Cyprus Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2025-2033

Cyprus Medical Tourism Market Overview:

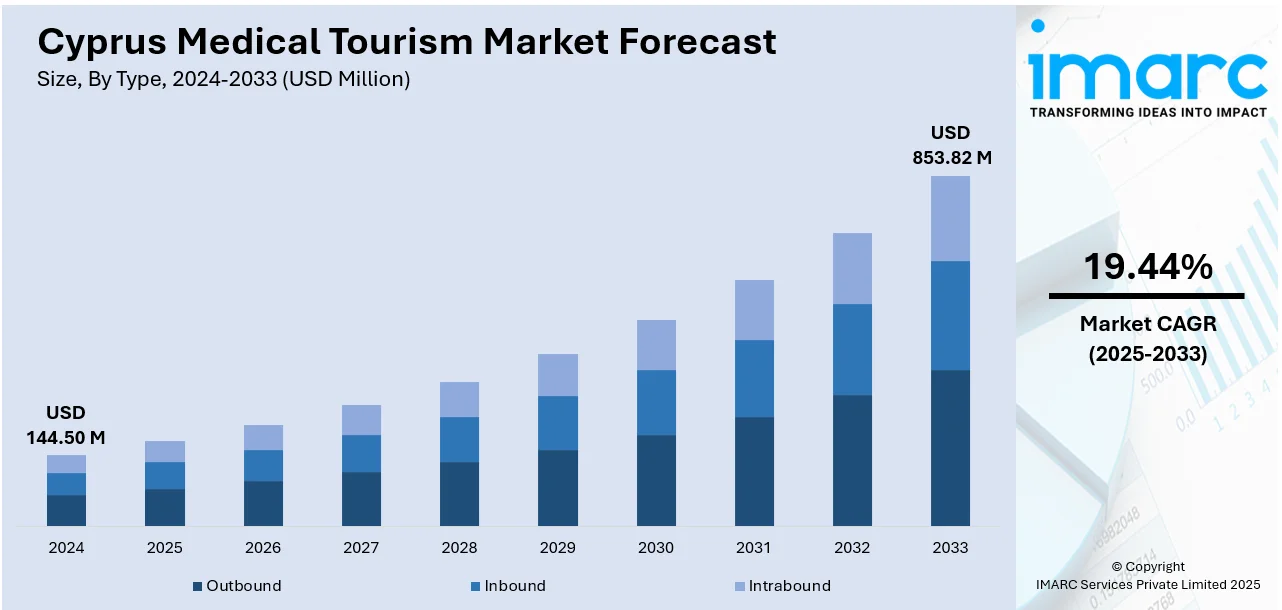

The Cyprus medical tourism market size reached USD 144.50 Million in 2024. Looking forward, the market is projected to reach USD 853.82 Million by 2033, exhibiting a growth rate (CAGR) of 19.44% during 2025-2033. The market is driven by Cyprus’s EU-aligned healthcare standards and cost-effective private medical services. Specialization in fertility treatments, legal accessibility, and high clinical success rates attract international reproductive health travelers. Additionally, the island’s tourism integration and recuperative environment are further augmenting the Cyprus medical tourism market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 144.50 Million |

| Market Forecast in 2033 | USD 853.82 Million |

| Market Growth Rate 2025-2033 | 19.44% |

Cyprus Medical Tourism Market Trends:

EU Standards and Competitive Private Healthcare Sector

Cyprus has established itself as an attractive destination for medical tourism through a private healthcare sector that adheres to European Union clinical and operational standards. Clinics and hospitals across Nicosia, Limassol, and Larnaca deliver medical and surgical services at significantly lower costs than in other EU countries, yet with comparable clinical outcomes. Many facilities are equipped with modern diagnostic imaging, robotic surgery tools, and minimally invasive technology, and are staffed by English-speaking medical professionals trained in the UK and other EU nations. Cyprus’s full EU membership provides additional regulatory oversight, ensuring patient safety, malpractice coverage, and medical accountability. Moreover, Cyprus's medical system operates in a multilingual context, with institutions fluent in English, Greek, and Russian—catering especially to patients from the UK, Eastern Europe, and the Middle East. Insurance portability across some EU plans also facilitates cross-border treatment access. With no waitlists for most elective procedures and shorter patient intake times, the country is gaining popularity for procedures such as orthopedics, fertility treatments, and cosmetic surgery. This balance between price, quality, and convenience has become a strong driver of Cyprus medical tourism market growth in the region’s competitive healthcare landscape.

