Crane Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034

Crane Market Size & Share:

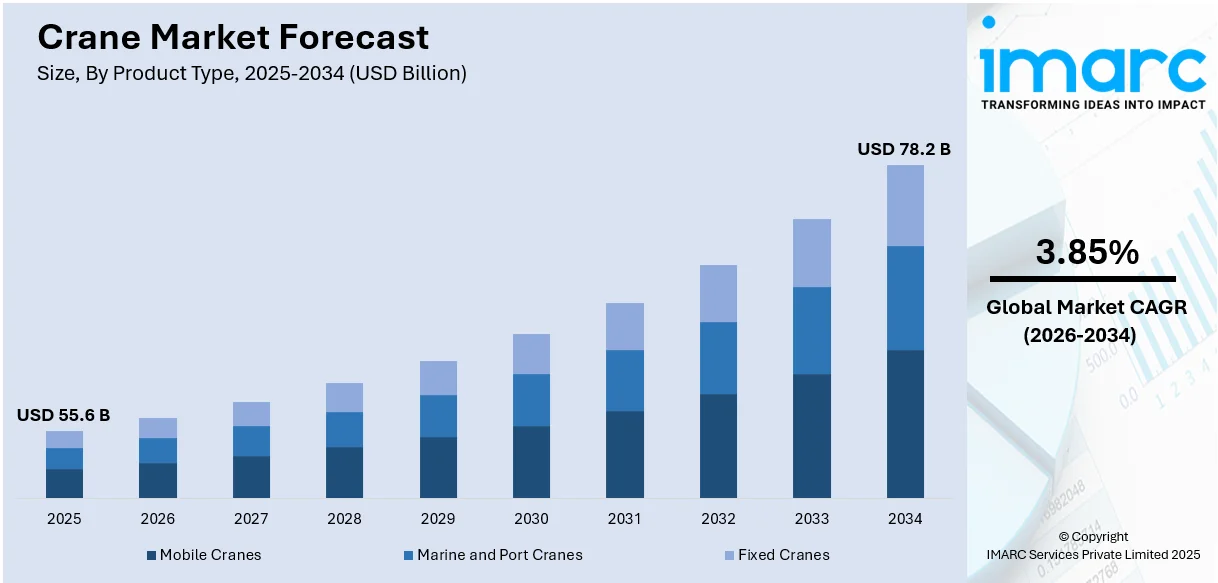

The global crane market size reached USD 55.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 78.2 Billion by 2034, exhibiting a growth rate (CAGR) of 3.85% during 2026-2034. The United States accounts for 71.0% of the crane market share in North America. The market in the U.S is driven by strong expansion in the construction, energy, and infrastructure development sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 55.6 Billion |

| Market Forecast in 2034 | USD 78.2 Billion |

| Market Growth Rate (2026-2034) | 3.85% |

The global crane market is experiencing significant growth mainly driven by development of heavy infrastructure and rapid urbanization across emerging economies. Increase in construction activity across residential, commercial and industrial sectors is creating a demand for various type of cranes. Technological advancements such as automation and improved safety features are being incorporated in modern cranes in order to meet the market requirements more effectively. For instance, in June 2024, Liebherr launched the LTM 1400- 6.1 the world's most powerful six-axle crane featuring a 70-meter telescopic boom and advanced setup processes. This crane offers increased lifting capacity, versatile accessories and enhanced safety features establishing itself as a market leader in mobile crane technology. This growth is supported by government investments in large-scale projects and a rising number of renewable energy installations like wind farms along with other related applications.

To get more information on this market Request Sample

The United States crane market is mainly driven by substantial infrastructure investments and ongoing construction activities across residential, commercial, and industrial sectors. Government initiatives such as the Infrastructure Investment and Jobs Act enhance the demand for cranes in large-scale projects like highways, bridges and public buildings. Technological advancements including automation and improved safety features increase efficiency and appeal of modern cranes. For instance, in July 2024, the world's first hydrogen powered crane began operating at port of Los Angeles representing a significant step in port technology. Emitting zero pollutants the crane aims to reduce the carbon emissions and improve air quality potentially transforming the shipping industry. The growth of renewable energy projects particularly wind farm installations further boosts the market needs. Additionally, the expansion of the manufacturing and logistics sectors coupled with urban redevelopment and stringent safety regulations plays a crucial role in propelling the United States crane market forward.

