Digital Lending Platform Market Size, Share, Trends and Forecast by Type, Component, Deployment Model, Industry Vertical, and Region, 2025-2033

Digital Lending Platform Market Size and Share:

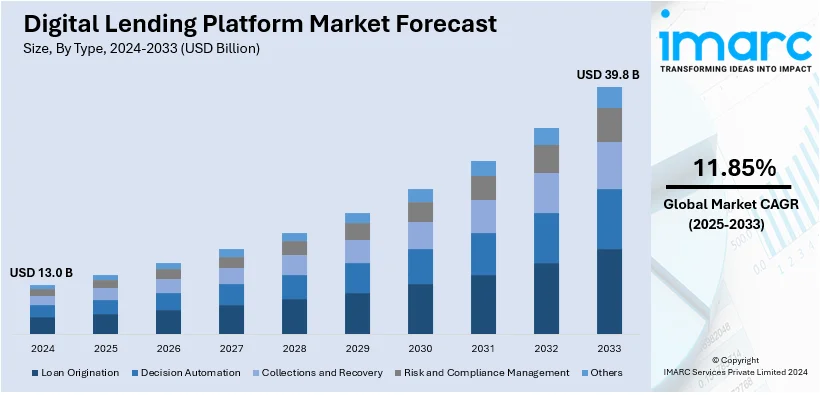

The global digital lending platform market size was valued at USD 13.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 39.8 Billion by 2033, exhibiting a CAGR of 11.85% from 2025-2033. North America currently dominates the market, holding a market share of over 31.2% in 2024. The growth of North American region is driven by advanced fintech adoption, robust regulatory frameworks, and widespread digital banking.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 13.0 Billion |

|

Market Forecast in 2033

|

USD 39.8 Billion |

| Market Growth Rate 2025-2033 | 11.85% |

The global digital lending platform market share is expanding significantly due to the growing user preferences for hassle-free loan processes, which offer streamlined application procedures, real-time approval mechanisms, and personalized loan products designed to meet diverse financial needs. Moreover, the rising introduction of favorable regulations and policies by governments and financial authorities is encouraging innovation within the digital lending ecosystem while ensuring user protection and maintaining the stability of financial systems. Apart from this, digital lending platforms are playing a critical role in promoting financial inclusion by extending credit services to underserved populations that are often excluded from conventional banking systems due to geographical or economic constraints.

The United States is a key region in the market, driven by a high reliance of smartphones combined with reliable and widespread internet connectivity, making digital lending platforms easily accessible to a vast segment of the population. Besides this, increasing investments in advanced technologies, such as artificial intelligence (AI) and machine learning (ML), to optimize lending processes and enhance operational efficiency are bolstering the market growth in the country. These technological advancements are enabling financial institutions to deliver faster and more accurate credit assessments while expanding their reach into previously underserved markets, including credit unions and smaller financial organizations. In 2024, US-based fintech Amount secured $30 million in equity funding to enhance its AI and machine learning capabilities. The funds will also support its expansion into the credit union market. Amount’s SaaS platform powers digital account opening and loan origination for financial institutions across the US.

Digital Lending Platform Market Trends:

Growing Focus on User Experience

The rising focus on enhancing user experience is a key factor supporting the digital lending platform market growth. Increasing emphasis on personalization is encouraging platforms to adopt advanced technologies that enable streamlined application processes, intuitive interfaces, and tailored loan products designed to meet individual borrower needs. Features such as real-time approvals, simplified documentation, and transparent loan terms are redefining the lending experience for individuals. Additionally, leading platforms are integrating AI, ML, and big data analytics to better understand borrower behavior and preferences. In May 2024, PhonePe launched its secured digital lending platform within its app, providing approximately 535 million registered users access to loans in six distinct categories, including gold loans, mutual fund loans, and car loans. This innovation highlights how digital lending platforms are not only improving customer satisfaction but also expanding their reach, fostering financial inclusion, and strengthening the market growth.

