Duty-free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Duty-free and Travel Retail Market Size and Share:

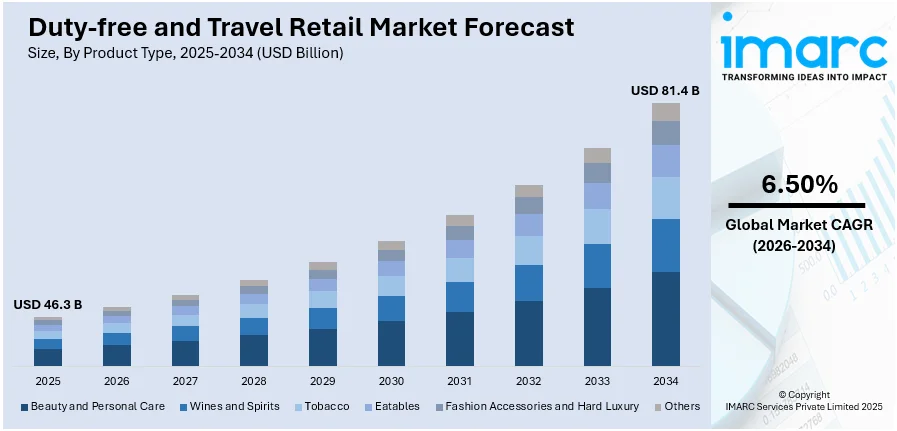

The global duty-free and travel retail market size was valued at USD 46.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 81.4 Billion by 2034, exhibiting a CAGR of 6.50% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of over 42.3% in 2025. The increasing international travel, rising disposable incomes, shifting preferences for premium products, strategic airport expansions, digital innovation, experiential shopping trends, regulatory initiatives, escalating collaborations between airport retailers, development of advanced technologies, and the post-pandemic recovery of the travel industry are some of the factors facilitating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 46.3 Billion |

|

Market Forecast in 2034

|

USD 81.4 Billion |

| Market Growth Rate 2026-2034 | 6.50% |

The market is driven by the expansion in international travel corridors, along with increased airport privatization and infrastructure modernization, which enhance access to retail opportunities in transit zones. Also, the adoption of digital solutions such as contactless payments, app-based ordering, and virtual shopping assistants is significantly enhancing convenience in the duty-free and travel retail market, particularly for high-frequency international travelers. These technologies streamline transactions, reduce queuing time, and enable a seamless shopping experience within restricted transit windows. Markets like China and India are at the forefront of this shift. China, nearing a cashless economy, recorded an annual electronic transaction volume of USD 434 Trillion, with over 80% of daily consumption conducted via mobile platforms, according to industry reports. Similarly, India processed more than 131 Billion UPI transactions in 2023–2024, signaling strong readiness for digital retail experiences in international travel environments.

To get more information on this market Request Sample

The market in the United States is experiencing a steady rise in international inbound traffic, thereby fueling sales and expanding duty-free and travel retail market share. Airport terminal expansions across key U.S. international hubs are driving the evolution of the duty-free and travel retail market by enabling larger retail footprints and broader brand representation. These infrastructural developments are designed to enhance passenger experience and increase commercial revenue through optimized space allocation for premium retail formats. A notable example is the USD 1.5 Billion redevelopment project at Portland International Airport in Oregon, where a new main terminal is scheduled to open in 2025. Such investments reflect a national trend toward integrating modern retail environments within airport design, encouraging increased traveler engagement and elevating duty-free sales potential across U.S. gateways. In addition, domestic demand for tax-exempt luxury goods among international travelers, supported by competitive pricing and exclusive product launches, is also contributing to revenue gains.

Duty-free and Travel Retail Market Trends:

Increasing International Travel and Tourism Activities

The rise in tourism and international travel is creating lucrative opportunities for duty-free and travel retail market growth. According to UN Tourism, an expected 1.4 billion foreign visitors were seen in 2024, an 11% rise from 2023. With an increase in travel globally, airports and borders crossings remain significant shopping centers for the purchase of duty-free goods. This trend is more prevalent in the regions experiencing increased tourism, such as the Asia-Pacific and the Middle East. Several airports in these regions are increasing their capacity to handle traffic throughput, so there are more outlets for duty-free stores to attain a highly diversified and international consumer audience. Moreover, the primary compelling aspect of performing duty-free shopping lies in the ability to purchase unique and high-quality products at lower prices compared to other retail stores outside the airport, which further makes it an attractive option for travelers seeking both value and convenience.