To get more information on this market, Request Sample

Specialization in Fertility Treatments and Reproductive Medicine

Cyprus has emerged as a sought-after destination for assisted reproductive services due to its expertise in in-vitro fertilization (IVF), egg donation, and surrogacy coordination. Fertility clinics in Limassol and Nicosia attract patients from across Europe, the Middle East, and Africa by offering flexible legal frameworks, success rates on par with Western clinics, and competitively priced treatment cycles. The country permits anonymous egg and sperm donation, which is restricted in several other European countries, thereby creating legal and procedural advantages for foreign patients. Additionally, waiting times are minimal, and pre-treatment consultations can often begin remotely. Cyprus also offers preimplantation genetic testing (PGT) and intracytoplasmic sperm injection (ICSI), with many clinics integrating these advanced techniques into standard IVF packages. Bilingual coordination teams manage accommodation, transport, and post-treatment wellness services for international patients, making the fertility journey smoother and less stressful. Many clinics also operate satellite partnerships in countries such as the UK and Germany, allowing follow-up care or preliminary diagnostics closer to home. With global demand for fertility solutions increasing, Cyprus’s legal accessibility and medical competency have made it a niche leader in reproductive health travel.

Tourism Synergy and Recuperative Climate

Cyprus’s appeal as a Mediterranean holiday destination significantly enhances its medical tourism proposition, particularly for recovery-oriented treatments. Patients often combine elective surgeries or wellness programs with post-procedure recovery in beachside resorts or spa retreats located across Paphos, Ayia Napa, and Troodos. The island’s mild climate, clean air, and peaceful environment contribute to faster recuperation, especially for elderly or chronic condition patients undergoing orthopedic, cardiovascular, or rehabilitation treatments. Hotels, private clinics, and wellness centers offer all-inclusive packages that include physiotherapy, dietary planning, and light physical activity—all integrated within a vacation setting. Cyprus’s tourism infrastructure supports this recovery model with easy airport access, luxury accommodations, and multilingual hospitality services. Health travelers from Europe find added value in being able to rest and rehabilitate in comfort and privacy while remaining within the EU. The combination of clinical service and wellness offerings increases the perceived value of treatment, especially for patients seeking both medical outcomes and experiential care. This health-tourism convergence has become a defining strength for Cyprus in attracting a diverse set of medical travelers, from cosmetic and dental patients to post-operative care seekers.

Cyprus Medical Tourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and treatment type.

Type Insights:

- Outbound

- Inbound

- Intrabound

The report has provided a detailed breakup and analysis of the market based on the type. This includes outbound, inbound, and intrabound.

