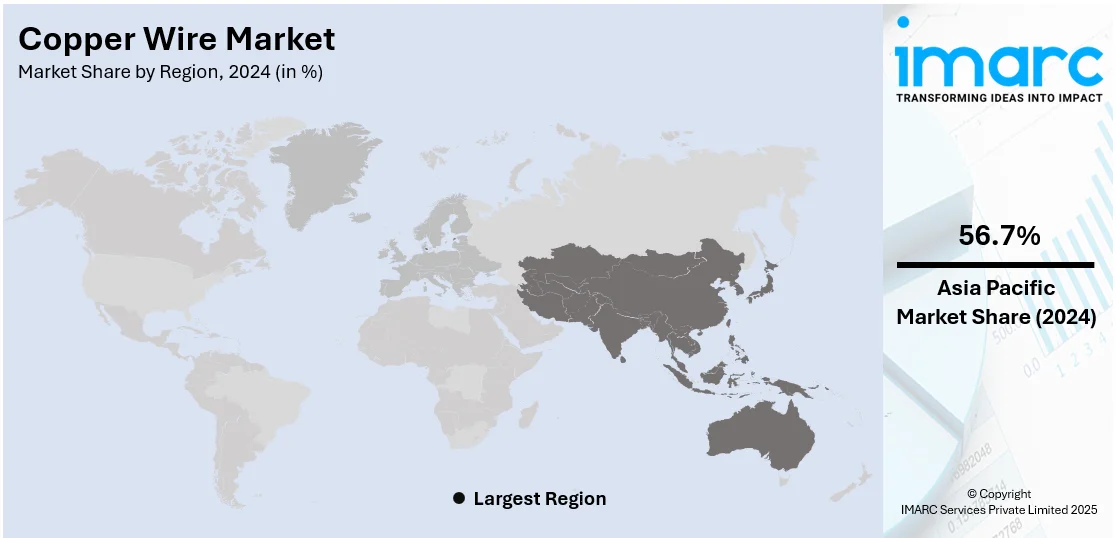

The global copper wire market size was valued at 21.57 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 34.20 Million Tons by 2033, exhibiting a CAGR of 4.99% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of 56.7% in 2024. Abundant marine resources, strong domestic consumption, cultural reliance on seafood, and large-scale aquaculture operations in countries like China, Indonesia, Vietnam, and Thailand are primarily accelerating copper wire market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 21.57 Million Tons |

| Market Forecast in 2033 | 34.20 Million Tons |

| Market Growth Rate (2025-2033) | 4.99% |

The global copper wire market is being driven by the expanding deployment of renewable energy infrastructure, which necessitates extensive cabling solutions for energy transmission and distribution. For instance, in April 2025, Hengtong Cable Australia (HCA) secured a contract to manufacture and supply 40,000 cable harnesses for PSD Energy’s Horsham Solar Farm project in Victoria. This project reinforces HCA’s expanding role in Australia’s renewable energy sector, showcasing its capability in delivering high-volume, locally supported infrastructure solutions. Growth in electric vehicle (EV) production also contributes significantly, with copper wiring integral to battery systems and charging networks. Rising investments in smart grid technology and the digitalization of power distribution further boost demand. The shift toward high-efficiency electrical components across industrial machinery and consumer electronics reinforces usage. In developing regions, urban electrification and increased construction of commercial and residential properties elevate the need for reliable wiring systems. Additionally, advancements in wire coating technologies have improved durability and conductivity, supporting broader adoption in demanding operating environments.

In the United States, the copper wire market growth is favored from ongoing modernization of aging electrical infrastructure, including transmission lines, substations, and residential grids. For instance, as per ASCE, the U.S. grid is undergoing massive modernization backed by USD 73 Billion from the USD 1.2 Trillion Infrastructure Investment and Jobs Act. Nearly 2,600 GW of power generation and storage projects are queued for grid connection, with solar alone comprising over 1,000 GW. Transformer demand may rise 160–260% by 2050, while lead times now extend up to 30 months. A WSP study shows 79% of Americans are concerned about aging infrastructure, and 61% would pay more for a reliable, renewable-powered grid. The federal push for domestic semiconductor manufacturing has also increased demand for copper wiring in chip fabrication facilities. Rising adoption of home automation systems and smart appliances necessitates robust wiring for enhanced connectivity and performance. Growth in data center construction across the country has further contributed to copper wire consumption, supporting high-capacity networking and energy systems. The surge in commercial retrofitting projects aimed at energy efficiency improvements is prompting the replacement of older cabling with high-performance copper alternatives. Additionally, rising utility-scale solar and wind installations are creating sustained demand for durable, conductive wiring solutions.

