Craft Beer Market Size, Share, Trends and Forecast by Product Type, Age Group, Distribution Channel, and Region, 2025-2033

Craft Beer Market Size and Share:

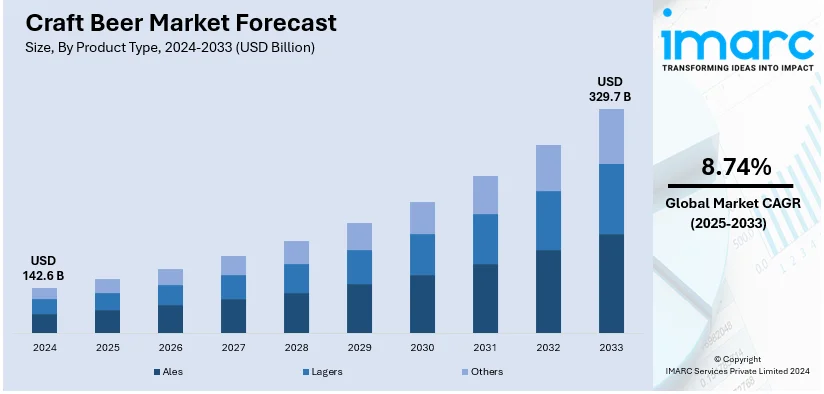

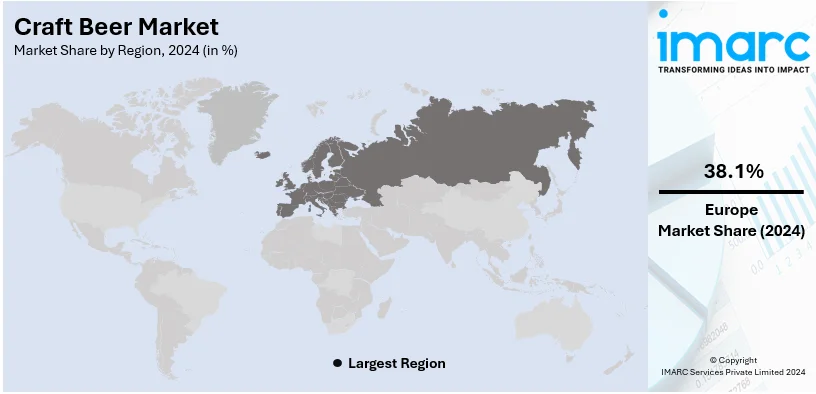

The global craft beer market size was valued at USD 142.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 329.7 Billion by 2033, exhibiting a CAGR of 8.74% from 2025-2033. Europe currently dominates the market, holding a market share of over 38.1% in 2024. The market is primarily driven by the rising consumer preference for unique, flavorful beers, increasing demand for locally brewed and artisanal beverages, growing popularity of beer tourism, and innovative marketing strategies targeting millennials and health-conscious consumers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 142.6 Billion |

|

Market Forecast in 2033

|

USD 329.7 Billion |

| Market Growth Rate 2025-2033 | 8.74% |

Evolving consumer preferences for distinctive and flavorful beverages are driving the craft beer market, thus increasing demand for artisanal and locally brewed products. Growing interest in premium beer experiences has been the impetus for increasing demand for small-batch, handcrafted brews, targeting millennials and younger demographics. Healthy consumers are also shaping the market, as they are attracted to low-calorie and organic craft beers. Beer tourism, which focuses on local breweries and unique tasting experiences, is further expanding market reach. Innovative marketing strategies, such as storytelling, social media engagement, and collaborations with local businesses, are also enhancing brand visibility and customer loyalty. Rising disposable incomes and a growing appreciation for diverse beer styles are solidifying the craft beer market's growth on a global scale.

To get more information on this market, Request Sample

The United States has emerged as a key regional market for craft beer. The market is influenced by the growing demand for distinctive, high-quality beverages with flavors and ingredients that are unique. Interest in locally brewed and artisanal products has increased demand, as consumers seek authentic experiences that align with regional traditions. Millennials and younger generations are driving market growth due to innovative branding and personalized offerings. Also, beer tourism and festivals, the growing popularity of which are due to the social nature of craft beer, give opportunities for breweries to communicate directly with the end consumer. Trends like low-calorie, organic, and gluten-free products are shaping the market, further influencing this segment of the beverage industry.

