Craft Spirits Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033

Craft Spirits Market Size and Share:

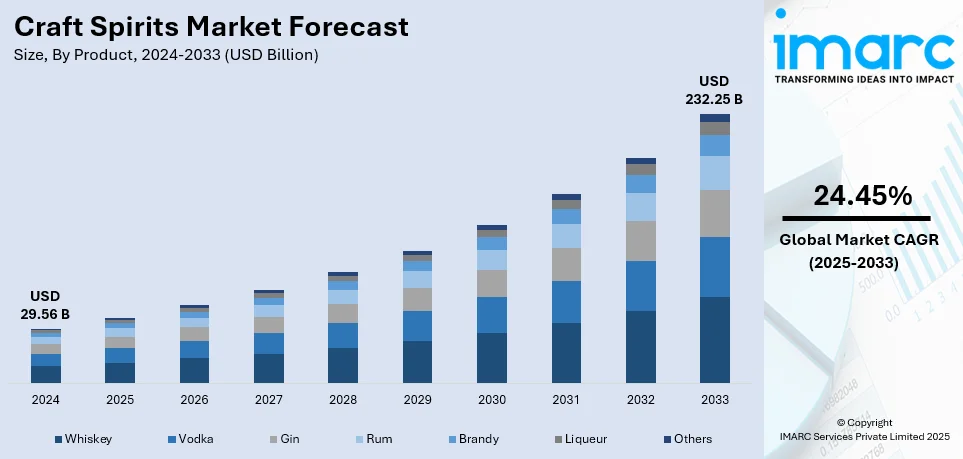

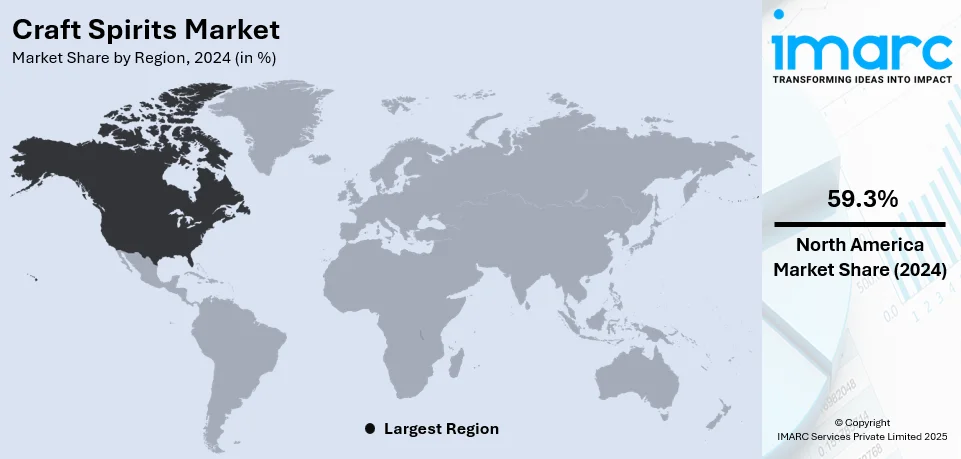

The global craft spirits market size was valued at USD 29.56 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 232.25 Billion by 2033, exhibiting a CAGR of 24.45% from 2025-2033. North America currently dominates the market, holding a market share of over 59.3% in 2024. The craft spirits market share is increasing due to the rising consumer demand for premium, artisanal drinks, growing interest in local and sustainable craft distilleries throughout the world, and the growing desire for authenticity, distinctive tastes, and small-batch manufacturing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 29.56 Billion |