Crane Market Trends:

Increasing Infrastructure Development

Governments in various countries are allocating substantial budgets to infrastructural projects such as highways, bridges, airports, and urban transportation systems. This push for modernized infrastructure not only necessitates the use of cranes for heavy lifting and transportation but also catalyzes the need for advanced, more efficient machinery capable of meeting the rigorous demands of large-scale projects. For instance, the Chinese government's Belt and Road Initiative involves multiple countries and demands an immense volume of construction work, and highways, all of which require extensive use of cranes. Additionally, India has approved 12 new industrial smart cities and other infrastructure projects to improve its manufacturing ecosystem. The smart city initiatives under the National Industrial Corridor Development Programme (NICDP) would cost INR 286.02 Billion (USD 3.41 Billion), while three railway projects in four states will aim to improve logistical networks.

Financial institutions, such as the World Bank and the Asian Infrastructure Investment Bank are also supporting these large-scale infrastructure initiatives, making funds more accessible. Moreover, in the last five years, World Bank have committed over USD 13 Billion to enable renewable energy generation. Almost two-thirds of this support is for transmission and distribution infrastructure to facilitate the integration of renewable energy, guarantees, as well as upstream support for enabling policies, regulations, and institutions to scale up private investments for renewable energy. The World Bank invested about USD 5.5 Billion to support energy efficiency, including direct investment in public infrastructure such as public buildings or street lighting. The commitment to infrastructural growth isn't limited to developing economies, even mature markets in Europe and North America are witnessing significant investments in infrastructure refurbishment.

Technological Innovations

Traditional cranes are being replaced by models equipped with state-of-the-art technologies such as GPS, Internet of Things (IoT) and automation. These technologies enhance operational efficiency, reduce labour costs, and improve safety measures. For example, modern cranes come with real-time monitoring systems that offer instant data on various operational aspects including weight limits, weather conditions and load balance ensuring that the operators can make informed decisions. According to an industrial report, IoT will have an economic impact of around USD 11 Trillion by the end of 2025. The growing demand for automation, centralized monitoring and predictive maintenance are leading the IoT technology most prominently in the manufacturing industry. Additionally, the advent of electric and hybrid cranes is meeting the growing demand for environmentally friendly construction equipment. These technologically advanced cranes offer advantages such as lower emissions and energy-efficient operation making them increasingly desirable in a world grappling with climate change. With governments and global organizations pushing for green technologies companies in the crane industry are focusing on research and development (R&D) to produce eco-friendly yet efficient machinery.

Growing Industrialization and Urbanization

As populations migrate from rural to urban areas in search of better opportunities, there is an increasing need for residential and commercial buildings, factories, and other public facilities. Approximately 56% of the global population lives in urban areas (2023) as per the World Bank data and is projected to increase to 68% by 2050. Urban expansion boosts demand for construction projects including high-rise buildings, bridges and metro systems driving crane sales. For instance, according to data by World Bank, India’s urban population is expected to grow to 600 Million by 2036 fostering demand for tower cranes and mobile cranes for construction activities. Industrial growth also demands specialized infrastructure such as warehouses, manufacturing facilities and logistics hubs. Cranes also play a pivotal role in the erection of these structures quickly and efficiently. Additionally, the expansion of industries including automotive, aerospace and shipping directly correlates with an increase in the demand for various types of cranes. The necessity for mass production in these sectors requires efficient material handling systems for which cranes are indispensable. Urbanization also brings with it the challenge of limited space augmenting the need for vertical expansion in the form of skyscrapers and high-rise buildings which again necessitates the use of specialized cranes capable of operating at great heights. In summary, the symbiotic relationship between the wave of industrialization and urbanization and the demand for cranes is propelling the market at an accelerated pace.

Crane Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global crane market report, along with forecasts at the global and regional levels for 2026-2034. Our report has categorized the market based on product type, and application.

Analysis by Product Type:

- Mobile Cranes

- Marine and Port Cranes

- Fixed Cranes

Mobile cranes leads the market with around 78.6% of market share in 2025. Modern mobile cranes come equipped with advanced hydraulic systems and controls that enable them to lift heavy loads with great precision often rivalling or even surpassing the capabilities of their stationary counterparts. Their design also caters to a broad spectrum of needs from the compact, manoeuvrable cranes used in confined urban settings to the large and rugged all-terrain cranes designed for challenging environments and heavy industrial applications. Another significant factor contributing to the dominance of mobile cranes in the market is the ongoing trend of urbanization. With cities expanding and infrastructure undergoing constant renewal the demand for cranes that can easily navigate through congested urban landscapes has skyrocketed. Furthermore, technological advancements have added layers of automation, real-time monitoring, and other smart features to the newer models of mobile cranes making them even more efficient and safe to operate.

