Credit Card Payment Market Size, Share, Trends and Forecast by Card Type, Provider, Application, and Region, 2025-2033

Credit Card Payment Market Size & Share:

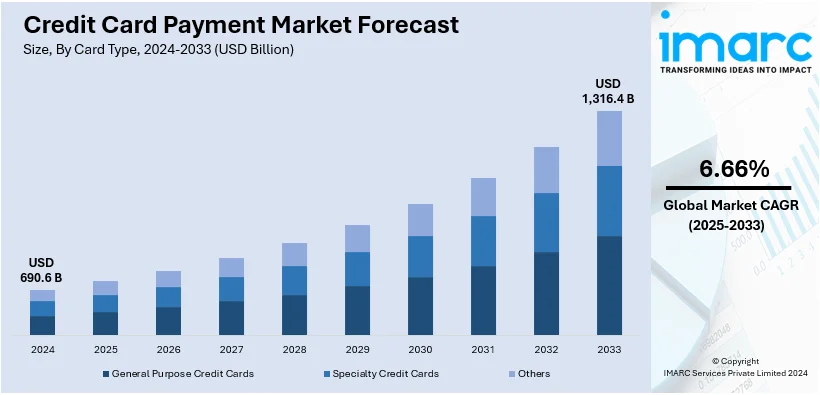

The global credit card payment market size was valued at USD 690.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,316.4 Billion by 2033, exhibiting a CAGR of 6.66% during 2025-2033. North America currently dominates the market, holding a significant market share of over 43.7% in 2024. Visa and MasterCard lead the global market, with Visa registering USD 35.9 Billion in net revenues during the Fiscal Year 2024. The increasing consumer preference for cashless transactions, advancements in digital payment technology, rising e-commerce sales, the adoption of contactless payment methods, enhanced security features, and government initiatives promoting digital payments are some of the factors positively impacting the credit card payment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 690.6 Billion |

|

Market Forecast in 2033

|

USD 1,316.4 Billion |

| Market Growth Rate 2025-2033 | 6.66% |

Advances in technology, along with an increasing need for digital payments among customers, are increasing the demand for credit card payments. Convenience has been further added to credit cards by contactless payments and mobile wallets. The increased popularity of online shopping and e-commerce also increases the need for speedy, secure, and hassle-free payment services. Credit cards are one such service being preferred by consumers in large numbers. Consumer incentives like cashback, reward points, and promotional offers also encourage usage. Financial institutions are working closely with merchants to customize benefits that encourage further adoption. Enhanced security measures like tokenization and biometric authentication boost user trust, and regulatory support for cashless economies is further facilitating credit card payment market growth.

To get more information on this market, Request Sample

The United States has emerged as a key regional market for credit card payment. The credit card payment market in the US is growing due to a high degree of financial inclusion and consumer reliance on credit-based transactions. The high growth of e-commerce, particularly online shopping, has greatly amplified the use of credit cards since they are widely accepted for smooth digital transactions. Rewards programs, cashback offers, and promotional financing options increase credit card usage due to the appeal of consumers towards value-added benefits. In addition, rapid urbanization, growth in purchasing power of consumers, and a digital transformation in financial services drive China's credit card payment market. The integration of credit cards into popular mobile payment platforms like WeChat Pay and Alipay has hugely expanded their usability, thus making them indispensable for online and offline transactions. In addition, in Europe, the market for credit card payments thrives because of a strong focus on financial infrastructure and due to high adoption rates of digital banking services. Cashless payments have increased in the retail and e-commerce sectors since the breakout of the COVID-19 pandemic, leading to high demand for credit cards.

Credit Card Payment Market Trends:

Rising focus on enhanced convenience and flexibility

The growing demand for credit card payments due to the rising focus on enhanced convenience and flexibility is offering a positive credit card payment market outlook. In line with this, people are increasingly preferring secure payment methods, which are contributing to the growth of the market. According to PWC report, the credit cards in India is projected to reach 200 million users by 2028-29, reflecting a significant surge in consumer demand. Moreover, credit cards allow individuals to make purchases both online and in physical stores with ease. Besides this, credit cards assist in eliminating the need for carrying large amounts of cash and offering an added layer of security in case of theft or loss, making them an attractive option among individuals. Furthermore, these cards provide a line of credit, enabling users to manage their finances efficiently. Apart from this, the ability to pay off balances over time offers financial flexibility to users. Additionally, credit card companies are offering zero-liability fraud protection, enhancing the confidence of users. As a result, credit cards cater to the evolving needs and preferences of people.