| Market Forecast in 2033 | USD 232.25 Billion |

| Market Growth Rate (2025-2033) | 24.45% |

The craft spirits market growth is attributed to the increasing demand for premium, small-batch, and locally produced alcoholic beverages. This category of spirits includes whiskey, gin, vodka, rum, and tequila. Consumers seek artisanal, handcrafted products, unique flavors, and a focus on quality while making a drink. Authenticity of drinking experiences, particularly in millennials and Gen Z, will see an increasing demand for innovative spirits. Key market players are focusing on product differentiation through aging techniques, organic ingredients, and sustainable distillation processes. The rise of cocktail culture, fueled by mixology trends in upscale bars and restaurants, has further boosted the market. Additionally, direct-to-consumer (DTC) sales and e-commerce platforms are expanding accessibility, allowing smaller distilleries to reach a global audience. Regionally, North America leads the market, driven by a strong craft distilling industry, followed by Europe, where premiumization and local sourcing trends are dominant. Asia Pacific is emerging as a fast-growing region due to rising disposable incomes and evolving consumer preferences. As sustainability, innovation, and premiumization continue to shape the craft spirits market trends.

The United States has become a significant regional market for craft spirits, influenced by a robust culture of small-batch distilling, consumer preference for premium spirits, and favorable regulatory policies. Craft distilleries have been the impetus for innovation in whiskey, gin, vodka, and rum. Consumers increasingly look for high-quality, locally sourced spirits with unique flavor profiles, thereby boosting demand for artisanal brands. Regulatory support, such as tax cuts for small distilleries under the Craft Beverage Modernization and Tax Reform Act, has encouraged entrepreneurship and market expansion. Additionally, the growing cocktail culture, fueled by high-end bars and mixology trends, has increased craft spirit consumption in the on-trade segment. Direct-to-consumer (DTC) sales and e-commerce platforms are also expanding access to craft spirits. As drivers of the market, sustainability, authenticity, and premiumization will sustain the U.S. craft spirits sector in the years ahead.

Craft Spirits Market Trends:

Increasing consumer demand for authenticity and artisanal products

A major factor boosting the global craft spirits demand is the growing customer preference for authentic artisanal beverages. According to the poll, 62% of American consumers who are 18 years of age or older reported using alcoholic drinks like wine, beer, or liquor at some point in 2023. Consumers are moving away from mass-produced spirits to smaller batches that will be centered on an emphasis on artisanship, distinctive flavors, and traditional production methods. Additionally, this desire for authenticity falls in line with high customer demands for locally produced, handcrafted goods. According to industry insights, worldwide, 60% of bartenders also highlight the use of local ingredients in craft spirits. Additionally, craft distilleries are leveraging the trend by extolling the virtues of heritage, ingredient transparent sourcing, and production-specific expertise to an endemic consumer market that seeks exclusivity in their beverages.

Market growth of craft spirits abroad

Early traction of craft spirits started in specifically developed market economies and is now spiking across international shores, with higher penetration across Asia Pacific. Industry reports showed that Chinese brands held 69.4% of the value share for the top 50 global spirit brands in 2023. Interestingly, six out of the ten top spirits brands globally are China-based, and five of those are baijiu brands according to value metrics. Also, rising disposable incomes, changing tastes of consumers in emerging markets, and increased demand for premium and luxury beverages are significantly contributing to the growing demand for craft spirits. In addition, with increasing receptiveness in international markets toward craft products, distilleries are focusing on making changes in their product lines according to local preferences without compromising the essence and craft associated with the craft spirits segment, which provides a significant avenue for growth opportunities across the world.

Magnifying emphasis on eco-friendly and sustainable production practices

One of the rapidly accelerating key trends in the global craft spirits market is sustainability. As consumers are presently focusing on environmentally responsible brands, this is forcing distilleries to switch to eco-friendly production practices, among which are renewable energy sources, minimum water usage, and organic inputs. As companies work to lessen their carbon footprints, packaging innovations like recyclable materials and lightweight bottles are also becoming popular. For instance, Bruichladdich Distillery reduced the carbon emissions from the packaging of single malt by 65% in July 2023 by redesigning its iconic product, The Classic Laddie. With 60% recycled glass in the new design, the bottle is 32% lighter and has a less environmental effect since it can be transported more efficiently with fewer cars and more bottles per pallet. In addition to meeting consumer expectations, this noteworthy trend toward sustainability aids artisan distilleries in standing out in a market that is becoming more competitive.

Craft Spirits Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global craft spirits market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and distribution channel.

