Customer Self-Service Software Market Report by Solution (Web Self-Service, Mobile Self-Service, Intelligent Virtual Assistants, Social Media and Community Self-Service, Email Management, IVR and ITR, and Others), Service (Professional Service, Managed Service), Deployment (Cloud-based, On-premises), End Use (BFSI, Manufacturing, Retail and E-commerce, Media and Entertainment, IT and Telecommunication, Healthcare, Government, and Others), and Region 2025-2033

Customer Self-Service Software Market Size:

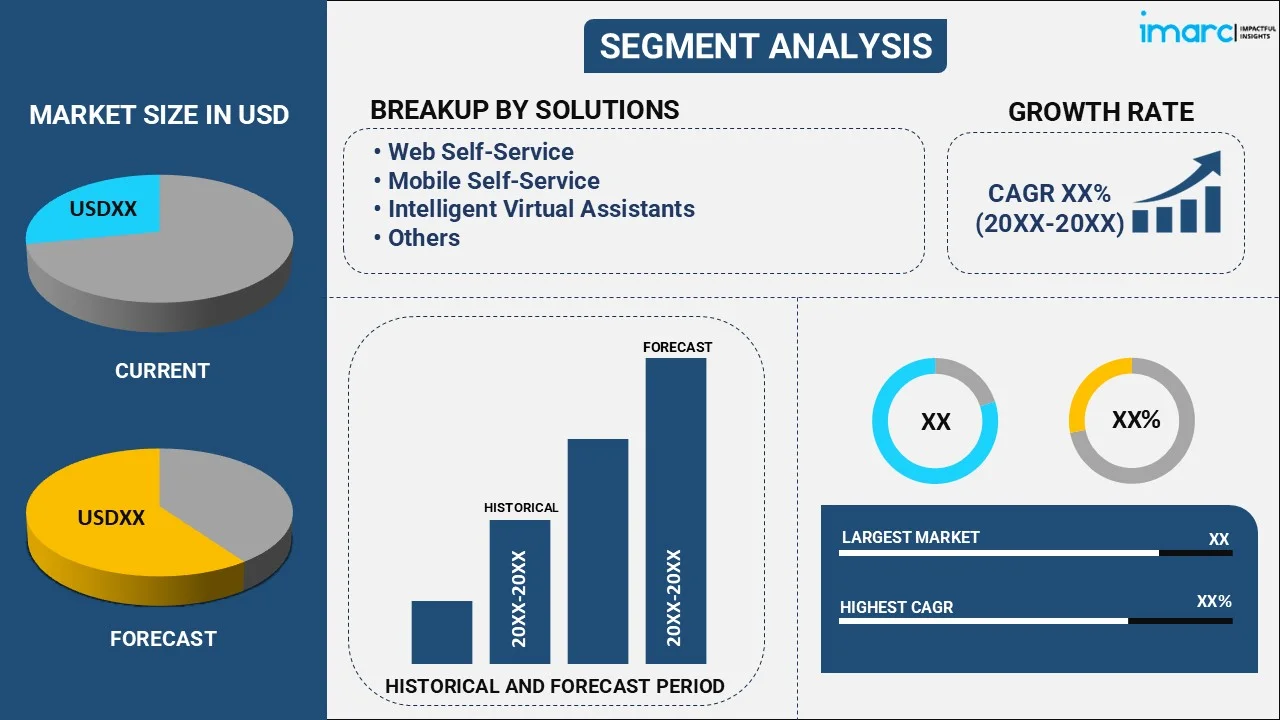

The global customer self-service software market size reached USD 18.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 105.4 Billion by 2033, exhibiting a growth rate (CAGR) of 20.22% during 2025-2033. The market is experiencing steady growth driven by the escalating demand for immediate and effective solutions among customers, rising digitization of various businesses processes to save time and manual labor, and increasing online shopping activities to purchase different products and services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 18.6 Billion |

|

Market Forecast in 2033

|

USD 105.4 Billion |

| Market Growth Rate 2025-2033 | 20.22% |

Customer Self-Service Software Market Analysis:

- Market Growth and Size: The customer self-service software market is experiencing robust growth, driven by the increasing demand for enhanced customer experience and cost-effective service models.

- Major Market Drivers: Key drivers include the rising need for efficient customer service solutions, cost reduction for businesses, and the growing preferences for digital self-service options. These drivers are fueled by the evolving customer expectations for instant and accessible service across multiple digital channels.

- Technological Advancements: Advances in artificial intelligence (AI), machine learning (ML), and natural language processing (NLP) are revolutionizing the customer self-service software market. These technologies enable more personalized, accurate, and intuitive self-service experiences, driving market growth.