Rising Regulatory Support

The digital lending platform market outlook is characterized by the regulatory bodies worldwide implementing favorable policies to enhance the transparency, security, and integrity of financial systems while fostering innovation and safeguarding user interests. These measures encourage financial institutions to adopt digital solutions that align with compliance standards and promote trust among users. In June 2024, Salesforce introduced its digital lending platform aimed at empowering government agencies and public sector organizations in India to improve citizen-centric financial services. Additionally, the enforcement of stringent data privacy regulations, such as the general data protection regulation (GDPR) and similar laws, are bolstering the popularity of platforms like Temenos and Finastra. These platforms integrate robust data protection features, ensuring compliance with regulatory standards while offering advanced functionalities. These developments underline the growing synergy between regulatory frameworks and technological advancements, encouraging further adoptions.

Expanding Alternative Channels

The digital lending platform market forecast indicates significant growth due to the fintech startups are rapidly increasing, introducing innovative financial solutions that provide diverse and accessible financing options beyond traditional banking systems. These channels cater to underserved segments, offering more flexibility and convenience, which is leading to their widespread adoption worldwide. Additionally, these platforms leverage cutting-edge technologies, such as blockchain and AI, to enhance efficiency and transparency. In March 2024, Epic River launched a specialized digital lending platform designed for credit unions, enabling seamless integration between financial institutions and healthcare providers to streamline patient payment processes. These innovations highlight the ability of alternative channels to address unique market needs, expand financial accessibility, and deliver personalized lending solutions. As these platforms continue to evolve, they are reshaping the lending landscape, fostering inclusivity and supporting the market growth.

Digital Lending Platform Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global digital lending platform market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, component, deployment model, and industry vertical.

Analysis by Type:

- Loan Origination

- Decision Automation

- Collections and Recovery

- Risk and Compliance Management

- Others

Loan origination holds the largest share in the market due to its critical role in initiating the lending process. The segment includes the comprehensive handling of loan applications, ranging from submission to approval. The advanced technologies, which include AI and data analytics, are utilized in managing this process. The growing need for seamless, paperless, and user-friendly loan application procedures is catalyzing the demand for financial institutions to opt for digital loan origination solutions. These platforms include features such as automated verification of documents, credit scoring, and real-time decision-making, thus cutting the turnaround time and providing an experience to the clients. Besides this, the increasing adoption of mobile and online banking accelerates the shift towards digital origination of loans as borrowers demand remote and efficient interaction. Continuous advances in automation and the incorporation of robust measures of compliance are making loan origination a key part of the digital lending platform market.

Analysis by Component:

- Solutions

- Services

Solutions are dominating the digital lending platform market due to their ability to address complex operational requirements of financial institutions through advanced and comprehensive software applications. This segment includes tools for loan origination, decision automation, risk management, and compliance, which streamline processes, enhance efficiency, and improve accuracy in lending operations. Financial institutions are adopting solutions to automate repetitive tasks, reduce processing times, and minimize errors, which eventually lead to improved client satisfaction. The integration of technologies, such as AI, ML, and data analytics, within these solutions allows for precise credit assessments and tailored loan offerings, further driving the demand. Additionally, the increasing focus on regulatory compliance is encouraging institutions to rely on robust solutions for ensuring adherence to data protection and financial integrity standards.

Analysis by Deployment Model:

- On-premises

- Cloud-based

On-premises holds the largest market share, which accounts for 67.7% of the market share in 2024. It is the largest segment because the on-premises feature allows financial institutions to have absolute control over their data and IT infrastructure. On-premises deployment enables firms to host and manage the platform on their own servers, ensuring that data gets enhanced security, privacy, and adherence to strict requirements of regulations. This model is very much desired by large-scale financial institutions that store sensitive client information and highly value robust cybersecurity. Also, in the on-premises version, the organizations get an option to have solutions customized in accordance with their specific need for operations. This works well for institutions that possess unique lending workflows. Where cloud-based models are becoming popular, the on-premises model is far more preferred because it reduces reliance on external networks for operation and reduces the chances of occurrence of data breaches. Data privacy laws will continue to tighten, so the on-premises segment will remain vital in the digital lending platform market.