Craft Beer Market Trends:

Increasing consumer preference for artisanal and unique flavors

The craft beer market outlook is expanding due to shifting customer preferences for artisanal and distinctive flavors. It is one of the major craft beer industry trends. This change is a response to the homogenized flavors of mass-produced beers; these beers offer a wide range of flavors and genres, such as IPAs, stouts, and sours, to suit a wide variety of palates. According to the Brewers Association, urban craft beer benefits from the Middle East's robust beverage alcohol sales, with Dubai Duty Free liquor generating USD 280 Million in 2022 (16% of sales) and UAE's 30% alcohol tax removal fuelling local market competition amidst growing passenger traffic at Dubai International, ranked 5th globally by ACI. The use of premium and locally obtained ingredients adds to the allure of these beers and speaks to consumers' growing concern about the provenance and quality of the food they eat. When compared to typical beer options, millennials, and Gen Z consumers are especially drawn to this trend since they are eager to try out new and varied flavor profiles and frequently see the product's consumption as a more unique and genuine experience.

Considerable growth in the number of microbreweries and brewpubs

A major craft beer market business opportunity is the considerable growth in the number of brewpubs and microbreweries around the globe. Due to the growth of these small-scale establishments, the beer enthusiast community has become more active and connected. According to the Brewers Association, in 2023, the number of microbreweries and brewpubs were recorded high, reaching 2,071 microbreweries, 3,467 brewpubs, 3,900 taproom breweries, and 245 regional craft breweries. Microbreweries and brewpubs provide a distinctive setting for brewing experiments and innovations. Many areas have supportive government laws that promote small-scale brewing enterprises, contributing to this growth. interact with brewers and the brewing process, which enhances the product's appeal and creates a more comprehensive experience. In addition, the whole experience of visiting these places, where customers can watch the brewing process in action and interact with brewers directly, adds to the product's appeal. This factor is leading to an improvement in the craft beer market statistics.

Rising health consciousness and demand for low-alcohol options

Another key driver of the market is the growing emphasis on health and well-being. Craft brewers have responded to this need with agility, creating a wide range of 'light' beers that offer healthier options without sacrificing flavor depth. The artisanal non-alcoholic beers are also witnessing an increase in demand due to the consumers who care about their health but can't compromise on taste. According to reports, health consciousness is projected to rise by 0.5% to 111.4 index points in 2024-25, driven by reduced smoking rates and lower alcohol consumption, favoring craft beer as consumers increasingly opt for no- and low-alcohol options aligned with wellness trends. This shift toward healthier options is driving the market. This attracts consumers who might have otherwise avoided beer consumption due to health concerns. This development has allowed the market to tap into a new consumer base, further fueling the craft beer market growth.

Craft Beer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global craft beer market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, age group, and distribution channel.

Analysis by Product Type:

- Ales

- Lagers

- Others

In 2024, lagers dominate the market with 48.1% share. Due to their broad appeal and ease of access, lagers constitute yet another noteworthy market category. Lagers are popular with a wide range of customers. They have a milder and smoother flavor profile than ales due to the lower temperature fermentation procedure. Pilsners and helles are two of the sub-types in this category that come in a variety of flavors to suit a wide range of consumer tastes.

A sizable section of the market is dominated by ales. They are renowned for their complex and deep flavors. This category features IPAs, stouts, and porters, among other kinds. Each has a unique flavor and aroma. Ales' fermentation process, which takes place at higher temperatures, adds to the depth and diversity of their flavors. The ale market is especially well-liked by beer connoisseurs who value artisanal and distinctive beer experiences.

Analysis by Age Group:

- 21-35 Years Old

- 40-54 Years Old

- 55 Years and Above

21-35 year old age group leads the market with around 51.6% of market share in 2024. People aged 21 to 35, who are drawn to flavors that are distinctive and varied. This group, which includes early Gen Zers and the latter half of Millennials, exhibits a significant taste for artisanal and specialty beers. They are more willing to try out new flavors and varieties, such as experimental brews and IPAs. Furthermore, social media and trends have a big impact on this group, which makes them more open to new product releases and marketing initiatives.

