Digital Content Creation Market Size, Share, Trends and Forecast by Component, Content Format, Deployment Type, Enterprise Size, End Use Industry, and Region, 2025-2033

Digital Content Creation Market Size and Share:

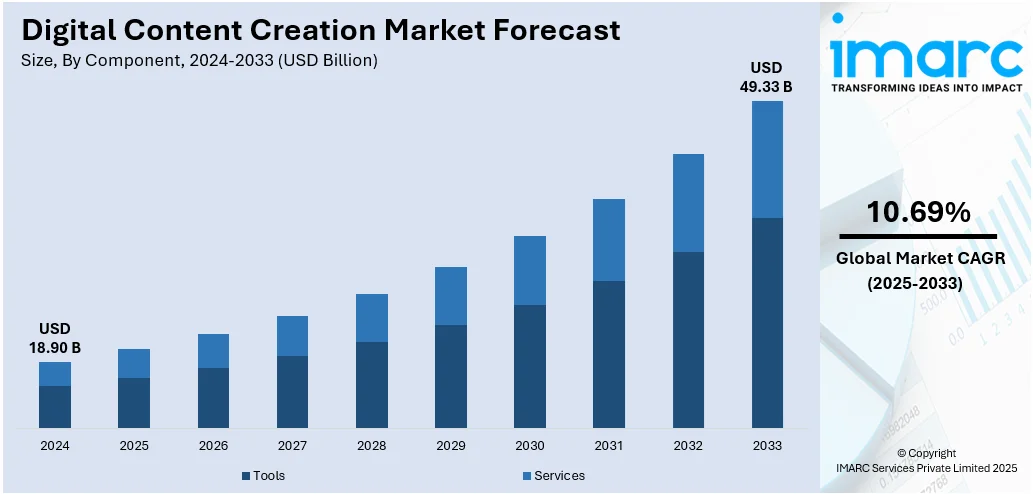

The global digital content creation market size was valued at USD 18.90 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 49.33 Billion by 2033, exhibiting a CAGR of 10.69% during 2025-2033. North America currently dominates the market, holding a significant market share of over 34.3% in 2024. The market is expanding due to increasing use of AI-based tools and demand for fast, visual content. Additionally, growing focus on mobile-first formats and cloud-based platforms continues to support digital content creation market share across media, retail, and corporate sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 18.90 Billion |

|

Market Forecast in 2033

|

USD 49.33 Billion |

| Market Growth Rate 2025-2033 | 10.69% |

The market is steadily fueled by the increasing use of AI-powered solutions across industries. Businesses are turning to automation for faster content turnaround without compromising on quality. This includes tools that can write blog drafts, generate social media captions, or even edit videos using preset styles. AI also plays a key role in personalization—adjusting content for audience segments automatically based on preferences or behavior. Content teams now rely on predictive suggestions and auto-tagging features to manage large libraries efficiently. These platforms not only reduce manual effort but also shorten review cycles by generating multiple drafts for quicker approval. Mid-size firms and startups especially benefit from these cost-saving advantages. As AI models become more precise, their role is expanding from optional add-ons to core features embedded in leading content platforms.

To get more information on this market, Request Sample

In the United States, short-form video is becoming a major force in the digital content creation space. American consumers spend a growing share of their online time watching videos under 60 seconds, especially on platforms like TikTok, YouTube Shorts, and Instagram Reels. This shift has prompted U.S. brands to rethink how they approach content planning—prioritizing speed, relatability, and mobile optimization. Companies are now producing more snackable content to stay visible in fast-moving feeds. Short videos are being used not only for promotions but also for product tutorials, user-generated content, and customer testimonials. U.S.-based platforms and tools are evolving quickly to support this trend, offering drag-and-drop editors, AI-based video summaries, and seamless platform integrations. These tools are helping small businesses and influencers scale content efforts with fewer resources.

Digital Content Creation Market Trends:

Influencer Marketing Driving Content Demand

Influencer marketing is playing a bigger role in shaping digital content creation market trends, therefore brands develop and distribute content. In 2024, global spending on digital advertising reached USD 247.3 Billion, with projections indicating it will touch USD 266.9 Billion by the end of 2025. This rise is closely linked to growing collaborations between brands and content creators who bring a personal, relatable tone to campaigns. These creators need frequent, customized content—like short videos, motion graphics, and story posts—which requires tools that allow fast, professional-grade output. The rising demand has led to a wave of digital tools focused on meeting influencer-driven content needs. In response, platforms are launching features that simplify editing, branding, and distribution. One recent example is Skroller, launched by Host Broadcast Services in 2024, aimed at helping sports organizations and broadcasters produce platform-specific content. Skroller emphasizes trend-based storytelling, social-first formats, and performance tracking. As brands seek more authentic engagement, influencer-led strategies are expected to keep driving the need for agile content tools that support fast, personalized, and scalable creation.