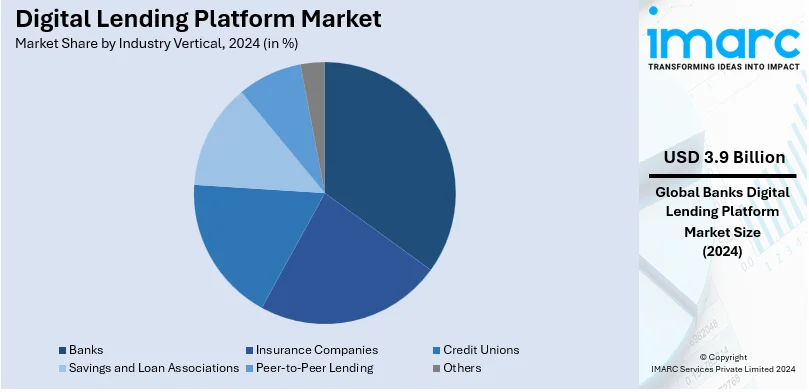

Analysis by Industry Vertical:

- Banks

- Insurance Companies

- Credit Unions

- Savings and Loan Associations

- Peer-to-Peer Lending

- Others

Banks are leading segment in the market, accounting for 30% in 2024. Banks represents the biggest share in the market, owing to their extensive user base, established trust, and financial resources to adopt advanced technologies. Banks are leveraging digital lending platforms to streamline loan origination, enhance decision-making, and improve overall operational efficiency. By integrating AI, ML, and data analytics, banks can provide faster credit assessments and offer tailored loan products, enhancing the customer experience. Additionally, the rising demand for mobile and online banking services is encouraging banks to adopt digital solutions that facilitate seamless, paperless transactions. Regulatory compliance is another key factor, as banks use these platforms to ensure adherence to stringent financial regulations while maintaining data security. With their ability to cater to both retail and commercial borrowers, banks are well-positioned to sustain their dominance in the digital lending platform market, driving innovation and customer-centric services.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America accounted for 31.2% of the total market share in 2024. North America is the largest shareholder in the market, as it has an advanced financial infrastructure, and technology-driven solutions are highly adopted in the region. The presence of established financial institutions, fintech companies, and technology providers fosters a highly competitive environment, encouraging innovation in lending processes. High internet penetration, smartphone usage, and tech-savvy population have further accelerated the adoption of digital lending platforms. Furthermore, the regulatory environment in North America promotes transparency, user protection, and innovation, enabling financial institutions to incorporate the latest technologies, such as AI and ML, into their operations. Rising user experience and expanding financial inclusion ensure North America maintains its market position in the digital lending platform. In 2024, Canadian fintech FRNT entered into a partnership with BitGo to launch an institutional lending platform for crypto investments. The tri-party structure between BitGo as custodian ensures safe and automated lending for assets like BTC and ETH. It caters to the burgeoning demand for digital asset-backed lending solutions.

Key Regional Takeaways:

United States Digital Lending Platform Market Analysis

The market for digital lending platforms is growing fast in the United States, holding 62.90% of the North American market share, because individuals and businesses are adopting online borrowing solutions. Banks and other financial institutions are concentrating efforts on making the lending process easier by using advanced AI and ML technologies that enhance credit scoring, risk assessment, and loan origination. This shift is driven by the growing demand for faster, more efficient loan disbursement that reduces the traditional dependency on physical branches. Fintech companies are using blockchain and digital wallets to provide transparent, secure, and decentralized lending options with personalized loan products. Moreover, the ongoing rise in mobile-first strategies is enabling clients to access lending services anytime, anywhere, promoting greater financial inclusion. The government is also facilitating the growth of digital lending through regulatory support for innovative financial technologies. The need for alternative financing, flexible and with lower interest rates and faster approval times, is now being sought after by individuals, especially millennials and Gen Z. Lenders are adopting digital platforms to respond to the demands and remain competitive in a vibrant ecosystem. With e-commerce and online businesses thriving, the integration of lending services into e-commerce platforms is supporting the market growth, positioning digital lending as a key driver of financial transformation. The Census Bureau reported that e-commerce sales rose by USD 244.2 Billion or 43% in 2020, which was the first year of the pandemic, rising from USD 571.2 Billion in 2019 to USD 815.4 Billion in 2020.