- Industry Applications: Customer self-service software is widely used in the BFSI, retail, e-commerce, IT, telecommunications, and manufacturing industries.

- Key Market Trends: Integration of AI and cloud computing, the rise of mobile self-service solutions, and an emphasis on personalized customer experiences are notable trends.

- Geographical Trends: North America leads the market driven by the growing digitization of various business processes and increasing demand for enhanced customer experience. However, Asia Pacific is emerging as a fast-growing market on account of the rising online shopping activities among the masses.

- Competitive Landscape: The market is characterized by the presence of key players engaged in strategic partnerships, technological innovations, and expansion strategies.

- Challenges and Opportunities: Challenges include addressing data security concerns and keeping up with rapidly changing technology. Nonetheless, opportunities for innovation and expansion into emerging markets, along with the development of more advanced, secure, and user-friendly solutions are projected to overcome these challenges.

Customer Self-Service Software Market Trends:

Increasing Demand for Enhanced Customer Experience

At present, customer expectations are shifting towards immediate and effective solutions. Customer self-service software plays a pivotal part in meeting these expectations by providing prompt, round-the-clock access to information and problem resolution. This software empowers customers in finding answers and resolving issues independently, leading to an enhanced customer experience. A key benefit of self-service systems is their ability to offer consistent information across various digital channels, ensuring customers receive uniform guidance regardless of how they interact with the business. This consistency is crucial in building trust and satisfaction among customers. Additionally, the self-service model caters to the growing preferences for digital interaction over traditional human-to-human contact in customer service. As more people prefer to use digital means to solve their queries, the demand for sophisticated and efficient customer self-service software is rising. The capability of the software to adapt to diverse customer needs and preferences, while providing a streamlined and user-friendly interface, further bolsters its appeal in enhancing customer experience.

Cost Reduction for Businesses

The implementation of customer self-service software significantly lowers operational costs for businesses by reducing the workload on customer service teams. By enabling customers to handle routine inquiries and basic troubleshooting independently, companies can decrease the number of staff required for customer support. This reduction in labor demands leads to substantial cost savings. Furthermore, self-service systems streamline the customer service process, allowing businesses to handle a higher volume of queries without proportional increases in resources or personnel. This efficiency not only reduces costs but also enhances the overall responsiveness of the customer service department. In addition to direct cost savings, customer self-service software provides indirect financial benefits through the collection and analysis of customer interaction data. This data is invaluable for identifying common issues and trends, which can guide improvements in products or services, leading to reduced future customer service demands. Consequently, the software serves as a cost-effective solution for businesses, offering both immediate and long-term financial benefits.

Technological Advancements and Integration Capabilities

The rapid evolution of technology, particularly in artificial intelligence (AI) and machine learning (ML), is significantly enhancing the capabilities of customer self-service software. These technological advancements are enabling the development of more sophisticated and intuitive systems that can provide personalized and accurate responses to customer inquiries. AI-driven self-service tools can analyze customer behavior and preferences, offering tailored assistance that improves the overall effectiveness of self-service options. The integration capabilities of modern customer self-service software are propelling the market growth. These systems can seamlessly integrate with various business tools, such as customer relationship management (CRM) systems, analytics tools, and other digital platforms, creating a unified and efficient customer service ecosystem. This integration ensures that customer interactions are consistent across different channels, maintaining a cohesive customer experience. Additionally, the ability to integrate with emerging technologies like chatbots and virtual assistants further expands the functionality and appeal of self-service software, making it an essential component in the digital transformation strategies of many businesses. These technological advancements not only enhance the customer experience but also provide businesses with powerful tools to manage and optimize their customer service operations.

Customer Self-Service Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on solution, service, deployment, and end use.

Breakup by Solution:

- Web Self-Service

- Mobile Self-Service

- Intelligent Virtual Assistants

- Social Media and Community Self-Service

- Email Management

- IVR and ITR

- Others

Web self-service accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the solution. This includes web self-service, mobile self-service, intelligent virtual assistants, social media and community self-service, e-mail management, IVR and ITR, and others. According to the report, web self-service represented the largest segment.

Web self-service primarily includes online portals and frequently asked questions (FAQ) sections on company websites where customers can access information and resolve their issues without direct interaction with customer service representatives. The popularity of web self-service stems from its accessibility and convenience, allowing customers to find solutions at any time without waiting for assistance. These systems often use a combination of searchable databases, help articles, and instructional content, making them a comprehensive resource for customer support. Additionally, web self-service platforms are increasingly incorporating artificial intelligence (AI)-driven tools like chatbots to enhance the user experience, making this segment a crucial component of customer service strategies in many organizations.