Copper Wire Market Trends:

Increasing demand for electrical infrastructure

The global copper wire market outlook suggests an increasing demand for electrical infrastructure. According to the International Energy Agency, electricity sector investment grew by 12% in 2022, exceeding USD 1 Trillion for the first time. As emerging economies continue to grow, the need for reliable and efficient power transmission and distribution systems rises in tandem. Copper wire plays a pivotal role in this scenario due to its excellent conductivity and durability. Governments and industries in these regions are investing heavily in expanding their electrical grids to meet the rising energy demands of urbanization and industrialization. This surge in infrastructure projects, including the development of substations, power lines, and distribution networks, directly fuels the demand for copper wire. Moreover, the aging electrical infrastructure in developed economies necessitates upgrades and replacements, further boosting copper wire consumption.

Growth of the renewable energy sector

The global shift towards renewable energy sources, such as wind and solar power, is one of the significant cooper wire market trends. According to the International Energy Agency, global renewable electricity generation is forecast to climb to over 17,000 terawatt-hours (TWh) by 2030, an increase of almost 90% from 2023. Copper is an essential component in the construction of wind turbines, solar panels, and the associated power transmission systems. Wind turbines, for example, utilize copper in their generators and electrical wiring to efficiently convert wind energy into electricity. Similarly, solar panels require copper for electrical conductivity and heat dissipation. As the world embraces cleaner and more sustainable energy solutions, the demand for copper in the renewable energy sector continues to grow. Government incentives and policies promoting the adoption of renewable energy further amplify this trend. The copper wire market benefits from this shift as it becomes intricately linked to the expansion of green energy infrastructure.

Shift towards electric vehicles (EVs)

The global automotive industry is undergoing a significant transformation with a notable shift towards electric vehicles (EVs). According to the International Energy Agency, almost 14 million new electric cars were registered globally in 2023. This transformation is driven by environmental concerns and the push for cleaner transportation options. Copper is a critical component in EVs, particularly in their battery systems and charging infrastructure. Lithium-ion batteries, commonly used in EVs, rely on copper wiring to efficiently transfer energy and power the vehicle. Additionally, the development of a robust charging infrastructure to support EV adoption worldwide necessitates substantial copper components. As governments worldwide set ambitious targets for EV adoption and automakers invest in electrification, the demand for copper in the automotive sector is poised to surge. The copper wire market benefits from this transition, making it an integral player in the future of sustainable transportation.

Copper Wire Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global copper wire market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on application.

Analysis by Application:

- Building and Construction

- Telecommunication and Power

- Transport

- Industrial Equipment

- Electronics

- Others

Building and construction leads the market with around 33.3% of market share in 2024. As per copper wire market forecast, the sector is a primary application of the market due to copper's essential role in electrical wiring systems. Its superior conductivity, durability, and reliability make it indispensable for power distribution in residential, commercial, and industrial buildings. Rapid urbanization, infrastructure development, and government initiatives like smart city projects further boost construction activity, increasing the demand for copper wires. Additionally, copper's use in plumbing, HVAC systems, and other building applications contributes to its dominance in this market.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of over 56.7%. This dominance is attributed to the region's rapid industrialization, growing infrastructure investments, and expanding automotive and electronics sectors. Countries such as China, India, Japan, and South Korea are major contributors, with large-scale demand for copper wires in construction, renewable energy projects, and electric vehicle manufacturing. Government-led initiatives to modernize power transmission and distribution networks further support market growth. Additionally, the region's strong base of copper smelting and refining operations ensures a steady supply for wire production. For instance, in April 2025, Adani Enterprises Ltd. announced the launch of smelting operations at its massive Kutch Copper facility in Gujarat within the next month. Furthermore, Directorate General of Trade Remedies (DGTR) recommended countervailing duties on copper wire imports from several Southeast Asian nations, potentially impacting profit margins for Indian wire manufacturers.