Europe Digital Lending Platform Market Analysis

The Asia Pacific digital lending platform market is rapidly growing as financial institutions and fintech companies are increasingly adopting technology to cater to the underserved and unbanked populations. The region is seeing a surge in mobile penetration, enabling consumers to access loans seamlessly through mobile apps and online platforms, driving the shift toward digital lending. According to Press Information Bureau, the number of smartphone users were 150 Million in 2014 which increased by 600 Million in 2022. As regulators in countries like India, China, and Singapore are continuously updating and relaxing policies to encourage fintech innovation, more platforms are emerging, offering customized lending solutions. The rise in digital payments is making it easier for lenders to assess borrower creditworthiness, creating an ecosystem that supports quicker loan disbursement. Additionally, as e-commerce and online shopping expand, lenders are tapping into data analytics to provide tailored financial products to consumers. The increasing adoption of AI and machine learning is enabling platforms to streamline risk assessment and fraud detection, improving trust in digital lending. Fintechs and banks are collaborating to enhance digital infrastructure and financial inclusion efforts, while venture capital investment in digital lending startups is propelling technological advancements. Rising urbanization, coupled with changing consumer behaviors, is further catalyzing the demand for digital loans, making the market poised for continuous growth.

Asia Pacific Digital Lending Platform Market Analysis

The digital lending platform market in Europe is rapidly expanding as financial institutions are increasingly adopting advanced technologies to enhance lending processes. Fintech companies are focusing on streamlining loan origination, risk assessment, and customer onboarding through AI and ML, driving the demand for more efficient and accurate lending systems. Regulators are actively encouraging digital transformation within the financial services industry, especially with initiatives aimed at improving financial inclusion and reducing administrative burdens. Consumers are becoming more comfortable with digital financial services, and the growing preference for contactless, remote banking services is leading to the shift towards online lending platforms. Banks and non-banking financial companies (NBFCs) are leveraging these platforms to offer personalized, faster loan approvals, especially for consumers seeking small-ticket loans, which is significantly boosting market growth. Moreover, the ongoing rise in e-commerce, coupled with the demand for seamless, integrated payment solutions, is also playing a pivotal role in shaping the market. The increasing availability of smartphones and the internet across the region is enabling consumers from diverse socio-economic backgrounds to access digital lending services, further accelerating the market's adoption. According to reports, within Europe, smartphone penetration rates are above 90% in most countries in 2022.

Latin America Digital Lending Platform Market Analysis

The digital lending platform market in Latin America is experiencing rapid growth as financial institutions are increasingly adopting technology to meet the demand for faster, more accessible lending solutions. Traditional banks are investing heavily in digital platforms to offer seamless loan origination and approval processes, reducing the reliance on physical branches and lengthy paperwork. The growing smartphone penetration in the region is enabling lenders to reach previously underserved populations, especially in rural areas. According to the Brazilian Institute of Geography and Statistics (IBGE), the internet was used in 92.5% of the Brazilian households (72.5 Million) in 2023, a rise of 1.0 pp over 2022. Additionally, financial inclusion initiatives are pushing for more accessible credit options, with digital lending providing a scalable solution. Startups and fintech companies are disrupting the traditional lending landscape by leveraging artificial intelligence and machine learning for credit scoring, offering more personalized lending products to consumers. Governments are also fostering the digital ecosystem by promoting regulations that ease the entry of digital lenders, enhancing market competition. Partnerships between traditional financial institutions and fintech players are strengthening as both sides seek to capitalize on the increasing demand for digital credit. Furthermore, as consumers are becoming more comfortable with digital transactions, the adoption of online loan applications and repayment systems is accelerating, driving the digital lending market's expansion across Latin America.

Middle East and Africa Digital Lending Platform Market Analysis

The digital lending platform market in the Middle East and Africa is expanding rapidly as financial institutions are increasingly adopting innovative technologies to cater to the underserved population. Governments are implementing digital financial inclusion initiatives, encouraging banks and fintech companies to leverage mobile and online platforms to provide accessible credit. The growing mobile penetration across the region is enabling consumers to access loans and credit services conveniently from their smartphones, further driving the demand for digital lending. At the same time, increasing smartphone usage and improved internet connectivity are enhancing the reach of digital lending services, especially in remote and rural areas. According to the Department of Communications and Digital Technologies, 5G population coverage across South Africa increased from 20% in 2022 to 38.42% in 2023, marking a substantial increase in a single year. Additionally, consumers are adopting more digital-first approaches due to a rise in awareness about the benefits of online lending, including quicker loan approvals, lower processing fees, and flexible repayment options. Meanwhile, the COVID-19 pandemic has accelerated the adoption of digital solutions across all sectors, including finance, making digital lending platforms more mainstream. Financial institutions are also integrating AI and machine learning algorithms into their lending processes, allowing them to offer personalized loan products and reduce risk by better assessing creditworthiness, contributing to market growth in the region.