AI and Personalization Reshaping Creation

The push for personalized content is making AI tools a central part of digital content creation strategies. Consumers now expect material that matches their interests, behavior, and past interactions, and this demand is pushing brands to adapt. AI allows creators to automate content development, fine-tune messaging, and predict what formats and topics will perform best. A survey in 2024 showed that nearly 73% of marketers believe most influencer marketing activities could soon be AI-driven. Tools using machine learning are already helping teams build data-backed creative assets, suggest post timings, and shape content around user preferences. This is particularly useful in areas like e-commerce, where product visuals, descriptions, and ads need to be targeted at the individual level. Adobe’s rollout of three new AI models in 2023—Firefly Image 2, Vector, and Design—provided marketers with advanced tools for on-brand graphic creation, video templates, and AI-assisted layout generation. With built-in systems to track AI usage, such as Content Credentials, these platforms are setting standards for responsible and scalable digital content delivery, further contributing to the digital content creation market growth.

Cloud Platforms Driving Remote Creation

Cloud-based content platforms are becoming essential for content teams that need flexibility, especially with the rise of remote work. In 2024, around 65% of U.S. companies had adopted flexible or hybrid working models, creating a strong demand for tools that enable collaboration across different locations. These platforms allow users to create, edit, and manage content from anywhere, without relying on high-end local systems. Teams can now work on campaigns in real time, review updates instantly, and maintain consistent branding across projects. This speed and accessibility have turned cloud systems into key enablers of productivity. Integration with scheduling tools, design software, and analytics dashboards further boosts their usefulness. A recent example is Deloitte Digital’s CreativEdge, launched in 2024. It’s powered by generative AI and is designed to simplify the production of customized marketing campaigns across multiple platforms. With quick rendering, brand asset libraries, and auto-formatting features, tools like CreativEdge are helping content teams scale output while reducing turnaround time—especially important in fast-paced digital marketing environments.

Digital Content Creation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global digital content creation market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, content format, deployment type, enterprise size, and end use industry.

Analysis by Component Insights:

- Tools

- Content Transformation

- Content Publishing

- Content Authoring

- Services

- Managed Services

- Professional Services

As per the digital content creation market outlook, in 2024, tools segment led the market, accounted for the largest market share of 74.3%. Their widespread use stems from the surge in DIY content by small businesses, influencers, and in-house teams looking for efficient ways to produce content without large production budgets. These tools now often bundle editing, scheduling, analytics, and team collaboration into a single interface. The adoption of AI capabilities—like automated script writing, video clipping, background removal, and voiceover generation has expanded usage beyond professionals to casual users. Templates and drag-and-drop interfaces make creation faster and more approachable. Many platforms also integrate directly with social media, e-commerce stores, and CRMs, enabling content teams to work without switching between systems. The steep growth in user-generated content, especially on platforms like TikTok and Instagram, keeps demand high for scalable, flexible, and easy-to-learn content creation tools.

Analysis by Content Format:

- Textual

- Graphical

- Video

- Audio

In 2024, the video led the market, accounted for the largest market share of 40.9%. Its popularity is fueled by audience engagement metrics that consistently outperform text and image formats. Brands across sectors are prioritizing short-form and long-form video for everything from product demos to customer testimonials and social ads. The rise of streaming platforms, virtual events, and real-time shopping streams further cements video’s role. Tools that auto-generate videos from scripts or repurpose blog content into clips have lowered entry barriers. AI avatars, voice synthesis, and real-time captioning are being adopted for faster turnaround. E-learning, influencer content, internal communications, and ads all rely heavily on video, especially with growing mobile consumption. Combined with faster internet and better phone cameras, the infrastructure to create and consume video is stronger than ever, keeping it in the lead.