Increasing preferences for online shopping

On of the significant credit card payment market trends is the escalating demand for credit cards on account of increasing preferences for online shopping among the masses across the globe. In addition, credit cards are becoming on-the-go payment options for individuals with busy lifestyles. The convenience of entering card details or using saved information for online transactions assists in improving the experiences of individuals. For instance, according to ITA, global B2C ecommerce revenue is expected to grow to USD 5.5 Trillion by 2027, with a significant increase in online shopping. Apart from this, e-commerce platforms are increasingly integrating seamless credit card payments into their checkout processes. Additionally, the rising focus on subscription-based services are making credit cards a preferred mode of payment for regular online purchases is bolstering the market growth. In line with this, credit cards are widely accepted by vast online retailers, making them a versatile payment option. This wide acceptance ensures that individuals can shop at various websites and platforms. Furthermore, various credit card companies are offering rewards, cashback, or loyalty programs, that attract people to use their cards for online purchases.

Technological advancements in payment processing

Advancements in payment processing technologies, like contactless payment, mobile wallets, and near field communication (NFC) technology are enabling faster, secure, and more convenient credit card transactions. In line with this, the rising adoption of contactless payment options, as they offer enhanced speed and are easy to use, is propelling the growth of the market. For instance, virtual credit cards are gaining popularity as a way to secure online transactions. These digital versions of physical cards are created with an expiry date or a spending limit, thus reducing the possibilities of fraud. In addition, one can simply tap their card or smartphone to complete the transaction, thus reducing the physical contact with the payment terminals. Moreover, the inclusion of biometric authentication techniques, like fingerprint recognition and facial recognition, benefits in increasing the safety of credit card transactions and thus helps to reassure people about their financial information. These technology-enabling improvements in payment facilitate the betterment of user experience. In this regard, people are looking for modern and secure payment solutions while going about their daily activities to avoid financial loss. Another factor adding to the growth of the market is the increasing demand for secure payment solutions due to increasing cyber threats.

Credit Card Payment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global credit card payment market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on card type, provider, and application.

Analysis by Card Type:

- General Purpose Credit Cards

- Specialty Credit Cards

- Others

General purpose credit cards stand as the largest component in 2024, holding around 73.6% of the market. General purpose credit cards are versatile cards that can be used in a wide range of transactions. They are widely accepted by various companies and are not tied to a specific merchant or industry. In addition, they offer standard credit card features, such as revolving credit lines, interest rates, and payment options. Apart from this, the rising adoption of general-purpose credit cards due to their widespread acceptance and usability for everyday transactions is supporting the growth of the market.

Analysis by Provider:

- Visa

- Mastercard

- Others

The market is lead by Visa with approximately 57.8% market share in 2024. This payment leader offers various credit and debit card products and services. With a large network that reaches financial institutions, merchants, and individuals, it helps facilitate secure and convenient payments. It is very proactive in its financial inclusion endeavors, trying to make available financial services to under-banked populations. Visa cards are accepted by many merchants worldwide. Also, the increasing demand for Visa because of its acceptance and reliability is supporting the growth of the market.

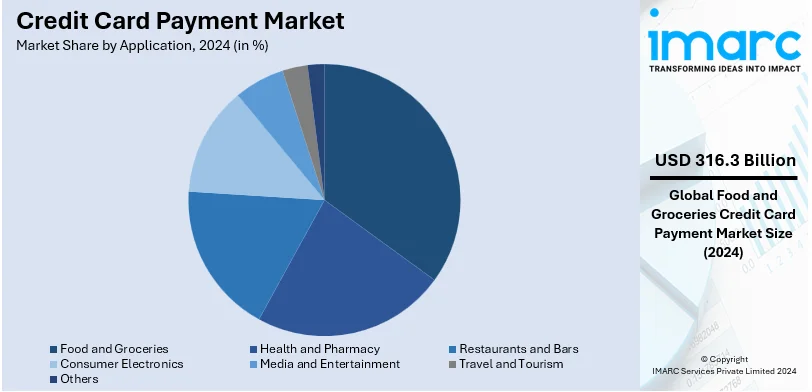

Analysis by Application:

- Food and Groceries

- Health and Pharmacy

- Restaurants and Bars

- Consumer Electronics

- Media and Entertainment

- Travel and Tourism

- Others

Food and groceries dominate the market with 45.6% of market share in 2024. Credit cards are widely used for purchasing food items in grocery stores and at restaurants. They offer enhanced convenience, security, and usually provide rewards or cashback on dining-related expenses. People are increasingly utilizing credit cards for food and groceries as are essential expenditures for individuals.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 43.7%. According to the report, North America accounted for the largest market share due to the rising focus on convenient and quick payment solutions among the masses. In line with this, technological advancements in payment processing, including the widespread adoption of contactless payments and mobile wallet solutions are propelling the growth of the market. These innovations also assist in enhancing the convenience and security of credit card payments.