Rising Disposable Incomes and Preferences for Premium Products

One of the significant duty-free and travel retail market trends is the escalating per capita income, which is altering tastes and preferences for luxury good. As per industry reports, in 2022, U.S. gross domestic product (GDP) per capita was USD 76,330, an 8.7% of growth from 2021. In addition to this, customers are concentrating on convenience, and are inclined to spend extravagantly on cosmetics, fragrances, electronics, and fashion accessories, which include products sold in duty-free shops for travelers, especially from the higher class. This is due to the power of symbolic images and the self-serving effect of duty-free products as being cheaper. In this respect, numerous shops rely on customers’ desire by offering a large choice of prestigious brands and exclusive collections, which meet the expectations of the international audience.

Strategic Airport Expansions and Renovations

The continual expansion and renovation of airports around the world is one of the primary factors creating a positive duty-free and travel retail market outlook. From an airport development standpoint, modern airports are evolving into multifaceted commercial centers, incorporating extensive retail, dining, and entertainment offerings. This transformation is significantly increasing non-aeronautical revenue streams for airport operators, thereby contributing to market growth. Furthermore, the escalating efforts made on the internal and external image improvement of the terminal facilities or the outlets to encourage consumers to shop for duty-free goods is another growth inducing factor for the market. This kind of strategic approach not only increases the appeal of airports as new retail destinations but also upsurges the market area for duty free operators, guaranteeing that they secure their industry expanding global traveling retail business.

Duty-free and Travel Retail Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Duty-free and Travel Retail market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

Beauty and personal care lead the market with around 28.5% of market share in 2025. The segment is driven by the increasing consumer awareness regarding skincare routines and products, coupled with rising concerns over skin health and aging. Innovations in formulations, such as natural and organic ingredients, anti-aging solutions, and products targeting specific skin concerns like acne or sensitivity, further increases product consumption, which, in turn propels market growth. The haircare segment is witnessing strong momentum due to continual advancements in product formulations and technologies. Innovations such as sulfate-free shampoos, vegan and cruelty-free offerings, and personalized haircare solutions are aligning with the diverse preferences of global travelers. These premium and specialized products are particularly appealing to international consumers. Also, the rising demand for clean beauty products, inclusive shade ranges, and celebrity-endorsed makeup lines is shaping purchasing behavior in travel retail environments. Duty-free platforms serve as strategic touchpoints for cosmetic brands, offering travelers a chance to explore exclusive or limited-edition items.

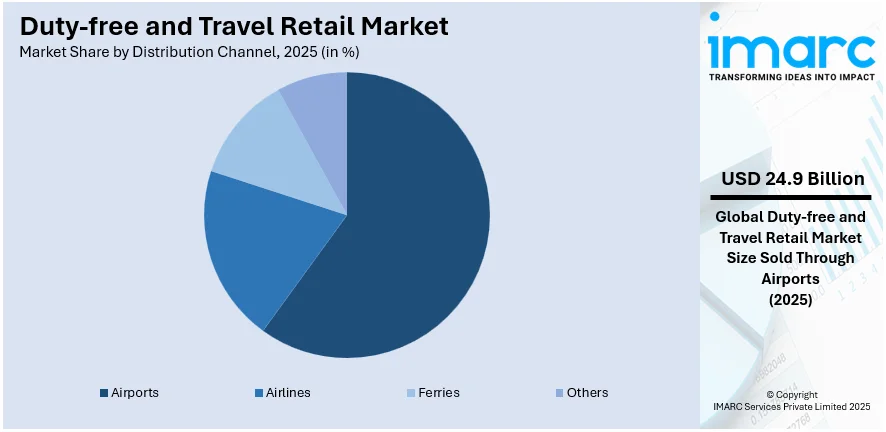

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Airports

- Airlines

- Ferries

- Others

Airports lead the market with around 57.5% of market share in 2025. This segment is responsible for a substantial portion of world sales. They are high-traffic commercial centers where people from various backgrounds gather, providing the perfect environment for displaying and selling luxury products. With the steady growth in international air travel, airports have increasingly transformed into comprehensive retail environments, offering a wide range of luxury goods, cosmetics, electronics, and alcoholic beverages. Placement of duty-free shops at departure and arrival points maximizes visibility and accessibility, facilitating impulse buying. In addition, airports allow brands to offer unique travel editions and offers that appeal to time-conscious consumers looking for convenience and value. Better infrastructure, better terminal design, and incorporation of digital solutions like click-and-collect services further solidified airport retail's position. With non-aeronautical revenues increasingly critical to airport operators, duty-free retail remains an important source of revenue.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of over 42.3%. The market in the region is driven by the increasing affluence of the middle-class population, which is expanding the consumer base for duty-free and travel retail products. This demographic shift is accompanied by a growing preference for premium and luxury goods among travelers, supported by rising disposable incomes. Moreover, strategic geographical locations of airports and border crossings in major cities such as Singapore, Hong Kong, Tokyo, and Beijing enhance the accessibility and attractiveness of duty-free shopping experiences. Furthermore, infrastructure developments and expansions in airports, including new terminals and renovated retail spaces, are facilitating a more immersive and extensive retail environment. These enhancements not only cater to the growing influx of tourists but also capitalize on the region's status as a global travel hub. Apart from this, the adoption of digital technologies and e-commerce platforms is transforming the retail landscape, offering convenience and personalized shopping experiences to consumers. Regulatory policies and partnerships between airports, retailers, and international brands are also pivotal, shaping the market's expansion by optimizing product offerings and regulatory environments.