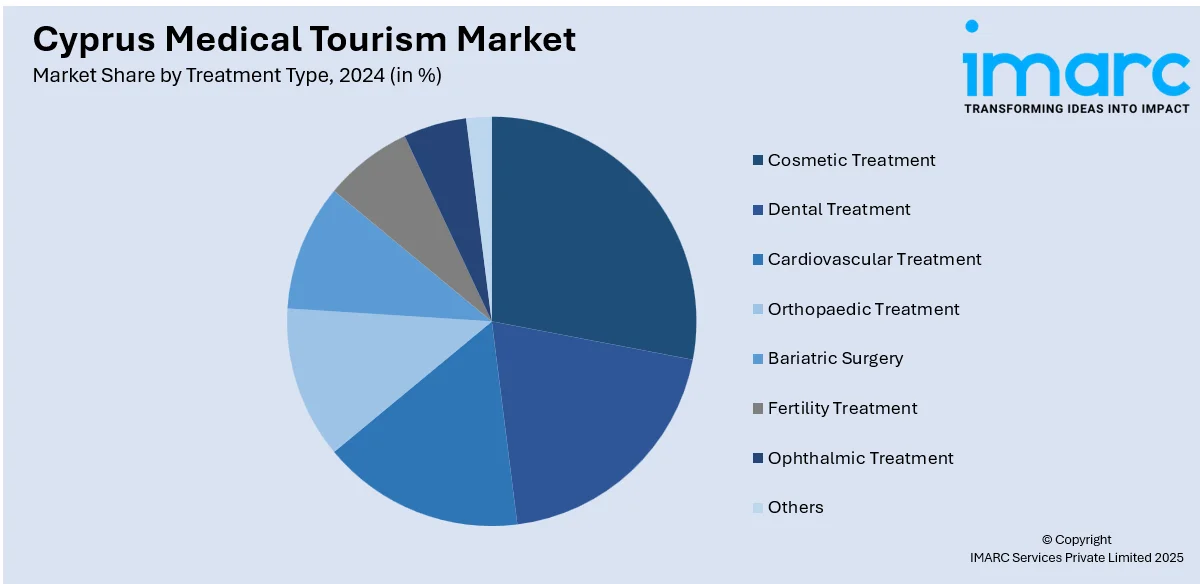

Treatment Type Insights:

- Cosmetic Treatment

- Dental Treatment

- Cardiovascular Treatment

- Orthopaedic Treatment

- Bariatric Surgery

- Fertility Treatment

- Ophthalmic Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the treatment type. This includes cosmetic treatment, dental treatment, cardiovascular treatment, orthopaedic treatment, bariatric surgery, fertility treatment, ophthalmic treatment, and others.

Regional Insights:

- Nicosia

- Limassol

- Kyrenia

- Famagusta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Nicosia, Limassol, Kyrenia, Famagusta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Cyprus Medical Tourism Market News:

- On January 27, 2025, Abu Dhabi-based healthcare provider PureHealth acquired a 60% majority stake in Cyprus’ Hellenic Healthcare Group (HHG) for USD 2.3 Billion, marking a significant expansion into the Cypriot healthcare sector. The acquisition, which includes key facilities like Apollonius Hospital, Aretaeion Hospital, and the American Medical Center, signals improved healthcare services and infrastructure on the island. This move is expected to enhance Cyprus' medical tourism appeal by offering advanced healthcare options and increasing competition in the private sector.

- On November 29, 2023, Vivant Medical Investments PLC announced plans for the AHEPA University Hospital Cyprus, positioning it as the largest private, fully accredited university hospital on the island. The €80 million hospital, located in the IMC Mansion, will feature advanced medical infrastructure, including 100 outpatient clinics, 200 inpatient health care clinics, and 10 operating theatres. This development is expected to enhance Cyprus' healthcare services and strengthen its position as a medical tourism destination, with global collaborations aimed at advancing medical research and patient care.

Cyprus Medical Tourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Outbound, Inbound, Intrabound |

| Treatment Types Covered | Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, Others |

| Regions Covered | Nicosia, Limassol, Kyrenia, Famagusta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Cyprus medical tourism market performed so far and how will it perform in the coming years?

- What is the breakup of the Cyprus medical tourism market on the basis of type?

- What is the breakup of the Cyprus medical tourism market on the basis of treatment type?

- What is the breakup of the Cyprus medical tourism market on the basis of region?

- What are the various stages in the value chain of the Cyprus medical tourism market?

- What are the key driving factors and challenges in the Cyprus medical tourism market?

- What is the structure of the Cyprus medical tourism market and who are the key players?

- What is the degree of competition in the Cyprus medical tourism market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Cyprus medical tourism market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Cyprus medical tourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Cyprus medical tourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)