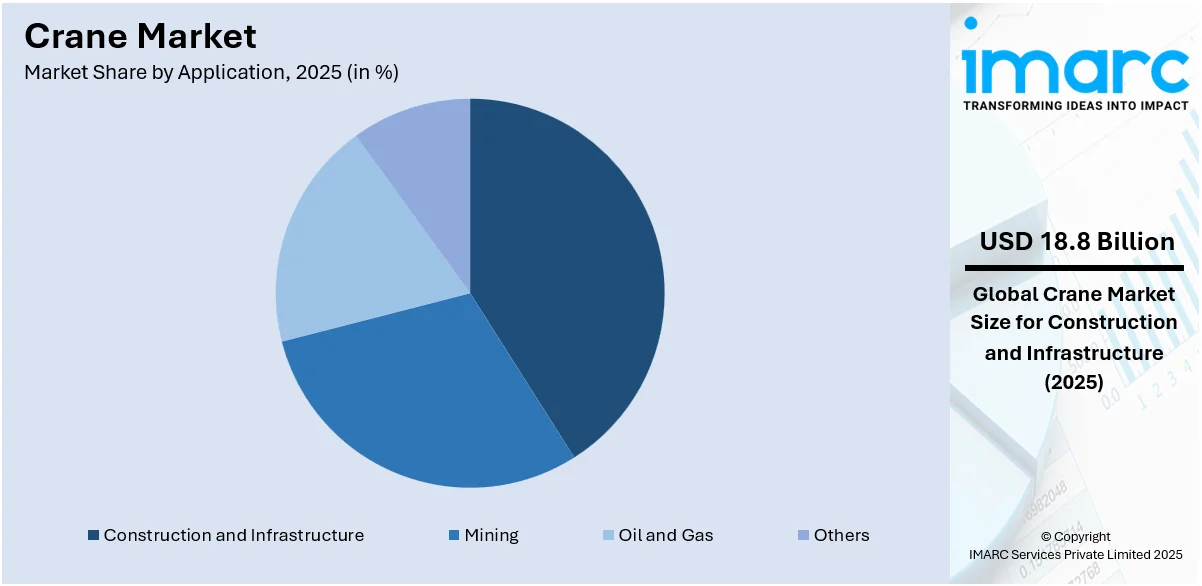

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Construction and Infrastructure

- Mining

- Oil and Gas

- Others

Construction and infrastructure leads the market with around 35.0% of market share in 2025. The increasing complexity and scale of modern construction and infrastructure projects have driven a need for specialized and high-capacity cranes. These are not only essential for lifting large and heavy construction materials such as steel girders, concrete blocks and prefabricated modules but also for precisely positioning them. Given that construction timelines are often tight and subject to strict regulatory constraints the speed and efficiency provided by cranes are invaluable. Moreover, infrastructure development isn't a one-time investment but an ongoing process that includes maintenance, upgrade and expansion. Aging infrastructure particularly in developed countries requires renovation and sometimes complete overhauls which also create a steady demand for cranes. The rise in global infrastructure initiatives often funded or subsidized by governments and international organizations serves as another pillar supporting the significant role of cranes in this sector.