However, the 40–54 age group, which makes up a sizable share of the market, is frequently distinguished by more sophisticated and discriminating tastes. This group, which is mostly made up of Gen Xers, flavors quality over quantity and typically has more disposable cash. They will probably enjoy classic, well-made beers, and they will probably be especially interested in real, regional breweries. This market is particularly drawn to well-known craft brands with a solid name and legacy because they frequently appreciate the craftsmanship and background of the brew.

Moreover, the market for those 55 years of age and above is expanding within the sector. Their selections are also heavily influenced by their health, with a preference for lighter, lower-alcohol, and maybe healthier options.

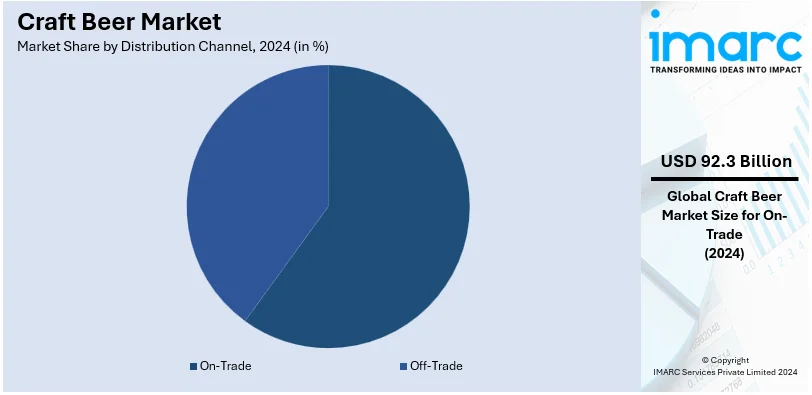

Analysis by Distribution Channel:

- On-Trade

- Off-Trade

On trade leads the market with 64.7% of market share in 2024. The on-trade distribution channel, which includes places like brewpubs, restaurants, taverns, and pubs. Customers place high importance on the social component of drinking this type of artisanal beer, which is the reason for its supremacy. Through the on-trade route, customers can sample a range of products, frequently under the guidance of experienced staff members or, in the case of brewpubs, directly from the brewers. They showcase rare or limited-edition beers to satisfy customers' cravings for uncommon and exciting experiences. Customers are drawn in by this engaging experience as well as the social atmosphere of these businesses, especially the younger people.

In contrast, a sizable portion of the industry is represented by the off-trade distribution channel, which includes retail establishments like supermarkets, liquor stores, and internet platforms. Customers who want the ease of using the product at home or in private settings may find this channel appealing. Furthermore, the increased availability of products in mainstream retail stores and the emergence of e-commerce sites that specialize in beer delivery are driving growth in the off-trade industry. This market includes people who want to buy these type of beers as gifts or who would rather consume them in the comfort of their own homes.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 38.1%. According to the report, Europe with a long history of brewing and a strong beer culture, notably in nations like Germany, Belgium, and the UK, Europe has the most market share. The region offers a vast array of varieties, from traditional ales and lagers to experimental brews, and is characterized by a fusion of modern innovation and old brewing processes. Craft beer is a vital component of the gastronomic and cultural experience, which is driving the market in addition to high domestic demand. Rapid urbanization, a burgeoning middle class with good income, and fast economic expansion within the Asia Pacific region provides a positive outlook for the market. An increase in microbreweries and a growing interest in craft beer culture, especially in countries like China, Japan, and Australia, are providing a thrust to the market further. The market is well-established and growing in North America, especially in the United States and Canada, though at a steadier and more mature rate. This region is known for its innovative brewing techniques and many craft beer styles. It has a strong culture of microbreweries and brewpubs. The market has high consumer awareness and appreciation for craft beer. There is also a particular emphasis on local and artisanal brews. The market in Latin America is in a phase of rapid growth. It is driven by increasing economic development and the influence of global beer trends. Countries including Brazil, Mexico, and Argentina are witnessing a rise in the number of craft breweries. They also have a growing consumer base keen on exploring diverse and locally produced beers. Despite being relatively modest, the Middle East and Africa market has room to grow. Premium and imported craft beers are in high demand in these markets, and consumers' curiosity in trying out new flavors and varieties of beer is only increasing. The Middle East and Africa market is expected to grow gradually, concentrating on specialized customer niches and adopting focused marketing techniques.