Analysis by Deployment Type:

- On-premises

- Cloud-based

Based on the digital content creation market forecast, in 2024, the cloud-based segment led the market, accounted for the largest market share of 77.5%. This growth is tied to the shift in how content teams operate—largely remote, global, and collaborative. Cloud systems let users edit, store, share, and publish content from anywhere, without relying on installed software or in-house servers. They also support real-time co-authoring, role-based access, and automatic backups, which are critical for large campaigns and distributed teams. Companies are favoring pay-as-you-go or subscription models offered by cloud services, which allow scaling without major capital expense. Updates are rolled out centrally, reducing downtime. The ecosystem also supports easy integrations with tools for analytics, publishing, and asset management. As speed and responsiveness are now vital in content marketing, especially around events or breaking trends, cloud deployment continues to be the most practical model for most teams.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

In 2024, the large enterprises led the market, accounted for the largest market share of over 65.0%, driven by the sheer volume of content they produce and the complexity of their campaigns. These organizations manage global product rollouts, multi-language campaigns, and omnichannel marketing, all of which require robust tools and strategies. Their teams include writers, editors, designers, data analysts, and localization experts—each needing access to shared platforms. The content isn’t just for external marketing; internal training, knowledge management, and stakeholder communication also demand consistent production. These companies often maintain digital asset management systems and integrate content creation with CRMs, ERPs, and analytics dashboards. With strict brand guidelines and legal compliance standards, enterprise-grade tools with approval workflows, audit trails, and secure cloud environments are essential. The budget scale also enables investment in AI content tools, licensing, and partnerships with creative agencies.

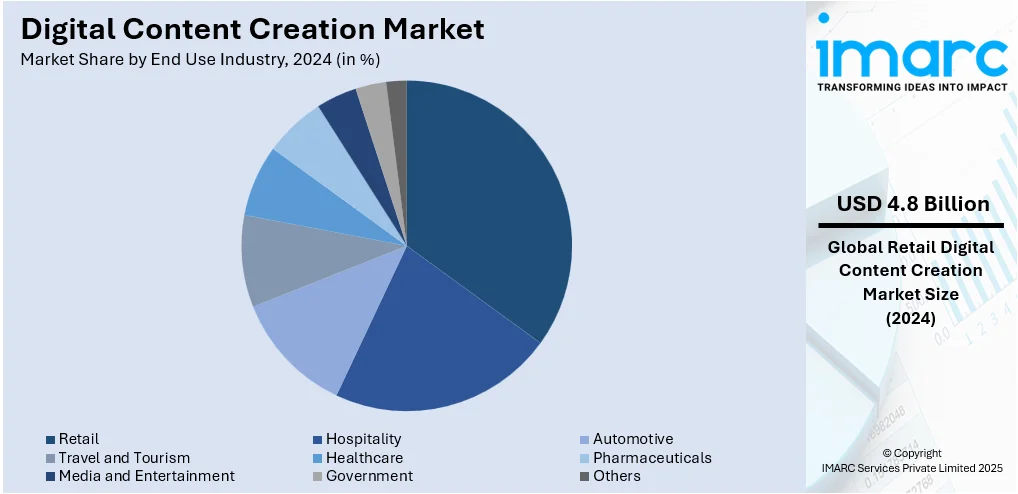

Analysis by End Use Industry:

- Retail

- Hospitality

- Automotive

- Travel and Tourism

- Healthcare

- Pharmaceuticals

- Media and Entertainment

- Government

- Others

The retail sector is set to lead the digital content creation market, holding a share of 25.5% in 2024. The shift toward digital storefronts, social commerce, and personalized marketing makes content a primary driver of conversion. Product videos, influencer collaborations, tutorials, AR/VR product previews, and seasonal campaigns all require fresh, tailored content at high volume. Retailers also use content for SEO, loyalty programs, mobile apps, and marketplace listings. Visual content is especially crucial—shoppers rely on it to compare features, pricing, and style. Live shopping events and customer reviews embedded with media are standard tactics now. AI-driven content platforms help retailers generate product descriptions, generate creative variations for ads, and localize assets quickly. The sector’s speed and responsiveness—driven by trends, inventory shifts, and campaign cycles—make content an operational priority rather than a side function.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the North America led the market, accounted for the largest market share of 34.3%. The region benefits from an advanced digital ecosystem, mature creator economy, and higher per capita investment in marketing and tech infrastructure. The U.S. and Canada house many of the major software players and content platforms, giving local users early access to innovation. Businesses in North America view content not just as a communication tool but as a revenue generator—tied directly into sales pipelines and customer retention strategies. The marketing spend per business is significantly higher here than in emerging markets. Influencer marketing is also more structured and monetized. With faster adoption of AI tools, cloud platforms, and compliance automation, the region sets the pace for global content standards. Educational institutions and media organizations also heavily contribute to the content demand, boosting the region’s dominance.

