Coronary Stents Market Report by Type (Drug-eluting Stents, Bare-metal Coronary Stents, Bioabsorbable Stents), Biomaterial (Metallic Biomaterial, Polymeric Biomaterial, Natural Biomaterial), Mode of Delivery (Balloon-expandable Stents, Self-expanding Stents), End User (Hospitals, Ambulatory Surgical Centers, and Others), and Region 2025-2033

Market Overview:

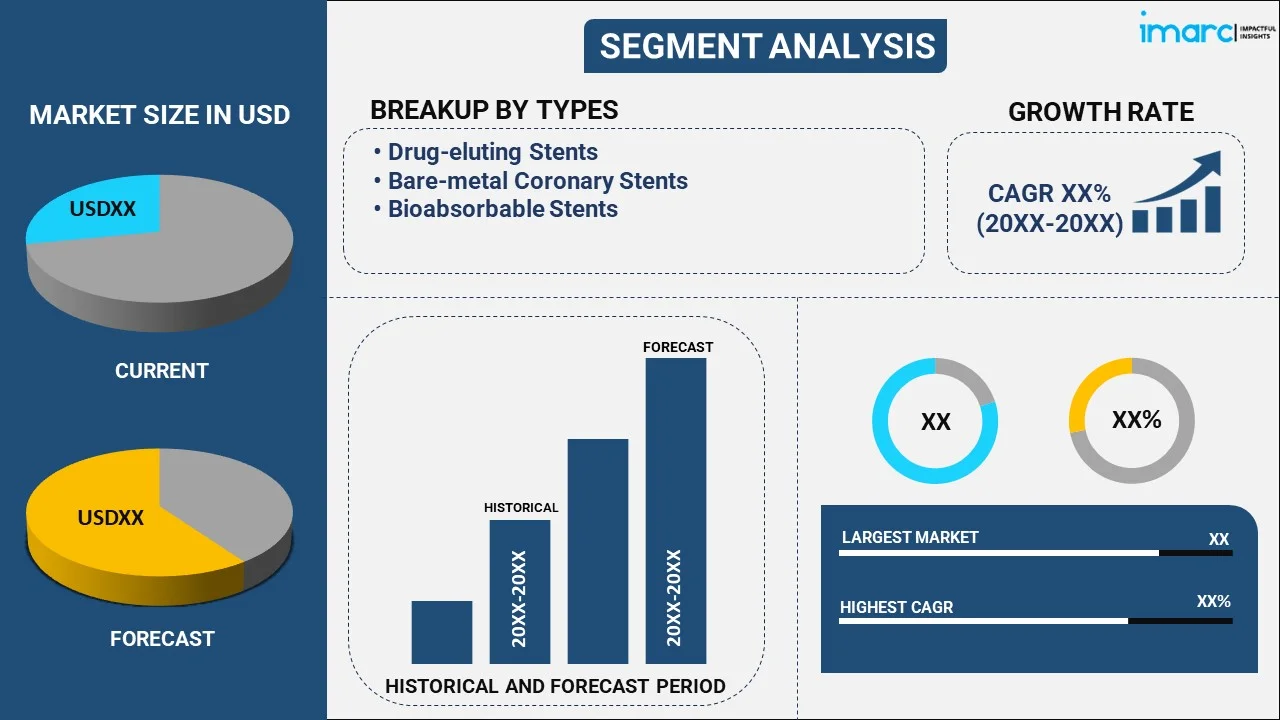

The global coronary stents market size reached USD 11.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 18.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.18% during 2025-2033. North America dominates the coronary stents market because of its advanced healthcare systems, higher adoption of latest medical technologies, and robust regulatory structures. The market is experiencing significant growth mainly driven by the rising prevalence of cardiovascular diseases, advancements in stent technology and a growing elderly population. Emerging markets and technological innovations, such as bioresorbable stents, further propels market growth across the globe.

Market Size & Forecasts:

- Coronary stents market was valued at USD 11.7 Billion in 2024.

- The market is projected to reach USD 18.9 Billion by 2033, at a CAGR of 5.18% from 2025-2033.

Dominant Segments:

- Type: Drug-eluting stents dominate the market because of their superior capacity to inhibit restenosis, resulting in better long-term results. Their coated drug slowly releases to prevent excessive tissue formation, considerably lowering the risk of artery re-narrowing. This offers a more efficient and long-lasting remedy for individuals with coronary artery disease.

- Biomaterial: Metallic biomaterial leads the coronary stents market attributed to its remarkable strength, longevity, and compatibility with biological systems. Its mechanical characteristics guarantee structural stability and enduring performance in medical uses. Moreover, its corrosion resistance and capacity to integrate smoothly with the human body make it a favored option for different implants.