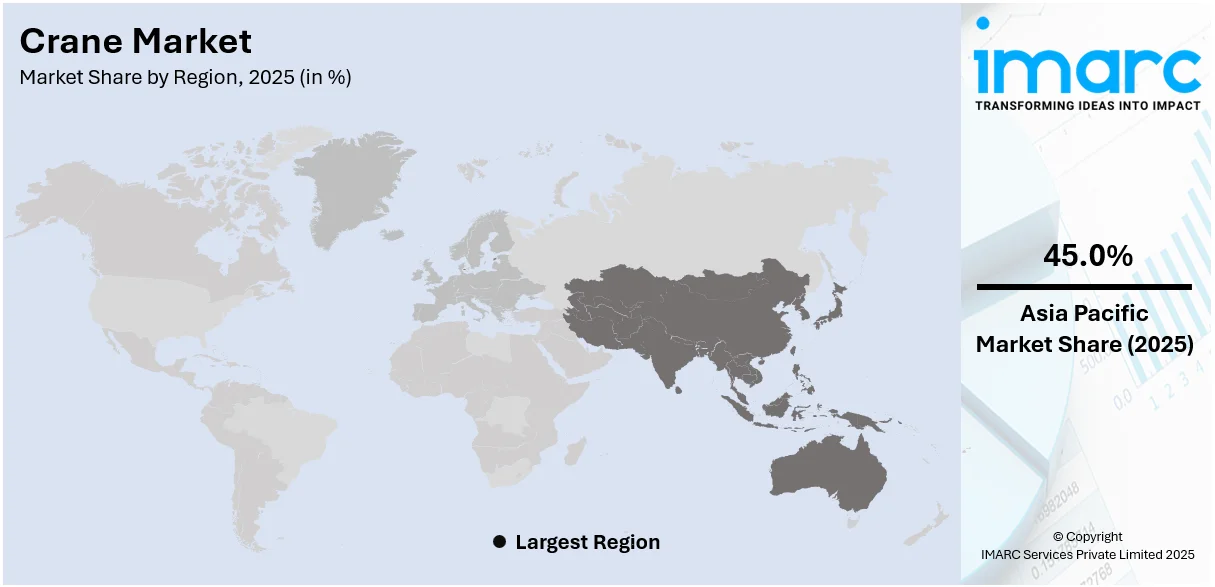

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2025, Asia Pacific accounted for the largest market share of over 45.0%. Asia Pacific’s astonishing pace of infrastructure development and urbanization occurring in the region particularly in various countries. These nations are undergoing rapid transformations making massive investments in roads, bridges, airports, ports, and public transport systems thereby fuelling a colossal demand for cranes. Furthermore, the economic growth in the Asia Pacific has led to increased industrial activities, spanning sectors, such as manufacturing, shipping, and logistics, all of which frequently employ cranes for material handling and transportation. The region has become the global hub for manufacturing and as industries expand the need for specialized cranes for factory operations warehousing and shipping also increases. Also, the regulatory landscape in the Asia Pacific is becoming increasingly favourable for construction and industrial activities. Governments are easing restrictions and offering incentives to attract foreign investments, which, in turn, augments the crane market.

Key Regional Takeaways:

North America Crane Market Analysis

The North American crane market is driven by substantial infrastructure investments, ongoing construction activities and the expansion of the energy sector. The United States leads the region benefiting from the Infrastructure Investment and Jobs Act which funds highways, bridges and urban transit systems thereby increasing demand for tower and mobile cranes. Additionally, the growth of renewable energy projects particularly wind and solar installations significantly boosts crane usage. Technological advancements such as automation and telematics enhance crane efficiency and safety attracting diverse industries. Canada also contributes to the market growth through infrastructure modernization and robust mining projects. Furthermore, the emphasis on sustainable construction practices and strict safety regulations are pivotal in propelling the North American crane market forward.

United States Crane Market Analysis

The United States accounts for 71.0% of the market share in North America. The crane market in the United States is driven by strong expansion in the construction, energy, and infrastructure development sectors. Rising investments in residential and commercial development projects have increased demand for tower and mobile cranes. For example, according to the data by U.S. Census Bureau Construction spending during September 2024 was estimated at a seasonally adjusted annual rate of USD 2,148.8 Billion, above the revised August estimate of USD 2,146.0 Billion, with major projects including high-rise buildings, bridges, and urban growth necessitating modern crane solutions. Furthermore, the Biden administration's Infrastructure Investment and Jobs Act (IIJA), with a USD 1.2 Trillion budget, has fuelled infrastructure development, including highways, bridges, and rail networks, driving up demand for cranes.

With the growth of renewable energy projects like wind and solar farms, the energy sector also plays a significant role. The building of wind turbines requires the use of big cranes due to the U.S. Department of Energy's report of over 120 GW of wind energy capacity in 2023. Additionally, technology developments like crane automation and telematics are improving operating safety and efficiency and drawing in customers from a variety of industries.

Europe Crane Market Analysis

Initiatives for renewable energy, urbanization, and infrastructure upgrading are driving the European crane market. The region's governments are making significant investments in green energy and smart city initiatives. For example, the European Green Deal promotes the use of wind energy and seeks to make the EU carbon neutral by 2050. Over 19% of the electricity generated in the EU in 2023 came from wind power. According to WindEurope data, the EU built 17 GW of new wind farms in 2023: 14 GW onshore; 3 GW offshore. This necessitates the use of heavy-duty cranes for the installation and maintenance of turbines.

In addition, the building industry is experiencing a comeback, especially in Eastern Europe, where infrastructure is being modernized to conform to Western norms. With more than 60% of Europe's crane demand in 2023 coming from Germany, France, and the UK, these three countries control the market. The need for tower cranes is also being fueled by the growth of prefabricated construction techniques.

Latin America Crane Market Analysis

Latin America’s crane market is driven by growth in mining, oil and gas and infrastructure development. Countries like Brazil, Chile and Peru are rich in natural resources with increased mining activities necessitating heavy-duty cranes. For instance, Vale, Brazil's leading mining player has reached multiple milestones this year. Following 2023's production achievements in which production climbed by 29% yearly, 2024 has been no exception. Its Q2 2024 results show a 2.4% rise or 80.6 Million Tonnes per year keeping the company on track to meet its estimated range of 310-320 Million Tonnes per year in 2024. Vale also claimed that it will consume 100% renewable energy in 2024. Infrastructure projects such as roadways and airports under government programs like Argentina’s PPP infrastructure plan are also contributing to market growth. Moreover, the renewable energy sector is gaining traction with Mexico and Brazil investing heavily in wind and solar energy.