Key Regional Takeaways:

United States Credit Card Payment Market Analysis

In 2024, the United States accounts for 83.50% of the credit card payment market in North America. Consumer spending, technological improvements, and changes in the financial services sector are some of the factors stimulating the United States credit card payment market. Credit cards are, of course, one of the main means of financing payments since consumer spending continues to grow with the shift into digital payments. Innovations, such as mobile wallets and contactless payments, plus advanced security features like EMV chips and biometric authentication, have further expanded the use of credit cards among consumers. Furthermore, the rise of fintech solutions and the integration of Buy Now, Pay Later (BNPL) services with traditional credit systems are changing the market. To protect BNPL users and regulate the BNPL sector, the Consumer Financial Protection Bureau (CFPB) announced in May 2024 that the rules of credit card consumers will be applicable to BNPL lenders, ensuring greater transparency and consumer protection. Credit card companies, in turn, are responding with more flexible payment options, rewards programs, and upgraded features to meet the change in consumer preferences, therefore propelling the market even further.

Asia Pacific Credit Card Payment Market Analysis

Asia-Pacific region is seeing a big shift to digital payments and here, credit cards play an important role in the process. The trend will enhance the growth of economies, expand financial inclusion, and overall experience for consumers. In this context, it has been stated by a PwC report that the number of credit cards in India is expected to double by FY28-29, to reach 200 million, up from the current numbers. This growth follows a five-year-period of significant issuance overhangs, with continued growth anticipated to continue. Travel is among the most significant applications for credit cards; the privileges of airport lounge access add a lot to their attractiveness. Credit cards provide comfort and security, factors especially desirable to the burgeoning middle classes and younger, tech-influenced generations in the region. With this, local and international financial institutions are expanding credit card offerings to meet the different needs of Asia-Pacific consumers, promoting innovation in the payments industry.

Europe Credit Card Payment Market Analysis

Rising disposable incomes, particularly in Western and Northern Europe, are fueling greater reliance on credit cards for everyday purchases and larger transactions. According to the European Commission, in 2022, the median annual disposable income was 18,706 PPS per inhabitant in the EU. The adoption of digital payment solutions such as mobile wallets, contactless payments, and enhanced security features like EMV chips and biometric authentication has improved both convenience and consumer confidence. The appeal of rewards programs, such as cashback and travel benefits, also drives usage. Strong regulatory frameworks, including the EU’s PSD2, promote transparency and consumer protection, fostering trust in credit card payments. Furthermore, the rise of Buy Now, Pay Later (BNPL) services and the growing shift to e-commerce are also contributing to market growth. A notable example is the exclusive partnership between ASOS and Capital One UK, announced in February 2023, which aims to launch a new ASOS credit card for eligible shoppers, highlighting the increasing integration of credit card offerings with online retail platforms.

Latin America Credit Card Payment Market Analysis

Economic growth, especially in countries like Brazil, Mexico, and Argentina, is contributing to rising disposable incomes, leading to increased credit card payment demand as consumers seek to manage their spending and access financing for larger purchases. The shift to digital payments, along with greater smartphone penetration, is encouraging the use of mobile wallets and contactless payments, driving further adoption of credit cards. Additionally, credit card companies are introducing innovative payment solutions, such as installment plans and flexible payment options, which are highly attractive in regions with fluctuating economies and inflation. E-commerce growth in Latin America is another significant factor, as more consumers turn to online shopping and use credit cards for secure, convenient transactions. According to the ITA, Brazil is the largest economy in Latin America and continues to experience rapid e-commerce growth of 14.3% and should exceed USD 200 Billion by 2026. Financial inclusion efforts in the region are also contributing to the expansion of credit card services, with banks offering products to a broader segment of the population, including the unbanked and underbanked.

Middle East and Africa Credit Card Payment Market Analysis

The credit card payment market in the Middle East and Africa (MEA) is driven by several key factors. Firstly, the region is experiencing rapid economic growth, particularly in countries like the UAE, Saudi Arabia, and South Africa, leading to an increase in disposable incomes and a growing middle class. This rise in income has fueled consumer demand for credit cards as a preferred payment method for both every day and larger purchases. Visa (NYSE:V), a global leader in digital payments, launched the results of its 2024 Financial Literacy Survey, which examines the financial knowledge and choices of consumers in the UAE regarding credit, savings, and spending. The survey revealed that 31% of respondents prefer to pay for future electronic gadgets with a credit card, while 9% are looking for Buy Now, Pay Later (BNPL) plans, and 4% favor credit card installment plans. This highlights the growing popularity of credit cards in the region. Additionally, the push towards digitalization, supported by government initiatives and infrastructure improvements, is contributing to the adoption of electronic payments, including credit cards. Mobile payment systems, contactless payments, and e-commerce growth are also playing a significant role in expanding the market. Furthermore, an increasing focus on financial inclusion is driving credit card penetration, with banks and financial institutions offering tailored products to cater to previously underserved populations. The rise of digital wallets and the growing adoption of fintech solutions also play an important role in boosting credit card usage in the region.