Key Regional Takeaways:

United States Duty-free and Travel Retail Market Analysis

The United States holds a substantial share of the North America luxury furniture market with 86.20% in 2025. The region is witnessing an expanding duty-free and travel retail sector, fueled by substantial investment in beauty and personal care. The increasing demand for high-end skincare, fragrances, and cosmetics is pushing brands to establish exclusive duty-free outlets. Premium product launches and collaborations with international beauty brands enhance consumer attraction. Airport retail spaces are being redesigned to cater to travelers seeking luxury shopping experiences. Advancements in digital marketing strategies and personalized promotions further contribute to this sector’s expansion. Operators are focusing on customer-centric strategies, leveraging loyalty programs and personalized services. The influence of social media and celebrity endorsements significantly drives impulse purchases. As beauty and personal care investments continue to rise, duty-free stores are positioning themselves as premium destinations for travelers, ensuring a seamless shopping experience while reinforcing the luxury appeal of airport retail.

Asia Pacific Duty-free and Travel Retail Market Analysis

Asia-Pacific is experiencing a dynamic surge in duty-free and travel retail, driven by the rapid expansion of the middle-class population. For instance, India's burgeoning middle class is fueling a surge in air travel, with domestic air traffic reaching 16.13 Crore in 2024, a 6% increase year-on-year. Rising disposable incomes and evolving lifestyle preferences are encouraging increased spending on luxury products, electronics, and fashion accessories. The younger demographic, with a strong inclination toward global brands, is actively engaging in high-value purchases. Airport operators and retailers are leveraging digitalization, offering mobile payment options and online pre-ordering services. Promotional campaigns and exclusive limited-edition product launches attract a broader consumer base. Retailers are forming strategic partnerships with global brands to cater to evolving preferences. Personalized shopping experiences are increasing, leading to the duty-free travel retail market demand and VIP services. As the middle-class population grows, duty-free and travel retail continue to expand, transforming airports into key retail hubs.

Europe Duty-free and Travel Retail Market Analysis

Europe is witnessing a strong growth trajectory in duty-free and travel retail, supported by the increasing number of airports and airlines. According to the European Commission, there were approximately 6.7 million commercial flights in the EU in 2024, which is 5.8% more than the 6.3 million in 2023. Major airport expansions and new airline routes are attracting a rising volume of travelers, enhancing retail opportunities. Airport authorities are investing in premium retail spaces, integrating luxury boutiques and duty-free stores with experiential shopping zones. The demand for high-end fashion, spirits, and skincare products continues to grow, leading to exclusive brand collaborations. Digital innovations such as virtual shopping assistants and AI-driven recommendations elevate the shopping experience. Airlines are also introducing onboard retail programs, offering exclusive in-flight duty-free deals. With new terminals and route expansions, duty-free operators are strategically expanding their offerings, ensuring seamless product accessibility and enhanced convenience, positioning airports as thriving commercial spaces for global travelers.

Latin America Duty-free and Travel Retail Market Analysis

Latin America is experiencing increased adoption of duty-free and travel retail due to the growing number of airports across the region. For instance, as of September 2024, the region featured around 151 airlines and 531 airports providing scheduled services. The region benefits from cross-border land travel and major air hubs such as São Paulo and Panama City. As new international and domestic airports are developed and existing ones are modernized, more retail space is being allocated for duty-free outlets. This expansion enhances accessibility to premium goods and boosts impulse purchases by travelers. Airport retail remains focused on essential goods and luxury categories. Airport authorities are increasingly partnering with global brands to capitalize on rising passenger traffic. The growing number of airports significantly contributes to the elevating demand for duty-free and travel retail in Latin America.

Middle East and Africa Duty-free and Travel Retail Market Analysis

The Middle East and Africa are experiencing robust duty-free and travel retail expansion, propelled by increasing international travel due to growing tourism. The regions such as UAE, Qatar, and Saudi Arabia, serve as key connectors for international air routes, offering expansive duty-free areas stocked with luxury fashion, electronics, fragrances, and tobacco. The region benefits from a strong inflow of international travelers and high per capita spending. For instance, from January to October 2024, Dubai received 14.96 million overnight guests, an 8% increase over the same period in 2023, demonstrating a robust tourist industry. The rising number of international visitors is stimulating demand for premium brands and travel-exclusive products. Airports are enhancing retail spaces with duty-free shopping zones, offering a mix of global and local brands. Retailers are optimizing pricing strategies and tax-free incentives to attract travelers.