Mobile self-service solutions are designed to offer a user-friendly experience tailored to smaller screens, ensuring that customers can easily navigate and find the information they need. Features like push notifications, location-based services, and integration with device-specific functions enhance the effectiveness of mobile self-service, making it a valuable tool for businesses aiming to offer comprehensive support across all digital touchpoints.

Intelligent virtual assistants (IVAs), powered by AI and machine learning (ML), are designed to simulate human interaction, providing personalized and interactive customer service experiences. These virtual assistants can understand and process natural language, enabling them to handle a wide range of customer queries efficiently.

The social media and community self-service segment is becoming popular as customers increasingly turn to social media platforms and online communities for support. This segment involves the use of social media channels and forums where customers can seek assistance either from the company directly or from other users. The appeal of this segment lies in its collaborative nature, where customers can share experiences, offer solutions, and provide feedback.

Email management remains a vital segment of the customer self-service software market, serving as a more traditional but still essential channel for customer support. This solution focuses on efficiently managing customer queries received via email. Advanced email management systems use automated responses, ticketing systems, and categorization techniques to streamline the handling of customer emails.

Breakup by Service:

- Professional Service

- Managed Service

Professional service holds the largest share in the industry

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes professional service and managed service. According to the report, professional service accounted for the largest market share.

Professional services encompass a range of services including consulting, integration and implementation, support and maintenance, and training and education. These services are crucial for businesses seeking to tailor self-service solutions to their specific needs and objectives. Professional services play a key role in ensuring successful software deployment, optimizing it for the unique customer base and operational workflow of the business. They also provide ongoing support and maintenance, ensuring that the software continues to function effectively and evolves in line with technological advancements and changing customer expectations. Additionally, through training and education, professional services empower businesses to fully leverage their self-service software capabilities, enhancing overall efficiency and customer satisfaction.

Managed services include services, such as round-the-clock monitoring, management of software applications, and handling of routine maintenance and updates. Managed services are particularly beneficial for organizations that lack the in-house expertise or resources to manage these systems effectively. By outsourcing these tasks, businesses can ensure that their self-service solutions are always running optimally, with reduced downtime and improved customer experiences.

Breakup by Deployment:

- Cloud-based

- On-premises

Cloud-based represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes cloud-based and on-premises. According to the report, cloud based represented the largest segment.

Cloud-based deployment involves hosting the software on the cloud infrastructure of the provider, offering businesses scalability, flexibility, and cost-effectiveness. The popularity of cloud-based solutions stems from their ability to provide real-time updates, easy accessibility from anywhere, and reduced need for extensive in-house information technology (IT) infrastructure. These systems are often preferred for their rapid deployment and ease of integration with other cloud-based services. Moreover, cloud-based self-service solutions offer enhanced security and data recovery options, which are crucial for maintaining customer trust. The ongoing advancements in cloud technology, along with the increasing adoption of cloud services across various industries, are supporting the market growth.

On-premises deployment involves installing the software on the servers of the company and managing it internally. On-premises solutions offer businesses complete control over their self-service software, including customization, security, and data management. This approach is particularly favored by organizations with stringent data security requirements or those operating in industries with strict regulatory compliance standards. On-premises deployment also allows for greater integration with existing in-house systems and infrastructure.

Breakup by End Use:

- BFSI

- Manufacturing

- Retail and Ecommerce

- Media and Entertainment

- IT and Telecommunication

- Healthcare

- Government

- Others

BFSI exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes BFSI, manufacturing, retail and e-commerce, media and entertainment, IT and telecommunication, healthcare, government, and others. According to the report, BFSI accounted for the largest market share.

The BFSI sector is increasingly adopting self-service technologies to provide customers with quick access to account information, transaction services, and support. These solutions enhance customer experience by offering convenience and security, crucial aspects in the financial sector. Self-service portals, mobile banking apps, and AI-driven chatbots in BFSI help in reducing operational costs and improving service efficiency. The high volume of customer interactions and transactions in this sector makes the deployment of self-service software particularly beneficial, allowing BFSI organizations to meet the evolving expectations of their clients while ensuring compliance with stringent regulatory standards.

In the manufacturing sector, customer self-service software is used to streamline operations and improve customer engagement. Manufacturers utilize self-service solutions to provide customers with easy access to product information, order tracking, and support services. These tools help in reducing response times and improving the efficiency of customer service processes.