Analysis by Product:

- Whiskey

- Vodka

- Gin

- Rum

- Brandy

- Liqueur

- Others

Whiskey is the largest segment of the craft spirits sector and accounted for a significant share of 45.0%. This is due to consumers demand premium, high-quality, and aged spirits. There has been an increasing interest from millennials and Gen Z in whiskey for its flavors, craftsmanship, and heritage associated with it. Small-batch distilleries are primarily gaining impetus nowadays due to innovative and unique aging techniques. Moreover, whiskey-based cocktails like Old Fashioned and Manhattan have also become popular drinks in bars and restaurants. Craft whiskey distilleries are on the rise in North America, especially in the U.S., with over 2,200 small distilleries offering unique, locally sourced whiskey. The movement toward authenticity and sustainability in alcohol consumption has also propelled the popularity of craft whiskey. Emerging trends such as cask-finished whiskey and organic whiskey have also gained consumer attention. Additionally, the aging ability of whiskey and the complexity of flavors that develop over time make it more appealing to connoisseurs. With rising disposable income and the premiumization trend in alcoholic beverages, whiskey is expected to continue its leadership in the craft spirits market in the coming years.

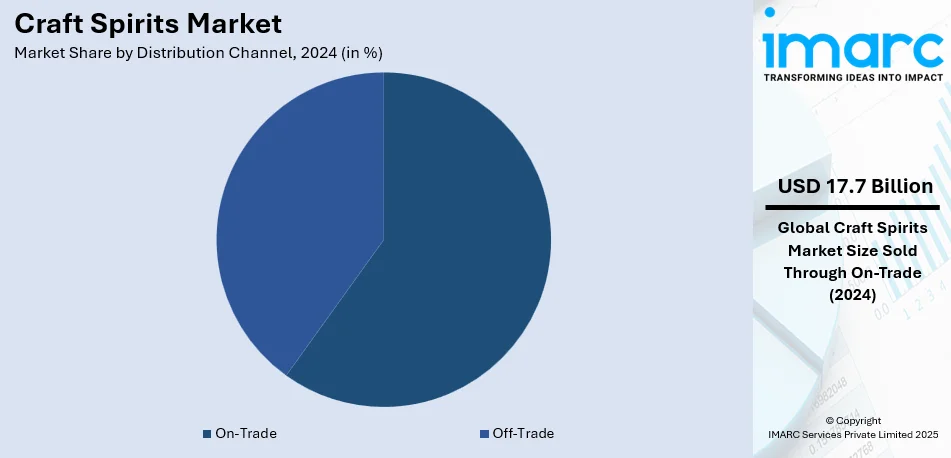

Analysis by Distribution Channel:

- On-Trade

- Off-Trade

The on-trade dominates the market, with a market share of 59.8%. One of the primary reasons for its dominance is the experiential nature of craft spirit consumption. Consumers are increasingly seeking unique and innovative cocktails, which are best crafted and served in premium hospitality venues by skilled mixologists. Bars and restaurants often act as a launchpad for new craft spirit brands, providing visibility and direct consumer engagement. Moreover, cocktail culture has played a major role in the on-trade sector in the growth of craft spirits. Craft distilleries partner with bars to develop signature drinks, thereby increasing brand recognition and consumer loyalty. The increased interest in social drinking experiences where consumers can try new flavors and pair spirits with gourmet food also increases this segment. Post-pandemic, many high-end bars and restaurants have shifted toward offering premium and locally sourced beverages, further boosting the craft spirit's market. As urban nightlife and fine dining continue to expand, the on-trade channel will remain the dominant distribution method for craft spirits globally.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the global craft spirits market, accounting for 59.3% of the market share, driven by a strong craft distilling culture, high consumer spending on premium alcoholic beverages, and supportive regulatory frameworks. The U.S. has been at the forefront of the craft spirits movement, with an increasing number of small and independent distilleries producing high-quality, innovative spirits. Many consumers in this region like products that are distilled locally and are small batches, hence helping the craft brand grow. Regime support can be in tax cuts for a small distillery under the U.S. Craft Beverage Modernization and Tax Reform Act. Consumers' desire to have authenticity and transparency in this product line further contributed to this market being dominated by North America. Moreover, e-commerce platforms and direct sales also increased the availability of craft spirits to a wider audience. The popularization of the drinking culture among consumers for whiskey, gin, and other craft spirits with increasing tourism in tasting sessions inside distilleries even further consolidated their position, leading North America on the international chart of craft spirits.