Key Regional Takeaways:

United States Digital Content Creation Market Analysis

The digital content creation market in the United States is witnessing robust growth driven by a surge in demand for interactive and immersive media experiences. The rise of personalized advertising, coupled with increasing investments in short-form video formats, is transforming the way content is produced and consumed. Notably, over 80% of marketers affirm influencer marketing as a highly effective strategy. Also, 63.8% of brands confirm plans to partner with influencers in 2025. This surge is fueling demand for advanced creation tools and platform integrations. The growing popularity of digital storytelling and creator-led monetization strategies is fostering a vibrant creator economy. Moreover, the proliferation of cloud-based editing and publishing tools enables professionals and amateurs alike to streamline workflows and enhance productivity. The U.S. market is also benefiting from the integration of advanced technologies like generative AI, revolutionizing content generation across video, audio, and design. Educational institutions and enterprises are leveraging digital content for training and brand communication, accelerating adoption. A shift towards collaborative content ecosystems is gaining traction, encouraging innovation through community-driven platforms and co-creation models, supported by mobile-first consumption and high-speed internet availability.

Europe Digital Content Creation Market Analysis

The digital content creation market in Europe is expanding steadily, propelled by the region’s growing emphasis on multilingual and localized content to cater to its diverse population. Cultural preservation through digital archives and heritage storytelling is contributing to the sector’s evolution. According to the IAB Europe, digital ad spending across the region exceeded USD 128.41 Billion in 2024, reflecting the increasing investment in digital content channels. The rising demand for accessible content that complies with regional inclusivity standards is influencing production trends. Europe's strong creative sector, supported by public initiatives to digitize media and entertainment, is fostering innovation in content formats such as AR/VR-based educational tools and digital exhibitions. Furthermore, the shift towards green digital production practices is encouraging the use of sustainable technologies in content workflows. Independent content creators are gaining visibility through decentralized distribution channels, democratizing media creation. The region’s emphasis on cybersecurity and data privacy is shaping secure content management systems and governance frameworks.

Asia Pacific Digital Content Creation Market Analysis

Asia Pacific’s digital content creation market is rapidly scaling, driven by the surge in youth-led mobile content consumption and the expanding influence of digital influencers. Regional content platforms are fostering hyperlocal creativity and boosting demand for intuitive development tools. According to the Ministry of Information & Broadcasting, India alone is home to 2 to 2.5 Million active digital creators defined as individuals with over 1,000 followers, highlighting the scale of participation in the regional creator economy. The growing prevalence of short-form content and mobile gaming integrations is redefining engagement metrics. Additionally, digital literacy programs across emerging economies enable a new generation of creators. The increasing adoption of AI-powered personalization and recommendation engines is stimulating demand across entertainment and marketing. As broadband infrastructure improves, especially in semi-urban and rural areas, the reach and impact of digital content continues to grow.

Latin America Digital Content Creation Market Analysis

In Latin America, the digital content creation market is gaining momentum through the rising adoption of mobile-first content strategies and creative economy initiatives. Urban youth engagement with digital platforms is fostering demand for visually compelling formats such as animation and motion graphics. Industry reports that the number of direct and indirect jobs generated by the Creator Economy in Brazil grew by 30% in 2024, showcasing the region’s growing reliance on digital content as a driver of economic opportunity. The growing popularity of live streaming for entertainment and educational purposes is transforming content delivery practices. Moreover, regional collaborations and cross-border digital storytelling are contributing to a more interconnected creative ecosystem. As digital payment solutions become more widespread, monetization opportunities for creators are expanding, fueling continued growth in the region.

Middle East and Africa Digital Content Creation Market Analysis

The Middle East and Africa are witnessing a notable rise in digital content creation, driven by a growing appetite for culturally resonant narratives and heritage-based storytelling. Social media penetration is accelerating this growth, a recent study revealed that 34.1 Million people in the Kingdom were active users of social media platforms as of early 2025, underscoring the region's high engagement levels. The expansion of digital education platforms and the popularity of mobile micro-learning content are fueling demand for localized content formats. Social media platforms enable creators to amplify reach and diversify content types, particularly in fashion, lifestyle, and gaming. Additionally, government-backed digital literacy initiatives are empowering a new wave of tech-savvy creators, shaping a vibrant and emerging digital content ecosystem across the region.