- Mode of Delivery: Self-expanding stents account for the largest market share, as they can automatically adapt to the size of the vessel, guaranteeing optimal placement. Their dependable expansion method offers consistent assistance, minimizes procedural difficulties, and improves the stent's efficiency in preserving blood flow, resulting in better patient results.

- End User: Hospitals represent the largest segment owing to their sophisticated infrastructure, experienced healthcare staff, and availability of state-of-the-art medical technologies. They deliver extensive care, perform specialized procedures, and guarantee effective handling of complicated cases, establishing them as the primary setting for the implantation and oversight of coronary stents.

- Region: North America dominates the coronary stents market because of its advanced healthcare systems, increasing use of latest medical technologies, and robust regulatory structures. The area enjoys substantial funding in research activities, alongside a robust healthcare system, providing excellent access to advanced treatments and medical procedures.

Key Players:

- The leading companies in coronary stents market include Abbott Laboratories, B. Braun Melsungen AG, Biotronik SE & Co. KG, Boston Scientific Corporation, Elixir Medical Corporation, Lepu Medical Technology (Beijing) Co. Ltd., Medtronic plc, Meril Life Sciences Pvt. Ltd., MicroPort Scientific Corporation, Terumo Corporation, and Translumina GmbH.

Key Drivers of Market Growth:

- Preference for Drug-Eluting Stents (DES): Drug-eluting stents (DES) are preferred over bare-metal stents because they can deliver drugs that inhibit the re-narrowing of arteries. They lower restenosis rates, decrease the need for repeat procedures, and provide better long-term results, establishing them as a favored option in coronary interventions.

- Technological Advancements: Improvements in coronary stent technology, such as bioresorbable stents and drug-eluting balloons, increase both treatment effectiveness and safety. These advancements enhance natural vessel recovery, lower complications such as thrombosis, and offer tailored treatment options, leading to better clinical results and increasing choices for intricate coronary situations.

- Growing Geriatric Population: There is a rise in senior population, which is at a higher risk for cardiovascular diseases because of age-related alterations in arteries. This demographic change driving the need for coronary stents as reliable, efficient solutions for managing heart diseases, significantly aiding the expansion of the worldwide stents market.

- Demand for Patient-Centric Treatment Solutions: Patients now desire less invasive procedures that provide faster recovery and improved quality of life. Coronary stents meet these expectations, particularly with customized designs that address specific anatomical requirements. This patient-focused strategy fosters increased adoption and market growth.

- Investment in Healthcare Infrastructure: Enhancing healthcare facilities, especially in developing regions, increases availability of sophisticated cardiac treatments, such as coronary stents. Funding from both public and private sectors strengthens hospital capabilities, allows for wider treatment access, and boosts the demand for advanced medical devices like coronary stents.

- Strategic Partnerships and Collaborations: Partnerships between manufacturers, researchers, and healthcare professionals enhance innovation, optimize production, and broaden the distribution of coronary stents. These collaborations promote technology integration, cost-effectiveness, and local accessibility, which collectively broaden market access and aid in the advancement of next-generation stent solutions.

Future Outlook:

- Strong Growth Outlook: The coronary stents market is poised for strong growth, owing to improvements in technology, increasing occurrences of cardiovascular illnesses, and the growing preferences for less invasive methods. The continuous development of innovative stent materials and delivery systems further enhances market prospects, ensuring improved patient outcomes and expanding global accessibility.

- Market Evolution: The coronary stents market is evolving rapidly, attributed to ongoing advancements in biomaterials, design innovations, and enhanced drug-eluting technologies. These developments improve the efficacy, safety, and patient outcomes, fostering increased adoption. The market is also expanding with growing healthcare awareness and rising demand for advanced cardiovascular treatments.

Coronary stents are small, self-expanding tubular metallic devices introduced inside narrow coronary arteries to keep them open after a balloon angioplasty procedure. These stents are coated with a medication, which is slowly released to prevent the walls of arteries from plaque buildup and re-narrowing. They also alleviate heart disease symptoms, such as chest pain and shortness of breath, and allow normal flow of blood and oxygen to the heart. As they are minimally invasive (MI) and require shorter recovery time, coronary stents are gaining traction over coronary artery bypass surgeries around the world.