The European craft spirits market is led by the preference for premium and locally sourced alcoholic beverages. Organic and artisanal spirits are becoming increasingly popular in the UK, Germany, and France, further driving the growth of the market. Strong cocktail culture and growing demand for gin, whiskey, and vodka are also positives in the region. Regulatory support for small-scale distilleries and sustainability trends boosts the industry further. In addition, e-commerce sales and craft spirit festivals are opening consumer access and building awareness about the presence of the market across Europe.

The Asia Pacific is a growing region for craft spirits due to high disposable income, changing drinking patterns, and a rising interest in premium adult beverages. Local craft distilleries in countries like China, India, and Japan are bustling with growth in whiskey, gin, and rice-based spirits. Strong demand factors include an increasing urban population and a growing bar culture. Besides these primary factors, social media influence, brand storytelling, and celebrity endorsement are making craft spirits more attractive. Also, government policies promoting local distilleries support the regional market growth.

Latin America's craft spirits market is rising on account of changing consumers' preferences toward more superior quality, small-batch variants of spirits, especially craft tequila, mezcal, and rum. The leaders in the trend are Mexico and Brazil, which have a strong tradition of artisanal distilling. Increased tourism and the popularity of craft cocktail culture are big drivers of demand. Local distilleries focus on sustainability using organic ingredients and traditional production methods. Export opportunities to North America and Europe continue to grow and open access to a global audience for Latin American craft spirits, further reinforcing the market.

The Middle East and Africa craft spirits market is expanding due to increasing urbanization, a growing expatriate population, and a rising demand for premium alcoholic beverages in select markets. South Africa is a key player, with a strong craft gin and whiskey scene. Tourists and high-end hospitality venues drive demand for unique, locally produced spirits. Although strict laws in some countries of the Middle East restrict the consumption of alcohol, premium bars, and duty-free outlets are emerging as growth areas. Luxury and experiential drinking also encourage interest in craft spirits.

Key Regional Takeaways:

United States Craft Spirits Market Analysis

In 2024, United States held a share of 88.00% of the craft spirits market in North America due to an increase in the number of alcohol brands that serve the changing preferences of consumers. It is estimated that the U.S. alcohol beverage industry database has about 2,900 companies that deal with all aspects of the alcohol beverage industry. As more independent, small distilleries enter the market, craft spirits bring greater diversification and character to the offering for consumers in terms of product choices, such as small batches and unique flavor profiles. Supported by a change in culture concerning customization and artisanality, many distilleries will highlight craftsmanship and authenticity. In addition, a strong local production movement supports the sustainability and adoption of local ingredients, which further adds to the appeal of these drinks. Furthermore, the expansion of microbreweries and craft distilleries fosters a competitive market environment, increasing consumer awareness and expanding the clientele, especially in the premium alcoholic beverage industry.

Europe Craft Spirits Market Analysis

In Europe, the rising adoption of craft spirits is being driven by the expansion of e-commerce and other online retail channels. Europe is stated to be the third biggest retail e-commerce market in the world, with total revenues of USD 631.9 Billion. The revenues will have an annual growth rate of 9.31%, and by 2027, the total sales of European retail e-commerce will be USD 902.3 Billion. Handmade items that would otherwise only be available in local markets are now more widely accessible thanks to the move toward internet purchasing platforms. Consumers can purchase a lot of unique spirits from independent distilleries, which opens the opportunity for consumers to explore new flavors while supporting local brands. As the internet retail market is rapidly expanding, it also means that more craft spirits are accessible and available, obviously to a wider consumer area. Most craft distilleries have adopted e-commerce as an important channel to expand their customer base and offer exclusive products and limited-edition bottles that attract new customers and loyal ones. Online presence, besides supporting convenience, allows consumers to delve into the story behind each brand, further cultivating the appeal of craft spirits. As digital platforms increasingly become the central point of purchase decisions, the craft spirits sector is expected to boom across Europe, as more people opt to enjoy premium beverages from the comfort of their homes.