Key Regional Takeaways:

United States Craft Beer Market Analysis

In 2024, the United States accounts for 86.85% of the craft beer market in North America. The emergence of locally crafted beverages has sparked significant consumer interest, fueled by a desire for distinctive, high-quality items in the US. Independent breweries are gaining from this transformation, as increasing numbers of people appreciate unique flavours and artisanal production techniques over mass-manufactured alternatives. The flourishing trend of pairing food with drinks has additionally enhanced consumption, particularly as craft selections frequently enhance gourmet and farm-to-table dining experiences. According to the research commissioned by the Beer Institute, two-thirds of drinkers in the country which is equivalent to 66%, opted for beer in the past three months. Moreover, younger consumers are gravitating toward these beverages due to their innovation and sustainability initiatives, including eco-friendly packaging and locally sourced ingredients. According to reports, a recent survey indicates that 43% of U. S. consumers view environmental impact as essential in packaging, though price, quality, and convenience remain the predominant factors influencing purchase choices. Significantly, 4-7% are prepared to pay more than 10% extra for eco-friendly alternatives like compostable and plant-based packaging. Preferences for sustainable packaging differ across demographics, which reveals opportunities for customized strategies amid evolving post-COVID priorities.

Asia Pacific Craft Beer Market Analysis

The rising disposable incomes of the middle class is driving the expansion of craft beer segment in the Asia Pacific. Urbanization is playing a key role in increasing awareness and access to premium beverages. New marketing strategies, such as interactive tasting events and collaborations with restaurants further boosting brand visibility. Changing consumer preferences, especially toward international and artisanal products, are opening doors for local brewers to tap into global trends. Health-conscious buyers are showing a growing interest in low-alcohol options. For instance, a study in 2020 revealed that over 40% of Indian beer drinkers aged 25 to 34 prefer low or no-alcohol beers, reflecting an increasing focus on health. Concerns about health (48%) and avoiding hangovers (31%) are key factors behind this shift, paving the way for low-calorie and gluten-free options. Craft beer, favored by 45% of Indian consumers, is capitalizing on this demand with high-quality, low-alcohol offerings and creative packaging. Further, government policies supporting small businesses are indirectly benefiting the industry by providing incentives for local manufacturers. Using locally sourced ingredients has allowed companies to manufacture their products to specific consumer tastes, creating appeal across different age groups.

Europe Craft Beer Market Analysis

An established tradition in this field continues to draw enthusiasts looking for artisanal alternatives to mass-produced drinks in the Europe. Local creators are utilizing heritage recipes to develop premium options that resonate with buyers. Increasing interest in culinary experiences, such as pairing drinks with meals, is boosting the charm of these products. The growth of small-scale festivals and tasting tours is aiding in connecting brewers directly with customers, strengthening loyalty. A rising emphasis on sustainability, including reusable packaging and eco-friendly methods, aligns with the environmentally conscious demographic. Digital sales platforms are providing brewers entry to global markets, while collaborations with retail chains are broadening their reach. According to The International Trade Administration, U. S. Department of Commerce, Germany’s e-commerce market, which was valued at USD 141. 2 Billion in 2022 with an 11% growth rate, showcases 80% penetration, influenced by 62. 4 Million online users (2020) predicted to rise to 68. 4 Million by 2025. Known for food and beverages, e-commerce supports craft beer through convenience, home delivery, and Germany's quality-focused online purchasing behaviors, utilizing platforms like Amazon and social media. Regulatory backing in various regions is encouraging innovation, and permitting experimentation with new techniques and ingredients.

Latin America Craft Beer Market Analysis

The craft beer sector is experiencing growth driven by evolving consumer preferences and a desire for locally produced drinks. The lively cultural background of the area offers abundant inspiration for flavours, attracting a younger demographic. Urban centres are observing an increase in specialized venues and tasting events, generating interest and promoting exploration. Reports indicate that Brazil's population of 212. 3 Million, with 91% (192. 9 Million) residing in urban settings, creates a concentrated consumer market for craft beer. Urban development stimulates the demand for niche beverages, bolstered by the country's median age of 34. 4, which aligns with the young, experimental target audience of the craft beer industry. This active urban populace enhances the growth potential for craft beer. Social media initiatives and collaborations with food festivals are enhancing exposure for new brands. The growth of distribution channels, including partnerships with larger beverage distributors, is improving access to artisanal choices.