Competitive Landscape:

Key players in the market are focusing on innovation, strategic partnerships, and technological advancements to enhance their offerings and maintain a competitive edge. They are leveraging AI, ML, and data analytics to improve credit assessment accuracy and provide personalized loan solutions. These companies are also prioritizing the development of user-friendly interfaces and streamlined application processes to attract a broader customer base. Many are forming alliances with financial institutions, fintech startups, and technology providers to expand their reach and improve operational efficiency. Additionally, they are investing in security measures to ensure compliance with data privacy regulations and build consumer trust. By continuously upgrading their platforms, these players aim to meet evolving user demands and strengthen their presence in the rapidly growing digital lending market. In 2024, Tavant introduced LO.ai at the MBA Annual Convention & Expo, expanding its Touchless Lending® platform. LO.ai uses generative AI to enhance loan pull-through rates, reduce costs, automate loan officer training, and improve borrower confidence. It ensures data security and compliance while addressing both origination and sales expenses for lenders.

The report provides a comprehensive analysis of the competitive landscape in the digital lending platform market with detailed profiles of all major companies, including:

- Black Knight Inc.

- Finastra

- FIS

- Fiserv Inc.

- Intellect Design Arena Ltd

- Intercontinental Exchange Inc.

- Nucleus Software Exports Ltd.

- Pegasystems Inc.

- Roostify Inc.

- Tavant Technologies

- Wipro Limited.

Latest News and Developments:

- November 2024: Following the successful launch of MSME digital secured lending model, City Union Bank is planning to expand it to housing, affordable home loan, loan against property (LAP) and micro LAP segments in the fourth quarter.

- August 2024: The Reserve Bank of India (RBI) launched a lending platform. This digital lending platform will enable frictionless credit. Moreover, the Unified Lending Interface (ULI) would also facilitate the flow of digital information to lenders, including land records in different states.

- In March 2024: Epic River, one of the providers that connect financial institutions with healthcare providers to streamline patient payments, developed its comprehensive digital lending platform specifically tailored for credit unions.

Digital Lending Platform Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Loan Origination, Decision Automation, Collections and Recovery, Risk and Compliance Management, Others |

| Components Covered | Solutions, Services |

| Deployment Models Covered | On-Premises, Cloud-Based |

| Industry Verticals Covered | Banks, Insurance Companies, Credit Unions, Savings and Loan Associations, Peer-To-Peer Lending, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Black Knight Inc., Finastra, FIS, Fiserv Inc., Intellect Design Arena Ltd, Intercontinental Exchange Inc., Nucleus Software Exports Ltd., Pegasystems Inc., Roostify Inc., Tavant Technologies, Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the digital lending platform market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global digital lending platform market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the digital lending platform industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital lending platform market was valued at USD 13.0 Billion in 2024.

The digital lending platform market is projected to exhibit a CAGR of 11.85% during 2025-2033, reaching a value of USD 39.8 Billion by 2033.

The market is driven by increasing demand for faster loan approvals, enhanced user experiences, and reduced operational costs. Advancements in artificial intelligence (AI) and data analytics are improving credit assessment accuracy. Rising internet penetration, mobile banking adoption, and financial inclusion initiatives are further catalyzing the demand.

North America currently dominates the digital lending platform market, accounting for a share of 31.2% in 2024. The dominance is fueled by a high level of fintech innovation, increasing demand for alternative lending solutions, favorable regulatory environment, and widespread internet connectivity.

Some of the major players in the digital lending platform market include Black Knight Inc., Finastra, FIS, Fiserv Inc., Intellect Design Arena Ltd, Intercontinental Exchange Inc., Nucleus Software Exports Ltd., Pegasystems Inc., Roostify Inc., Tavant Technologies, and Wipro Limited, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)