Asia Pacific Craft Spirits Market Analysis

The Asia-Pacific region has seen a rapid rise in craft spirits, driven by the growing number of clubs and pubs. Reports state that as of January 23, 2025, there were over 65,667 Bars in India, a 7.21% rise from 2023. Craft spirits have become a popular option due to the region's growing nightlife culture and the younger generation's growing taste for high-end beverages. Nowadays, pubs and clubs are considered an ideal ground for opening these products offering carefully selected varieties and targeting a more choice-demanding consumer. As more venues begin to indulge in craft spirits, consumer access to such products thus increases interest in consumers who want to taste new flavors and upgrade their drinking habits. In this regard, craft spirits are no longer just alcoholic beverages however, are increasingly being perceived as part of an elevated social experience. Craft cocktails made with locally distilled spirits have become more popular, and the trend is being bolstered by the growing number of businesses that sell these handcrafted drinks.

Latin America Craft Spirits Market Analysis

In Latin America, the rise in disposable income is significantly driving the adoption of craft spirits. Latin America's total disposable income for the period from 2021 to 2040 is estimated to rise about 60%. Improving economic conditions make consumers increasingly ready to spend on premium products, one of which includes artisanal alcohol. This trend mirrors a worldwide shift in consumer behavior, where people are starting to place more value on quality and authenticity, especially when it comes to beverages. Craft spirits are gaining popularity among consumers looking for distinctive, upscale alcoholic experiences due to their distinctive tastes and meticulous production methods. Craft spirits are a crucial component of the growing industry as the demand for luxury and artisanal items is rising along with disposable income. This trend matches the greater trend of consumer preferences for locally sourced, small-scale products, as this is reflective of the current search for authenticity within the global market.

Middle East and Africa Craft Spirits Market Analysis

Growing tourism sectors within the Middle East and Africa region have led to the uptake of craft spirits. It also experienced a boost in the arrival of international tourists, leading to increased demand for alcoholic experiences and other varieties and unique ones. For example, from January to October 2024, 14.96 Million overnight visitors arrived in Dubai, representing a rise of 8% when compared to the same period in 2023. Increased demand for authentic, high-quality beverages that reflect traditional and craftsmanship practices in their respective regions has helped see an increase in the availability and attractiveness of craft spirits. The lively tourism in cities and other holiday destinations has created a ready platform for distillers in a region to offer their products to an international market. In addition to contributing to a rise in craft spirits sales, it also creates a culture that appreciates a premium product and one that is specifically produced locally. As tourism increases, this is bound to increase the craft spirits availability, which will indirectly give tourists a taste of regional flavors and fuel the wider market for artisanal beverages in the region.

Competitive Landscape:

Dynamic activity from the major companies, including new product launches, strategic alliances, and international market growth, defines the industry. The leading craft distilleries are focusing on producing small batches, creating unique flavor infusions, and using sustainable distillation methods that reflect the evolving preferences of the consumer. Many companies are exploring new aging methods, including finishing in wine or sherry barrels, to make the spirit even more complex and exclusive. The trend of mergers and acquisitions has been the most important; major beverage companies are buying up successful craft brands to increase their premium portfolio. For example, global liquor majors are investing in independent distilleries to benefit from the growth in demand for artisanal spirits. Further, collaborations with bars, restaurants, and celebrity endorsements aid in strengthening the market presence of brands. E-commerce and DTC sales channels are being sought after too and will also reach more consumers for brands. Sustainability initiatives, which are mainly eco-friendly packaging and carbon-neutral distillation, are becoming a part of the overall strategy for brands. As authenticity grows in consumer demand, craft spirit producers continue to innovate and expand their footprint globally. These efforts create a positive craft spirits market outlook.