Middle East and Africa Crane Market Analysis

Urbanization, infrastructure development, and oil and gas projects are the main factors propelling the Middle East and Africa (MEA) crane market. Tower and mobile cranes will be used extensively in the Middle East as nations like Saudi Arabia, the United Arab Emirates, and Qatar spend substantially in mega-projects like the Dubai Urban Master Plan 2040 and NEOM (USD 500 Billion). Demand is being driven in Africa by infrastructure projects like the Trans-African Highway Network that are financed by governments and international organizations. Another important factor is the growing mining sector in the area. The MEA crane market is estimated to expand, propelled by developments in automated and energy-efficient cranes.

Competitive Landscape:

Several companies are investing heavily in R&D to produce cranes with advanced technologies, such as GPS, IoT, and automation features. The aim is to make cranes more efficient, safer, and easier to operate. Companies are developing cranes with real-time monitoring systems, touch screen controls, and predictive maintenance capabilities. Companies are expanding into emerging markets where the growth in infrastructure development and industrialization is high. Setting up local manufacturing units, collaborating with regional vendors, or establishing a local sales network are some ways companies are making inroads into new markets. Moreover, companies are offering specialized training programs, either as a part of the sales package or as a separate service. After-sales support, including maintenance and parts replacement, is also a focus area. Leading players are also investing in ensuring their products comply with the increasingly stringent safety and environmental regulations worldwide.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Broderson Manufacturing Corporation (Lanco International Inc.)

- Hiab Corporation

- IHI Corporation

- Kobelco Construction Machinery Co., Ltd

- Konecranes

- Link-Belt Cranes (Sumitomo Heavy Industries Ltd.)

- Tadano Ltd

- Terex Corporation

- The Liebherr Group

- The Manitowoc Company Inc.

- XCMG Group

Latest News and Developments:

- October 2024: Manitowoc launched the new Grove GRT8100-1 rough-terrain crane. The variable outrigger positioning system enables better lifting capacity and site access.

- September 2024: Hiab, part of Cargotec, launched the new HIAB iQ.958 HiPro heavy loader crane with the new advanced operating system SPACEevo to improve productivity and safer operation. Due to its design, it delivers an excellent lift-to-weight ratio.

- November 2023: Demag expanded its DH hoist portfolio with a relaunch. New features include the standard size 400, the standardized option of infinitely variable positioning and a significantly expanded range of accessories, which have been combined into equipment packages.

- April 2023: Link-Belt launched X4S series. It offers superior lift performance, improved stability, and productivity

Crane Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mobile Cranes, Marine and Port Cranes, Fixed Cranes |

| Applications Covered | Construction and Infrastructure, Mining, Oil and Gas, Others |

| Regions Covered | Asia Pacific, Europe, North America, Middle East and Africa, Latin America |

| Companies Covered | Broderson Manufacturing Corporation (Lanco International Inc.), Hiab Corporation, IHI Corporation, Kobelco Construction Machinery Co., Ltd, Konecranes, Link-Belt Cranes (Sumitomo Heavy Industries Ltd.), Tadano Ltd, Terex Corporation, The Liebherr Group, The Manitowoc Company Inc., XCMG Group., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, crane market forecast, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global crane market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the crane industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The crane market was valued at USD 55.6 Billion in 2025.

The crane market is projected to exhibit a CAGR of 3.85% during 2026-2034, reaching a value of USD 78.2 Billion by 2034.

The market is primarily driven by heavy infrastructure development, rapid urbanization, and increased construction activities across residential, commercial, and industrial sectors, ongoing technological advancements such as automation and enhanced safety features, along with government investments in large-scale projects and the rise of renewable energy installations.

Asia Pacific currently dominates the crane market, accounting for a share of over 45.0%, driven by the rapid urbanization, extensive infrastructure development, rising construction activities, and significant investments in industrial and transportation projects across emerging economies such as China and India.

Some of the major players in the crane market include Broderson Manufacturing Corporation (Lanco International Inc.), Hiab Corporation, IHI Corporation, Kobelco Construction Machinery Co., Ltd, Konecranes, Link-Belt Cranes (Sumitomo Heavy Industries Ltd.), Tadano Ltd, Terex Corporation, The Liebherr Group, The Manitowoc Company Inc., and XCMG Group., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)