Key Regional Takeaways:

United States Copper Wire Market Analysis

The United States accounted for 80.40% of the market share in North America in 2024. The country witnesses increased copper wire demand as telecommunication and power sectors experience robust growth. According to reports, in the USA more than 60% of all copper and copper alloys consumed are used because of electrical conductivity, and about 80% of that are wires and cables. Copper wire plays a pivotal role in broadband expansion, 5G rollout, and power grid modernization across various states. With investments in fiber optic infrastructure and smart grid technologies, copper wire remains integral for both legacy and hybrid systems. Upgrades in transmission and distribution networks and rising electricity consumption further contribute to copper wire utilization. Rising rural broadband initiatives and power infrastructure refurbishment strengthen market dynamics, reinforcing copper wire's strategic importance. Power companies and telecom providers continue integrating copper wire to balance cost-effectiveness and performance. This dual growth of telecommunication and power sectors continues to propel copper wire as a foundational component, ensuring efficient connectivity and electrical reliability throughout the United States.

Asia Pacific Copper Wire Market Analysis

Asia-Pacific is experiencing surging copper wire utilization fueled by the automotive industry’s shift towards electric vehicles. For instance, buses and four wheelers will account for 54% and 36% of the copper usage in the automotive sector by 2030, respectively. The transformation of mobility trends is elevating the demand for conductive materials, with copper wire playing a central role in EV batteries, motors, and charging systems. As governments and industries accelerate electrification, copper wire becomes indispensable for high-performance energy transfer and durability. Local automotive manufacturers increasingly adopt copper-intensive components to meet evolving emission norms and energy efficiency goals. The expansion of domestic EV production and charging infrastructure also supports continuous copper wire integration. This regional pivot towards cleaner transportation underscores the automotive industry's shift towards electric vehicles, ensuring copper wire’s relevance across supply chains. Asia-Pacific’s progressive stance on e-mobility confirms copper wire’s essential role in future mobility ecosystems.

Europe Copper Wire Market Analysis

Europe demonstrates a steady rise in copper wire application due to the rapid expansion of the renewable energy sector. For instance, a three-megawatt wind turbine can contain up to 4.7 tons of copper with 53% of that demand coming from the cable and wiring. With strong momentum in wind, solar, and hydroelectric initiatives, copper wire emerges as a fundamental material in generating, storing, and distributing clean energy. Transmission lines, energy storage units, and converters increasingly rely on high-conductivity copper wire to ensure system stability and efficient load handling. Incentives for decarbonization and national energy transition plans further amplify copper wire integration in renewable projects. As the continent scales up offshore wind farms and photovoltaic installations, copper wire ensures reliable power transmission. Regulatory frameworks supporting renewable energy targets reinforce consistent material demand. This continued commitment to green energy places copper wire at the forefront of Europe’s renewable energy sector transformation, solidifying its strategic industrial value.

Latin America Copper Wire Market Analysis

Latin America shows rising copper wire usage driven by growing electrical infrastructure development. Investments in energy distribution, grid upgrades, and rural electrification programs are significantly boosting demand for conductive materials. As countries strengthen access to reliable electricity, copper wire remains crucial for safe and efficient transmission. Electrical infrastructure expansion aligns with ongoing modernization strategies, leading to increased deployment of copper wire in urban and semi-urban settings. This infrastructural evolution further positions copper wire as an essential utility enabler across Latin America.

Middle East and Africa Copper Wire Market Analysis

The Middle East and Africa are witnessing higher copper wire consumption due to the construction industry's growth. For instance, the construction sector accounts for nearly half of all copper use. Residential buildings cover about two-thirds of the construction market. Urbanization, commercial developments, and residential projects are accelerating electrical system installations that heavily depend on copper wire. The construction boom fosters widespread use of copper wire for internal wiring, grounding, and power distribution. As infrastructure projects increase in complexity and scale, copper wire remains integral to meet electrical demands. The construction industry’s growth ensures continuous integration of copper wire in regional building initiatives.