Competitive Landscape:

Companies in the digital content creation industry are adopting new strategies to address evolving technology demands and manage increasingly diverse content production workflows. They are using advanced creation platforms and automation tools to streamline the development of high-quality content, reduce manual effort, and improve consistency across formats. Many organizations are optimizing how content creation tools integrate with publishing, analytics, and collaboration systems, ensuring smooth operation from concept to distribution without delays. Some are enhancing real-time editing and feedback features, enabling teams to monitor content performance instantly and make quick adjustments to align with audience engagement trends. These efforts help improve content output, maintain brand consistency, and support fast, data-driven decision-making. By focusing on speed, quality, and platform compatibility, companies are improving the overall efficiency of content production while minimizing risks related to outdated messaging, disjointed workflows, or missed opportunities across digital channels.

The report provides a comprehensive analysis of the competitive landscape in the digital content creation market with detailed profiles of all major companies, including:

- Acrolinx GmbH

- Activision Blizzard Inc.

- Adobe Inc.

- Aptara Inc.

- Avid Technology Inc.

- Comcast Corporation

- Corel Corporation

- Integra Software Services Pvt. Ltd.

- MarketMuse Inc.

- Microsoft Corporation

- Quark Software Inc.

Latest News and Developments:

- June 2025: FlipHTML5 launched its AI magazine generator, enabling users to create professional magazines from simple prompts or content guidelines. The tool generated text, images, and layouts, supported 30 languages, and offered multimedia editing features, simplifying digital magazine creation without requiring design expertise or extensive time investment.

- June 2025: UW–Eau Claire Athletics partnered with FanWord to launch "The Gold Standard," a digital storytelling hub highlighting student-athletes and staff. Using FanWord Assist, they streamlined content creation for game recaps and features. This initiative positioned the Blugolds as early adopters of innovative storytelling tech among NCAA Division III programs.

- May 2025: TriNet introduced AI-driven HR solutions, including an AI-powered Personal Health Assistant and a learning management system with automated content creation. These enhancements supported 1,000+ training courses and aimed to streamline onboarding, improve employee development, and promote wellbeing, leveraging third-party integrations for added digital efficiency.

- April 2025: Adobe launched Firefly Image Model 4 Ultra with enhanced realism and prompt fidelity. It introduced a Firefly mobile app, video model, vector generator, and Adobe Boards tool. Adobe Express also gained AI-powered video editing tools, Clip Maker, and Vimeo integration, streamlining multimedia content creation and animation.

- February 2025: Adobe launched its Firefly Video Model in public beta, offering commercially safe AI video generation using licensed content. Integrated into Premiere Pro and Firefly web app, it featured tools like text-to-video, camera angle control, and style locking, aiming to streamline professional video production while raising creative industry concerns.

Digital Content Creation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Content Formats Covered | Textual, Graphical, Video, Audio |

| Deployment Types Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Use Industries Covered | Retail, Hospitality, Automotive, Travel and Tourism, Healthcare, Pharmaceuticals, Media and Entertainment, Government, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acrolinx GmbH, Activision Blizzard Inc., Adobe Inc., Aptara Inc., Avid Technology Inc., Comcast Corporation, Corel Corporation, Integra Software Services Pvt. Ltd., MarketMuse Inc., Microsoft Corporation, Quark Software Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the digital content creation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global digital content creation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the digital content creation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital content creation market was valued at USD 18.90 Billion in 2024.

The digital content creation market is projected to exhibit a CAGR of 10.69% during 2025-2033, reaching a value of USD 49.33 Billion by 2033.

The digital content creation market is driven by the growing demand for digital media, rising use of AI-based tools, social media expansion, influencer marketing growth, remote work adoption, and the need for fast, personalized, and platform-specific content across industries.

In 2024, North America dominated the digital content creation market accounted for 34.3% market share, driven by high digital spending, early adoption of AI tools, strong creator ecosystem, advanced infrastructure, and increased demand for content across entertainment, e-commerce, and enterprise communication platforms.

Some of the major players in the global digital content creation market include Acrolinx GmbH, Activision Blizzard Inc., Adobe Inc., Aptara Inc., Avid Technology Inc., Comcast Corporation, Corel Corporation, Integra Software Services Pvt. Ltd., MarketMuse Inc., Microsoft Corporation, Quark Software Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)