To get more information on this market, Request Sample

Coronary Stents Market Trends:

Rising Preference for Drug-Eluting Stents (DES)

Drug-eluting stents (DES) are becoming the preferred option over bare-metal stents (BMS) due to their effectiveness in reducing restenosis which is the re-narrowing of arteries after stenting. These stents are coated with medication that is slowly released to prevent the formation of scar tissue within the artery, thus significantly lowering the risk of blockages. For instance, in May 2024, Abbott introduced the XIENCE Sierra Everolimus eluting coronary stent system in India offering enhanced stent design with a new delivery system and unique sizes to aid in treating complex cases. The stent featured a specialized coating to reduce artery re-blocking and demonstrated efficacy in challenging lesions and complex conditions. In line with this, clinical studies have shown that DES improves long-term outcomes by reducing the need for repeat procedures compared to BMS. According to coronary stents market analysis, the market is set for significant growth due to the rising adoption of DES over bare-metal stents mainly driven by their superior performance in reducing restenosis and long-term complications.

Technological Advancements

Technological advancements in coronary stents include the development of bioresorbable stents which dissolve after their job is done, thus eliminating the need for long-term implants and reducing risks like late stent thrombosis. For instance, in July 2024, MicroPort Scientific Corporation's Firesorb® bioresorbable cardiac stent gained approval from the National Medical Products Administration in China. The stent had shown exceptional performance in clinical studies, with low rates of target lesion failure and thrombosis. Besides this, drug-coated balloons are another innovation that deliver drugs directly to the artery without leaving behind a permanent device generally ideal for complex lesions or patients with higher risks of restenosis. These technologies aim to improve patient outcomes by reducing long-term complications, enhancing vessel healing, and offering more personalized treatment options in coronary interventions.

Growing Geriatric Population and Rise of Cardiovascular Diseases

With the rising global geriatric population, the prevalence of cardiovascular diseases, particularly coronary artery disease, is on the rise. According to the report published by World Health Organization (WHO), by 2030, 1 in 6 people will be over 60 years old, and there will be 1.4 billion older individuals. By 2050, this number will double to 2.1 billion, with 426 million aged 80 or older. As arteries harden and narrow because of age-related factors like cholesterol buildup, elderly individuals are increasingly requiring coronary interventions. The higher susceptibility to heart conditions among this group is driving the demand for coronary stents to restore blood flow and prevent complications like heart attacks. Advancements in stent technology combined with the need for safe more effective treatments in older patients, are contributing to the coronary stents market growth. This demand is further supported by extended life expectancy and improved access to healthcare globally.

Coronary Stents Market Growth Drivers:

Rising Demand for Patient-Centric Treatment Solutions

The growing focus on patient-centered care is influencing the expansion of the coronary stents market. Modern patients value therapies that provide rapid recovery, reduced invasiveness, and enhanced quality of life after surgery, which are standards that coronary stents effectively fulfill. Their capability to successfully manage coronary artery disease while reducing complications makes them a favored choice. Moreover, the growth of personalized medicine is bolstering this trend, as stents can now be customized to meet specific anatomical requirements, enhancing outcomes even more. A prime illustration is Elixir Medical’s DynamX Bioadaptor, which in 2024 showed encouraging outcomes in the INFINITY-SWEDEHEART trial at the ESC Congress. It reached a target lesion failure rate of only 2.35%, almost equivalent to Medtronic’s 2.77% with its drug-eluting stent. Its innovative design, which promoted natural artery function, could reduce long-term risks, emphasizing how advancements aligned with patient-centered care are broadening the coronary stent market.

Increasing Investment in Healthcare Infrastructure

The growing investment in healthcare infrastructure, especially in developing markets, is catalyzing the demand for coronary stents. Governments and private sector entities are significantly investing in healthcare facilities, medical devices, and advanced treatment alternatives to enhance care quality and ensure access to critical interventions. In 2025, Tata Group revealed a ₹500 crore investment in Breach Candy Hospital in Mumbai to upgrade its infrastructure and improve patient care through advanced technologies. These investments are broadening access to coronary stents for a wider population, particularly in developing areas where cardiovascular disease rates are increasing. As access to advanced healthcare services improves, including specialized treatments such as coronary stents, the need for these life-saving devices is anticipated to rise. This trend enhances patient outcomes and also speeds up the growth of the coronary stent market in both developed and emerging areas.

Strategic Partnerships and Collaborations

Collaborative relationships among medical device producers, research institutions, and healthcare providers are crucial in fostering the expansion of the market. These collaborations promote the advancement of cutting-edge stent technologies that address the changing requirements of patients. Collaborators can speed up the development of more effective, cost-efficient, and advanced stent solutions by sharing their expertise, resources, and research findings. These partnerships also simplify manufacturing processes and broaden distribution channels, making stents more accessible in various regions, especially in underrepresented areas. Moreover, such collaborations frequently result in the incorporation of advanced technologies, enhancing the overall performance and quality of coronary stents. As these partnerships develop, they assist in meeting the increasing need for efficient cardiac therapies, ultimately contributing to the expansion of the coronary stents market share by improving both availability and innovation in the sector.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global coronary stents market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on type, biomaterial, mode of delivery and end user.