Competitive Landscape:

The copper wire market is characterized by intense competition, with players ranging from vertically integrated producers to regional suppliers specializing in niche applications. Competitive dynamics are shaped by factors such as production capacity, pricing strategies, product quality, and technological innovation in wire processing and insulation. Market participants compete on the basis of operational efficiency and the ability to secure long-term contracts with sectors like construction, automotive, power transmission, and electronics. There is increasing emphasis on sustainability, with firms investing in recycling and low-emission manufacturing to gain regulatory and market advantages. Geographic proximity to end-use industries also influences competitiveness, enabling faster delivery and reduced logistical costs. Moreover, companies offering customized solutions for high-voltage or specialized industrial applications tend to hold strong market positions. For instance, in April 2025, LS Cable & System secured a USD 140.7 Million contract with SP PowerAssets Limited to supply 230 kV ultra-high voltage underground power cables for a major energy project transmitting solar power from Indonesia to Singapore. The turnkey project includes manufacturing and installation, supporting cross-border renewable energy infrastructure. The initiative highlights LS Cable’s role in enabling large-scale clean energy transmission and is part of broader efforts to strengthen regional grid connectivity and sustainable power delivery across Southeast Asia.

The report provides a comprehensive analysis of the competitive landscape in the copper wire market with detailed profiles of all major companies, including:

- Schneider Electric SE

- Prysmian Group

- Mitsubishi Materials Corp.

- Southwire Company

- Nexans SA

- Furukawa Electric Co. Ltd.

- Belden Inc.

- Hindalco Industries Ltd.

- Polycab India Ltd.

- Finolex Cables Ltd.

Latest News and Developments:

- April 2025: Met-Ed, a subsidiary of FirstEnergy Corp., announced that it is upgrading the energy delivery system in north-western York County, Pennsylvania. The project focuses on upgrading over a mile of aging copper wire on a local power line by replacing it with larger-diameter wire. This new wire is expected to carry more electricity, improving service reliability for approximately 300 Met-Ed customers in the Dillsburg area and supporting the community’s increasing energy demands.

- February 2025: UltraTech Cement announced its entry into the wires and cables segment, marking a strategic expansion beyond cement. The company revealed plans to invest INR 1,800 crore to establish a manufacturing plant near Bharuch in Gujarat.

- October 2024: Aurubis and COFICAB renewed their multi-year contract to ensure a stable and sustainable copper wire rod supply for the automotive sector. The partnership focuses on combining responsibly sourced primary copper with a high share of recycled materials to support the industry's transition to greener practices.

- October 2024: Remee Wire & Cable launched a new family of stranded copper ground wires under its Renewables™ by Remee line. These wires were developed for outdoor utilization in solar arrays and wind farms. The product range included bare and tinned copper conductors from 14 AWG to 4/0 AWG. Each conductor featured concentric lay strands made from various copper tempers.

- August 2024: Bedra Vietnam Alloy Material Co., Ltd. launched a new line of advanced copper alloy rods and wires tailored for new energy vehicles and consumer electronics. The company said the alloys were engineered to be lead-free, beryllium-free, and environmentally friendly.

- April 2024: Prysmian Group and Aurubis entered into a long-term agreement for the supply of copper wire rods, ensuring a stable and sustainable copper source for Prysmian's European manufacturing operations. Aurubis, a vertically integrated copper wire rod producer, said it will incrementally increase supply volumes, supporting Prysmian's growth and sustainability objectives, as Prysmian aims for net-zero emissions by 2050 and increased recycled copper usage.

Copper Wire Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons, Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Building and Construction, Telecommunication and Power, Transport, Industrial Equipment, Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Schneider Electric SE, Prysmian Group, Mitsubishi Materials Corp., Southwire Company, Nexans SA, Furukawa Electric Co. Ltd., Belden Inc., Hindalco Industries Ltd., Polycab India Ltd., Finolex Cables Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the copper wire market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global copper wire market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the copper wire industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The copper wire market was valued at 21.57 Million Tons in 2024.

The copper wire market is projected to exhibit a CAGR of 4.99% during 2025-2033, reaching a value of 34.20 Million Tons by 2033.

The copper wire market is driven by rising demand in power generation, transmission, and electronics due to copper's excellent conductivity. Growth in renewable energy projects, electric vehicles, and infrastructure development also boosts demand. Additionally, recycling initiatives and technological advancements in wiring systems contribute to market expansion.

Asia Pacific currently dominates the copper wire market, accounting for a share of 56.7% in 2024, driven by rapid industrialization, infrastructure growth, and expanding electronics and automotive manufacturing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)