Leading Credit Card Payment Companies:

The credit card payment market forecast indicates strong competition in the market, with key players employing diverse strategies to strengthen their position amid evolving consumer expectations. One primary approach is the adoption of cutting-edge technologies, such as AI and machine learning, to enhance fraud detection, personalize user experiences, and streamline transaction processes. These innovations improve customer trust and loyalty while maintaining security. Companies are also expanding partnerships with merchants, fintech firms, and digital wallet providers to broaden acceptance networks. This ensures that credit cards remain integral in both online and offline ecosystems. For instance, integrations with popular platforms like PayPal, Apple Pay, and Google Pay enhance convenience and appeal to tech-savvy consumers. Additionally, rewards programs and co-branded cards are a major focus, targeting customer retention. Issuers collaborate with retailers, airlines, and other sectors to offer exclusive benefits, such as cashback, travel rewards, and discounts.

The report provides a comprehensive analysis of the competitive landscape in the credit card payment market with detailed profiles of all major companies, including:

- American Express Company

- Bank of America Corporation

- Barclays Bank UK PLC

- Capital One

- Citigroup Inc

- ICICI Bank Ltd

- JPMorgan Chase & Co.

- Mastercard Incorporated

- Synchrony Bank

- The PNC Financial Services Group, Inc.

- Visa Inc.

Latest News and Developments:

- September 2024: Axis Bank and Mastercard have teamed up to introduce MyBiz, a premium business credit card aimed at small business owners and sole proprietors in India. The card, part of the World Mastercard® category, offers a comprehensive suite of benefits including airport lounge access, travel insurance, and business-related services like productivity tools and marketing solutions through Mastercard Easy Savings Specials.

- October 2024: Non-bank lender Mahindra Finance, in collaboration with RBL Bank, has received approval from the Reserve Bank of India (RBI) to launch a co-branded credit card. The initiative aims to meet the aspirational needs of Mahindra Finance's customers. This development occurs amid rising concerns over credit card portfolios, with regulatory efforts to discourage risky asset growth. A Mahindra group entity holds a 3.53% strategic stake in RBL Bank, acquired for approximately USD 49 Million. This partnership comes as RBL Bank seeks to reduce its dependence on Bajaj Finance for credit card distribution.

- December 2023: Mastercard Inc. partnered with Samsung Electronics on a newly launched Mastercard program, which is known as Wallet Express. The service provides banks and card issuers with a quick and cost-effective means of expanding their digital wallet offerings. The partnership allows issuers to integrate Samsung Wallet into their services, providing users with a versatile range of payment options.

Credit Card Payment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Card Types Covered | General Purpose Credit Cards, Specialty Credit Cards, Others |

| Providers Covered | Visa, Mastercard, Others |

| Applications Covered | Food and Groceries, Health and Pharmacy, Restaurants and Bars, Consumer Electronics, Media and Entertainment, Travel and Tourism, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Express Company, Bank of America Corporation, Barclays Bank UK PLC, Capital One, Citigroup Inc, ICICI Bank Ltd, JPMorgan Chase & Co., Mastercard Incorporated, Synchrony Bank, The PNC Financial Services Group, Inc., Visa Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the credit card payment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global credit card payment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the credit card payment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The credit card payment market was valued at USD 690.6 Billion in 2024.

The credit card payment market is projected to exhibit a CAGR of 6.66% during 2025-2033, reaching a value of USD 1,316.4 Billion by 2033.

The key factors driving the market include significant technological advancements, increasing digital payment adoption, growing consumer demand for convenience, enhanced security measures, and rising e-commerce growth. Additionally, rise in reward programs and financial inclusion initiatives are also contributing to market expansion.

North America currently dominates the credit card payment market, accounting for a share exceeding 38.4%. This dominance is fueled by ongoing innovations, high financial inclusion, and a growing preference for digital payment solutions.

Some of the major players in the credit card payment market include American Express Company, Bank of America Corporation, Barclays Bank UK PLC, Capital One, Citigroup Inc, ICICI Bank Ltd, JPMorgan Chase & Co., Mastercard Incorporated, Synchrony Bank, The PNC Financial Services Group, Inc., and Visa Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)