Middle East and Africa Craft Beer Market Analysis

A rising market is developing in reaction to the increasing demand for unique and premium beverages among city professionals in the region. Local manufacturers are investigating non-alcoholic options to meet cultural tastes, expanding their appeal. For example, in September 2023, urban craft beer gains from the Middle East's strong beverage alcohol sales, as Dubai Duty Free liquor brought in USD 280 Million in 2022 (16% of sales), and the UAE's removal of a 30% alcohol tax is boosting local market competition amid rising passenger traffic at Dubai International, which is ranked 5th globally by ACI. The incorporation of traditional ingredients introduces a regional character, drawing interest from both local and international buyers. E-commerce platforms are enabling direct access to specialized offerings, while partnerships with restaurants and cafes are increasing visibility. The sector is thriving on tourism-driven demand, with travellers in search of unique products that showcase local craftsmanship.

Competitive Landscape:

To capitalize on changing consumer preferences, unique beer styles, flavors, and packages are being developed by the companies. This includes low-alcohol and gluten-free beers, as well as organic options, to better service health-conscious buyers. Furthermore, craft breweries are gaining value for authenticity, local heritage, and storytelling to build strong brand identities and connect emotionally with consumers. In addition, most breweries are increasing their geographical reach with the help of distributorships and retailer partnerships, thus they can reach wider markets globally and locally. Furthermore, to cater for the environmentally friendly consumers, breweries turn to sustainable practices such as producing renewable energy, eco-friendly packaging, and reducing water consumption for production. The large companies are also buying small highly performing craft breweries for differentiating their products and increased market share.

The report provides a comprehensive analysis of the competitive landscape in the craft beer market with detailed profiles of all major companies, including:

- Bell’s Brewery

- D.G. Yuengling & Son, Inc.

- Dogfish Head Craft Brewery

- Duvel Moortgat

- Minhas Craft Brewery

- New Belgium Brewing Company

- Oskar Blues Brewery

- Sierra Nevada Brewing Co.

- Stone Brewing

- The Boston Beer Company

- The Gambrinus Company

Latest News and Developments:

- August 2024: Tilray Brands Inc. and Molson Coors Beverage Co. have signed a deal to acquire four craft breweries. These include Revolver Brewing (Texas), Terrapin Beer Co. (Georgia), Hop Valley Brewing Co. (Oregon), and Atwater Brewery (Michigan). The acquisition will expand Tilray's beverage portfolio to encompass 18 brands. This strategic move strengthens its position in the craft beer market and broadens its geographic footprint.

- February 2024: American Brew Crafts Pvt Ltd. unveiled a Belgian-style craft beer, Flying Monkey, in Hyderabad. The launch introduces a bold, adventurous element to the city’s beer culture. This new variant aims to redefine craft beer experiences, appealing to a younger, experimental audience. The innovation reflects ABCL’s commitment to enhancing the regional beer landscape.

Craft Beer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ales, Lagers, Others |

| Age Groups Covered | 21-35 Years Old, 40-54 Years Old, 55 Years and Above |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bell’s Brewery, D.G. Yuengling & Son, Inc., Dogfish Head Craft Brewery, Duvel Moortgat, Minhas Craft Brewery, New Belgium Brewing Company, Oskar Blues Brewery, Sierra Nevada Brewing Co., Stone Brewing, The Boston Beer Company, The Gambrinus Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the craft beer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global craft beer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the craft beer industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The craft beer market was valued at USD 142.6 Billion in 2024.

The craft beer market is projected to exhibit a CAGR of 8.74% during 2025-2033, reaching a value of USD 329.7 Billion by 2033.

The craft beer market is majorly driven by the rising consumer preference for unique and flavorful beers, increasing demand for locally brewed and artisanal beverages, growing popularity of beer tourism, and ongoing innovative marketing strategies targeting millennials and health-conscious consumers.

Europe currently dominates the market, accounting for a share of around 38.1%. The dominance is driven by rising consumer preference for premium beverages, growing demand for unique flavors, expanding microbreweries, increasing tourism, and a strong tradition of beer consumption across the region.

Some of the major players in the craft beer market include Bell’s Brewery, D.G. Yuengling & Son, Inc., Dogfish Head Craft Brewery, Duvel Moortgat, Minhas Craft Brewery, New Belgium Brewing Company, Oskar Blues Brewery, Sierra Nevada Brewing Co., Stone Brewing, The Boston Beer Company, and The Gambrinus Company, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)