The retail and e-commerce sector significantly benefits from customer self-service software, especially given the rise of online shopping. These solutions help retailers provide customers with instant access to product information, order status, return policies, and frequently asked questions (FAQs).

In the media and entertainment industry, customer self-service software is used to enhance user engagement and content accessibility. This sector utilizes self-service platforms to provide customers with easy access to media content, account management, and customer support.

The IT and telecommunication sector uses customer self-service software to manage a wide range of customer service tasks. These include providing technical support, account management, and service upgrades. The self-service tools in this sector are crucial for handling large volumes of customer inquiries efficiently, reducing wait times, and improving overall customer satisfaction.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest customer self-service software market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

The North America customer self-service software market is driven by factors like advanced technological infrastructure, high adoption of digital solutions, and a strong presence of leading software providers. Additionally, the growing emphasis on customer experience in industries like retail, banking, financial services, and insurance (BFSI), and healthcare fuels the adoption of self-service technologies.

Asia Pacific maintains a strong presence driven by the increasing digitalization of businesses and growing internet penetration. Additionally, government initiatives promoting digital infrastructure and the increasing investment in artificial intelligence (AI) and cloud technologies are propelling the market growth.

Europe stands as another key region in the market, driven by a strong focus on improving customer engagement and the growing need for efficient service delivery in various sectors.

Latin America exhibits growing potential in the customer self-service software market, fueled by the increasing digital transformation of businesses and the rising demand for improved customer service solutions.

The Middle East and Africa region show a developing market for customer self-service software, driven by the growing adoption of digital technologies and an increasing focus on enhancing customer service in sectors like retail, BFSI, and tourism.

Leading Key Players in the Customer Self-Service Software Industry:

Key players in the customer self-service software market are actively engaging in various strategic initiatives to strengthen their market position and meet the evolving needs of diverse industries. They are focusing on the development and enhancement of artificial intelligence (AI)-powered solutions to provide more personalized and efficient self-service experiences. Mergers and acquisitions (M&As), partnerships with technology providers, and collaborations with industry leaders are common strategies to expand their product capabilities and market reach. Additionally, these companies are investing heavily in research and development (R&D) to innovate in areas like natural language processing (NLP), machine learning (ML), and predictive analytics. This focus on technological advancement is aimed at offering more sophisticated, user-friendly, and integrated self-service solutions to cater to a rapidly digitalizing global market.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Aspect Software Inc.

- Avaya Inc.

- BMC Software Inc.

- HappyFox Inc.

- Microsoft Corporation

- Nuance Communications Inc.

- Oracle Corporation

- Salesforce.Com Inc.

- SAP SE

- Verint Systems Inc.

- Zappix Inc

- Zendesk Inc.

- Zoho Corporation Pvt. Ltd

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- June 2023: Avaya Inc. announced the launch of Avaya Customer Experience Services (ACES), formerly known as Avaya Professional Services, which leverages artificial intelligence (AI), cloud, and digital technologies to create improved business outcomes.

- September 2023: Microsoft Corporation announced its new Copilot in Dynamics 365 Customer Service, which will help its own employees deliver faster and more focused customer care by drafting contextual and personalized solutions to questions in both chat and email and by providing an interactive chat experience over knowledge bases and case history.

Customer Self-Service Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered | Web Self-Service, Mobile Self-Service, Intelligent Virtual Assistants, Social Media and Community Self-Service, Email Management, IVR and ITR, Others |

| Services Covered | Professional Service, Managed Service |

| Deployments Covered | Cloud-based, On-premises |

| End Uses Covered | BFSI, Manufacturing, Retail and E-commerce, Media and Entertainment, IT and Telecommunication, Healthcare, Government, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aspect Software Inc., Avaya Inc., BMC Software Inc., HappyFox Inc., Microsoft Corporation, Nuance Communications Inc., Oracle Corporation, Salesforce.Com Inc., SAP SE, Verint Systems Inc., Zappix Inc, Zendesk Inc., Zoho Corporation Pvt. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global customer self-service software market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global customer self-service software market?

- What is the impact of each driver, restraint, and opportunity on the global customer self-service software market?

- What are the key regional markets?

- Which countries represent the most attractive customer self-service software market?

- What is the breakup of the market based on the solution?

- Which is the most attractive solution in the customer self-service software market?

- What is the breakup of the market based on the service?

- Which is the most attractive service in the customer self-service software market?

- What is the breakup of the market based on the deployment?

- Which is the most attractive deployment in the customer self-service software market?

- What is the breakup of the market based on the end use?

- Which is the most attractive end use in the customer self-service software market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global customer self-service software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the customer self-service software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global customer self-service software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the customer self-service software industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)