Competitive Landscape:

The key players in the market are actively pursuing strategic initiatives to capitalize on evolving consumer trends and market dynamics. These initiatives include expanding their product portfolios to include a broader range of premium and luxury goods, catering to the increasing demand from affluent travelers. Moreover, investments in digital transformation initiatives are prevalent, with companies enhancing their online platforms and integrating advanced technologies such as AI and data analytics to personalize the shopping experience and improve operational efficiency. Partnerships and collaborations with airports, airlines, and brands are also common strategies aimed at expanding market presence and enhancing the exclusivity of product offerings. Additionally, sustainability initiatives have become a focal point, with companies emphasizing eco-friendly practices and promoting sustainable products to align with growing consumer awareness and preferences. Geographically, companies are focusing on expanding their footprint in emerging markets within Asia-Pacific and Latin America, leveraging the region's rapid economic growth and rising tourism activities.

The report provides a comprehensive analysis of the competitive landscape in the duty-free and travel retail market with detailed profiles of all major companies, including:

- Aer Rianta International

- China Duty Free Group Co., Ltd

- Dubai Duty Free

- Dufry

- Gebr. Heinemann SE & Co. KG

- James Richardson Group

- King Power Corporation

- Lagardère Travel Retail

- Lotte Duty Free

- Qatar Duty Free

- Shinsegae Duty Free

- The Shilla Duty Free

Latest News and Developments:

- March 2025: PIF launched Al Waha, Saudi Arabia’s first locally owned duty-free retailer, to enhance travel retail. The company will develop luxury outlets at airports, land borders, and seaports, featuring high-quality Saudi products. Al Waha aims to secure a greater share of passenger spending and boost the Saudi economy. It will also explore in-flight shopping and other travel retail opportunities.

- January 2025: Suntory Global Spirits and Delhi Duty Free launched an exclusive House of Suntory Shop-in-Shop at Terminal 3, Indira Gandhi International Airport. The space blends Suntory’s Japanese heritage with Delhi Duty Free’s retail expertise. The installation highlights Suntory’s century of innovation, inspired by Japanese art and Monozukuri craftsmanship. Alongside its renowned whiskies, Suntory offers Roku Japanese Craft Gin and Haku Japanese Craft Vodka.

- December 2024: Kreol Travel Retail launched Anchor Milk Powder (1.6kg) at Muscat Duty-Free, produced in New Zealand by Fonterra. This initiative highlights Anchor’s focus on quality and nutrition for global travelers. Fonterra’s Lynne Mason emphasized the brand’s commitment to convenience, while Muscat Duty-Free CEO Renat Rozpravka welcomed the expanded product range. The launch strengthens Kreol Travel Retail’s role in bringing trusted brands to the Middle East’s travel retail market.

- January 2024: At Lisbon Airport, Aer Rianta International (ARI) opened Preloved - Fashion in Full Circle, a brand-new, upscale vintage clothing and accessory boutique. In response to the growing consumer demand for environmentally responsible products, this business offers high-end designer items that are vintage or pre-owned, emphasizing sustainable luxury.

Duty-free and Travel Retail Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Aer Rianta International, China Duty Free Group Co., Ltd, Dubai Duty Free, Dufry, Gebr. Heinemann SE & Co. KG, James Richardson Group, King Power Corporation, Lagardère Travel Retail, Lotte Duty Free, Qatar Duty Free, Shinsegae Duty Free, The Shilla Duty Free, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the duty-free and travel retail market from 2020-2034.

- The duty-free and travel retail market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the duty-free and travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The duty-free and travel retail market was valued at USD 46.3 Billion in 2025.

The duty-free and travel retail market is projected to exhibit a CAGR of 6.50% during 2026-2034, reaching a value of USD 81.4 Billion by 2034.

The market is driven by growing international tourism, rising disposable incomes, increasing airport infrastructure development, and the demand for luxury goods and premium brands. The shift in consumer behavior toward experiential shopping and personalized offerings, along with favorable government regulations and rising spending by millennials and Gen Z travelers, is also contributing to market expansion.

Asia Pacific currently dominates the duty-free and travel retail market, accounting for a share of 42.3% in 2025. The dominance is fueled by robust international passenger traffic, the rising presence of regional hubs such as Singapore, South Korea, and China, growing affluence among middle-class consumers, and the increasing popularity of luxury shopping among tourists in the region.

Some of the major players in the duty-free and travel retail market include Aer Rianta International, China Duty Free Group Co., Ltd, Dubai Duty Free, Dufry, Gebr. Heinemann SE & Co. KG, James Richardson Group, King Power Corporation, Lagardère Travel Retail, Lotte Duty Free, Qatar Duty Free, Shinsegae Duty Free, and The Shilla Duty Free, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)