Breakup by Type:

- Drug-eluting Stents

- Bare-metal Coronary Stents

- Bioabsorbable Stents

Breakup by Biomaterial:

- Metallic Biomaterial

- Polymeric Biomaterial

- Natural Biomaterial

Breakup by Mode of Delivery:

- Balloon-expandable Stents

- Self-expanding Stents

Breakup by End User:

- Hospitals

- Ambulatory Surgical Centers

- Others

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global coronary stents market. Detailed profiles of all major companies have also been provided. Some of the companies covered include:

- Abbott Laboratories

- B. Braun Melsungen AG

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- Elixir Medical Corporation

- Lepu Medical Technology (Beijing) Co. Ltd.

- Medtronic plc

- Meril Life Sciences Pvt. Ltd.

- MicroPort Scientific Corporation

- Terumo Corporation

- Translumina GmbH

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Coronary Stents Market News:

- In May 2025, SGPGI Lucknow introduced AI-enabled intravascular OCT technology to enhance precision angioplasty by providing high-resolution, real-time imaging of arterial plaques. This system aids in accurate stent placement and better understanding of coronary artery disease, especially among younger Indian patients.

- In February 2025, Teleflex announced a €760M deal to acquire Biotronik’s vascular intervention portfolio, including coronary stents, drug-coated balloons, and the PK Papyrus rescue stent. The acquisition will expand Teleflex’s coronary and peripheral offerings.

- In March 2024, Boston Scientific received FDA approval for the AGENT™ Drug-Coated Balloon (DCB), the first of its kind in the US to treat coronary in-stent restenosis. Backed by strong trial data, it offered a safe, effective substitute to conventional treatments like angioplasty or radiation.

- In December 2023, Terumo India launched Ultimaster Nagomi a new drug-eluting designed for treating coronary artery disease. The stent is suitable for small or large sized coronary arteries offering customized options for a larger patient group.

- In August 2024, major global private equity firms, including KKR, Apax Partners and TPG Capital, announced their plans to acquire Sahajanand Medical Technologies (SMT), India's largest cardiac stent maker, at a valuation of Rs 3,500 crore to Rs 4,000 crore. The stent maker had a 31 percent market share in India and had filed papers for an IPO to raise Rs 1,500 crore.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Type, Biomaterial, Mode of Delivery, End User, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, B. Braun Melsungen AG, Biotronik SE & Co. KG, Boston Scientific Corporation, Elixir Medical Corporation, Lepu Medical Technology (Beijing) Co. Ltd., Medtronic plc, Meril Life Sciences Pvt. Ltd., MicroPort Scientific Corporation, Terumo Corporation and Translumina GmbH. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The global coronary stents market was valued at USD 11.7 Billion in 2024.

We expect the global coronary stents market to exhibit a CAGR of 5.18% during 2025-2033.

The rising demand for coronary stents in minimally invasive (MI) surgeries, as they aid in alleviating symptoms of heart disease, including chest pain and shortness of breath, is primarily driving the global coronary stents market.

The sudden outbreak of the COVID-19 pandemic had led to postponement of elective coronary artery surgical procedures to reduce the risk of the coronavirus infection upon hospital visits, thereby negatively impacting the global market for coronary stents.

Based on the type, the global coronary stents market has been divided into drug-eluting stents, bare-metal coronary stents, and bioabsorbable stents. Among these, drug-eluting stents currently exhibit a clear dominance in the market.

Based on the biomaterial, the global coronary stents market can be categorized into metallic biomaterial, polymeric biomaterial, and natural biomaterial. Currently, metallic biomaterial accounts for the majority of the global market share.

Based on the mode of delivery, the global coronary stents market has been segregated into balloon-expandable stents and self-expanding stents, where self-expanding stents currently hold the largest market share.

Based on the end user, the global coronary stents market can be bifurcated into hospitals, ambulatory surgical centers, and others. Currently, hospitals exhibit a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global coronary stents market include Abbott Laboratories, B. Braun Melsungen AG, Biotronik SE & Co. KG, Boston Scientific Corporation, Elixir Medical Corporation, Lepu Medical Technology (Beijing) Co. Ltd., Medtronic plc, Meril Life Sciences Pvt. Ltd., MicroPort Scientific Corporation, Terumo Corporation, and Translumina GmbH.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)