The report provides a comprehensive analysis of the competitive landscape in the craft spirits market with detailed profiles of all major companies, including:

- Bacardi Limited

- Campari Group (Lagfin S.C.A.)

- Constellation Brands, Inc.

- Copper Fox Distillery

- Diageo plc

- Heaven Hill Distilleries, Inc.

- Hotaling & Co.

- Pernod Ricard

- Rogue Ales & Spirits

- Sibling Distillery Limited

- William Grant and Sons Ltd

- Woodinville Whiskey (LVMH)

Latest News and Developments:

- November 2024: The seventh release in the Paul John Indian Single Malt series, the restricted 2024 Christmas Edition, has been released. Mango, pineapple, vanilla cake, and sandalwood are just a few of the distinctive tropical tastes found in this unpeated Indian whiskey made in Goa. It has rich aromas of spice, coconut, candied orange, and toasted oak after being finished in Virgin Oak and Caribbean Rum barrels. A lovely blend of fruit tart and salty toffee with chewy tannins may be found in the aftertaste.

- September 2024: At Whisky Live Paris 2024, Radico Khaitan debuted Rampur Barrel Blush, their latest Indian single malt. The whiskey, which retails for USD 105, combines Australian Shiraz wine cask finishing with American Bourbon barrel aging to create a complex, multi-layered flavor. The Paris festival, which features spirits from across the world, takes place from September 28 to 30.

- May 2024: By launching its spirits product line in South Korea, Barrell Craft Spirits increased its market share in Asia. A strategic alliance with UOT, a regional distribution company, made this step possible. Barrell Craft Spirits will be able to capitalize on the rising demand for high-end spirits in the area thanks to the cooperation, which will cover both off-trade and on-trade sectors in South Korea.

- June 2024: Hakushu 18-Year-Old Peated Malt, Yamazaki Golden Promise, Yamazaki Islay Peated Malt, and Yamazaki 18-Year-Old Mizunara are the four unique expressions in the House of Suntory's groundbreaking 2024 Tsukuriwake Series. At the Yamazaki and Hakushu Distilleries, this limited-edition series showcases creativity, artistry, and diversity. Using unusual ingredients and methods to test the limits of Japanese whiskey production, it adds to the Tsukuriwake portfolio and was developed by 5th Generation Chief Blender Shinji Fukuyo.

- March 2024: By increasing the distribution of its ryes and bourbons, New Riff Distilling strengthened its position in the U.S. market. Their single-barrel bourbon and 100% malted rye whiskey, which are already offered in Georgia, Louisiana, North Carolina, and South Carolina, are part of the expansion. This expansion is a result of New Riff's goal to expand its brand and boost availability in strategic southern U.S. states.

Craft Spirits Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Whiskey, Vodka, Gin, Rum, Brandy, Liqueur, Others |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bacardi Limited, Campari Group (Lagfin S.C.A.), Constellation Brands, Inc., Copper Fox Distillery, Diageo plc, Heaven Hill Distilleries, Inc., Hotaling & Co., Pernod Ricard, Rogue Ales & Spirits, Sibling Distillery Limited, William Grant and Sons Ltd, Woodinville Whiskey (LVMH), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the craft spirits market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global craft spirits market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the craft spirits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The craft spirits market was valued at USD 29.56 Billion in 2024.

The craft spirits market is estimated to exhibit a CAGR of 24.45% during 2025-2033.

The craft spirits market is driven by the rising consumer demand for premium, artisanal drinks, growing interest in local and sustainable craft distilleries throughout the world, and the growing desire for authenticity, distinctive tastes, and small-batch manufacturing.

North America currently dominates the market driven by a strong craft distilling culture, high consumer spending on premium alcoholic beverages, and supportive regulatory frameworks.

Some of the major players in the craft spirits market include Bacardi Limited, Campari Group (Lagfin S.C.A.), Constellation Brands, Inc., Copper Fox Distillery, Diageo plc, Heaven Hill Distilleries, Inc., Hotaling & Co., Pernod Ricard, Rogue Ales & Spirits, Sibling Distillery Limited, William Grant and Sons Ltd, Woodinville Whiskey (LVMH), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)